Life insurance dividends are a portion of an insurer's profits that are sometimes paid to policyholders. Dividends are considered a return of a portion of the premiums paid for a life insurance policy. They are not guaranteed and are based on the performance of the company's financials. Policyholders have several options for using their dividends, including purchasing additional insurance, reducing future premium payments, or receiving a cash payment. While dividends are generally not taxable, there may be tax implications on any interest earned on the dividends. Understanding the specifics of life insurance dividends is essential for policyholders to make informed decisions about their financial goals and how to utilize their dividends effectively.

What You'll Learn

Dividends as a return of premium overpayment

Dividends are considered a return of a portion of the premiums you paid for a life insurance policy. In other words, they are a refund for overpayment of the premium. This is because the insurance company invests the premium payments it receives from policyholders. If the company keeps expenses down and its investments perform well, it will declare a dividend, returning a portion of the surplus to policyholders.

Dividends are not guaranteed, and the amount is not disclosed by the insurance company. The dividend amount depends on the performance of the company's financials, based on interest rates, investment returns, and new policies sold. The higher the dividend, the more expensive the policy. Dividends can be distributed as cash, used to purchase additional paid-up insurance, or to reduce premiums due.

Policyholders can choose to receive dividends as a cash payment, with the insurance company sending a check after each policy anniversary. They can also be used to reduce future premium payments, with the insurance company automatically applying any dividends to lower the amount due. Dividends can also be left with the insurance company to collect interest, which is taxable when withdrawn.

While dividends are not taxable, any interest earned on them is. Dividends are typically treated as a return of an overpayment of premium, rather than an investment gain, and so they are not subject to income tax. Therefore, the best option is usually to take the cash or check and reinvest the proceeds in an investment vehicle that could earn more income.

Life Insurance at 65: What You Need to Know

You may want to see also

Dividends as a tax-free return

Dividends from life insurance policies are generally not taxable. The Internal Revenue Service (IRS) considers them to be a return of premiums paid. This means that they are treated as tax-free returns of premiums. However, there are a few exceptions to this rule.

If the amount of dividends you receive is greater than the total premiums you have paid into the policy, the excess may be taxable. In this case, any dividends over the amount you paid are considered income rather than a return of premium. For example, if you pay $1,000 in life insurance premiums in a year and receive a $1,250 dividend, you may owe taxes on the excess $250.

Another instance where life insurance dividends may be taxable is if you earn interest on dividends. Leaving your dividends in your policy to earn interest can be a good way to grow your cash value as a source of wealth. However, the interest income may be taxable if it earns you more than you have paid in premiums.

It is important to note that dividend payments from participating life insurance policies are generally not subject to taxes by the IRS since the insurance companies generated the gains from their policyholders. Dividends are distributed income-tax-free until the taxpayer's investment in the contract has been reduced to zero.

When evaluating insurance policies, it is recommended that individuals investigate how dividends are calculated and whether or not they are guaranteed. Additionally, it is important to review the plan in its entirety to determine if it is the best whole life insurance policy for your circumstances.

Term Conversion Life Insurance: Understanding the Basics

You may want to see also

Dividend payment options

Pay your annual policy premium

If your dividend is less than your annual premium, you will receive a bill for the difference. If your dividend is more than your policy's annual premium, you can choose to receive the excess in cash, buy paid-up additional insurance, or repay a policy loan or lien.

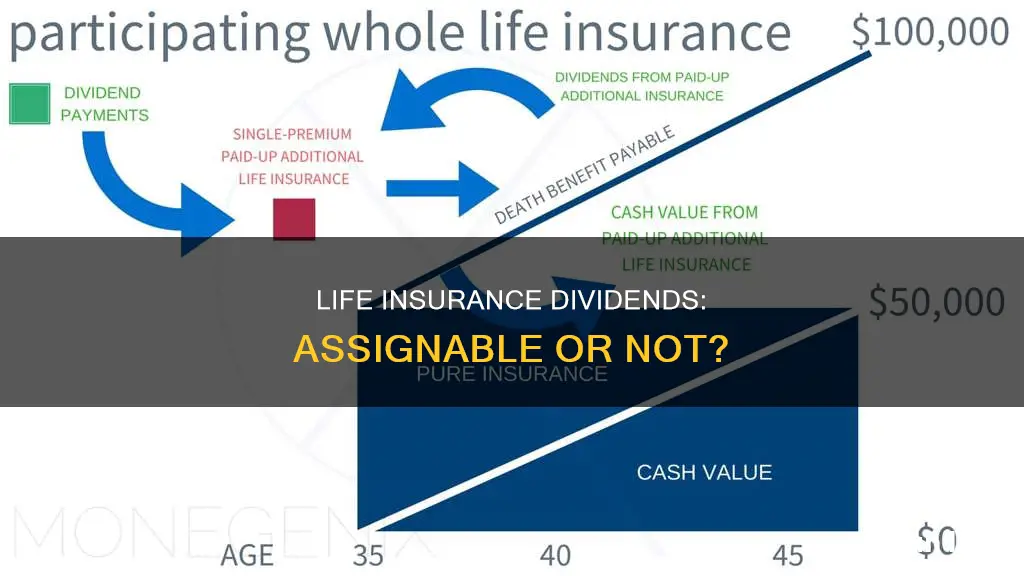

Buy paid-up additional insurance

The insurance you buy with your dividends is in addition to your basic coverage, and you can buy it at any age. You will earn dividends on both your basic coverage and the paid-up additions. Paid-up additions can provide more protection for your beneficiaries, give you cash and loan values, and allow you to stop paying premiums.

