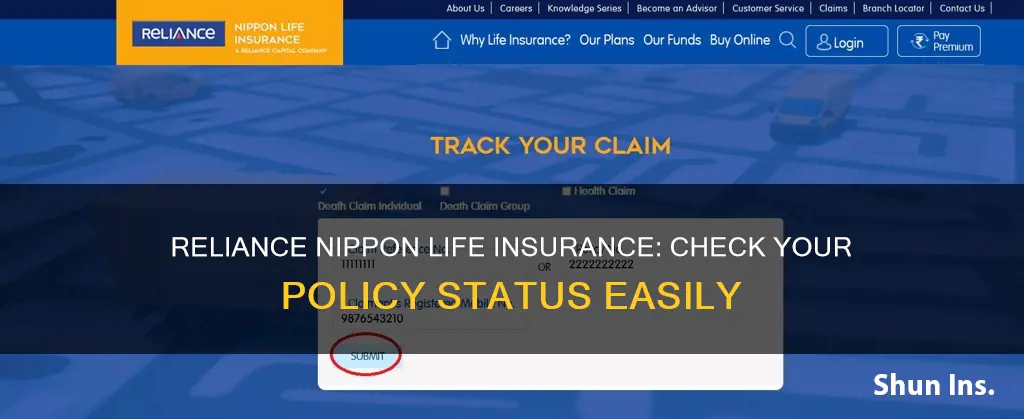

Reliance Nippon Life Insurance Company is a leading insurer that offers comprehensive coverage and a wide range of insurance products. Checking the status of your Reliance Nippon life insurance policy is easy and can be done online or offline. This allows you to stay informed about the current status of your insurance policy, including whether it is active, renewed, or cancelled, and gives you a better understanding of the policy's performance.

| Characteristics | Values |

|---|---|

| Company | Reliance Nippon Life Insurance |

| Type of Insurance | Life Insurance |

| Policy Status | Present report of an insurance policy |

| Policy Status Information | Premium payment, due date of the plan, performance of insurance plans |

| Online Status Check | Visit official website, click "Login", enter policy number, mobile number, email ID, client ID, and date of birth |

| Offline Status Check | Visit the nearest branch office |

| Other Status Check Methods | Submit name, email ID, and phone number on the official website, call the toll-free number, request a call back from customer support |

| Policy Status Advantages | Awareness of policy premium, grace period, updates, fund performance, bonuses |

| Online Payment | Net Banking, Debit Card, Credit Card, eCard, Mobile Wallet |

| Online Payment via Paytm | Available |

| Online Payment via NACH/ECS | Available, requires submission of an Existing ECS/NACH form and a cancelled cheque |

What You'll Learn

Online status check

Checking the status of your Reliance Nippon Life Insurance policy online is a straightforward process. Here is a step-by-step guide on how to do it:

For existing customers:

- Visit the official website of Reliance Nippon Life Insurance.

- Click on the "Login" option, followed by the "Customer" option.

- On the new page, enter your login credentials. You can log in using your policy number, mobile number, email ID, or client ID along with your date of birth.

- If you don't have a login ID, you can create one by clicking on "Sign-up" and following the instructions. You will need to create a password and may also have the option to sign in with your mobile number or through your Facebook or Gmail account.

- If you forget your password, simply click on "Forget Password" and follow the instructions to reset it.

Checking status through Policybazaar:

You can also check your policy status on Policybazaar, a broker website for insurance. Here are the steps:

- Visit the official website of Policybazaar Brokers Private Limited.

- Click on the 'Sign in' tab on the top right of the page.

- Enter your registered phone number and the one-time password (OTP) received on the same.

- Once you are redirected to the dashboard, choose the "Policy" tab to view the status of all your insurance policies.

Additionally, you can download the mobile app or access the self-help portal on the Reliance Nippon Life Insurance website to view your policy details, such as downloading your premium receipt.

Remember, checking your insurance policy status regularly is important to stay updated on premium payments, due dates, and any other changes or benefits to your plan.

Chronic Tonic Seizures: Life Insurance Impact and Exclusions

You may want to see also

Offline status check

Checking your Reliance Nippon Life Insurance status offline is a simple process. Here is a step-by-step guide to help you:

Step 1: Locate your nearest branch

To check your policy status offline, you will need to visit your nearest Reliance Nippon Life Insurance branch. You can find your nearest branch by going to the official website and navigating to the "Contact Us" section. From there, you can use the branch locator tool by entering your city and state to get the details of the nearest branch. Reliance Nippon Life Insurance has a widespread network of 713 branches across India, so you should be able to find one nearby.

Step 2: Visit the branch

Once you have located your nearest branch, you can visit it during their working hours. Make sure to carry your policy documents and any relevant identification proof.

Step 3: Request your policy status

At the branch, you can request to check the status of your policy. The customer service representatives will be able to assist you and provide you with the information you need. You may be asked to provide your policy number, client ID, or other relevant details to access your policy information.

Step 4: Receive your policy status

After verifying your details, the branch representatives will be able to provide you with an update on your policy status. This may include information about your premium payments, due dates, and any other relevant details regarding your insurance plan.

