Variable Appreciable Life Insurance is a unique type of life insurance that offers both a death benefit and an investment component. It combines the traditional aspects of life insurance with the potential for growth and investment returns. This type of policy allows policyholders to allocate a portion of their premium into an investment account, which can grow over time based on market performance. The investment portion of the policy can appreciate, providing potential tax advantages and the possibility of outperforming traditional fixed-rate investments. When the insured individual passes away, the death benefit is paid out, and the value of the investment account is also considered in the overall payout. This insurance product is an attractive option for those seeking a combination of insurance coverage and investment opportunities.

What You'll Learn

- Definition: Variable Appreciable Life Insurance (VALI) is a type of life insurance that offers investment options

- Features: VALI combines life coverage with investment opportunities, allowing policyholders to grow their money

- Benefits: It provides flexibility, potential for higher returns, and tax advantages compared to traditional life insurance

- Risks: VALI involves investment risks, and policyholders may lose some of their premium payments

- Comparison: VALI differs from whole life insurance by offering variable investment options and potential for higher returns

Definition: Variable Appreciable Life Insurance (VALI) is a type of life insurance that offers investment options

Variable Appreciable Life Insurance (VALI) is a unique and innovative approach to life insurance, offering policyholders a blend of traditional life coverage and investment opportunities. This type of insurance is designed to provide both financial protection and the potential for long-term growth, making it an attractive option for those seeking a more dynamic insurance product.

In essence, VALI allows individuals to invest a portion of their premium payments in various investment options, similar to a mutual fund or a variable annuity. These investment components are often diversified, aiming to provide capital appreciation and income generation over time. The beauty of VALI lies in its ability to offer both the security of a life insurance policy and the potential for wealth accumulation through investments. Policyholders can choose from a range of investment strategies, allowing them to align their insurance with their financial goals and risk tolerance.

One of the key advantages of VALI is its flexibility. Policyholders can adjust their investment strategy according to market conditions and their own financial objectives. This adaptability is particularly appealing to those who want to actively manage their insurance portfolio, potentially benefiting from market upswings while still maintaining the essential safety net of life insurance. The investment options within VALI can vary, including stocks, bonds, and other securities, providing a diverse and potentially robust investment environment.

When considering VALI, it is crucial to understand the trade-offs involved. While it offers investment opportunities, the primary purpose of life insurance is to provide financial security for beneficiaries in the event of the insured's death. Therefore, individuals should carefully evaluate their risk tolerance and ensure that the investment portion of VALI aligns with their long-term financial goals. Additionally, the fees associated with VALI policies, including investment management fees, should be transparent and clearly understood to ensure that the overall value proposition remains favorable.

In summary, Variable Appreciable Life Insurance (VALI) presents a compelling option for those seeking a life insurance product with an integrated investment strategy. It combines the traditional benefits of life insurance with the potential for wealth growth, offering policyholders a flexible and dynamic approach to financial planning. As with any financial decision, thorough research and understanding of the policy's terms and conditions are essential to making an informed choice.

Life Insurance: Asset or Liability?

You may want to see also

Features: VALI combines life coverage with investment opportunities, allowing policyholders to grow their money

Variable Appreciable Life Insurance (VALI) is a unique financial product that offers a combination of life insurance coverage and investment potential. This innovative policy is designed to provide individuals with a way to secure their loved ones' financial future while also allowing them to grow their money over time. Here are some key features that highlight the benefits of VALI:

Life Coverage and Investment in One: VALI is a powerful tool for those seeking both financial security and investment growth. It offers a life insurance policy with a twist—the policy's cash value can be invested in various investment options. This means that instead of a traditional fixed-rate policy, VALI provides a flexible approach to insurance. Policyholders can choose to allocate a portion of their premium payments into different investment accounts, such as stocks, bonds, or mutual funds. This investment aspect allows the policy's value to appreciate over time, potentially outpacing the growth of a typical savings account.

