Whole life insurance, offered by MassMutual, is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers a guaranteed death benefit and a cash value component that grows over time. This type of insurance provides financial security for the policyholder's beneficiaries and can also serve as a valuable financial tool for wealth accumulation and long-term savings. With MassMutual, policyholders can benefit from the stability and security of a whole life insurance policy, ensuring that their loved ones are protected and that their financial goals are met.

What You'll Learn

- Definition: Whole life insurance is a permanent policy with guaranteed death benefit and cash value accumulation

- Benefits: Offers lifelong coverage, fixed premiums, and potential investment returns

- Features: Includes a death benefit, cash value, and investment options

- Comparison: How it differs from term life and universal life insurance

- MassMutual: A leading provider known for financial strength and customer service

Definition: Whole life insurance is a permanent policy with guaranteed death benefit and cash value accumulation

Whole life insurance is a type of permanent life insurance policy that offers a range of unique benefits. It is designed to provide coverage for the entire lifetime of the insured individual, hence the term "permanent." One of the key advantages of whole life insurance is its guaranteed death benefit. This means that, regardless of the insured's age or health at the time of death, the policy will pay out a predetermined amount to the designated beneficiaries. This guarantee provides financial security and peace of mind, knowing that your loved ones will receive a specified sum in the event of your passing.

In addition to the death benefit, whole life insurance policies also accumulate cash value over time. This is a significant feature that sets it apart from other insurance products. As the policyholder, you will make regular premium payments, and a portion of these payments goes towards building cash value. This cash value can grow tax-deferred and can be borrowed against or withdrawn if needed. The accumulation of cash value allows policyholders to build a substantial fund that can be used for various purposes, such as funding education expenses, starting a business, or providing additional financial security during retirement.

The guaranteed death benefit and cash value accumulation are the cornerstones of whole life insurance. The death benefit ensures that your family or beneficiaries receive the intended financial support, while the cash value provides an additional layer of financial security and flexibility. This type of policy is particularly attractive to those seeking long-term financial planning and a reliable source of funding for their future needs.

MassMutual, a well-known insurance company, offers whole life insurance policies tailored to meet individual needs. Their whole life insurance products are designed to provide comprehensive coverage and financial benefits, ensuring that policyholders and their families are protected and prepared for the future. With MassMutual, individuals can access professional guidance to determine the appropriate coverage amount and policy options that align with their financial goals and risk tolerance.

In summary, whole life insurance is a permanent policy that offers a guaranteed death benefit and the potential for cash value accumulation. It provides long-term financial security and peace of mind, ensuring that your loved ones are protected and that you have a valuable asset that can be utilized for various financial purposes. Understanding the features of whole life insurance, as offered by companies like MassMutual, can help individuals make informed decisions about their insurance needs and overall financial strategy.

Who Can Sue for Your Life Insurance Proceeds?

You may want to see also

Benefits: Offers lifelong coverage, fixed premiums, and potential investment returns

Whole life insurance from MassMutual is a long-term financial product that provides coverage for your entire life. This type of policy offers several key advantages:

Lifelong Coverage: One of the primary benefits is the guarantee of coverage for your entire life. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force as long as you make the required premium payments. This means that your loved ones will receive a death benefit when you pass away, providing financial security for your family's long-term needs.

Fixed Premiums: With whole life insurance, you pay a consistent premium throughout the policy's duration. This predictability is a significant advantage, as it allows you to plan your finances effectively. The premium remains the same, regardless of changes in your health or age, providing stability and peace of mind.

Potential Investment Returns: This type of insurance also includes an investment component. A portion of your premium is allocated to an investment account, which can grow over time. This investment aspect allows your money to potentially accumulate value, providing a return on your investment. The investment returns can vary depending on market performance, but they offer the opportunity for your policy to grow and potentially outpace the cost of insurance.

Additionally, the cash value of the policy, which is the portion that has accumulated value, can be borrowed against or withdrawn, providing access to funds during your lifetime. This feature can be particularly useful for various financial needs, such as funding education expenses or starting a business.

In summary, whole life insurance from MassMutual offers a comprehensive solution for individuals seeking lifelong coverage, fixed premiums, and the potential for investment growth. It provides financial security and the flexibility to adapt to changing life circumstances, ensuring that your loved ones are protected and your financial goals are met.

Life Insurance Annual Interest: Taxable or Not?