It's important to note that you can also check your policy status online by visiting the official website, calling the toll-free number, or using the email support provided by Reliance Nippon Life Insurance. However, if you prefer an offline method or need assistance that requires in-person interaction, visiting your nearest branch is a convenient option. Remember to keep your policy documents and identification proof handy when visiting the branch to facilitate a smooth process.

Northwestern Mutual: Suicide Coverage in Life Insurance Policies

You may want to see also

Changing personal details

To change your personal details, specifically your mailing address, with Reliance Nippon Life Insurance, you must submit a written request to the insurer along with your Reliance life insurance policy status. The address will be updated within two working days of submitting the request.

To change your correspondence address, you can submit a written request and address proof at the nearest branch location. The address will be reflected in the records within two working days of receiving the request and complete documents at the branch.

If you want to change your nominee, you may do so at any time after the policy is issued by submitting a completed and duly signed nomination form and self-attested copy of your KYC documents (address and ID proof of the nominee) at the nearest branch location. The change of nominee will be updated in the records within 10 working days of receiving the request and complete documents at the branch.

To change your premium payment mode to NACH (National Automated Clearing House)/ECS (Electronic Clearing System) or credit card, you must submit a completed and duly signed ECS/credit card mandate with a cancelled cheque leaf or credit card copy, as applicable, at the nearest branch location. The change of payment mode will be reflected in the records within 15 working days of receiving the request and complete documents at the branch, subject to approval from the drawee/card-issuing bank.

If you want to change your premium payment frequency, you may do so on your policy anniversary date by submitting a duly signed request. The frequency change will be reflected in the records within 10 working days of receiving the request and complete documents at the branch, subject to the request being received 15 days prior to the policy anniversary date.

Life Insurance and Suicide: What's Covered?

You may want to see also

Updating mailing address

To update your mailing address for your Reliance Nippon Life Insurance policy, you must submit a written request to change your correspondence address. This can be done by following the steps outlined below:

Step 1: Prepare the Necessary Documents

You will need to prepare a written request for the address change, which can be in the form of a letter or an email. In your request, be sure to include your full name, policy number, and the new mailing address you wish to update. It is also a good idea to include your date of birth and any other relevant identifying information to ensure your request is processed accurately.

Additionally, you will need to provide valid proof of your new address. This can include a recent utility bill, a bank statement, a rental agreement, or any other official document that displays your name and new address.

Step 2: Submit the Request and Documents to the Nearest Branch

Once you have prepared your written request and gathered the necessary documents, you can submit them to the nearest Reliance Nippon Life Insurance branch. Be sure to bring your original documents, as well as a set of photocopies, to the branch.

Step 3: Wait for Confirmation

After submitting your request and documents, the address change will typically be reflected in their records within 2 working days. You may receive a confirmation email or letter from Reliance Nippon Life Insurance informing you that your mailing address has been successfully updated. If you do not receive a confirmation within a reasonable amount of time, you can contact their customer service team to follow up on the status of your request.

Additional Information:

It is important to keep your contact information, including your mailing address, up to date with your insurance provider to ensure you receive important policy-related communications and updates. By updating your mailing address in a timely manner, you can help ensure that you stay informed about any changes or actions needed regarding your insurance policy.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

Checking premium payment

Checking your premium payment status for your Reliance Nippon Life Insurance policy is a straightforward process that can be done online or offline. Here is a step-by-step guide on how to do it:

Online Method:

- Visit the official website of Reliance Nippon Life Insurance.

- Log in to your account by clicking on "Login" and then "Customer".

- Enter your login credentials, such as your Client ID, Policy Number, and Date of Birth.

- Once logged in, navigate to the relevant section to view your policy details. Here, you should be able to see information about your premium payments, including the due date of your next payment.

- Alternatively, you can download the mobile app or access the website to download your premium receipt. Enter your policy number and date of birth to easily download the receipt.

Offline Method:

- Visit a nearby branch office of Reliance Nippon Life Insurance to inquire about your premium payment status. You can find the nearest branch by visiting the "Contact Us" section on the official website and using the branch locator tool.

- Provide the necessary details, such as your policy number and personal information, to the branch representative. They will be able to assist you in checking your premium payment status and provide any other policy-related information you may need.

It is important to keep track of your premium payments to ensure that your insurance policy remains active and provides the necessary coverage. Remember that non-payment or late payment may impact your benefits, so staying informed about your payment status is crucial.

CVS and Tricare: Insurance and Life Coverage Options

You may want to see also

Frequently asked questions

Visit the official website and log in with your customer ID and password. Select the policy that is due for payment, and you will be able to see its status.

Yes, you can check your policy status offline by visiting a nearby branch. You can find the nearest branch by visiting the "Contact Us" section on the official website and clicking on the branch locator.

You will need to enter your policy number, mobile number, email ID, or client ID, along with your date of birth.

You can log in to the website or download the app to check if the paid premium has been applied. You can also visit a branch to get help from an executive.

Yes, you can call the toll-free number 1800 102 1010 to know more about your Reliance life insurance policy status.