Life insurance proceeds are generally not taxable and do not need to be reported. However, if you are the policyholder and surrendered the life insurance policy for cash, you may need to report the amount if it is more than the cost of the policy. Any interest received on life insurance proceeds is taxable and must be reported.

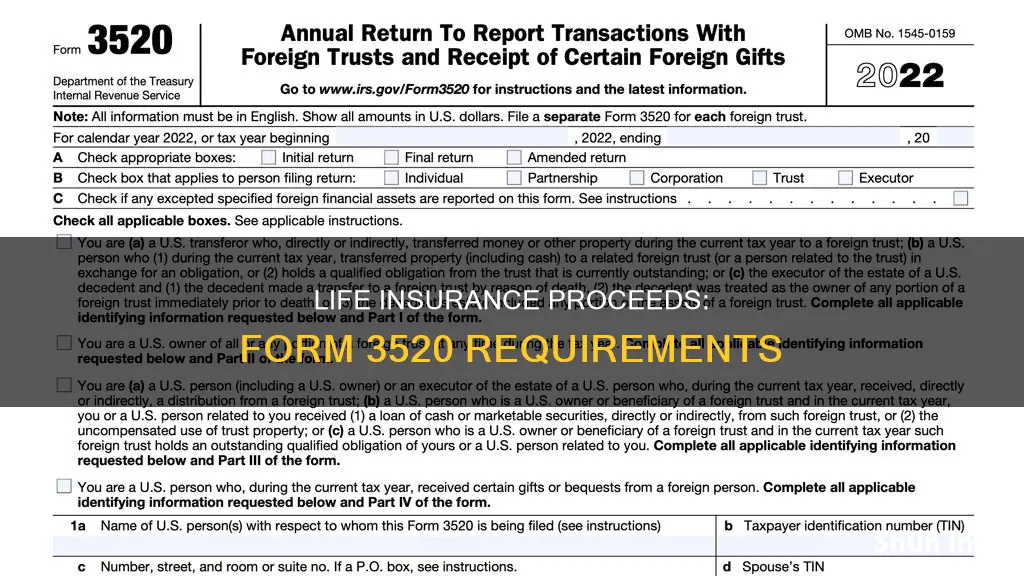

Form 3520 is used to report foreign trusts and gifts. If a US person receives a gift of a foreign life insurance policy from a foreign individual or entity, and the value exceeds the threshold filing value for that year, then Form 3520 may be required.

If the policy is considered non-compliant, it may be necessary to consult a tax professional.

What You'll Learn

Foreign life insurance and Form 3520

Foreign life insurance policies are generally not included on Form 3520/3520-A as a trust. However, if a U.S. person receives a foreign life insurance policy as a gift from a foreign individual or entity, and the value exceeds the threshold filing value for that year, then Form 3520 may be required.

Form 3520 is used by U.S. persons (and executors of estates of U.S. decedents) to report certain transactions with foreign trusts, ownership of foreign trusts, and receipt of certain large gifts or bequests from foreign individuals or estates. The form must be filed separately for transactions with each foreign trust.

The general deadline for filing Form 3520 is the 15th day of the 4th month following the end of the person's tax year for income tax purposes. If an extension is granted for filing an income tax return, the deadline for Form 3520 is extended to the 15th day of the 10th month following the end of the person's tax year. For U.S. decedents, the deadline is the 15th day of the 4th month following the end of the decedent's last tax year for income tax purposes, which can also be extended to the 15th day of the 10th month if an extension is granted.

In the context of foreign life insurance, it is important to note that the IRS requires U.S. persons who own foreign life insurance policies to report them annually on an FBAR (FinCEN Form 114). This is because foreign life insurance policies are often considered "foreign accounts" by the IRS, leading to different reporting requirements compared to U.S.-based policies. The cash or surrender value of the foreign life insurance policy is included on the FBAR each year that the threshold is met.

Additionally, foreign life insurance policies may need to be reported on other forms, such as Form 8938 (FATCA) and Form 720, depending on the specifics of the policy and the taxpayer's situation.

