Navigating the world of life insurance can be complex, especially when it comes to determining the right rates for your coverage. Understanding the factors that influence these rates is crucial for making an informed decision. This guide will explore the various elements that impact life insurance premiums, helping you understand what rates you should expect based on your personal circumstances and needs. By the end, you'll be better equipped to choose a policy that offers both adequate protection and affordable premiums.

What You'll Learn

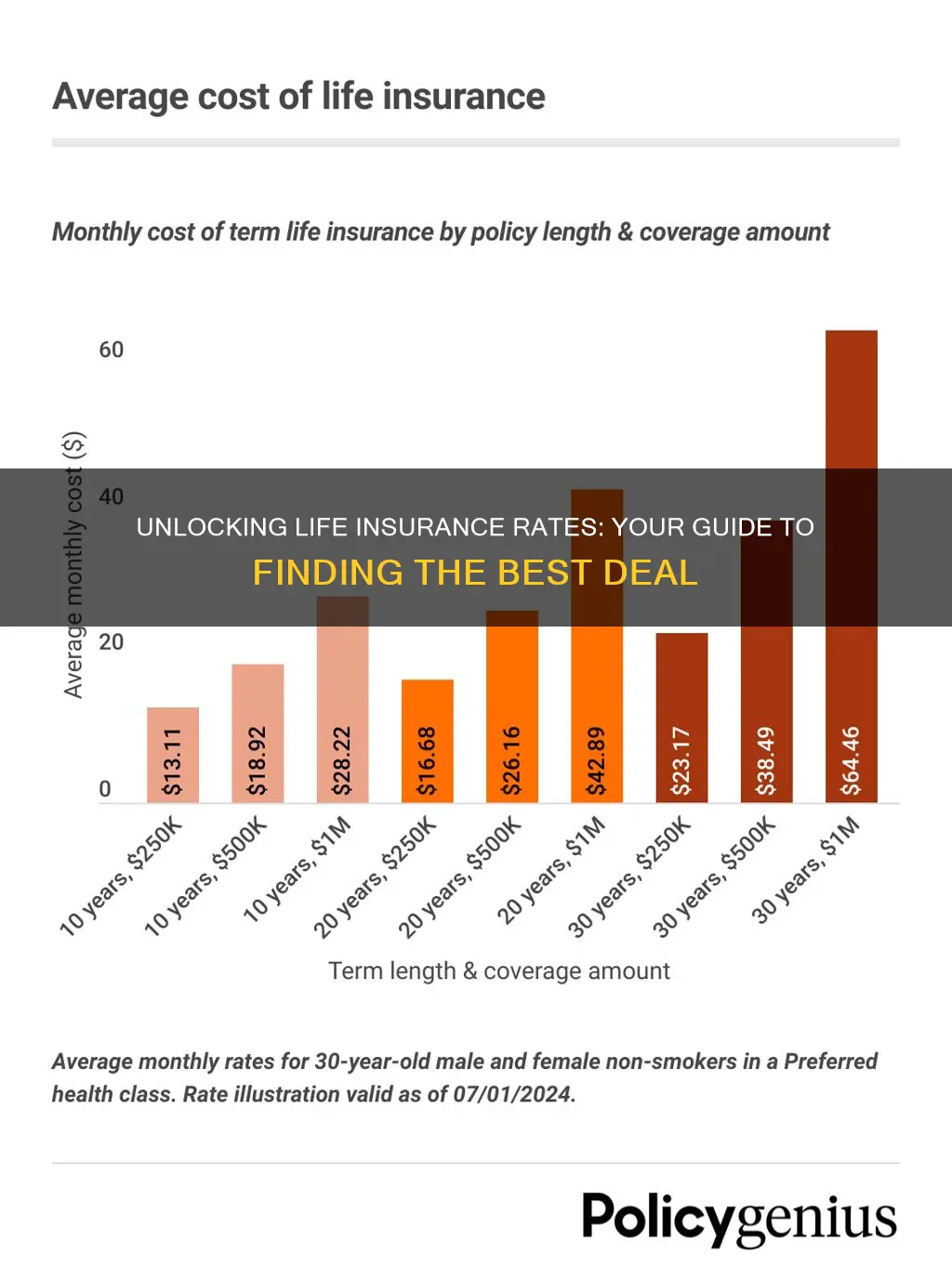

- Term Length: Compare rates for different term lengths (e.g., 10, 20, 30 years)

