Life insurance policies typically include a suicide clause that prevents the insurer from paying out to beneficiaries if the insured person's death was due to suicide within a certain period from the start of the policy. This period is usually two years but can range from one to three years. After this exclusion period, most life insurance policies do cover suicide, and beneficiaries are entitled to receive the full death benefit. If a policy does not include a suicide exclusion clause, the insurance company is required to pay the full death benefit if the insured dies by suicide.

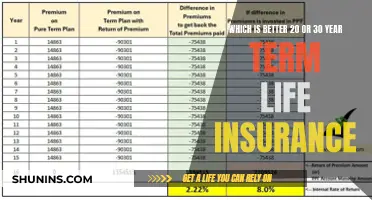

| Characteristics | Values |

|---|---|

| Time period for suicide clause | Typically 1-3 years, often 2 years |

| Suicide clause purpose | Preventing financial incentive for suicide |

| Suicide clause effect | Insurers may deny death benefit or refund premiums paid |

| After suicide clause ends | Insurers pay death benefit |

| Group life insurance | Often no suicide clause, but supplemental insurance may have one |

| Contestability period | First 1-3 years, separate from suicide clause |

| Effect of changing policy | Restarts suicide clause and contestability period |

| Whole life insurance | Beneficiaries may receive cash value even during exclusion period |

| Military life insurance | No suicide clause or contestability period |

What You'll Learn

Suicide clauses in life insurance policies

Suicide clauses are standard in life insurance policies. They limit the insurer's liability to pay out to survivors of a policyholder who dies by suicide within a certain period, typically the first two years of the policy being active, known as the exclusion period. This clause is intended to prevent an individual from taking out a policy with the intention of ending their life soon after.

During the exclusion period, if the policyholder dies by suicide, the insurer may deny the death benefit payout or limit it to returning the premiums paid up to that point. After the exclusion period, the policy generally covers suicide, and beneficiaries will receive the full death benefit.

The length of the exclusion period can vary depending on the insurer and state regulations. While most states enforce a standard two-year period, some, like Colorado, Missouri, and North Dakota, have shorter periods of one year.

It is important to note that different types of life insurance policies may have specific clauses and conditions that impact coverage. For example, group life insurance policies, often provided as part of employee benefits, usually include similar suicide clauses to those found in individual life insurance policies. On the other hand, military-focused life insurance policies typically pay out the death benefit regardless of the cause of death, including suicide.

MetLife's Permanent Life Insurance: What You Need to Know

You may want to see also

Suicide exclusions in group life insurance policies

Group life insurance policies, often provided as part of an employee benefits package, usually include a suicide clause. This clause is active for a certain period, typically two years, after the policy goes into effect. During this exclusion period, the insurer won't pay out to beneficiaries for a suicidal death. The purpose of this clause is to prevent someone from purchasing a policy right before taking their own life so that their loved ones can receive financial benefits.

However, after this exclusion period, group life insurance generally does cover suicide, and beneficiaries would be entitled to receive the full death benefit.

It's important to note that group life insurance policies through an employer or organisation may treat suicide differently. Military life insurance policies, for example, typically pay out the death benefit to the insured's beneficiaries regardless of the cause of death, including suicide.

Supplemental life insurance purchased through an employer usually has a standard suicide clause and contestability period. In contrast, individual term life insurance policies may only pay out the sum of premiums paid to date if the insured dies during the exclusion period.

Eerie's Life Insurance: What You Need to Know

You may want to see also

Suicide exclusions in military life insurance policies

Military life insurance policies, such as those offered by Veterans' Group Life Insurance (VGLI) and Servicemembers' Group Life Insurance (SGLI), typically provide coverage for suicide. These policies are unique in that they pay out the death benefit to the insured's beneficiaries regardless of the cause of death, including suicide or acts of war.

While most individual life insurance policies include a "suicide clause" that excludes coverage for suicide within the first one to three years of the policy (known as the exclusion period), military life insurance policies through the Veterans Affairs (VA) do not have such a clause. This means that members of the military and veterans with life insurance through the VA are generally covered in cases of suicide.

The absence of a suicide exclusion clause in military life insurance policies ensures that the insured's beneficiaries receive the full death benefit, regardless of the circumstances surrounding the death. This coverage provides financial protection and peace of mind for military personnel and their loved ones.

It is important to note that supplemental life insurance policies purchased through an employer may have a standard suicide clause and contestability period, which could impact the payout in the event of suicide. Therefore, it is essential to carefully review the specific terms and conditions of any life insurance policy, including military life insurance, to understand the coverage provided and any potential exclusions.

