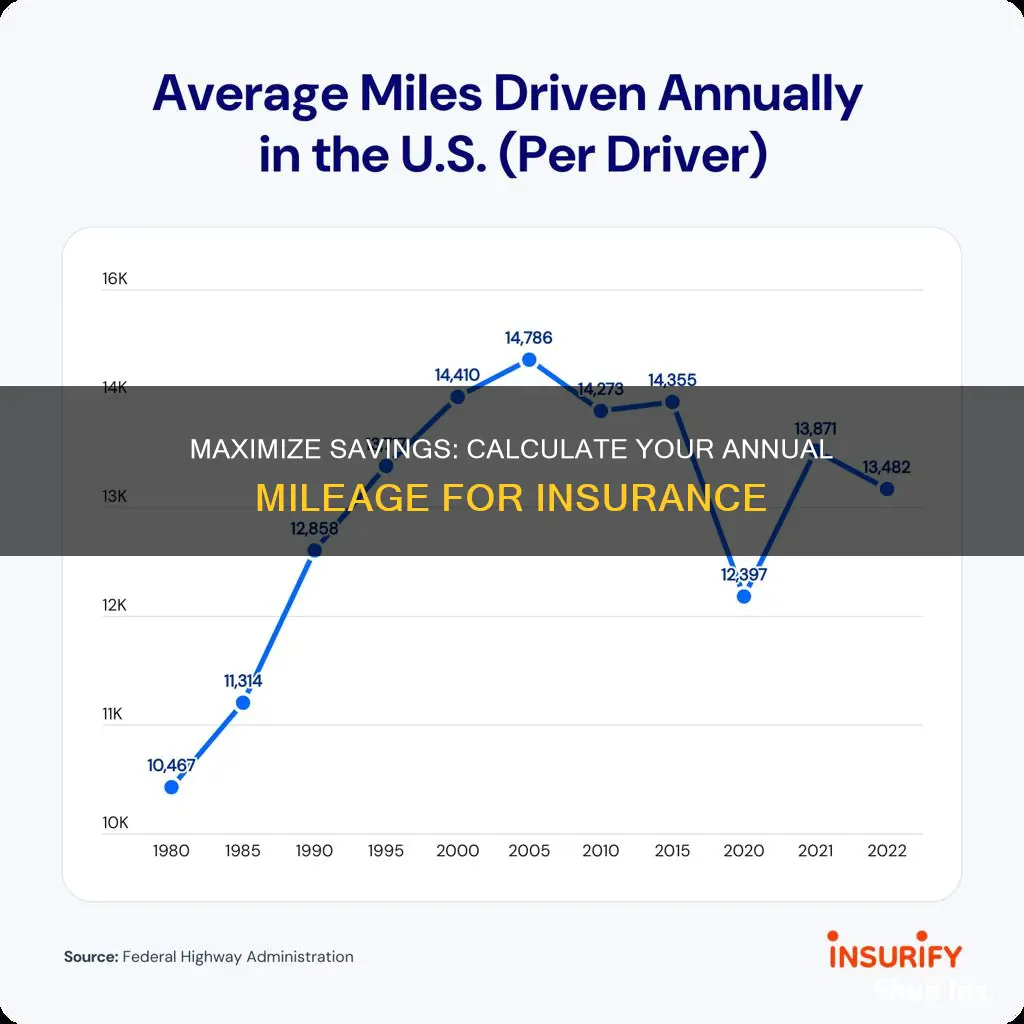

When it comes to determining your insurance rates, understanding how many miles you drive annually is crucial. This information helps insurers assess the risk associated with your driving habits and can significantly impact the cost of your coverage. Whether you're a daily commuter or a weekend adventurer, knowing your annual mileage is essential for finding the right insurance plan that suits your needs and budget.

What You'll Learn

Mileage Calculation: Determine your annual driving distance

To accurately determine your annual driving distance, you can start by reviewing your vehicle's records and any available data. Many modern cars have built-in trip computers that can provide a running total of your mileage. Check the odometer readings at the beginning and end of each month, and calculate the difference to get an estimate of your monthly driving distance. This method is straightforward and provides a good starting point.

Another approach is to keep a detailed log of your trips. Every time you drive, record the date, starting and ending odometer readings, and the purpose of the trip. You can then sum up the total mileage for each month and calculate the annual figure. This method is more time-consuming but offers a high level of accuracy, especially if you drive a variety of vehicles or have multiple trips in a day.

For those who prefer a more automated solution, there are various apps and online tools available that can help track your mileage. These tools often sync with your smartphone's GPS and can provide real-time data on your driving distance. Some even offer features like trip categorization and mileage reports, making it easier to keep track of your annual driving habits.

