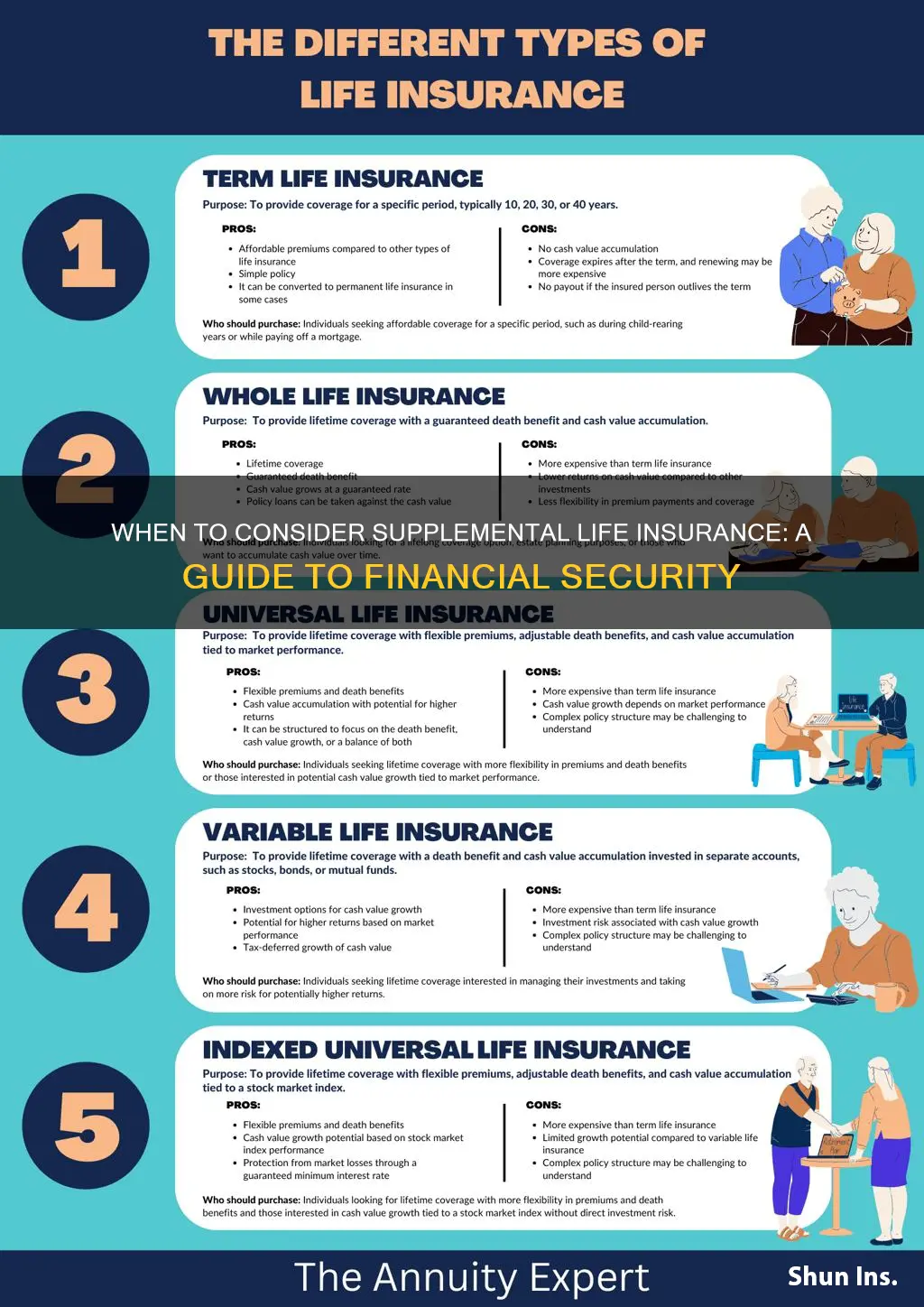

When considering supplemental life insurance, it's important to understand that it's typically designed to complement your primary life insurance policy. Supplemental life insurance can be a valuable addition for those who want extra coverage beyond what their employer provides or their primary policy offers. It's often a good idea to consider supplemental insurance when you have a significant financial responsibility or dependency on your income, as it provides an additional layer of protection for your loved ones. This type of insurance can be particularly beneficial for individuals with high-risk jobs, those with large debts or mortgages, or anyone who wants to ensure their family's financial security in the event of an unexpected death. Understanding your specific needs and financial situation is key to determining when supplemental life insurance becomes a wise investment.