Customizable Investment Strategies: One of the standout features of VALI is the ability to customize investment strategies. Policyholders can work with financial advisors to design investment portfolios tailored to their risk tolerance and financial goals. This customization ensures that the policy's investments align with the individual's preferences, providing a sense of control and personalized financial management. As the policyholder's financial situation changes, the investment strategy can be adjusted accordingly, making it a dynamic and adaptable insurance solution.

Long-Term Financial Security: VALI provides a safety net for the insured individual's beneficiaries in the form of life coverage. If the insured passes away, the death benefit is paid out to the designated beneficiaries, ensuring their financial well-being. Simultaneously, the invested portion of the policy continues to grow, potentially accumulating significant value over the policyholder's lifetime. This dual benefit of life insurance and investment growth makes VALI an attractive option for those seeking comprehensive financial planning.

Potential for Tax Advantages: The investment component of VALI may offer tax advantages, depending on the jurisdiction and specific policy details. In some cases, the policy's growth may be tax-deferred, allowing the invested amount to compound over time without incurring immediate tax liabilities. This feature can be particularly beneficial for long-term financial planning, as it enables policyholders to build a substantial investment portfolio while also providing tax-efficient growth.

Flexibility and Control: With VALI, policyholders have a degree of flexibility in managing their insurance and investment needs. They can choose to increase or decrease the amount allocated to investments, adjust the investment strategy, or even take loans against the policy's cash value (with certain restrictions). This level of control allows individuals to adapt their financial strategy as their circumstances and goals evolve.

Adjustable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Benefits: It provides flexibility, potential for higher returns, and tax advantages compared to traditional life insurance

Variable Appreciable Life Insurance (VALI) is a unique and innovative type of life insurance that offers several advantages over traditional life insurance policies. One of its key benefits is the flexibility it provides to policyholders. Unlike conventional life insurance, VALI allows individuals to make investment decisions that align with their financial goals and risk tolerance. Policyholders can choose from a range of investment options, such as stocks, bonds, or mutual funds, which are incorporated into the insurance policy. This flexibility enables individuals to potentially increase their returns over time, as the performance of their chosen investments directly impacts the policy's value.

The potential for higher returns is a significant advantage of VALI. Traditional life insurance policies typically offer fixed death benefits, which may not keep pace with inflation or market growth. In contrast, VALI policies grow in value based on the performance of the selected investments. This growth can lead to higher cash values and, consequently, a larger death benefit when the policyholder passes away. Additionally, the investment options in VALI policies can be adjusted over time to take advantage of market opportunities or to align with the policyholder's changing financial objectives.

Another benefit of VALI is the potential for tax advantages. In many jurisdictions, the cash value accumulation in VALI policies is not subject to income tax while it remains in the policy. This means that the policyholder can build a tax-deferred cash value, which can be used for various purposes, such as funding education expenses, starting a business, or providing retirement income. Furthermore, when the policyholder takes policy loans or surrenders the policy, the tax treatment may be more favorable compared to other investment vehicles, making VALI an attractive option for those seeking tax-efficient wealth accumulation.

VALI also offers the advantage of long-term financial security. As the policy's value grows, it can provide a substantial death benefit to the policyholder's beneficiaries, ensuring financial protection for loved ones. Moreover, the investment aspect of VALI allows policyholders to potentially build a substantial cash value, which can be borrowed against or withdrawn, providing financial flexibility during the policyholder's lifetime. This combination of flexibility, higher return potential, and tax advantages makes VALI an attractive alternative to traditional life insurance, especially for those seeking a more dynamic and personalized approach to life insurance and wealth management.

Canceling Ladder Life Insurance: A Step-by-Step Guide

You may want to see also

Risks: VALI involves investment risks, and policyholders may lose some of their premium payments

Variable Appreciable Life Insurance (VALI) is a unique type of life insurance that combines the security of a life insurance policy with the potential for investment growth. It is designed to offer policyholders a way to build wealth over time while also providing a death benefit to their beneficiaries. However, like any investment-based product, VALI comes with certain risks that policyholders should be aware of.

