New York State requires all drivers to have auto liability insurance coverage. The New York State Department of Motor Vehicles (DMV) allows motorists to provide proof of insurance in either a paper or electronic format. If you have auto insurance, your insurance company will issue you with two original NY State Insurance ID Cards or access to a digital electronic NY State Insurance ID Card. You must register your vehicle at the DMV within 180 days of the effective date on your insurance ID card, bringing one copy of your Insurance Identification Card with you. The DMV office will keep the paper card, and you should keep the other with your vehicle as proof of insurance.

| Characteristics | Values |

|---|---|

| Does NY allow printed auto insurance cards? | Yes, NY allows motorists to show proof of auto insurance in either a paper or electronic format. |

| Is proof of insurance required? | Yes, proof of insurance is required whenever a vehicle is operated. |

| What is the minimum amount of liability coverage? | $10,000 for property damage for a single accident, $25,000 for bodily injury and $50,000 for death for a person involved in an accident, $50,000 for bodily injury and $100,000 for death for two or more people in an accident. |

| Is there a specific type of insurance required? | Yes, New York State-issued automobile liability insurance coverage is required. Out-of-state insurance is not acceptable. |

| Who issues the proof of insurance? | The insurance company will issue proof of insurance in the form of NY State Insurance ID Cards or provide access to a digital electronic NY State Insurance ID Card. |