If you have access to your vehicle's event data recorder (EDR), also known as a 'black box', you can extract valuable mileage information. EDRs record various driving parameters, including speed, acceleration, and mileage, and can provide a comprehensive overview of your driving patterns. This method is particularly useful for those who want a more technical approach to mileage calculation.

Lastly, consider your insurance provider's guidelines and recommendations. Insurance companies often have resources to help policyholders estimate their annual mileage. They may provide online calculators or offer advice on how to accurately log your trips. Utilizing these resources can ensure that your insurance coverage is tailored to your actual driving habits.

Business Insurance: Auto Claim Coverage?

You may want to see also

Vehicle Type: Consider car model and usage

When determining how many miles you drive annually for insurance purposes, it's essential to consider the type of vehicle you own. The car model and its usage significantly impact the mileage and, consequently, the insurance premium. Here's a detailed breakdown:

Car Model and Mileage: Different car models have varying engine sizes, fuel efficiencies, and design purposes, which directly affect their mileage. For instance, a compact car designed for urban commuting will typically have a lower annual mileage compared to an SUV or a luxury sedan. Sports cars and high-performance vehicles often have higher mileage due to their powerful engines and aggressive driving dynamics. Insurance companies often use these factors to assess the risk associated with insuring a particular car model.

Usage and Mileage: The frequency and purpose of your vehicle's usage play a crucial role. If you primarily use your car for daily commuting to work or school, the mileage will be relatively consistent and predictable. However, if you frequently take long-distance trips or use your vehicle for business purposes, the mileage will be higher. For example, a car used for a delivery service or a taxi will accumulate more miles in a year compared to a personal vehicle used for occasional weekend getaways.

Impact on Insurance: Insurance companies consider the car model and usage to determine the risk profile of the vehicle. Higher mileage can indicate a higher risk of accidents, wear and tear, and potential mechanical issues. As a result, insurance premiums may be adjusted accordingly. For instance, a high-mileage car might be classified as a high-risk vehicle, leading to higher insurance rates. Conversely, a low-mileage, well-maintained car from a reliable model with a good safety record may attract lower premiums.

Personalizing Your Policy: Understanding your vehicle's mileage and usage patterns allows you to make informed decisions when purchasing insurance. You can provide accurate mileage estimates to insurance agents or brokers, ensuring you get a fair deal. Additionally, if you have a choice of car models, considering the mileage impact can help you choose a vehicle that aligns with your insurance budget.

Remember, insurance companies often use mileage-based insurance programs, where premiums are calculated based on the estimated annual mileage. This approach provides a more personalized and accurate insurance quote, ensuring you pay for the coverage you need based on your actual driving habits.

Unemployed? Here's How to Get Car Insurance

You may want to see also

Driving Patterns: Regular commutes or occasional long trips

When determining how many miles you drive annually for insurance purposes, it's essential to consider your driving patterns. One of the most significant factors influencing your mileage is the frequency and nature of your trips. Regular commutes to and from work or school can significantly impact your annual mileage. For instance, if you drive 30 miles each way, five days a week, that's 600 miles a week or 2400 miles a month. Over a year, this equates to 28,800 miles, which could be a substantial figure for insurance calculations.

On the other hand, if your driving is more sporadic, with occasional long trips, the mileage will be lower. For example, if you take a 1,000-mile road trip once a month, that's 12,000 miles a year. This is significantly less than the regular commuter's mileage and could result in a lower insurance premium.

The key is to be honest and accurate about your driving habits. Insurance companies often use mileage-based rates, so providing precise information about your annual driving distance can help you get the best deal. If you're not sure about your exact mileage, consider tracking your trips for a few months to get a more accurate estimate.

For regular commuters, there are strategies to optimize your mileage and potentially reduce costs. Carpooling or using public transportation can significantly decrease your annual mileage. If you can reduce your personal driving to a few times a week, you'll lower your annual mileage, which can be beneficial for your insurance.

In summary, whether you're a regular commuter or someone who takes occasional long trips, understanding your driving patterns is crucial. It allows you to provide accurate information to insurance companies, ensuring you get the right coverage at a competitive price. Being aware of your mileage can also encourage more efficient driving habits, which is beneficial for both your wallet and the environment.

Credit Card Auto Insurance: Understanding Dual Coverage for Vehicles

You may want to see also

Insurance Rates: Higher mileage often leads to increased premiums

Driving habits and vehicle usage play a significant role in determining insurance rates, and one of the most critical factors is the number of miles you drive annually. Insurers use mileage as a key metric to assess the risk associated with insuring a vehicle. Higher mileage often translates to increased premiums, and understanding why is essential for making informed decisions about your insurance coverage.

