Permanent life insurance is any policy that provides coverage for the full lifetime of the insured person. Whole life insurance is a type of permanent life insurance. While permanent life insurance is more expensive than term insurance, it combines a death benefit with a savings component that earns interest on a tax-deferred basis. Whole life insurance generally includes a cash value component that can be borrowed against or used to pay future monthly premiums.

| Characteristics | Values |

|---|---|

| Length of protection | Whole life insurance provides coverage for the full lifetime of the insured person. Term life insurance provides coverage for a set period of time. |

| Features | Whole life insurance combines a death benefit with a savings component that grows at a guaranteed rate. Term life insurance does not offer a savings component. |

| Benefits | Whole life insurance offers long-term death benefit protection and the opportunity to build cash value. Term life insurance offers short-term death benefit protection and flexible features that allow you to use your benefits early if you become terminally ill. |

| Cost | Whole life insurance is more expensive than term life insurance due to its lifelong coverage and savings component. Term life insurance is cheaper because it offers temporary coverage without a savings component. |

What You'll Learn

Whole life insurance is a type of permanent life insurance

Whole life insurance policies are meant to last indefinitely, or until the policyholder passes away. It is called "whole life" because it covers the policyholder for their entire life. It is also referred to as "permanent life" because it is designed to be kept in force for the rest of the policyholder's life.

Whole life insurance policies generally offer long-term death benefit protection and a host of potentially valuable features. Most whole life policies give the policyholder the opportunity to build cash value. This feature can be especially helpful later in life since the cash value that accumulates can be accessed to help pay for unexpected emergencies or milestone events like college and retirement. The cash value of whole life insurance grows at a guaranteed rate.

Whole life insurance is the most common type of permanent life insurance and typically costs more than term life. This is because most policies offer coverage that lasts until much later in life, such as until 90, 100, or 120 years old. Whole life insurance also has a cash value component. A portion of the premium goes toward the cash value, which can grow over time. Once enough cash value has accumulated, the policyholder can borrow against it or surrender the policy for cash.

Whole life insurance is a lifelong commitment. It is important to make sure you can afford the premiums, as missing payments could cause the policy to lapse. Whole life insurance is a good option for those who want coverage that essentially lasts their lifetime. The death benefit from whole life policies typically pays out whenever the policyholder dies.

Dialysis and Life Insurance: What's Covered and What's Not

You may want to see also

Whole life insurance is more expensive than term life insurance

One of the main differences between whole life and term life insurance is the cost. Whole life insurance premiums are much higher than those for term life insurance. This is because whole life insurance includes both insurance and investment components. The insurance component provides a death benefit, while the investment component allows the policy to build cash value over time. This cash value can be accessed by the policyholder during their lifetime, either through loans or withdrawals.

In contrast, term life insurance is a more basic form of insurance that does not include a cash value component. As a result, it tends to be much more affordable than whole life insurance. Term life insurance is often the best option for individuals who are on a budget and just want to provide coverage for their family.

While whole life insurance is more expensive, it offers several benefits that term life insurance does not. Firstly, it provides lifelong coverage, which means that the death benefit is guaranteed as long as the policyholder continues to pay the premiums. Secondly, the cash value component of whole life insurance can be a useful source of funds for future needs, such as college tuition or retirement. The cash value grows at a guaranteed rate and can be accessed tax-free, making whole life insurance a valuable tool for financial planning.

In summary, whole life insurance is more expensive than term life insurance due to its permanent coverage and the inclusion of a cash value component. While term life insurance may be a more affordable option for some individuals, whole life insurance offers additional benefits such as lifelong protection and the ability to build cash value. Ultimately, the choice between whole life and term life insurance depends on an individual's financial goals and needs.

Life Insurance Denial: What You Need to Know

You may want to see also

Whole life insurance includes a cash value component

Whole life insurance is a type of permanent life insurance. Permanent life insurance provides coverage for the full lifetime of the insured person, and whole life insurance generally includes a cash value component. This cash value component is a savings account that grows tax-free and can be borrowed against or withdrawn from. This feature can be especially helpful later in life since the cash value can be accessed to help pay for unexpected emergencies or milestone events like college tuition and retirement.

The cash value of whole life insurance grows at a guaranteed rate in a tax-deferred account. This means that the policyholder pays no taxes on earnings as long as the money stays in the policy. The cash value of whole life insurance can be used to provide a death benefit to beneficiaries, but it can also be borrowed against or withdrawn from to meet other financial needs. For example, the policyholder could take out a loan to pay for home renovations or college tuition, or they could withdraw cash to help cover retirement expenses.

However, it is important to be careful with a cash value life insurance policy. If the policyholder borrows against the policy's cash value and is unable to pay it back with interest, their beneficiaries could end up receiving a lower death benefit. Additionally, if the amount borrowed is more than the premiums paid into the policy, the policyholder could owe a hefty tax bill on the amount borrowed.

Whole life insurance is typically more expensive than term life insurance because it includes both insurance and investment components. The premiums for whole life insurance are locked in at the time of purchase and are guaranteed not to increase. While term life insurance only provides coverage for a set period of time, whole life insurance provides lifelong protection as long as the premiums are paid.