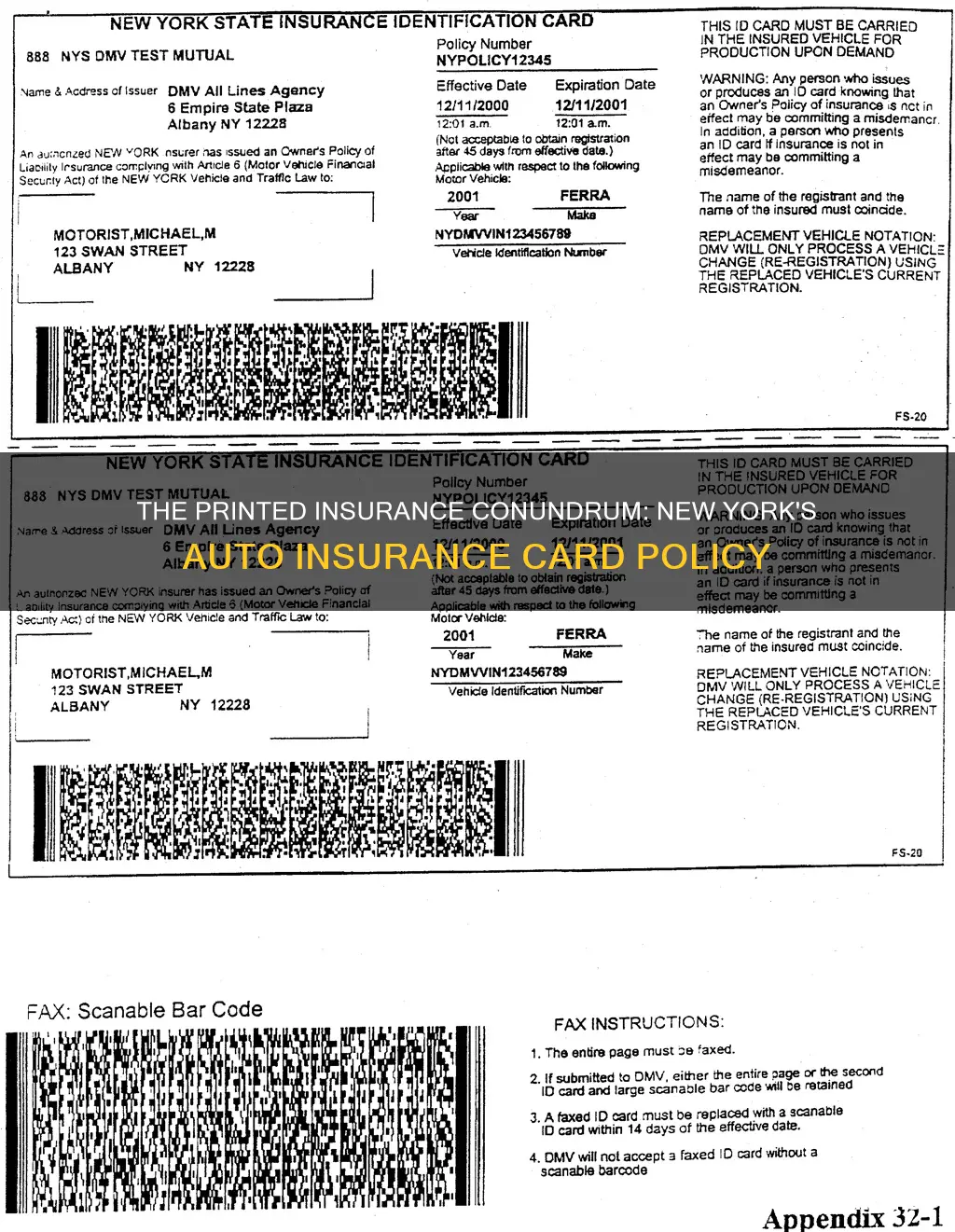

| What is the size of the ID card? | Minimum size: 3" x 5", Maximum size: 5 ½" x 8 ½". |

| Can a printed copy of the electronic ID card be used as proof? | Yes, printed insurance ID cards may be delivered to the policyholder if proof of insurance is provided in an electronic format. |

| Can proof of insurance be provided by phone or at a DMV office? | No, proof of insurance cannot be provided by phone or at a DMV office. |

What You'll Learn

Proof of insurance in an electronic format

Motorists in New York State are now allowed to provide proof of auto liability coverage in an electronic format. This is in addition to the existing option of providing paper proof. This change is the result of recent amendments to the NYS Department of Motor Vehicles Commissioner Regulations, Part 32.

- Acquiring registrations in DMV offices

- Providing proof of insurance coverage during a traffic stop

- Providing proof of insurance coverage to a judge, justice, or magistrate in response to a summons

There are some requirements that must be met for electronic proof of insurance to be valid. Firstly, it must meet the technical requirements set forth in Commissioner Rules & Regulations, Part 32, that are applicable to paper insurance ID cards. Secondly, it must be capable of being displayed on a portable electronic device, as defined in paragraph (a) of subdivision two of section 1225-d of the Vehicle and Traffic Law. Additionally, insurance companies that provide electronic proof of insurance must obtain approval from the named insured. Finally, electronic proof must be legible and able to be scanned by a 2D barcode scanner for registration purposes.

It is important to note that electronic proof of insurance cannot be used for temporary insurance ID cards, entities that are self-insured, or fleet, dealer, or transporter transactions.

While New York allows for electronic proof of insurance, it is always a good idea to keep a physical copy of your insurance card as well. This will ensure that you have a backup in case your phone is dead, has no service, or you are unable to access the digital version for any other reason.

Auto Insurance Adjusters: Fair or Foul?

You may want to see also

Insurance ID card requirements

The New York State Department of Motor Vehicles (DMV) requires auto liability insurance to register a vehicle in New York. When you get insurance, your insurance company will issue proof of insurance in two ways:

- They will give you two original NY State Insurance ID Cards, or provide you with access to your digital electronic NY State Insurance ID Card.

- They will send an electronic notice of insurance coverage to the DMV.

Your NY State Insurance Identification Cards and the electronic notice of insurance together verify your insurance coverage.

You must register your vehicle at the DMV within 180 days of the effective date on your insurance ID card. Bring one copy or form of your Insurance Identification Cards with you. The DMV office will keep the paper card. Keep the other paper card with the vehicle as your proof of insurance. Anyone operating your vehicle must be able to provide proof of insurance while they are operating the vehicle.

The name and vehicle information on your insurance identification card must be the same as on your vehicle registration. The DMV will not accept out-of-state insurance documents.

The DMV now allows motorists to show proof of auto insurance in either paper or electronic format. This proof is required whenever a vehicle is operated. Proof of insurance in an electronic format can be used when acquiring registrations in DMV offices, providing proof of insurance coverage during a traffic stop, and providing proof of insurance coverage to a judge/justice/magistrate in response to a summons.

If proof of insurance is provided in an electronic format, printed insurance ID cards may be delivered to the policyholder. Insurance companies that provide proof in an electronic format must have approval from the named insured. This proof must be legible and able to be scanned by a 2D Bar code scanner for registration purposes.

Direct Auto Insurance: Good or Bad?

You may want to see also

Paper insurance ID cards

In the state of New York, motorists are required to have proof of auto liability coverage, or insurance ID cards, either in a paper or electronic format. This proof of insurance must be produced whenever a vehicle is operated.

