Life insurance is a benefit that employers may offer to their employees. It is completely optional for employers to offer this benefit, but it is worth considering if the employer and employees can benefit from the possible lower rates of insuring a group. Employees can add this benefit to their existing plan to enhance their coverage levels. Basic employer-provided life insurance is usually free, but it may not be enough to meet an individual's needs. The amount of coverage is typically determined using a multiple of an employee's annual salary, and coverage ends when the employee leaves the company.

| Characteristics | Values |

|---|---|

| Coverage | Typically capped at low amounts, e.g. one to two times the employee's annual salary |

| Cost | Usually free or offered at a low cost |

| Portability | May not be portable if the employee leaves the job |

| Choice | Limited choice as employers typically only work with one carrier |

| Coverage Amounts | May not be enough to meet financial needs |

| Premiums | Premiums are not fixed and may increase annually or every five years |

What You'll Learn

- Pros of employer life insurance: convenience, savings, acceptance, early protection, and added coverage

- Cons of employer life insurance: coverage tied to your job, limited choice, low coverage amounts, and premiums aren't fixed

- Employer life insurance is typically group term life insurance

- Employer life insurance is usually for a fixed term

- Employer life insurance is not always enough coverage

Pros of employer life insurance: convenience, savings, acceptance, early protection, and added coverage

Convenience

Opting for employer life insurance is simple. It is often offered as part of an employee benefits package, so all you have to do is opt in. The paperwork is usually straightforward and can be completed during the hiring process, with HR departments available to answer any questions.

Savings

Employers typically pay for most or all of the premiums for basic group life insurance, so employees can save money or use it for other needs.

Acceptance

Most employer life insurance plans are guaranteed, meaning you will be accepted regardless of any serious medical conditions. This is especially beneficial for those who might struggle to get insured otherwise.

Early Protection

For those who are just starting their careers or are in the early stages, employer life insurance can provide financial security for those who depend on you when you might not have the funds for a comprehensive policy.

Added Coverage

As your life changes and your needs evolve, you can usually increase your coverage. Employers may offer the option to pay an additional premium to increase basic protection. Riders for extra protection can also be added to your basic policy, providing additional peace of mind.

Meemic's Life Insurance Offer: What You Need to Know

You may want to see also

Cons of employer life insurance: coverage tied to your job, limited choice, low coverage amounts, and premiums aren't fixed

While getting life insurance through your employer is a good idea, there are some cons to consider.

Coverage Tied to Your Job

Group life insurance is often not portable. This means that if you leave your job, you may not be able to take the policy with you. You might be able to convert your group policy to individual life insurance, but the price could go up significantly. If your next job doesn’t offer group life insurance, you can buy an individual policy from the open market.

Limited Choice

Coverage through work tends to be a type of term life insurance, and employers typically only work with one carrier. Therefore, you won’t find the range of policy options that you might find outside of work. If you’re looking for a more complex product like whole life insurance or universal life insurance, you might want to compare prices on the open market first and speak with a fee-only life insurance advisor before proceeding.

Low Coverage Amounts

If you have dependents or a lot of financial obligations, a group life insurance policy could leave you underinsured. Use a calculator to figure out how much life insurance you need. If your group coverage is worth less than this amount, you might want to buy an individual policy on your own to ensure you and your family have adequate coverage.

Premiums Aren't Fixed

The premiums for group life insurance go up either on an annual basis or every five years. If your employer pays for your coverage, the premiums for coverage over $50,000 may be subject to income tax. The first $50,000 worth of coverage is tax-free.

Dependent Life Insurance: Worth the Cost?

You may want to see also

Employer life insurance is typically group term life insurance

Group term life insurance is a popular benefit for both employers and employees because it may provide lower rates for insuring a group of people. It is often offered to full-time employees, and the amount of coverage is typically determined using a multiple of an employee's annual salary. For example, an employee earning $60,000 per year may qualify for a policy with benefits of up to two times their salary, or $120,000.

The main advantage of group term life insurance is the convenience and ease of enrollment it offers. Employees do not need to worry about finding a provider or going through a lengthy process to receive an individual quote. Enrollment is often done during open enrollment or new employee onboarding, and employees only need to answer a few questions to activate their policy.

Another benefit is the potential for group discounts and lower life insurance premiums. Employers often subsidise some or all of the premium costs, resulting in lower out-of-pocket expenses for employees. Additionally, group term life insurance plans typically do not require medical underwriting, saving employees time and allowing those who would require high-risk insurance to qualify for coverage.

However, there are also some drawbacks to employer-provided life insurance. The maximum policy value may be limited and based on an employee's salary, which may not provide sufficient coverage. This type of insurance is also usually tied to employment, meaning that if an employee leaves the company, their coverage may end.

In conclusion, employer life insurance, typically offered as group term life insurance, can be a convenient and cost-effective way for employees to obtain life insurance coverage. However, it is important to consider the limitations of this type of insurance and evaluate whether the coverage meets an individual's financial needs.

How Many Life Insurance Policies Can You Have?