One of the primary risks associated with VALI is the involvement of investment risks. The policy's performance is directly linked to the investment strategies employed by the insurance company. These investments can range from stocks, bonds, and mutual funds to other financial instruments. While these investments have the potential to grow and provide higher returns, they also carry the risk of loss. Market volatility, economic downturns, and poor investment choices can lead to a decrease in the value of the policy's investment account. As a result, policyholders may experience a reduction in their policy's cash value, which could impact the overall value of the insurance contract.

In addition to investment risks, VALI policies also expose policyholders to the possibility of losing some of their premium payments. When you pay premiums for a VALI policy, a portion of those payments goes into the investment account, and the rest is used to cover the death benefit and administrative costs. If the investments underperform or experience losses, the policy's cash value may decrease. This could mean that the policyholder might not have enough cash value to cover future premiums, potentially leading to a lapse in coverage. In such cases, the policyholder may need to pay additional premiums or even surrender the policy to avoid a lapse, which could result in a loss of premium payments and potential coverage gaps.

It is crucial for individuals considering VALI to carefully review the investment options and associated risks before making a decision. Understanding the potential for investment losses and the impact on premium payments is essential for managing expectations and making informed choices. Policyholders should also be aware of the insurance company's investment strategies, fee structures, and any guarantees or limitations provided by the policy. By being well-informed, individuals can better assess whether VALI aligns with their financial goals and risk tolerance.

In summary, while VALI offers an opportunity to build wealth and provide financial security, it is important to recognize the inherent risks. Investment risks can lead to potential losses, and policyholders may face the challenge of premium payments being affected by investment performance. Prospective policyholders should conduct thorough research, seek professional advice when needed, and carefully evaluate their financial situation to determine if VALI is a suitable long-term financial strategy.

Usaa Life Insurance: Annual Fee or Free?

You may want to see also

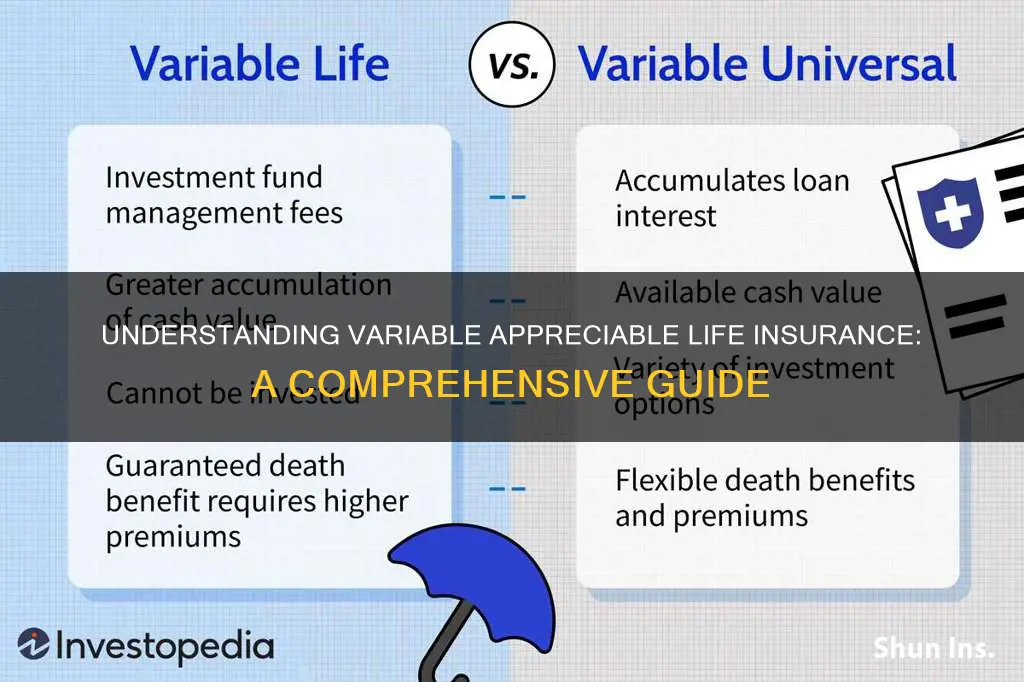

Comparison: VALI differs from whole life insurance by offering variable investment options and potential for higher returns