Life Insurance Benefits: Are They Taxed by the IRS?

You may want to see also

US persons and Form 3520

US persons (and executors of estates of US decedents) must file Form 3520 with the IRS to report certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections Internal Revenue Code 671 through 679, and receipt of certain large gifts or bequests from certain foreign persons. This form is due on the 15th day of the 4th month following the end of the person's tax year for income tax purposes. If an extension is granted for filing income tax returns, Form 3520 is due no later than the 15th day of the 10th month following the end of the person's tax year.

US persons must file Form 3520 if any of the following apply:

- They are the responsible party for reporting a reportable event that occurred during the current tax year.

- They are a US person who transferred property (including cash) to a related foreign trust or a person related to the trust in exchange for an obligation, or they hold a qualified obligation from that trust that is currently outstanding.

- They are a US person who, during the current tax year, is treated as the owner of any part of the assets of a foreign trust under the rules of sections 671 through 679.

- They are a US person (including a US owner) or an executor of the estate of a US person who received a distribution from a foreign trust during the current tax year.

- They are a US person who is a US owner or beneficiary of a foreign trust, and during the current tax year, they or a related US person received a loan of cash or marketable securities (including an extension of credit) directly or indirectly from such foreign trust, or the uncompensated use of trust property.

- They are a US person who received more than $100,000 from a nonresident alien individual or a foreign estate (including related foreign persons) as gifts or bequests, or more than the section 6039F threshold amount from foreign corporations or foreign partnerships (including related foreign persons) as gifts.

Form 3520 does not need to be filed to report certain transactions, including most fair market value (FMV) transfers by a US person to a foreign trust, transfers to foreign trusts with a current determination letter from the IRS recognising their status as exempt from income taxation, and distributions from foreign trusts that are taxable as compensation for services rendered.

It is important to note that the failure to report foreign life insurance may result in fines and penalties, although these can often be avoided or minimised through IRS offshore voluntary disclosure/tax offshore amnesty programs.

Life Insurance and Suicide in Australia: What's Covered?

You may want to see also

Foreign trusts and Form 3520

The Internal Revenue Service (IRS) requires US persons to file Form 3520, an informational return, to report certain transactions with foreign trusts and the receipt of certain foreign gifts. Form 3520 is used to report:

- Certain transactions with foreign trusts

- Ownership of foreign trusts under the rules of sections 671-679 of the Internal Revenue Code

- Receipt of certain large gifts or bequests from foreign persons

A foreign trust is any trust other than a domestic trust. A domestic trust is defined as a trust that satisfies the \"court test\" and the \"control test\" under Section 7701(a)(30)(E) of the Code. The court test requires that a US court be able to exercise primary supervision over the trust's administration, while the control test requires that US persons control all substantial decisions of the trust.

US persons who create a foreign trust or have transactions with one may face US income tax consequences and must comply with information reporting requirements. Failure to satisfy these requirements can result in significant penalties.

Form 3520 must be filed when a US person:

- Creates or transfers money/property to a foreign trust or makes a loan to one

- Receives distributions from a foreign trust, receives the uncompensated use of trust property, or receives a loan from a foreign trust

- Is treated as the US owner of a foreign trust under the grantor trust rules

- Receives certain large gifts or bequests from foreign persons

There are exceptions to filing Form 3520 for certain tax-favored foreign trusts, such as Canadian registered retirement savings plans and certain tax-favored foreign retirement trusts.

Form 3520 must be filed by the 15th day of the fourth month following the end of the US person's tax year, or April 15th for calendar year taxpayers. If an extension is granted for filing an income tax return, the due date for Form 3520 is extended but cannot go beyond the 15th day of the 10th month following the end of the US person's tax year.

Penalties for failing to file Form 3520, filing it late, or providing incomplete/inaccurate information can be significant. The initial penalty is generally the greater of $10,000 or a percentage of the gross value of property/distributions involved, and additional penalties may be imposed for continued non-compliance.

US persons must also be mindful of other reporting requirements when dealing with foreign trusts, such as Form 3520-A, Form 8938, and FinCEN Form 114.