You may want to see also

Features: Includes a death benefit, cash value, and investment options

Whole life insurance offered by MassMutual is a comprehensive financial product designed to provide long-term coverage and various benefits to policyholders. One of its key features is the death benefit, which ensures that a predetermined amount is paid out to the policyholder's beneficiaries upon their passing. This financial safety net can provide peace of mind, knowing that your loved ones will be financially protected even if you're no longer around. The death benefit is typically guaranteed and remains in effect for the entire duration of the policy, making it a reliable source of financial security.

In addition to the death benefit, whole life insurance from MassMutual includes a cash value component. This feature allows the policy to accumulate cash value over time, which can be borrowed against or withdrawn. The cash value grows tax-deferred and can be used for various purposes, such as funding education expenses, starting a business, or supplementing retirement income. It provides a flexible financial asset that can be utilized according to the policyholder's needs and goals.

The investment options associated with whole life insurance policies offer another layer of customization. Policyholders can choose how to allocate their cash value between different investment options provided by MassMutual. These options typically include a mix of stocks, bonds, and other investment vehicles, allowing for potential growth and diversification of the policy's value. By selecting appropriate investment strategies, individuals can maximize the long-term growth potential of their whole life insurance policy while still benefiting from the guaranteed death benefit and cash value accumulation.

MassMutual's whole life insurance also provides a fixed premium, which means the cost of the policy remains consistent throughout the term. This predictability allows policyholders to plan and budget effectively, knowing their insurance premiums will not increase over time. Additionally, the policy offers a level of permanence, as it remains in force for the entire lifetime of the insured individual, providing long-term financial protection.

In summary, whole life insurance from MassMutual offers a robust set of features, including a guaranteed death benefit, cash value accumulation, and customizable investment options. These elements combine to create a financial product that provides security, flexibility, and potential for growth, making it an attractive choice for individuals seeking comprehensive long-term insurance coverage.

Life Insurance: Can Weight Impact Your Application?

You may want to see also

Comparison: How it differs from term life and universal life insurance

Whole life insurance, offered by MassMutual, is a type of permanent life insurance that provides coverage for the entire lifetime of the policyholder. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance offers a guaranteed death benefit and a cash value component. This means that the policyholder will receive a payout upon their passing, and the policy will also accumulate cash value over time, which can be borrowed against or withdrawn.

One key difference between whole life insurance and term life insurance is the level of flexibility. With term life, the policyholder can choose the duration of the coverage, typically ranging from 10 to 30 years. Once the term ends, the policy expires, and the coverage is no longer in effect unless the policyholder renews it. In contrast, whole life insurance provides long-term coverage with no expiration date, ensuring that the policyholder's loved ones are protected throughout their lives.

Another aspect that sets whole life insurance apart is the investment component. The cash value in a whole life policy grows tax-deferred, similar to a savings account. This allows policyholders to build a substantial cash reserve over time. Additionally, the death benefit in whole life insurance is typically higher than in term life policies, providing more financial security for the policyholder's family.

When compared to universal life insurance, whole life insurance offers more stability and predictability. Universal life policies have adjustable premiums and death benefits, which can be influenced by market performance. In contrast, whole life insurance has fixed premiums and a guaranteed death benefit, providing a more consistent and reliable financial plan. This predictability can be especially important for long-term financial planning and ensuring that the policyholder's loved ones are adequately protected.

In summary, whole life insurance from MassMutual provides permanent coverage, a guaranteed death benefit, and a cash value component, setting it apart from term life and universal life insurance. The flexibility, long-term coverage, and investment potential make it a comprehensive and reliable choice for individuals seeking financial security for their families. Understanding these differences can help individuals make informed decisions when choosing the right type of life insurance to meet their specific needs.

American General Life Insurance: Is It Worth the Hype?

