Cash value life insurance, while offering long-term savings and investment opportunities, has faced criticism for several reasons. One major concern is the complexity of the product, which can make it difficult for consumers to fully understand the costs and potential risks involved. Additionally, the high upfront costs and potential for high fees can lead to significant out-of-pocket expenses for policyholders. Critics also argue that the investment returns on cash value policies may not keep pace with inflation over time, potentially reducing the overall value of the policy. These factors have sparked debates about the suitability of cash value life insurance for certain individuals and the need for clearer regulatory oversight to protect consumers.

What You'll Learn

- High Cost: Cash value insurance can be expensive, with fees and commissions that may outweigh the benefits

- Slower Growth: The investment growth in cash value policies is typically slower compared to other investment options

- Limited Flexibility: Policyholders may face restrictions on accessing their funds without penalties

- Complexity: Understanding the intricacies of cash value insurance can be challenging for policyholders

- Tax Implications: Tax treatment varies, and policyholders may face unexpected tax consequences

High Cost: Cash value insurance can be expensive, with fees and commissions that may outweigh the benefits

Cash value life insurance, while offering some long-term savings potential, can indeed be an expensive financial product. One of the primary concerns is the high cost associated with these policies. When you purchase cash value insurance, a significant portion of your premium goes towards building cash value, which is essentially an investment account within the policy. However, this process is not without its drawbacks.

The fees and commissions charged by insurance companies can be substantial. These costs are often built into the policy's structure, and they can accumulate over time. For instance, the initial premium may include a large upfront fee, and subsequent payments could be split between policy maintenance and investment growth. While the cash value can grow tax-deferred, the fees eat into this potential benefit. These expenses might include surrender charges, which are penalties for canceling the policy early, and investment management fees, which are charged to manage the policy's investment portfolio.

In some cases, the total cost of these fees can be quite high, sometimes even exceeding the policy's cash value growth. This means that while you might have invested in a policy with the intention of building a financial cushion or a legacy, the high costs could negate these benefits. It's important for consumers to carefully review the policy details and understand the fee structure to ensure they are making an informed decision.

Additionally, the complexity of cash value insurance can make it challenging for policyholders to understand the true cost of their investment. The investment options and associated risks might not be as transparent as in other financial products, leading to potential misunderstandings about the value of their policy. As a result, individuals may find themselves paying high fees without fully comprehending the benefits they are receiving.

In summary, the high cost of cash value insurance, driven by various fees and commissions, can be a significant concern for policyholders. It is crucial to carefully evaluate these expenses and consider alternative financial instruments that might offer more cost-effective solutions for long-term savings and insurance needs.

Understanding VA Life Insurance: A Comprehensive Guide

You may want to see also

Slower Growth: The investment growth in cash value policies is typically slower compared to other investment options

The concept of cash value life insurance is often associated with a slower growth rate in investment compared to other financial instruments. This is primarily due to the nature of the policy and the way it is structured. Cash value policies are designed to provide a long-term financial benefit, typically in the form of a death benefit upon the insured's passing. The accumulation of cash value is a gradual process, and it takes time for the policyholder's investments to grow and mature.

One of the reasons for this slower growth is the conservative investment approach. Cash value policies often invest in a diversified portfolio of assets, including bonds, stocks, and other fixed-income securities. While this strategy provides a measure of stability, it also means that the potential for high returns is limited. The focus is on preserving capital and generating steady, long-term growth, which can be slower compared to more aggressive investment vehicles.

Additionally, the fees and charges associated with cash value life insurance can impact the overall growth rate. These policies typically involve higher expenses, including mortality charges, policy administration fees, and surrender charges. These costs are necessary to fund the insurance component of the policy and ensure the financial security of the insurer. As a result, a portion of the policyholder's premium is used to cover these expenses, which can reduce the amount available for investment growth.

Furthermore, the tax-deferred nature of cash value policies can also contribute to the slower growth. Unlike some other investment accounts, cash value accounts are not subject to immediate taxation on investment gains. However, this also means that the growth is not accelerated by tax advantages in the short term. The compound interest and investment returns are allowed to grow tax-free until the policyholder accesses the funds, which can result in a more gradual increase in value.

In summary, the slower growth in cash value life insurance policies is a result of the conservative investment approach, higher fees, and the tax-deferred nature of the account. While this may not appeal to those seeking rapid investment returns, it also provides a level of security and long-term financial planning that other investment options might not offer. Understanding these factors is essential for individuals considering cash value life insurance as part of their financial strategy.

Life Insurance: Regular Updates for Peace of Mind

You may want to see also

Limited Flexibility: Policyholders may face restrictions on accessing their funds without penalties

Cash value life insurance, while offering a range of benefits, can present certain drawbacks, particularly in terms of flexibility for policyholders. One of the main concerns is the limited ability to access the funds accumulated within the policy without incurring penalties. This restriction can be a significant disadvantage for those seeking financial flexibility and control over their investments.