If you or someone you know is struggling with mental health issues or having suicidal thoughts, it is crucial to seek help. Resources such as the Suicide & Crisis Lifeline (988) are available 24/7 to provide confidential support and assistance.

Safeco's Life Insurance Offerings: What You Need to Know

You may want to see also

Contestability periods in life insurance policies

The contestability period of a life insurance policy is a clause included in all life insurance policies that allows the insurer to review the policyholder's application for incorrect information and deny a death claim if they find evidence of fraud or misrepresentation. This period usually lasts for the first two years of the policy, though it can vary by state and insurer. During this time, the insurance company can investigate any aspect of a policyholder's health that could have been misrepresented on their application, including pre-existing medical history or lifestyle factors. If information is found to have been withheld or falsified, the insurer can deny coverage or void the contract.

The contestability period serves as a deterrent against fraud and helps to control the cost of insurance due to misrepresented claims. It also safeguards the integrity of the insurance company and ensures that it is not taken advantage of by claimants. While it is rare, there have been cases where an insurance company has withheld or reduced the death benefit if it discovers fraud in the application even after the contestability period has expired.

It is important to note that the contestability period is separate from the suicide clause, which is also typically included in most life insurance policies. The suicide clause states that if the policyholder dies by suicide within a certain period of time (usually one to two years) after the policy is issued, the insurer may deny the death benefit or only return the premiums paid. However, after this exclusion period, most life insurance policies do cover suicide, and beneficiaries would be entitled to receive the full death benefit.

If you are a beneficiary of a life insurance policy and the policyholder has died, you will need to take proactive steps to receive the payout. Find the life insurance company and request a certified copy of the death certificate, as well as any supporting documents such as an autopsy or police report. Fill out the company's claim paperwork as fully and honestly as possible, and be prepared to wait for the money as the payout may be delayed during the contestability period.

Christian Healthcare Ministries: Life Insurance Coverage?

You may want to see also

Claim denials for suicide

Life insurance policies typically include a "suicide clause" that prevents the insurer from paying out the claim if the insured's death was due to self-inflicted injury within a certain period from the start of the policy. This period is usually two years but can range from one to three years. The clause is meant to prevent someone from purchasing a policy and then taking their own life so that their loved ones can receive financial benefits.

If the insured person dies during the exclusion period, the insurance company will not make a payout. Instead, it will refund the premiums to the beneficiary. However, if the insured person dies after the exclusion period, the policy will generally cover suicide, and the beneficiary will receive the full death benefit.

There are a few reasons why a life insurance claim for suicide may be denied:

- Misrepresentation on the policy application: If the insured person misrepresented themselves on the policy application, such as by failing to disclose risky behaviours or a mental health diagnosis, the claim may be denied.

- Inaccurate information: If the insurance company finds evidence of inaccurate or missing information on the policy application, such as undisclosed health conditions or other discrepancies, the claim may be denied.

- Non-payment of premiums: If the insured person was behind on their life insurance payments, the claim may be denied.

- Outliving a term life insurance policy: If the insured person had term life insurance and outlived the policy's term, there would be no death benefit payout.

If your life insurance claim for suicide is denied, you can take the following steps:

- Wait for the insurance company's decision and review the denial letter.

- Gather relevant documentation, such as the insured's medical records, the policy application, proof of premium payments, and the death certificate.

- Understand your rights under state laws, as some states have protections for beneficiaries.

- Contact the insurance company to appeal the decision and provide any relevant information.

- Consult an experienced attorney or insurance professional for guidance.

Does Your Job's Life Insurance Policy Require Drug Testing?

You may want to see also

Frequently asked questions

Life insurance covers suicidal death as long as the insured bought the policy two to three years before their passing. This is the period covered by the policy's suicide clause.

A suicide clause is a section of an insurance policy that outlines certain restrictions that apply if the insured person dies by suicide, typically within the first two years of the policy.

If someone dies by suicide during the suicide clause period, the insurance company will likely not pay the full death benefit to the beneficiaries. Instead, they may receive a refund of the premiums paid or the cash value of the policy.

The contestability period is a separate clause that allows the insurer to deny or reduce the death benefit if they find undisclosed health conditions or discrepancies in the application. This period typically lasts for the first two years of the policy.

If your claim is denied, you can contest the decision. The insurance company has the burden of proof to show that the circumstances of the insured person's death allow them to deny the claim. Challenging a denied claim often works in the beneficiary's favor.