What You'll Learn

- When to Buy: Consider supplemental insurance when you have dependents or high-risk jobs?

- Amount Needed: Assess your financial obligations and choose a policy that complements your primary coverage

- Health Factors: Pre-existing conditions or lifestyle choices may impact eligibility and premiums

- Budget Constraints: Evaluate your budget and choose a plan that fits your financial situation

- Term Length: Decide on a term length that aligns with your current and future needs

When to Buy: Consider supplemental insurance when you have dependents or high-risk jobs

When it comes to life insurance, the primary purpose is often to provide financial security for your loved ones in the event of your untimely demise. However, not all life insurance policies are created equal, and sometimes, a standard policy might not be sufficient to cover all your family's needs. This is where supplemental life insurance comes into play, offering an additional layer of protection tailored to specific circumstances.

One of the most compelling reasons to consider supplemental insurance is the presence of dependents. Dependents are individuals who rely on your income for their basic needs, such as children, spouses, or elderly parents. If something happens to you, the financial burden of providing for these dependents can be overwhelming for your remaining family members. Supplemental insurance can help bridge this gap, ensuring that your dependents receive the financial support they need to maintain their standard of living. For instance, if you have a young family, the additional coverage can provide peace of mind, knowing that your children's education, healthcare, and overall well-being will be financially secure.

Another critical factor to consider is your occupation. Certain jobs come with a higher risk profile, and individuals in these fields should strongly consider supplemental insurance. High-risk jobs, such as construction, mining, or emergency services, expose workers to dangerous situations and increase the likelihood of accidents or injuries. In the event of a work-related incident, a standard life insurance policy might not provide enough coverage to support your family adequately. Supplemental insurance can offer an extra layer of financial protection, ensuring that your loved ones are taken care of, even if you're unable to work due to an accident or illness related to your job.

Additionally, if you have a history of health issues or engage in activities that increase your risk profile, supplemental insurance can be particularly beneficial. Pre-existing medical conditions or hobbies like skydiving or rock climbing can impact your life insurance rates. In such cases, supplemental insurance can provide the necessary coverage without the need for extensive medical exams, making it more accessible and affordable.

In summary, supplemental life insurance is a valuable consideration for anyone with dependents or those in high-risk professions. It provides an additional safety net, ensuring that your family's financial security is not compromised in the event of your passing. By taking this proactive step, you can rest assured that your loved ones will be protected, even in the face of unforeseen circumstances.

Life Insurance Dividends: Assignable or Not?

You may want to see also

Amount Needed: Assess your financial obligations and choose a policy that complements your primary coverage

When considering supplemental life insurance, it's crucial to evaluate your financial obligations and determine the appropriate amount of coverage. This assessment ensures that your loved ones are adequately protected in the event of your passing. Here's a detailed guide to help you navigate this process:

Identify Your Financial Responsibilities: Begin by making a comprehensive list of all your financial commitments. This includes regular expenses such as mortgage or rent payments, car loans, student loans, credit card debts, and any other long-term financial obligations. Additionally, consider future expenses that may arise, such as your children's education costs or any planned large purchases. By calculating the total value of these obligations, you can understand the financial impact you want to mitigate with supplemental insurance.

Evaluate Your Primary Insurance: Your primary life insurance policy is the foundation of your coverage. Review the policy details to understand the death benefit amount and any associated riders or additional coverage options. Determine if your primary insurance already provides sufficient coverage for your family's needs. If the death benefit is substantial and covers your identified financial obligations, you may not require extensive supplemental insurance. However, if your primary policy's death benefit is insufficient, supplemental insurance can fill the gap.

Determine the Policy Amount: The amount of supplemental life insurance you need should complement your primary coverage. Here's a step-by-step approach:

- Calculate the Total Financial Need: Sum up all your financial obligations, including those mentioned earlier, to get a clear picture of the financial support your family requires in your absence.