The New York State Department of Motor Vehicles (DMV) requires auto liability insurance to register a vehicle. When you get insurance, your insurance company will issue proof of insurance in two ways:

- Providing you with two original NY State Insurance ID Cards

- Giving you access to your digital electronic NY State Insurance ID Card

If you have paper insurance ID cards, you must keep one copy with your vehicle as proof of insurance. Anyone operating your vehicle must be able to provide proof of insurance while driving. The other paper card must be brought to the DMV office when registering your vehicle. The DMV will keep this copy.

Auto Insurers: Startup Investors?

You may want to see also

Proof of insurance during a traffic stop

In New York, driving without auto insurance is considered a criminal offence. If you're pulled over for a traffic violation, you may be asked to present your insurance identification card. Failure to do so can result in a fine of up to $1,500, suspension of your driving privileges, a $750 fee to restore your license, impounding of your vehicle, or even jail time.

New York motorists can provide proof of auto liability coverage (Insurance ID Cards) in either a paper or electronic format. If you choose to present an electronic format, it must be displayed on a portable electronic device and be legible and scannable by a 2D barcode scanner.

The insurance ID card must contain the same name as the name on your vehicle registration application. The card will also have the policy and the dates that the policy is in effect.

If you are unable to present your insurance card during a traffic stop, it is presumed that you are driving without insurance. However, this presumption can be challenged by providing evidence that your insurance policy was in effect at the time of the traffic violation, such as through a letter from your insurance company.

Cure Auto Insurance: Rate Hikes and the Reasons Behind Them

You may want to see also

Proof of insurance when acquiring registrations

To register a vehicle in New York State, you must have New York State-issued automobile liability insurance coverage. If you do not maintain this coverage, the DMV can suspend your vehicle registration and your driver's license.

The minimum amount of liability coverage is $10,000 for property damage for a single accident, $25,000 for bodily injury and $50,000 for death for a person involved in an accident, and $50,000 for bodily injury and $100,000 for death for two or more people in an accident.

Your liability insurance coverage must remain in effect while the registration is valid, even if you don't use the vehicle (with some exceptions for motorcycles). It must be New York State insurance coverage, issued by a company licensed by the NY State Department of Financial Services and certified by the NY State DMV—out-of-state insurance is never acceptable.

When you get insurance, your insurance company will issue proof of insurance in two ways: they will give you two original NY State Insurance ID Cards, and they will send an electronic notice of insurance coverage to the DMV (your insurance agent or broker cannot file this notice). You will need both of these to verify your insurance coverage.

You must register your vehicle at the DMV within 180 days of the effective date on your insurance ID card. Bring one copy or form of your Insurance Identification Cards with you. The DMV office will keep the paper card, and you should keep the other paper card with the vehicle as your proof of insurance. Anyone operating your vehicle must be able to provide proof of insurance while they are operating the vehicle.

The DMV will accept copies or faxes of your Insurance Identification Card, but they will not accept a card if their barcode reader cannot read the barcode.

Recent changes to the NYS Department of Motor Vehicles Commissioner Regulations now allow NYS motorists to provide proof of auto liability coverage (Insurance ID Cards) in a paper or electronic format when acquiring registrations in DMV Offices. Proof of insurance in an electronic format must meet the technical requirements set forth in Commissioner Rules & Regulations, Part 32, and it must be capable of being displayed on a portable electronic device as defined in paragraph (a) of subdivision two of section 1225-d of the Vehicle and Traffic Law. If proof in an electronic format is provided, printed insurance ID cards may be delivered to the policyholder. Insurance companies that provide proof in an electronic format must have approval from the named insured.

DUIs: Getting Auto Insurance After

You may want to see also

Frequently asked questions

Yes, the New York State Department of Motor Vehicles (DMV) allows motorists to show proof of auto insurance in either a paper or electronic format.

The minimum amount of liability coverage required in New York is $10,000 for property damage for a single accident, $25,000 for bodily injury and $50,000 for death for a person involved in an accident, and $50,000 for bodily injury and $100,000 for death for two or more people in an accident.

If you do not maintain auto insurance coverage in New York, the DMV can suspend your vehicle registration and your driver's license.

The printed auto insurance card must include the effective date of your liability insurance coverage, the policy number of your liability insurance coverage, and the 3-digit code of your insurance company. The name and vehicle information on the insurance card must also match the information on your vehicle registration.

Yes, the DMV allows motorists to provide proof of auto insurance electronically. However, this option is only available if your insurance company has been certified and approved by the named insured.