How to Access Life Insurance Money Before Death

You may want to see also

Whole life insurance premiums remain the same throughout

Whole life insurance is a form of permanent life insurance that lasts as long as you live, assuming you pay the premiums. Whole life insurance premiums remain the same throughout the duration of the policy. This means that the premium amount is locked in at the time of purchase and is guaranteed not to change. While whole life insurance is more expensive than term life insurance, it may be a better value in the long run because it never needs to be renewed, and the rates do not change as the policyholder gets older.

The insurance company splits whole life premiums in two ways. One part of the payment goes to the insurance component, while the other part helps build the policy's cash value. This cash value component is a savings account that grows over time at a guaranteed rate on a tax-deferred basis. The cash value of whole life insurance grows at a guaranteed rate, and the policyholder can borrow against or withdraw from the cash value.

Whole life insurance is a good option for those who want coverage for their entire lifetime and the ability to build cash value. It is also a good choice for those who want stable and predictable premiums. However, it is important to note that whole life insurance is typically more expensive than term life insurance due to the lifelong coverage and the accumulation of cash value.

Life and Health Insurance Exams: Separate or Together?

You may want to see also

Permanent life insurance lasts a lifetime

Permanent life insurance is designed to provide long-term or lifelong coverage. As long as the policyholder continues to pay the premiums, their coverage will remain in place. This is in contrast to term life insurance, which only covers the policyholder for a set period.

Permanent life insurance policies combine a death benefit with a savings component that earns interest on a tax-deferred basis. The savings element, or cash value, can be accessed by the policyholder during their lifetime to help pay for emergencies or milestone events like college fees and retirement. The cash value generally grows at a guaranteed rate, though some policies offer variable rates depending on investment methods or market interest rates.

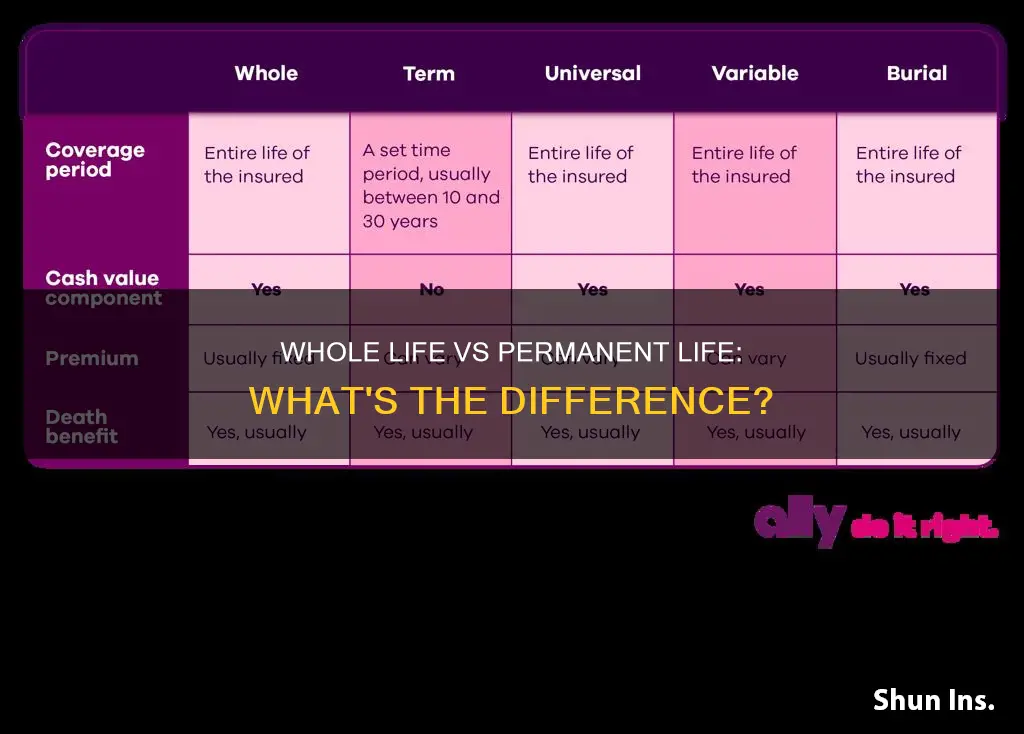

The two primary types of permanent life insurance are whole life and universal life. Whole life insurance policies have fixed premiums and the cash value grows at a guaranteed rate. Universal life insurance policies also contain savings and a death benefit, but they feature more flexible premium options, and the cash value is based on market interest rates.

Permanent life insurance policies have much higher premiums than term life insurance policies, which lack a savings component. However, permanent life insurance policies enjoy favourable tax treatment, with cash value generally growing on a tax-deferred basis.

Life Insurance for NC Teachers: What's Covered Automatically?

You may want to see also

Frequently asked questions

Permanent life insurance is any life insurance policy that is designed to provide coverage for the full lifetime of the insured person. It is more expensive than term insurance but combines a death benefit with a savings component that earns interest on a tax-deferred basis.

Whole life insurance is a type of permanent life insurance. It generally includes a cash value component that can be borrowed against or used to pay future monthly premiums. Whole life insurance typically costs more than term life insurance because it serves as an investment.

Every whole life insurance policy is a permanent life insurance policy, but not every permanent life insurance policy is a whole life insurance policy. The two primary types of permanent life insurance are whole life and universal life. The cash value of whole life insurance grows at a guaranteed rate, while universal life insurance features more flexible premium options and its earnings are based on market interest rates.