- Age and Health: Younger, healthier individuals often get lower rates

- Coverage Amount: Higher coverage amounts typically result in higher premiums

- Smoking and Lifestyle: Non-smokers and healthy lifestyles may qualify for better rates

- Medical History: Pre-existing conditions can impact insurance rates

Term Length: Compare rates for different term lengths (e.g., 10, 20, 30 years)

When considering life insurance, one of the most critical decisions you'll make is the term length. This decision will significantly impact your premiums and the overall cost of your policy. Here's a breakdown of how term length affects rates and what you should consider:

Term Length Options:

- 10-Year Term: This is often the most affordable option. It provides coverage for a specific period, typically 10 years. If you die within this term, your beneficiaries receive the death benefit. After 10 years, the policy may lapse unless you renew it or convert it to a permanent policy.

- 20-Year Term: This term offers longer coverage, typically lasting two decades. Rates are generally higher than 10-year terms but lower than 30-year terms. It provides peace of mind for a more extended period.

- 30-Year Term: This is a popular choice for those seeking long-term protection. Rates are typically the highest among the three options. It ensures coverage for a significant portion of your life, providing financial security for your loved ones for an extended period.

Rate Variations:

The term length directly influences the rates because insurers calculate premiums based on the risk associated with providing coverage for a specific period. Here's why:

- Shorter Terms (10 years): Insurers consider this a lower-risk option since the coverage period is shorter. They may offer lower rates as the risk of paying out a death benefit is reduced.

- Longer Terms (20, 30 years): These longer terms present a higher risk for insurers. They are more likely to pay out a death benefit over an extended period, so they charge higher premiums to account for this increased risk.

Choosing the Right Term Length:

The ideal term length depends on your individual circumstances:

- Financial Situation: If you have a limited budget, a shorter term might be more feasible. Longer terms can be more expensive but provide comprehensive coverage.

- Coverage Needs: Consider how long you'll need financial support for your dependents. If they rely on your income for a long time, a longer term might be essential.

- Flexibility: Shorter terms offer more flexibility, allowing you to renew or convert the policy if needed. Longer terms provide long-term security but may be less adaptable.

Comparing rates for different term lengths is crucial to finding the best value for your life insurance policy. While shorter terms are generally more affordable, longer terms offer extended coverage. Evaluate your financial situation, coverage needs, and risk tolerance to determine the most suitable term length for your specific circumstances.

Finding Your Life Insurance License: Quick and Easy Steps

You may want to see also

Age and Health: Younger, healthier individuals often get lower rates

When it comes to life insurance, age and health are two of the most significant factors that influence the rates you'll be offered. Younger, healthier individuals often find themselves in a favorable position when it comes to securing life insurance coverage at lower rates. This is primarily because insurance companies assess the risk associated with insuring a person based on their age and overall health status.

As you age, the risk of developing health issues or facing unexpected medical emergencies increases. Insurance providers take this into account and adjust the premiums accordingly. Younger individuals, on the other hand, are considered to have a lower risk profile. Their chances of developing critical illnesses or facing severe health complications in the near future are relatively lower compared to older adults. This reduced risk translates into more competitive rates for life insurance.

Maintaining a healthy lifestyle also plays a crucial role in securing lower life insurance rates. Insurance companies often encourage policyholders to adopt healthy habits as it directly impacts their risk assessment. For instance, individuals who engage in regular physical activity, maintain a balanced diet, and avoid harmful habits like smoking or excessive alcohol consumption are more likely to be offered lower rates. These healthy behaviors contribute to a reduced likelihood of developing chronic diseases or facing major health crises.