When an individual purchases a cash value life insurance policy, a portion of their premium contributes to building cash value, which grows over time through interest and investment gains. This cash value can be borrowed against or withdrawn, but it is not easily accessible without consequences. Policyholders often face restrictions on withdrawals, and any early access to these funds may result in penalties, similar to early withdrawal fees in retirement accounts. These penalties can be substantial and may reduce the overall value of the policy, making it less attractive for those seeking immediate financial flexibility.

The limited flexibility can be particularly challenging for policyholders who may need access to their funds for various reasons. For instance, individuals might require financial resources for unexpected expenses, business opportunities, or personal investments. However, the process of accessing the cash value can be cumbersome and may involve lengthy approval processes, making it difficult to respond promptly to financial needs. This lack of immediate accessibility can be a significant drawback for those who value the ability to quickly utilize their investments.

Furthermore, the restrictions on accessing funds can impact the overall investment strategy of policyholders. Many individuals use cash value life insurance as a long-term investment tool, allowing their money to grow tax-deferred until needed. However, the inability to withdraw funds without penalties may discourage policyholders from utilizing their investments for short-term gains or taking advantage of other investment opportunities. This limitation could potentially hinder the policyholder's ability to diversify their portfolio and maximize returns.

In summary, the limited flexibility in accessing cash value life insurance funds without penalties can be a significant concern for policyholders. It restricts their ability to use these funds for immediate needs or take advantage of other investment opportunities. While cash value life insurance offers valuable benefits, understanding and addressing these limitations are essential for individuals to make informed decisions about their financial strategies.

Pregnant and Want Life Insurance? Here's What You Need to Know

You may want to see also

Complexity: Understanding the intricacies of cash value insurance can be challenging for policyholders

The concept of cash value life insurance can be intricate and complex, often leaving policyholders with a sense of confusion and uncertainty. This type of insurance, while offering some financial benefits, has several aspects that can be challenging to fully comprehend. One of the primary issues is the long-term commitment it entails. When an individual purchases cash value life insurance, they are essentially entering into a decades-long agreement with an insurance company. Understanding the implications of this commitment is crucial, as it involves regular premium payments and the potential for long-term financial obligations. Policyholders must carefully consider their financial capabilities and future plans to ensure they can meet these payments without adverse consequences.

Another layer of complexity lies in the investment component of cash value insurance. This type of policy often includes an investment element, where a portion of the premiums is invested in various financial instruments. The performance of these investments directly impacts the cash value accumulation within the policy. Policyholders need to grasp the risks and potential rewards associated with these investments, as they can significantly affect the overall value of the policy over time. Market volatility, investment fees, and the potential for losses are all factors that can complicate the understanding of the policy's financial behavior.

Furthermore, the tax implications of cash value life insurance can be intricate. The cash value accumulation within the policy may grow tax-deferred, providing a potential tax advantage. However, understanding the rules and regulations surrounding tax-deferred growth is essential. Policyholders must be aware of how and when they can access this cash value without incurring penalties or taxes, as missteps in this area could result in unintended financial consequences.

The complexity of cash value insurance is further exacerbated by the various policy options and riders available. Insurance companies offer a range of additional benefits and riders that can customize the policy to meet specific needs. However, these options can make the policy structure intricate and challenging to navigate. Policyholders must carefully evaluate their requirements and choose the most suitable riders, ensuring they understand the impact of these additions on their overall insurance experience.

In summary, the intricacies of cash value life insurance can indeed be a challenge for policyholders. From the long-term financial commitment to the investment and tax considerations, there are multiple factors to comprehend and manage. It is essential for individuals to seek comprehensive information, consult financial advisors, and carefully review their policies to ensure they make informed decisions regarding their insurance choices. While cash value insurance can provide financial security, a thorough understanding of its complexities is vital to avoid potential pitfalls.

Life Insurance Proceeds: Taxable or Not?

You may want to see also

Tax Implications: Tax treatment varies, and policyholders may face unexpected tax consequences

The tax implications of cash value life insurance can be complex and often lead to unexpected consequences for policyholders. When it comes to cash value policies, the tax treatment varies depending on the jurisdiction and the specific policy structure. One of the main issues is the potential for unexpected taxation on withdrawals or policy loans.

Cash value life insurance policies typically accumulate cash value over time, which can be borrowed against or withdrawn by the policyholder. However, these withdrawals may be subject to income tax. The tax treatment can vary; in some cases, the withdrawals could be considered taxable income, and the policyholder may need to pay taxes on the entire amount withdrawn. This can be a significant financial burden, especially if the policyholder is not aware of this potential tax liability. For instance, if a policyholder takes out a loan against their cash value, the interest accrued on the loan may be taxable, and the principal repayment could be treated as a distribution, triggering tax consequences.

Additionally, the tax treatment of policy loans can be intricate. When a policyholder borrows money from their cash value, they may be required to pay back the loan with interest. The interest paid on these loans is often not tax-deductible, and the loan itself may be considered a taxable distribution. This means that the policyholder could face a double tax burden: paying taxes on the interest and then potentially being taxed again when the loan is repaid, especially if the repayment exceeds the policy's cash value.