- Consider the Primary Policy's Limitations: Assess if your primary insurance has any limitations or exclusions. For instance, some policies might not cover certain high-risk activities or pre-existing medical conditions. Ensure that the supplemental policy addresses these gaps.

- Choose a Policy That Complements Your Primary Coverage: Select a supplemental insurance policy that provides the necessary coverage to meet your financial needs. This could involve increasing the death benefit or adding riders to enhance coverage. For example, you might opt for a term life insurance policy that complements your permanent life insurance, ensuring a comprehensive safety net.

Remember, the goal is to create a comprehensive insurance plan that provides financial security for your loved ones. By carefully assessing your financial obligations and understanding the role of supplemental insurance, you can make informed decisions to protect your family's well-being.

Understanding ADA and Taxable Income from Principal Life Insurance

You may want to see also

Health Factors: Pre-existing conditions or lifestyle choices may impact eligibility and premiums

When considering supplemental life insurance, it's crucial to understand how health factors can influence your eligibility and the cost of your policy. Pre-existing medical conditions and lifestyle choices play a significant role in determining whether you qualify for coverage and how much you'll pay in premiums.

Pre-existing conditions, such as chronic illnesses, heart disease, diabetes, or cancer, can make obtaining life insurance more challenging. Insurance companies often view these conditions as high-risk factors. For instance, individuals with a history of diabetes may face higher premiums or even be deemed uninsurable by some providers. Similarly, those with a recent diagnosis of cancer or a heart condition might be considered high-risk, potentially leading to higher costs or the need for additional medical underwriting.

Lifestyle choices also have a substantial impact on life insurance eligibility and premiums. Smoking, for example, is a well-known risk factor for various health issues, including lung cancer, heart disease, and respiratory problems. As a result, smokers often pay higher premiums for life insurance, and some companies may even refuse to provide coverage to current smokers. Similarly, excessive alcohol consumption, drug use, or participation in high-risk sports can also affect your insurance rates.

Additionally, your overall health and fitness level can influence your insurance rates. Maintaining a healthy weight, regular exercise, and a balanced diet can contribute to a lower risk profile for insurance companies. These positive lifestyle choices may result in more favorable insurance terms and lower premiums.

It's essential to be transparent and honest about your health history and lifestyle when applying for supplemental life insurance. Providing accurate information allows insurance providers to assess your risk accurately and offer suitable coverage options. Consulting with an insurance advisor can help you navigate these complexities and make informed decisions regarding your supplemental life insurance needs.

Life Insurance Agents: Essential or Unnecessary?

You may want to see also

Budget Constraints: Evaluate your budget and choose a plan that fits your financial situation

When considering supplemental life insurance, budget constraints are a critical factor to evaluate. It's essential to choose a plan that aligns with your financial capabilities to ensure you can maintain the coverage you need without compromising other essential expenses. Here's a guide to help you navigate this decision:

Assess Your Financial Situation: Begin by evaluating your current financial health. Calculate your monthly income and expenses to understand your cash flow. Consider your fixed costs, such as rent or mortgage payments, utilities, and minimum loan payments. Also, factor in variable expenses like groceries, transportation, and entertainment. This comprehensive overview will help you identify the funds available for insurance premiums.

Determine Your Coverage Needs: Before finalizing a plan, assess your life insurance requirements. Consider your family's financial obligations and future goals. Do you have dependents who rely on your income? Are there any specific expenses or goals you want to ensure are covered in the event of your passing? Understanding your coverage needs will help you decide on the appropriate amount of insurance to purchase.

Compare Plan Options: Insurance providers offer various supplemental life insurance plans, each with different features and costs. Research and compare these options to find the best fit for your budget. Some plans may offer higher coverage amounts but at a higher premium, while others might provide more affordable rates with lower coverage. Look for plans that offer flexibility, allowing you to adjust the coverage amount as your financial situation changes.