Additionally, younger individuals often have a longer life expectancy, which is another factor considered by insurance providers. Longer life expectancy means that the insurance company has more time to recoup their costs, and thus, they may offer lower rates to these individuals. It's important to note that while age and health are significant, insurance companies also consider other factors like occupation, lifestyle choices, and family medical history to determine the overall risk and set the appropriate rates.

In summary, if you are a younger, healthier individual, you are likely to benefit from lower life insurance rates. Insurance companies recognize the reduced risk associated with this demographic and offer more competitive pricing as a result. However, it's essential to remember that maintaining a healthy lifestyle and making informed choices can further enhance your chances of securing the best rates available.

Period Problems: Life Insurance Exam Impact

You may want to see also

Coverage Amount: Higher coverage amounts typically result in higher premiums

When it comes to life insurance, the coverage amount you choose will significantly impact the cost of your policy. Higher coverage amounts generally lead to higher premiums, and this relationship is a fundamental aspect of how life insurance works. The reason for this is quite straightforward: the more money the insurance company has to pay out in the event of your death, the greater the risk they are taking on, and thus, the higher the premium to cover potential liabilities.

The coverage amount is the financial benefit that your beneficiaries will receive if you pass away during the term of the policy. This amount can vary widely, from a few thousand dollars to millions, depending on your needs and financial goals. For instance, if you have a large family to support or significant financial obligations, you might opt for a higher coverage amount to ensure your loved ones are financially secure. However, it's important to strike a balance between the coverage you need and the cost of the policy.

The insurance company calculates the premium based on several factors, including your age, health, lifestyle, and the coverage amount. As the coverage amount increases, the premium will also increase because the company is taking on a larger financial risk. For example, insuring someone for $1 million will likely be more expensive than insuring them for $100,000, even if all other factors are identical. This is because the potential payout in the former case is significantly higher, and the insurance company must account for this increased risk.

It's worth noting that while higher coverage amounts can provide more financial security for your loved ones, they also mean a larger financial commitment for you. Therefore, it's essential to evaluate your financial situation and consider whether the increased premium is justified by the additional coverage. You might also want to explore other options, such as term life insurance, which provides coverage for a specific period, or whole life insurance, which offers lifelong coverage and a cash value component.

In summary, when considering what rates you should be getting on life insurance, the coverage amount is a critical factor. Higher coverage amounts lead to higher premiums, and this relationship is a key consideration in your decision-making process. It's about finding the right balance between the coverage you need and the cost of the policy, ensuring that you and your loved ones are protected without incurring unnecessary financial burdens.

Unraveling the Mystery: Understanding Supplemental Life AD&D Insurance

You may want to see also

Smoking and Lifestyle: Non-smokers and healthy lifestyles may qualify for better rates

When it comes to life insurance, your lifestyle choices can significantly impact the rates you receive. Insurance companies often consider factors such as smoking habits, overall health, and lifestyle choices when determining the cost of a life insurance policy. One of the most influential factors is smoking, and it's crucial to understand how it affects your premiums.

Non-smokers and individuals who lead healthy lifestyles are typically offered more competitive rates for life insurance. This is because they are considered lower-risk candidates for insurance companies. When you smoke, whether it's cigarettes, cigars, or pipes, it increases your risk of developing various health issues, including lung cancer, heart disease, and respiratory problems. These health risks directly translate to higher insurance premiums as the insurer has to account for the potential costs associated with these conditions.

A healthy lifestyle, on the other hand, can lead to significant savings on life insurance. Maintaining a balanced diet, engaging in regular physical activity, and managing stress effectively are all positive habits that can improve your overall health. By adopting these practices, you reduce the likelihood of developing chronic diseases, which in turn makes you a more attractive candidate for insurance providers. As a result, insurance companies may offer you lower rates, recognizing the lower risk associated with your lifestyle choices.