Variable Appreciable Life Insurance (VALI) is a type of permanent life insurance that offers a unique blend of insurance protection and investment opportunities. It is designed to provide long-term financial security while also allowing policyholders to benefit from market-related investment returns. One of the key differences between VALI and traditional whole life insurance lies in its investment component.

Whole life insurance, a permanent policy, guarantees a fixed death benefit and premium payments for the entire life of the insured individual. It offers a steady and predictable return on the premiums paid, ensuring a stable cash value accumulation over time. However, the investment options within whole life insurance are typically limited to fixed or guaranteed interest rates, which may not align with the dynamic nature of financial markets.

In contrast, VALI introduces a variable investment aspect, allowing policyholders to allocate a portion of their premiums into various investment options. These investment choices can include stocks, bonds, mutual funds, or other diversified portfolios. By doing so, VALI provides an opportunity for policyholders to potentially earn higher returns compared to the fixed rates associated with whole life insurance. The variable nature of VALI's investments means that the policy's cash value can fluctuate based on market performance, offering both risk and reward.

The potential for higher returns is a significant advantage of VALI. With the ability to invest in a wide range of assets, policyholders can benefit from the growth of the financial markets. This feature is particularly appealing to those seeking to maximize their long-term financial growth while still maintaining the insurance coverage they need. However, it's important to note that this investment approach also comes with additional risks, as market volatility can impact the policy's value.

In summary, the comparison between VALI and whole life insurance highlights the added flexibility and potential for higher returns that VALI offers. By incorporating variable investment options, VALI provides policyholders with the opportunity to grow their money in line with market trends, which can be a valuable consideration for those aiming to optimize their financial strategy. Understanding these differences is essential for individuals seeking to make informed decisions about their life insurance and investment needs.

MetLife Insurance: Suicide Coverage and Exclusions

You may want to see also

Frequently asked questions

Variable Appreciable Life Insurance is a type of life insurance that offers both death benefit protection and an investment component. It combines the security of a life insurance policy with the potential for investment growth, allowing policyholders to build cash value over time.

This insurance policy typically involves a combination of a permanent life insurance policy (such as whole life or universal life) and an investment account. A portion of the premium goes towards funding the death benefit, while the remaining amount is invested in various investment options offered by the insurance company. The investment portion can grow tax-deferred, and any earnings or appreciation can be used to increase the cash value of the policy.

Variable Appreciable Life Insurance provides several advantages. Firstly, it offers lifelong coverage, ensuring financial protection for your loved ones. Secondly, the investment component allows policyholders to potentially build wealth over time, as the value of the investment account can grow. Additionally, policyholders have control over their investment choices, and they can adjust their strategy based on their financial goals and market conditions.

The death benefit is the amount paid out to the policy's beneficiaries upon the insured individual's death. It is typically a fixed amount agreed upon at the time of policy issuance. However, in variable appreciable life insurance, the death benefit can be adjusted periodically based on the performance of the underlying investments. This flexibility allows the policy to potentially increase in value over time.

Like any investment-based product, there are risks involved. The investment portion of the policy is subject to market fluctuations, and there is no guarantee of returns. If the investments underperform, the policy's cash value may decrease. Additionally, policyholders should be aware of fees and charges associated with the investment account, as these can impact the overall performance. It is essential to carefully review the policy terms and consult with a financial advisor to understand the risks and potential benefits.