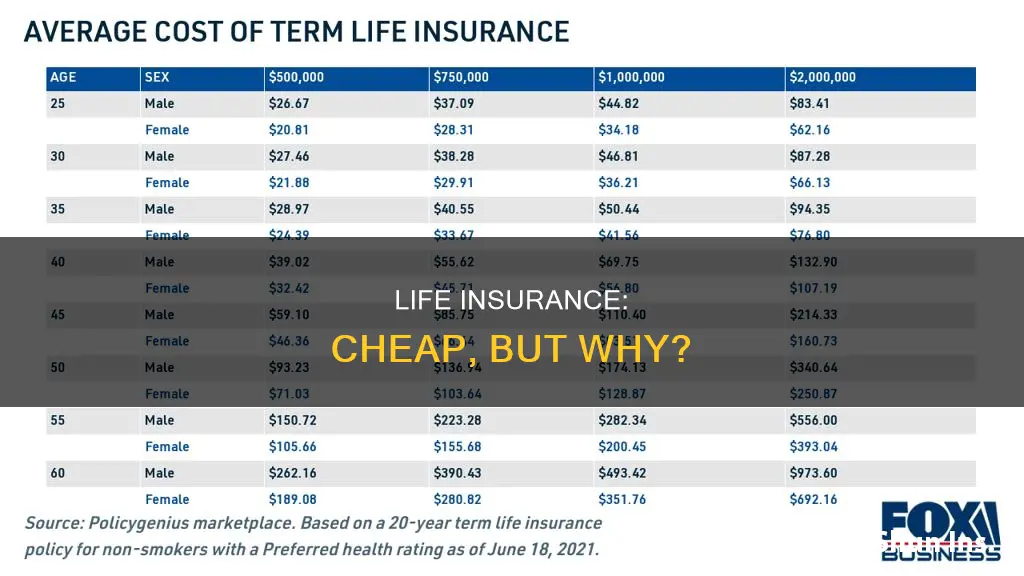

Life insurance is a financial product that provides peace of mind and financial support for loved ones after the policyholder's death. The cost of life insurance depends on several factors, including age, gender, health, hobbies, occupation, and the type of policy chosen. Term life insurance, which covers a set period, is generally more affordable than whole life insurance, which lasts a lifetime and includes a cash value component. Life insurance rates increase with age, and men tend to pay more than women due to shorter lifespans and riskier jobs and lifestyles. Maintaining a healthy lifestyle, quitting smoking, and avoiding high-risk activities can help lower premiums. Obtaining quotes from multiple insurers and purchasing coverage early can also reduce costs. While life insurance is not for everyone, it can be a valuable tool for those seeking to provide for their loved ones after their death.

| Characteristics | Values |

|---|---|

| --- | --- |

| Age | Younger people tend to pay less for life insurance than older people. |

| Gender | Males tend to pay more for life insurance than females. |

| Health | People with health problems tend to pay more for life insurance. |

| Tobacco use | Smokers tend to pay more for life insurance than non-smokers. |

| Hobbies | People with dangerous hobbies tend to pay more for life insurance. |

| Criminal history | People with criminal convictions tend to pay more for life insurance. |

| Occupation | People with dangerous jobs tend to pay more for life insurance. |

| Financial history | People with poor financial history tend to pay more for life insurance. |

| Coverage amount | More coverage results in higher rates. |

What You'll Learn

Life insurance is based on risk factors

Life insurance rates are based on risk factors. The younger and healthier you are, the lower your premium is likely to be.

Age

The older you are, the more likely you are to experience health problems, and the more likely you are to die. This means that life insurance quotes will generally get more expensive as you age.

Gender

Your gender might statistically impact the likelihood of getting certain diseases, the riskiness of your lifestyle, or your overall life expectancy, all of which may affect life insurance rates.

Health

Your health also plays a role in determining how much you’ll pay for life insurance. Those who experience health problems are likely to face higher premiums. Insurers typically look at your height, weight, and medical history — especially any chronic or serious illnesses you've experienced.

Family history

Your family medical history could predispose you to certain ailments, which means you could pay more for life insurance.

Lifestyle

Lifestyle choices can also impact your life insurance premium. Risky hobbies like skydiving and rock climbing may increase your premium significantly. Smoking can trigger long-term health problems, which is why insurers typically have much higher life insurance rates for smokers.

Occupation

Your occupation can also impact your premium. For example, police officers, firefighters, pilots, and construction workers are likely to see higher life insurance rates.

Type of policy

Term life insurance is generally cheaper than whole life insurance. Term life insurance is only for a set time period, such as 10, 20, or 30 years, and there is no cash value component. Whole life insurance, on the other hand, lasts until your death and has a cash value component.

Writing Off Life Insurance: Corporate Strategies and Benefits

You may want to see also

Age and gender affect premiums

Age and gender are two of the most significant factors that affect life insurance premiums.

Age

The likelihood of an insurer having to pay out on a policy increases with age. Therefore, younger policyholders pay lower premiums. Life insurance premiums increase by an average of 8-10% each year. Besides, younger people tend to be healthier, which also helps them get a lower rate.

Gender

Men generally pay more for life insurance due to a shorter average life expectancy and a statistically higher risk of an early heart attack, among other risks. Women, on average, live longer than men. In the United States, the average life expectancy for women is 81.1, while it is 76.1 for men. This disparity means that women generally pay less for life insurance than men.