Additionally, quitting smoking can have a substantial impact on your life insurance rates. If you've successfully quit smoking for a certain period, typically a year or more, it can significantly improve your chances of securing better rates. Insurance companies often view former smokers as a lower-risk group, especially if they have maintained a smoke-free lifestyle for an extended period. This positive change in lifestyle can lead to substantial savings on your life insurance premiums.

In summary, non-smokers and individuals with healthy lifestyles often qualify for more favorable life insurance rates. Insurance companies recognize the reduced risk associated with these individuals and reward them with lower premiums. Conversely, smoking and unhealthy habits can lead to higher rates, as these factors increase the likelihood of health-related issues. By making positive lifestyle changes, you can potentially save money on life insurance and ensure that you are getting the best rates possible.

Unlocking Cash: Understanding Life Insurance's Form Number

You may want to see also

Medical History: Pre-existing conditions can impact insurance rates

When considering life insurance, your medical history, including any pre-existing conditions, plays a significant role in determining the rates you'll be offered. Insurance companies use this information to assess the risk associated with insuring your life. Pre-existing conditions can indeed impact your insurance rates, and understanding these factors is crucial for making informed decisions.

Certain medical conditions can affect the overall cost of life insurance. For instance, if you have a history of chronic illnesses such as diabetes, heart disease, or cancer, insurance providers may consider you a higher-risk candidate. These conditions often require ongoing medical management and can lead to increased healthcare costs, which are reflected in the insurance premiums. Additionally, the severity and stability of these conditions are taken into account; a well-controlled condition might result in lower rates compared to one that is active or has frequent complications.

The impact of pre-existing conditions becomes even more pronounced when it comes to term life insurance, which provides coverage for a specific period. Insurance adjusters often scrutinize medical records to identify any potential health risks. Conditions like hypertension, high cholesterol, or obesity may lead to higher rates or even denial of coverage, especially if they are not well-managed. It's essential to be transparent about your medical history during the application process to ensure accurate rate calculations.

Furthermore, the timing of disclosure is critical. Some insurance companies may offer a medical exam or review your records before providing a quote. If you withhold information about pre-existing conditions, it could result in denied claims or legal consequences. Being honest and providing detailed medical records allows the insurance company to make an accurate assessment and offer suitable coverage options.

In summary, your medical history, including pre-existing conditions, is a critical factor in determining life insurance rates. Insurance providers use this information to gauge the potential risks and associated costs. By being transparent and providing comprehensive medical details, you can ensure that you receive appropriate coverage at competitive rates. Understanding these factors empowers you to make informed decisions and secure the right life insurance policy for your needs.

Colonial Penn's Term Life Insurance: What's the Duration?

You may want to see also

Frequently asked questions

The rate you should expect for life insurance depends on various factors, including your age, health, lifestyle, and the type of policy you choose. Younger and healthier individuals typically qualify for lower rates, as they pose less risk to the insurance company. Factors like smoking, obesity, pre-existing medical conditions, and certain hobbies or occupations can impact your premium. It's essential to be transparent about your health and lifestyle during the application process to ensure accurate rate calculations.

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It is generally more affordable than permanent life insurance, which offers lifelong coverage. The rates for term life insurance are often lower because the policy only covers a specific duration, and the risk to the insurer is limited to that period. Permanent life insurance, on the other hand, includes a savings component, which can lead to higher rates due to the long-term commitment and investment aspect.

Yes, if you already have a life insurance policy, you might be able to secure a lower rate by increasing your coverage or converting your existing policy to a new one with better terms. Insurance companies often offer discounts for long-term customers or those with a history of loyalty. Additionally, improving your health or lifestyle since your initial application can also lead to lower rates. It's advisable to review your policy regularly and consider adjustments to optimize your coverage and premiums.