Deposit your dividend into an interest-earning account

The interest you earn on your dividend in an interest-earning account is not taxable. You can withdraw money from this account at any time. If you miss a premium payment, your dividend may be used to pay one month's premium.

Repay a loan or lien

If you have a loan or lien against your policy, you can use your dividends to pay down the amount you owe.

Pay premiums in advance

You can use your dividends to pay premiums as far in advance as possible. However, this option is not available if your premiums are being paid using certain payment methods, such as automatic payment by allotment from your retirement pay or deduction from VA compensation or pension.

Receive dividends in cash

You can choose to receive your dividend as a direct deposit into your bank account or a US Treasury check in the mail in limited situations.

It is important to note that you can typically change your dividend payment option at any time by contacting your insurance provider. Additionally, you can usually only choose one dividend payment option for each policy, but you can select different options for multiple policies.

Senior Life Insurance: Is It Worth the Cost?

You may want to see also

Dividend-paying whole life insurance policies

Dividend-paying whole life insurance is a permanent life insurance policy where the insurance provider offers a return of premium to the policy owner in the form of a dividend. A dividend is considered a return of premium for tax purposes, which means it is tax-free.

However, this is only partially true. Mutual insurance companies invest premium dollars and make profits on their investments. These profits come back to mutual policyholders in the form of a dividend. Mutual policyholders participate in the profits of the company.

The whole life insurance dividend, defined as a return of premium, is tax-free and is reinvested back into the policy cash value, which means you now earn compound interest every year on that dividend.

There are many different ways you can receive your dividends from whole life insurance:

- A reduction in premiums

- An actual check from your insurance company

- Letting the dividend remain within the savings component of your policy

Dividends from life insurance policies are not subject to income tax. Dividend payments received from participating life insurance policies are generally not subject to taxes by the Internal Revenue Service (IRS) since the insurance companies generated the gains from their policyholders. Dividends are distributed income-tax-free until the taxpayer's investment in the contract has been reduced to zero.

How to Use Dividends from Whole Life Insurance Policies

There are many different options for using whole life policy dividends, ranging from a check in the mail to acquiring additional insurance. The most common uses of dividends include:

- Cash or check: A policyholder may request that the insurer send a check for the dividend amount.

- Premium deductions: A policyholder may request that the dividend be put towards their future premiums to offset the cost.

- Additional insurance: A policyholder may use the dividend amount to purchase additional insurance or prepay on their policy.

- Savings account: A policyholder may decide to keep the dividend with the insurance company to earn interest on the amount.

Cancer and Life Insurance: Blood Test Checks?

You may want to see also

Mutual vs stock life insurance companies

Dividends on life insurance policies are considered a return of a portion of the premiums paid by the policyholder. These dividends are not guaranteed and are dependent on the performance of the company's financials.

Now, here's a comparison between mutual and stock life insurance companies:

Ownership Structure

Mutual life insurance companies are owned by their policyholders, who are considered members with voting rights and benefits in liquidation scenarios. On the other hand, stock life insurance companies are usually publicly traded and owned by shareholders, who have voting rights and prioritise their interests.

Dividends

Mutual insurers can distribute profits as dividends to policyholders or reduce future premiums. In contrast, stock companies typically distribute profits to shareholders, and policyholders do not receive dividends.

Management Focus and Investment Strategies

Mutual life insurers often prioritise long-term stability and policyholder interests, leading to more conservative investment strategies. Stock insurers, on the other hand, may take on more risk to satisfy shareholder demands for returns.

Corporate Governance

Policyholders in mutual insurance companies can vote on company matters and influence decisions, potentially leading to more frugal management practices. In stock insurance companies, policyholders do not have voting rights, and management decisions are made to benefit shareholders.

Compensation Structures

Executives in stock insurance companies may receive compensation linked to stock performance, encouraging riskier investments. Mutual insurance company management, on the other hand, may adopt a more conservative approach as they are not incentivised by stock options.

Capital Raising

Stock insurance companies can raise funds by issuing stock, while mutual insurers rely on debt issuance or policyholder borrowing, necessitating more cautious investment approaches.

Reorganisations and Demutualisations

Mutual insurance companies may undergo reorganisations or demutualisations, changing their structure. Demutualisation is the process of a mutual insurer becoming a stock company to gain access to capital and increase profitability.

Product Offerings

Mutual life insurance companies generally focus on whole life insurance policies, while stock life insurance companies offer universal life products like indexed or variable life insurance. Whole life policies carry less risk and more guarantees, while universal life policies offer more risk and potentially higher returns.

Financial Stability

Mutual insurers tend to maintain larger financial reserves and are more financially stable than stock insurers. This is because mutual companies' dividends are often reinvested into the company, while stock companies' dividends are paid out to shareholders.

Customer Focus

Mutual insurers are generally more focused on serving the long-term interests of policyholders, while stock insurers need to balance the demands of shareholders and policyholders, potentially prioritising short-term financial performance.

Haven Life Insurance: Maryland's Top Choice for Coverage

You may want to see also

Frequently asked questions

A life insurance dividend is a portion of the insurer’s profit that is sometimes paid to policyholders. Dividends are considered a return of a portion of the premiums paid for a life insurance policy.

Whole life insurance policies can be eligible for dividends. If you have a "participating" policy, which is typically a whole life insurance contract issued by a mutual life company, you can receive dividends.

Policyholders can typically use their dividends to purchase paid-up additional insurance, lower their out-of-pocket premium payments, receive a cash payment, reduce the balance of an outstanding policy loan, or let the dividends accumulate interest.

In most cases, life insurance dividends are not taxable as they are considered a return of funds already paid tax on through income taxes. However, there may be tax implications if dividend returns exceed the amount of premiums paid.