Variable universal life insurance is a type of permanent life insurance that combines a death benefit with a savings component, allowing the policyholder to build cash value over time. This cash value can be invested in the market through subaccounts, similar to mutual funds, offering the potential for high returns but also carrying the risk of substantial losses. While variable universal life insurance provides flexibility in premium payment amounts and timing, it is a complex product with high fees and potential for cash value losses. The policy does not guarantee a return on the cash value year after year, and poor investment performance can result in the need for higher premium payments to maintain coverage.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Main benefit | Financial payout to loved ones when the policyholder dies |

| Investment options | Subaccounts that operate like mutual funds |

| Premium payment flexibility | Yes |

| Cash value | Can be placed in variable and fixed subaccounts |

| Tax advantages | Yes |

| Investment risk | Yes |

What You'll Learn

- Variable universal life insurance combines a death benefit with investment options

- Variable universal life insurance has tax-deferred growth potential

- Variable universal life insurance is more complex than term and whole life policies

- Variable universal life insurance offers flexible premium payments

- Variable universal life insurance has a higher risk than other types of life insurance

Variable universal life insurance combines a death benefit with investment options

Variable universal life insurance is a type of permanent life insurance policy that combines a death benefit with a savings component, known as cash value. This coverage can last an entire lifetime, provided the insured continues to pay the insurance costs. Variable universal life insurance offers flexible premium payment options and allows the insured to invest and grow their cash value through subaccounts that function similarly to mutual funds. While this exposure to market fluctuations can lead to substantial returns, it may also result in significant losses.

Variable universal life insurance provides policyholders with control over their cash value investments, enabling them to select subaccounts that align with their risk tolerance and investment objectives. The interest and growth of the cash value depend on the performance of these investments. The cash value growth in a variable universal life insurance policy is tax-deferred, and policyholders can access their cash value by withdrawing or borrowing funds.

However, it is important to note that the return on the cash component is not guaranteed and may fluctuate from year to year. If the investments perform poorly, the cash value may not grow as expected, and there is a possibility of losing money. In such cases, higher premium payments may be necessary to maintain the death benefit and rebuild the cash value.

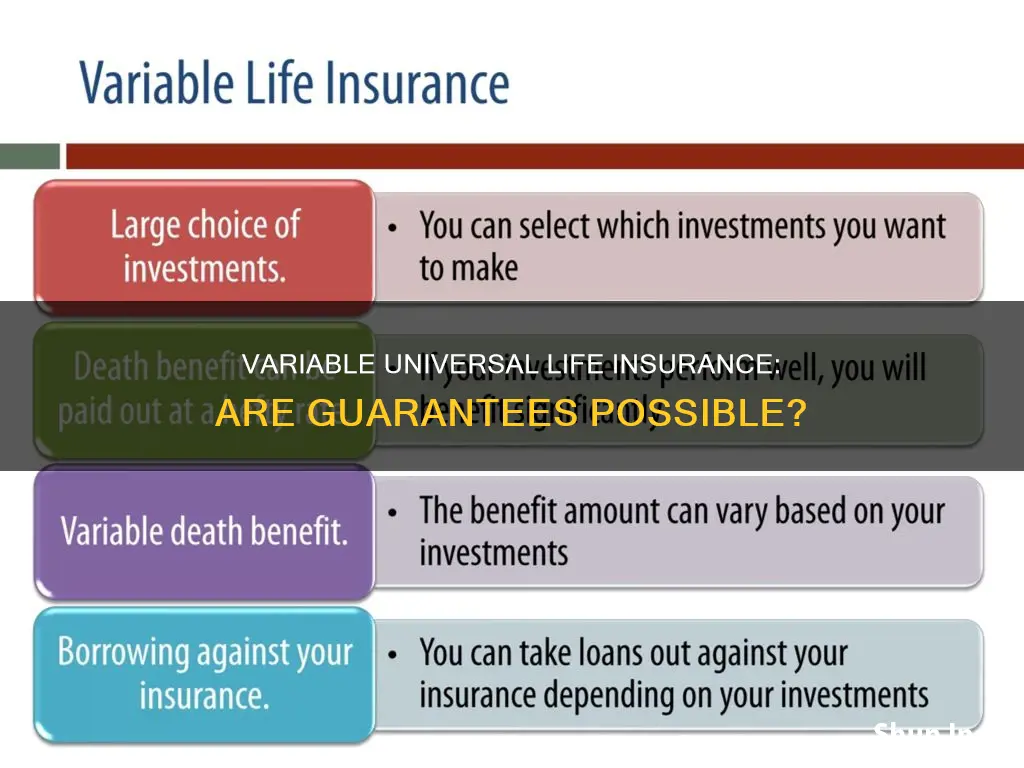

Variable universal life insurance offers advantages such as flexible death benefits and premiums, available cash value, a variety of investment options, tax-deferred cash value growth, and tax-free loans. Nevertheless, it also carries risks, including the possibility of accumulating loan interest and experiencing decreases in cash value due to market performance.

Life Insurance Proceeds: Are They Taxed in New Mexico?

You may want to see also

Variable universal life insurance has tax-deferred growth potential

Variable universal life insurance (VUL) is a form of permanent life insurance that combines a death benefit with investment subaccounts. The cash value of the policy can be placed in variable and fixed subaccounts, allowing for tax-deferred growth potential.

The main benefit of VUL is that it provides a financial payout to loved ones upon the policyholder's death, while also offering investment options for the cash value of the policy. This allows policyholders to potentially grow their money tax-deferred. The growth of the VUL insurance policy's cash value is tax-deferred, and policyholders may access their cash value by taking a withdrawal or borrowing funds. The death benefit is also often income tax-free.