Other Factors

Other factors that affect life insurance premiums include:

- Lifestyle choices: Risky hobbies like skydiving and dangerous jobs like logging can increase premiums.

- Tobacco use: Smoking can trigger long-term health problems and increase premiums.

- Health: A history of medical conditions and family history of illness can increase premiums.

- Weight, cholesterol levels, and blood pressure: Insurers will consider these metrics when determining premiums.

- High-risk behaviours: Insurers will assess whether your behaviours are tied to statistically shorter lifespans.

Whole Life Insurance: The Never-Ending Coverage Plan

You may want to see also

Health and lifestyle choices matter

Health

Your health is a significant factor in determining the cost of your life insurance premium. Insurers will consider your current health, including your height, weight, prescriptions, medical conditions, and substance abuse history. They will also look at your family's health history, as certain ailments could be hereditary.

Lifestyle

Your lifestyle choices can also influence your insurance premium. For example, insurers may charge higher premiums if you engage in high-risk activities such as skydiving or rock climbing. Lifestyle factors such as your diet, exercise habits, tobacco and alcohol use, and sleep patterns can also impact your premium.

Habits

In addition to lifestyle choices, certain habits can also affect your premium. For instance, smoking is a significant factor in the price of life insurance, as it increases the risk of various health problems. Similarly, a poor driving record can also lead to higher premiums.

Age

Age is another critical factor in determining life insurance rates. Younger people tend to have lower premiums since they are less likely to get ill and have longer life expectancies. As you get older, the cost of life insurance generally increases.

Gender

Gender also plays a role in the cost of life insurance. Women tend to have lower rates than men because they have a longer life expectancy on average.

Occupation

Your occupation can also impact your life insurance premium. If you have a risky job, you may pay more for life insurance.

How to Lower Your Premium

There are several ways to lower your life insurance premium. Maintaining a healthy weight, practicing good health habits, and seeking regular medical care can help. Additionally, quitting smoking, improving your diet, and exercising regularly can also reduce your premium.

Trans America Life Insurance: Marijuana Testing Policy Explained

You may want to see also

Occupation and hobbies can increase premiums

When applying for life insurance, insurance companies will consider your occupation and hobbies when determining your rates and eligibility for coverage. If your job or hobbies put you at greater risk of injury or death, this can negatively impact your rates and coverage options.

Occupations Considered High-Risk

- First responders (e.g. law enforcement, firefighters)

- Active military

- Aviation jobs (e.g. commercial and private pilots)

- Construction workers

- Natural resources workers (e.g. oil and gas industry, mining industry, fishing industry)

- Bartenders

- Marijuana industry workers

- CEO or CFO conducting international business

- Commercial pilots

- Dangerous goods delivery drivers

- Dentists who travel for work

- Doctors who travel for work

- Firefighters and first responders

- Lawyers who travel for work

- Nurses who travel for work

- Oil refinery workers

- Municipal police officers

- Ranchers and farm workers

- Veterinarians who travel for work

Hobbies Considered High-Risk

- Scuba diving

- Skydiving

- Rock climbing

- Flying a private plane

- Motorsport racing

- Bungee jumping

- Adventure mountaineering

- Aviation

- Hunting

If you have a high-risk occupation or engage in high-risk hobbies, you will likely pay higher premiums for your life insurance coverage. Additionally, certain riders, such as the waiver of premium disability rider and the accidental death benefit rider, may not be available to you.

Life Insurance for Military Members: Private Options Explored

You may want to see also

Policy type and coverage level impact cost

The type of life insurance policy and the level of coverage you choose will have a significant impact on the overall cost. Term life insurance, for example, is typically the cheapest option, as it covers you for a specific period, such as 10, 20, or 30 years. Whole life insurance, on the other hand, tends to be more expensive since it provides coverage for your entire life.

When it comes to coverage levels, the death benefit amount you choose will affect your premiums. The higher the death benefit, the higher the cost of the policy. This is because the insurance company will be responsible for paying a larger amount to your beneficiaries upon your death. Additionally, the length of the term can impact the cost. Longer terms generally result in higher overall costs, but the annual premiums may be lower compared to shorter terms.

Your age and health are also crucial factors. Younger and healthier individuals often pay lower premiums since they are less likely to pass away during the policy period. Older individuals or those with health issues may have to pay significantly more for the same level of coverage.

Furthermore, your gender can play a role in determining the cost of life insurance. Men usually have shorter life expectancies than women, so they tend to pay higher rates.

It's worth noting that life insurance rates can vary across different companies, so it's always a good idea to shop around and compare quotes to find the most affordable option that meets your needs.

HIV and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The cost of life insurance is determined by factors such as age, gender, health, family history, coverage type, and lifestyle choices.

To get cheaper life insurance, consider purchasing a policy at a younger age, avoiding dangerous activities, maintaining a healthy lifestyle, and comparing quotes from multiple carriers.

Yes, term life insurance is typically cheaper than whole life insurance because it is not permanent and does not have a cash value component.

Some companies known for offering affordable life insurance include Protective, Banner by Legal & General, Penn Mutual, Pacific Life Insurance, and Thrivent.

The cost of life insurance depends on various factors, but according to eFinancial, a healthy 20 to 40-year-old can expect to pay between $24 and $29 per month for a 10-year, $250,000 term life insurance policy.