Life Insurance and Terminal Illness: What's the Payout?

You may want to see also

Foreign gifts and Form 3520

Form 3520 is used by U.S. persons and executors of estates of U.S. decedents to report certain transactions with foreign trusts, ownership of foreign trusts, and receipt of certain large gifts or bequests from certain foreign persons.

Reporting Foreign Gifts

U.S. persons who receive large gifts or bequests from foreign persons may need to complete Part IV of Form 3520. A foreign gift or bequest is generally any amount received from a non-U.S. person (a foreign person) that the recipient treats as a gift or bequest and excludes from gross income. Foreign gifts do not include amounts paid for qualified tuition or medical payments made on behalf of the U.S. person.

A foreign person can be a nonresident alien individual, a foreign corporation, partnership, or estate, as well as a domestic trust that is treated as owned by a foreign person.

The reporting threshold for gifts or bequests from a nonresident alien or foreign estate is $100,000 during the taxable year. If the gifts or bequests exceed this amount, each gift exceeding $5,000 must be separately identified.

For purported gifts from foreign corporations or foreign partnerships, the reporting threshold is lower, at $18,567 for 2023 and $19,570 for 2024 (adjusted annually for inflation). Gifts exceeding these thresholds must also be individually identified, along with the identity of the donor.

Due Dates for Form 3520

The due date for filing Form 3520 is generally the 15th day of the 4th month following the end of the U.S. person's tax year (usually April 15th for individuals). If an extension is granted for filing an income tax return, the due date for Form 3520 is extended to the 15th day of the 10th month following the end of the tax year (no later than October 15th for calendar-year taxpayers).

U.S. citizens or residents living outside the U.S. and Puerto Rico, as well as those in the military or naval service outside the U.S. and Puerto Rico, have a due date of the 15th day of the 6th month following the end of their tax year (June 15th).

Penalties for Non-Compliance

If Part IV of Form 3520 is filed late, contains incomplete or incorrect information, or is not filed at all, the IRS may determine the income tax consequences of the foreign gift or bequest. Additionally, penalties may apply. A penalty of 5% of the value of the gift or bequest may be imposed for each month the gift or bequest is not reported, up to a maximum of 25% of the gift's value. However, if there is reasonable cause for the failure to file accurately or on time, the penalty may be waived in some cases.

Life Insurance Activation: Instant or Not?

You may want to see also

Civil penalties for non-compliance with Form 3520

If the non-compliance continues after the IRS notifies the individual, an additional penalty of up to $10,000 for each 30-day period or fraction thereof during which the failure continues after the expiration of the 90-day period, up to a maximum of $50,000, may be imposed. These penalties may apply even if there is no tax due associated with the trust.

The IRS allows for an extension of the filing deadline by submitting Form 7004. However, if a complete Form 3520 is not filed by the due date, including extensions, the time for assessment of any tax imposed with respect to any event or period to which the information required to be reported in Parts I through III of Form 3520 relates will not expire before three years after the date on which the required information is reported.

The primary defence against a Form 3520 Penalty is to show reasonable cause before the matter spirals into litigation. If the taxpayer can show they offer a sufficient explanation to convince the IRS agents that while they were non-compliant, they should not be penalised because they met the reasonable cause standard — then the IRS will sometimes avoid issuing a penalty, or abate a penalty that was already issued.

Life Insurance and CSS Profile: What's Included?

You may want to see also

Frequently asked questions

Life insurance proceeds do not need to be reported on Form 3520. However, if a US person owns the foreign life insurance policy, there are reporting requirements during the years of ownership.

If the policy is considered an investment vehicle, it may be necessary to file Form 8621, as many foreign policies are considered Passive Foreign Investment Companies (PFICs).

If the policy is owned by a foreign person/entity, the death benefit should be reported on Form 3520 as a bequest from a foreign person.

Bonus payments made to the beneficiary at the death of the insured are treated as life insurance proceeds and do not need to be reported separately. Bonus payments made to the owner while the insured is still alive are considered income.

It is recommended to consult with a tax professional to ensure compliance with reporting requirements and avoid potential penalties.