The cash value inside a VUL policy can be invested in market-based investment options, which can lead to long-term growth. The investment options available will depend on the insurance provider but may include mutual funds, stocks, bonds, money market securities, ETFs, and more.

It is important to note that the growth of the cash value within a VUL policy is not guaranteed and is subject to market risk. Policyholders should carefully assess the risks before purchasing a VUL policy and consider consulting a financial or tax advisor.

Life Insurance Proceeds: Form 3520 Requirements

You may want to see also

Variable universal life insurance is more complex than term and whole life policies

The complexity of variable universal life insurance lies in its flexibility and risk profile. While it offers flexible premium payments and the potential for higher returns, there is also the risk of losing money if the market performs poorly. The policyholder must carefully manage their investments and make sure they have enough funding to keep the contract active.

In contrast, term life insurance is a basic death benefit with coverage for a set number of years, and whole life insurance offers guaranteed lifetime protection with fixed premiums. These policies are simpler and more stable but may not offer the same growth potential as variable universal life insurance.

Variable universal life insurance is designed for long-term financial goals and is often used by high-income earners and retirees as part of a complex financial strategy. It is important for individuals to carefully consider their financial goals, risk tolerance, and time horizon before choosing a life insurance policy.

Life Insurance and Suicide in Australia: What's Covered?

You may want to see also

Variable universal life insurance offers flexible premium payments

The premium flexibility in variable universal life insurance typically includes flexibility in both the timing and amount of payments. You may have the option to set up regular payments or pay whenever you choose, as long as you stay within the limits set by your insurer. For example, if you plan to make a significant purchase in a particular month, you can lower your insurance premium for that month and compensate by paying a higher premium the following month. As long as the total payment for the period is the same, there would be no penalty for adjusting the amounts.

Variable universal life insurance policies should be regularly monitored to ensure sufficient funding and keep the contract active. Premium payments contribute to the death benefit, build cash value, and cover the insurer's operational costs. Charges for insurance coverage and contract fees are deducted from your premium payments, and the remaining amount goes towards the policy's cash value.

The cash value of variable universal life insurance can be directed to either a variable subaccount or a fixed subaccount. Variable subaccounts offer investment options, while fixed accounts provide a set interest rate. You can allocate funds based on your risk tolerance and investment objectives. The cash value of your policy will fluctuate based on the performance of your chosen investment portfolios or the interest credited to your fixed account.

While variable universal life insurance offers flexible premium payments, it's important to be mindful of the potential consequences of adjusting your payments. Reducing premium payments may impact the accumulation of cash value and the overall performance of your policy. Additionally, large lump-sum contributions or significant withdrawals can change the tax status of your policy, leading to different tax implications. Therefore, it's essential to consult with a financial advisor and tax advisor to make informed decisions regarding your variable universal life insurance policy.

Life Insurance and Food Stamps: Is There a Link?

You may want to see also

Variable universal life insurance has a higher risk than other types of life insurance

Variable universal life insurance (VUL) is a type of permanent life insurance that combines lifelong insurance protection with flexible premiums and a cash value that can be accessed while the policyholder is alive. The cash value of a VUL policy can be invested in the market through subaccounts, which operate like mutual funds, to produce greater returns. While VUL offers increased flexibility and growth potential compared to other life insurance options, it also carries higher risks and complexities.

One of the key risks of VUL is the fluctuation in cash value and death benefits due to investment performance. The cash value of a VUL policy is not guaranteed and can decrease if the market performs poorly. Policyholders bear the investment risk, and there is a possibility of losing money. If the cash value becomes too low, policyholders may need to pay higher premiums to maintain their coverage. Additionally, VUL policies can have high fees and charges, including management fees, administration fees, and mortality fees.

Another risk associated with VUL is the potential for the policy to lapse or expire. If the policy does not have enough cash value to cover the contract's fees and charges, it may lapse and the policyholder could lose their insurance protection. Withdrawing a large amount of cash or taking out a loan against the policy can also put the policy at risk of lapsing.

Furthermore, VUL policies are complex financial products that require careful consideration. They are designed for individuals who plan to actively monitor their life insurance, can fund the policy heavily in its early years, and are willing to accept stock market risk. The variable nature of VUL policies means that beneficiaries may receive more or less money depending on market conditions.

In summary, variable universal life insurance offers the potential for higher returns on the cash value of the policy but comes with higher risks and complexities compared to other types of life insurance. Policyholders bear the investment risk, and there is a possibility of losing money or lapsing the policy if the market performs poorly. Therefore, it is crucial to carefully assess the risks and seek professional advice before purchasing a VUL policy.

Flight Emergencies: Insurance Coverage for Flight-for-Life Services

You may want to see also

Frequently asked questions

Variable universal life (VUL) insurance is a form of permanent life insurance. It combines the main benefit of life insurance—a financial payout to your loved ones when you die—with investment subaccounts. These investment subaccounts can be used to invest the cash value of your policy.

The pros of variable universal life insurance include the fact that there's a death benefit that's often income tax-free, the potential to grow your money tax-deferred, flexible payment timing and amount, and the ability to adjust your coverage amount. On the other hand, the cons of VUL include complexity, higher cash needs, long time horizons, and market risks.

Variable universal life insurance has four primary features: a death benefit, cash value that you can access while you’re still alive, investment options, and flexible premium payments.

Variable universal life insurance offers several tax advantages. Your loved ones typically would not pay federal income taxes on a payout (death benefit) they receive from your policy. Additionally, the cash value of your policy grows tax-deferred, meaning you don't owe federal taxes until you withdraw money from the policy.

Variable universal life insurance is highly customizable, so the cost depends on the policy you choose, the investments or benefits you prefer, the insurance factors revealed during the underwriting process, and the amount of coverage you need.