You may want to see also

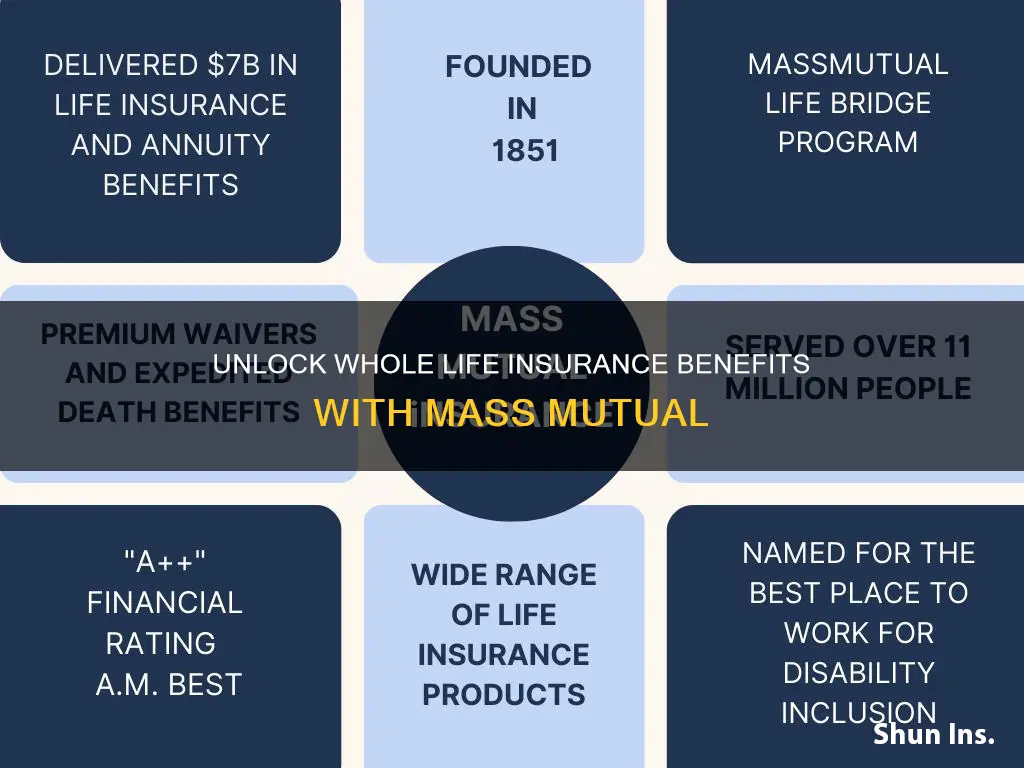

MassMutual: A leading provider known for financial strength and customer service

MassMutual, or Massachusetts Mutual Life Insurance Company, is a renowned and trusted name in the insurance industry, particularly in the realm of whole life insurance. With a rich history spanning over 170 years, the company has established itself as a leading provider, offering a wide range of financial products and services to its customers. One of the key aspects that sets MassMutual apart is its unwavering commitment to financial strength and customer satisfaction.

Whole life insurance, offered by MassMutual, is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers lifelong protection. This type of policy builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility and security. MassMutual's whole life insurance plans are designed to meet various financial needs, such as providing for family expenses, funding education, or serving as a long-term savings strategy.

The company's financial strength is a critical factor in ensuring the reliability and stability of their insurance products. MassMutual has consistently maintained a strong financial position, allowing them to fulfill their obligations to policyholders. Their financial stability is reflected in ratings from reputable agencies such as A.M. Best, Moody's, and Standard & Poor's, which have assigned MassMutual excellent financial strength ratings. This financial strength provides policyholders with peace of mind, knowing that their insurance provider can meet its commitments over the long term.

In addition to its financial prowess, MassMutual is highly regarded for its customer service. The company understands that building long-term relationships with its clients is essential. They offer personalized guidance and support, ensuring that each customer's unique needs are met. MassMutual's representatives are trained to provide comprehensive advice, helping clients make informed decisions about their insurance and financial planning. The company's focus on customer service extends to its claims process, which is designed to be efficient and straightforward, ensuring that policyholders receive the benefits they are entitled to.

MassMutual's reputation for financial strength and customer service has contributed to its success and longevity in the industry. The company's ability to provide reliable insurance solutions, coupled with its commitment to customer satisfaction, makes it a preferred choice for individuals seeking long-term financial security. Whether it's for wealth accumulation, estate planning, or providing for loved ones, MassMutual's whole life insurance options offer a comprehensive approach to meeting various financial goals.

Life Insurance Eligibility: What You Need to Know

You may want to see also

Frequently asked questions

Whole Life Insurance, offered by MassMutual, is a permanent life insurance policy that provides coverage for your entire life. It offers a combination of a death benefit and a cash value component, which grows tax-deferred. This type of insurance is designed to provide long-term financial security and peace of mind, ensuring that your loved ones are protected even in your absence.

The cash value in Whole Life Insurance is a feature that allows the policy to accumulate money over time. A portion of your premium payments goes towards building this cash value, which can be borrowed against or withdrawn as needed. This feature provides flexibility, allowing you to access the funds for various purposes, such as paying for education, starting a business, or covering unexpected expenses, while still maintaining your insurance coverage.

Yes, MassMutual's Whole Life Insurance policies often include investment options, allowing policyholders to potentially grow their cash value. These investments can be customized to fit individual financial goals and risk tolerances. By allocating a portion of the cash value to investment options, policyholders can benefit from potential capital appreciation and dividend distributions, providing an opportunity to build wealth alongside their insurance coverage.