Furthermore, the tax implications can extend to the death benefit received by the beneficiary upon the insured individual's passing. The tax treatment of the death benefit varies depending on the policy and the jurisdiction. In some cases, the death benefit may be subject to income tax, and the beneficiary might need to pay taxes on the entire amount received. This can be a significant concern, especially for high-net-worth individuals or those with substantial insurance coverage.

Understanding the tax implications is crucial for policyholders to make informed decisions. It is essential to consult with tax professionals and insurance experts to navigate these complexities. They can provide tailored advice based on the specific policy and the policyholder's financial situation, ensuring that they are aware of all potential tax consequences and can plan accordingly. Being well-informed about these tax implications can help individuals avoid financial surprises and make more strategic choices regarding their cash value life insurance policies.

Life Insurance: Can You Opt-Out of Your Employer's Plan?

You may want to see also

Frequently asked questions

Cash value life insurance, while offering a dual benefit of coverage and savings, can be criticized for its complexity and potential for high costs. The policy's value grows over time through regular premium payments, but the investment options may not always be as competitive as other investment vehicles. Additionally, the fees associated with the policy can be significant, and the policyholder might not fully understand the long-term implications of their investment choices.

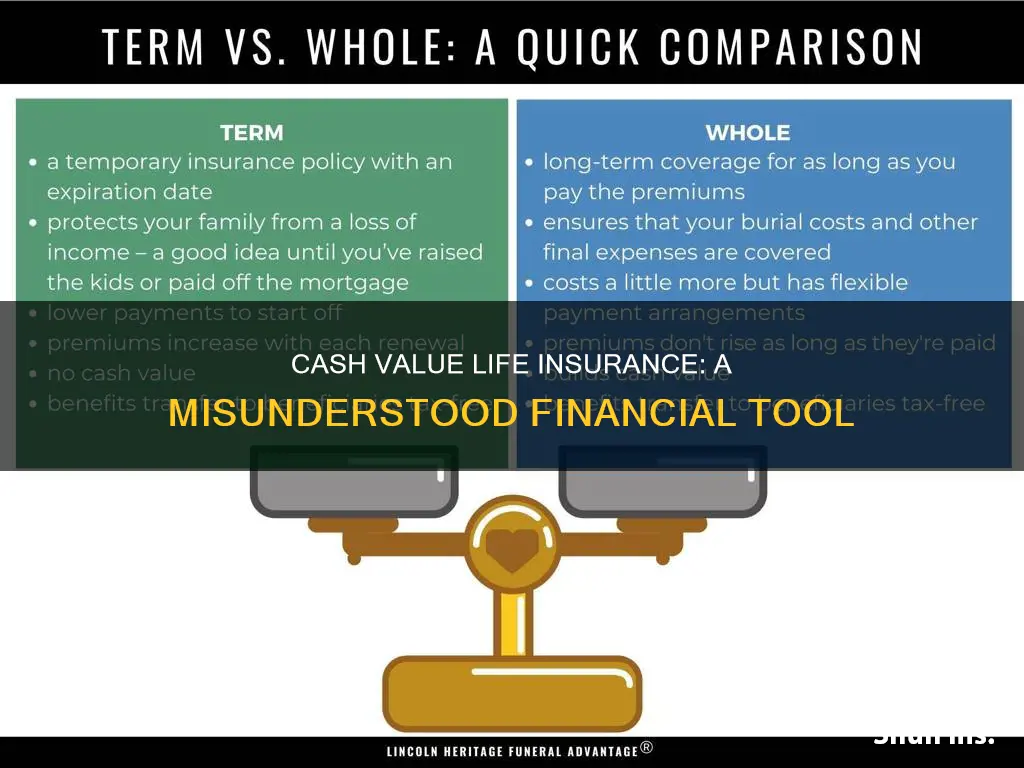

The cost of cash value life insurance can be higher compared to term life insurance, especially for younger and healthier individuals. This is because the policy's cash value component adds to the overall cost. While the premiums might be higher, the policy provides permanent coverage and a savings element, which some individuals may find more appealing. However, for those seeking pure coverage without investment components, term life insurance is often a more cost-effective option.

Yes, there are potential drawbacks. The investment portion of cash value life insurance may not perform as expected, and the policyholder might not realize significant returns. The investment options are often limited, and the policy's performance is influenced by market conditions. Additionally, the policy's cash value growth is typically slow, and it may take many years to accumulate a substantial amount. This could be a concern for those seeking immediate and substantial savings.

Absolutely. The intricate nature of these policies can make them challenging to understand, especially for those without financial expertise. Policyholders might struggle to comprehend the various fees, charges, and investment strategies involved. Misunderstanding the policy's mechanics could lead to poor decision-making, such as taking out loans against the policy's cash value, which can result in penalties and reduced coverage. Therefore, thorough understanding and professional guidance are essential to ensure the policy is utilized effectively and efficiently.