Consider Payment Flexibility: Evaluate the payment options provided by different insurance companies. Some may offer flexible payment plans, allowing you to make smaller, more manageable payments. This flexibility can be beneficial if you're on a tight budget, as it provides a more gradual approach to paying for insurance. Additionally, consider the frequency of premium payments (monthly, annually, etc.) and choose a method that suits your financial calendar.

Review and Adjust Regularly: Life insurance needs can change over time due to various life events, such as marriage, the birth of children, or career advancements. Regularly review your policy to ensure it remains adequate. If your financial situation improves, you may be able to increase your coverage without significant budget strain. Conversely, if your budget tightens, you can explore options to adjust your plan accordingly.

By carefully evaluating your budget and choosing a supplemental life insurance plan that fits your financial situation, you can ensure that you and your loved ones are protected without compromising your financial stability. It's a thoughtful process that requires consideration of your current and future needs, allowing you to make an informed decision.

ICICI Prudential Life Insurance: ULIP or Not?

You may want to see also

Term Length: Decide on a term length that aligns with your current and future needs

When considering supplemental life insurance, one of the most crucial decisions you'll make is determining the appropriate term length. This decision should be based on a thorough understanding of your current financial obligations and future goals. The term length refers to the duration for which the insurance policy will provide coverage. It's essential to choose a term that suits your needs at the current time and can adapt as your life circumstances change.

For many individuals, a common starting point is to consider the duration of their mortgage or any significant long-term debt. If you have a substantial mortgage or other debts that you plan to pay off within a specific timeframe, it might be wise to match the term length of your supplemental life insurance to that period. For instance, if you're aiming to pay off your mortgage in 15 years, opting for a 15-year term life insurance policy could be a strategic choice. This way, you ensure that your family or beneficiaries are protected during the years when your financial obligations are most significant.

However, life is unpredictable, and your needs may change over time. It's essential to consider your long-term goals and financial security. For example, if you have young children and plan to provide for their education, a longer term length might be more appropriate. A 25-year or even a 30-year term policy could ensure that your children's educational expenses are covered, providing them with financial security during their formative years. As your children grow and your financial situation evolves, you can review and adjust your policy accordingly.

Additionally, some individuals may prefer a more flexible approach, opting for a term length that aligns with a significant life event or milestone. For instance, you might choose a term that matches the duration of your current employment contract or the time until your children become financially independent. This approach allows you to tailor the insurance coverage to specific life stages, ensuring that your family's needs are met during those critical periods.

In summary, when deciding on the term length for supplemental life insurance, it's crucial to strike a balance between your current obligations and future aspirations. Regularly reviewing and adjusting your policy as your life circumstances change will ensure that you maintain appropriate coverage. By making informed decisions, you can provide the necessary financial protection for your loved ones and achieve peace of mind knowing that your family's well-being is secure.

Cashing Out Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Supplemental life insurance is a valuable consideration when you have specific financial dependents or obligations that your primary life insurance policy might not fully cover. It's often recommended to review and assess your insurance needs when significant life changes occur, such as getting married, having children, purchasing a home, or starting a business. These events can increase your financial responsibilities, making supplemental insurance a prudent choice to ensure your loved ones are protected.

You may need supplemental life insurance if your current policy's death benefit is insufficient to cover your family's essential expenses and long-term financial goals after your passing. Consider factors like your income, debts, mortgage or rent, education costs for children, future retirement needs, and any other financial commitments. If the sum of these expenses and goals exceeds the death benefit of your primary policy, supplemental insurance can provide additional coverage.

Yes, certain life stages often prompt individuals to seek supplemental life insurance. For instance, young families with children might want to ensure their kids' future needs are met. Homeowners with substantial mortgages or those planning to start a business may require additional coverage. As you approach retirement age, supplemental insurance can help secure your family's financial future during this transition. It's essential to assess your unique circumstances and consult with an insurance advisor to determine the most suitable timing.

Yes, it is possible to obtain supplemental life insurance even with pre-existing health conditions. However, the process might be more complex, and the terms and premiums could vary. Insurers often consider factors like the severity of the condition, recent medical history, and lifestyle choices when evaluating applications. It's advisable to disclose all relevant health information accurately and seek professional advice to find the best supplemental insurance option that suits your needs and budget.