You may want to see also

Employer life insurance is usually for a fixed term

Life insurance is a valuable benefit that employers can offer their employees. It is usually term life insurance, which is only in effect for a specific length of time. This means that employer life insurance is typically for a fixed term, often tied to the duration of an employee's tenure at the company. Here are some key points to consider:

Fixed Term of Coverage

The term of employer-provided life insurance is usually linked to the employee's tenure. This means that the coverage is often valid only while the employee remains employed by the company. So, if an employee leaves the company, the life insurance coverage provided by the employer typically ends. It's important to note that some policies may allow for a conversion privilege, where employees can get a private policy through the same insurance company, but these policies may be more expensive and have lower coverage limits.

Fixed or Limited Coverage Amount

Employer-provided life insurance typically offers a fixed or limited amount of coverage. The coverage amount is often based on a multiple of the employee's annual salary or linked to their position at the company. While this can provide a significant benefit, it may not meet all the financial needs of the employee and their dependents. It's important for employees to assess their own financial situation and consider supplemental coverage if needed.

Convenience and Cost Savings

One of the main advantages of employer-provided life insurance is convenience. Enrolling in this type of coverage is generally simple, as it is often part of the employee benefits package and may not require a medical exam or extensive paperwork. Additionally, employers usually pay for most or all of the premiums, resulting in cost savings for the employee. This can be especially beneficial for employees who are early in their careers and may not have the funds for a separate life insurance policy.

Limited Choice and Lack of Control

Employer-provided life insurance typically offers limited choice in terms of policy options. Employers usually work with a single insurance carrier, and the coverage tends to be term life insurance rather than permanent life insurance. Employees have less control over the policy compared to purchasing their own plan, which can make it challenging to get all their desired benefits.

In summary, employer life insurance is usually for a fixed term, often tied to the employee's tenure. It offers convenience and cost savings but may have limited coverage amounts and policy options. Employees should carefully consider their financial needs and assess whether supplemental coverage is necessary to ensure adequate protection for themselves and their dependents.

Life Insurance and Tax Credits: Missouri's Unique Benefits

You may want to see also

Employer life insurance is not always enough coverage

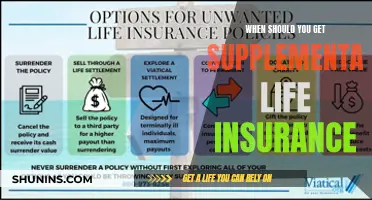

While employer-provided life insurance can be a good benefit, especially if you have no other life insurance in place, it's important to remember that it may not meet all your financial needs. Here are some reasons why employer life insurance may not be enough:

- Limited coverage amount: The most common life insurance plans provided by employers typically cover up to one to two times your annual salary. While this may be sufficient for those who are single and without dependents, it might not be enough for those who are married, have children, or own a home. A general rule of thumb is that your life insurance coverage should be equal to around ten times your salary. This will help ensure that your loved ones can maintain their standard of living and cover expenses such as mortgage payments and children's education.

- Dependents and financial obligations: If you have dependents who rely on your income, you may require additional coverage to provide for their needs in the event of your death. Some experts recommend getting coverage worth five to ten times your salary, especially if you have a non-working spouse, a large family, or special-needs dependents.

- Spouse coverage: Your employer's benefits package may not provide adequate life insurance coverage for your spouse. "Families can often suffer economic hardship if either spouse dies, not just the primary breadwinner," says Jim Saulnier, a certified financial planner. Therefore, it's important to consider whether your employer's coverage is sufficient for your spouse.

- Changing job or health status: Employer-provided life insurance is usually tied to your job, and if you leave your current position, you may lose your coverage. Additionally, as your health declines, it may become more difficult and expensive to obtain new insurance. By purchasing an individual policy, you can ensure continuous coverage regardless of your job or health status.

- Increasing premiums: While employer-provided life insurance may be free or low-cost initially, the premiums tend to increase over time, especially as you age. In contrast, individual policies often offer guaranteed level-premium term life insurance, which means you pay the same amount every year for as long as you have the policy.

- Lack of portability: Group life insurance is often not portable, meaning that if you change jobs, you may not be able to take your policy with you. While you may be able to convert your group policy to an individual one, it will likely be more expensive.

In summary, while employer life insurance can be a good starting point, it's important to consider your unique financial situation and whether the coverage provided is sufficient for your needs. If not, purchasing an individual policy or supplemental coverage may be necessary to ensure adequate financial protection for you and your loved ones.

Term Life Insurance: Does It Expire?

You may want to see also

Frequently asked questions

Employer life insurance is group term life insurance that may be offered as part of an employee benefits package. It is completely optional for employers to offer this benefit, but it can be a good way to attract talented workers, minimise employee turnover and boost productivity.

Employer life insurance can be convenient and easy to enrol in, with the potential for group discounts and lower life insurance premiums. It also doesn't usually require a medical exam to qualify.

Employer life insurance is often limited in coverage, tied to your employment and gives you less control over the policy.