When insurance companies calculate premiums, they consider the likelihood of accidents and the potential wear and tear on a vehicle. More miles driven mean more opportunities for accidents and increased chances of vehicle damage. For instance, a driver who commutes long distances daily or frequently travels on long-distance trips is statistically more likely to be involved in accidents compared to someone who drives shorter distances for local errands. This higher risk is reflected in the insurance rates, as insurers adjust the premiums to account for the potential costs associated with more extensive vehicle usage.

The relationship between mileage and insurance rates is often directly proportional. Insurers typically categorize vehicles into different mileage bands, and the premium rates vary accordingly. For example, a car with a low annual mileage might fall into a lower-risk category, resulting in more affordable insurance. Conversely, a vehicle with a high annual mileage could be considered a higher-risk asset, leading to increased premiums to cover potential repair or replacement costs. This is especially true for sports cars or luxury vehicles, which are often associated with higher mileage and, consequently, more expensive insurance.

Several factors contribute to the mileage-based premium structure. Firstly, higher mileage indicates a higher likelihood of frequent use, which can lead to increased wear and tear on various vehicle components. This includes the engine, transmission, and brakes, among others. Secondly, more miles driven mean more potential exposure to hazardous driving conditions, such as heavy traffic, road construction, or adverse weather, all of which can contribute to a higher accident risk. Insurers factor in these considerations to ensure that the premiums reflect the true cost of insuring a vehicle with a given mileage history.

To manage insurance rates effectively, consider the following strategies. Firstly, maintain a record of your annual mileage and share this information with your insurer. This transparency can help in negotiating better rates, especially if your mileage has been consistently low over several years. Secondly, explore usage-based insurance programs offered by some insurers. These programs use telematics or onboard devices to monitor driving habits and mileage, allowing for more personalized premium calculations. By actively managing your driving behavior and mileage, you can potentially lower your insurance costs while still having adequate coverage.

Insurance Primary: Yours or Theirs?

You may want to see also

Discounts: Some insurers offer discounts for low mileage

When it comes to insurance, the number of miles you drive annually can significantly impact your premiums. Insurers often consider mileage as a crucial factor in determining the risk associated with insuring a driver. For those who drive fewer miles, there are potential savings to be had. Many insurance companies offer discounts specifically tailored to low-mileage drivers, recognizing that lower mileage typically translates to a reduced risk of accidents and claims.

One of the most common discounts for low mileage is the 'Low Mileage Discount'. This discount is designed to reward drivers who keep their annual mileage relatively low. The criteria for qualifying for this discount can vary between insurers, but generally, you'll need to drive fewer than a certain number of miles per year. For instance, some insurers may offer a discount if you drive less than 7,500 miles annually, while others might provide savings for those who drive even fewer miles, such as 5,000 or 3,000 miles per year. It's important to check with your insurance provider to understand their specific mileage requirements.

To take advantage of these discounts, you'll need to provide accurate mileage information to your insurer. This might involve filling out a questionnaire or providing a log of your annual mileage. Some insurers may also require proof, such as a logbook or a trip computer reading, to verify the information you provide. Honesty and transparency are key when it comes to these discounts, as insurers may adjust your premium if they discover you've been misleading them about your mileage.

In addition to the low mileage discount, some insurers also offer other types of discounts that can further reduce your insurance costs. For example, you might be eligible for a 'Safe Driver Discount' if you maintain a clean driving record, or a 'Multi-Policy Discount' if you combine your car insurance with other policies, such as home or life insurance, with the same company. Combining these discounts with the low mileage discount can result in significant savings on your insurance premiums.

It's worth noting that the specific discounts and eligibility criteria can vary widely between insurance companies. Therefore, it's essential to shop around and compare quotes from multiple insurers to find the best deal for your situation. Additionally, keep in mind that driving habits, vehicle usage, and other factors can also influence the availability and amount of discounts you receive. Understanding these factors and how they relate to your insurance premiums can help you make informed decisions and potentially save money on your car insurance.

U.S. Auto Insurance: Unraveling the Medical Coverage Mystery

You may want to see also

Frequently asked questions

The annual mileage for insurance purposes is typically calculated based on the total distance you drive in a year. This can be estimated or provided by reviewing your vehicle's odometer readings over a 12-month period. It's important to be accurate and honest about your mileage, as insurance companies may adjust premiums based on the estimated driving frequency.

Yes, many insurance providers offer discounts for vehicles used for business purposes. If you drive your car for work-related activities, you can provide documentation such as mileage logs, business receipts, or a letter from your employer to support your claim. This can help you qualify for a lower premium, as insurance companies often consider the risk associated with business use when setting rates.

If your annual mileage fluctuates, it's best to provide an estimate based on your average driving habits over the past few years. Insurance companies often consider trends and patterns in mileage data. You can also consider purchasing a usage-based insurance policy, which tracks your actual driving habits and adjusts premiums accordingly, providing more flexibility for those with varying mileage needs.