If you've been in a car accident, it's important to know how to write a description of the auto loss for an insurance claim. The first step is to promptly report the accident to your insurance company and the local police department, especially if there has been significant damage or injury. You'll then need to file an accident report with the Department of Motor Vehicles if the damage exceeds a certain amount or if anyone is injured. It's crucial to understand your insurance policy's specific requirements and act accordingly. You may need to submit a sworn proof of loss within a certain timeframe, providing details of the accident, how it happened, and the purpose of the vehicle at the time. Keeping records, such as police reports, witness statements, and repair estimates, will support your claim and help you receive fair compensation.

| Characteristics | Values |

|---|---|

| Report losses | Immediately report all losses to your insurance company |

| Report theft or vandalism | Report to the police immediately, otherwise your claim may be denied |

| Protect your vehicle from further damage | Cover a broken windshield to prevent further damage to the interior |

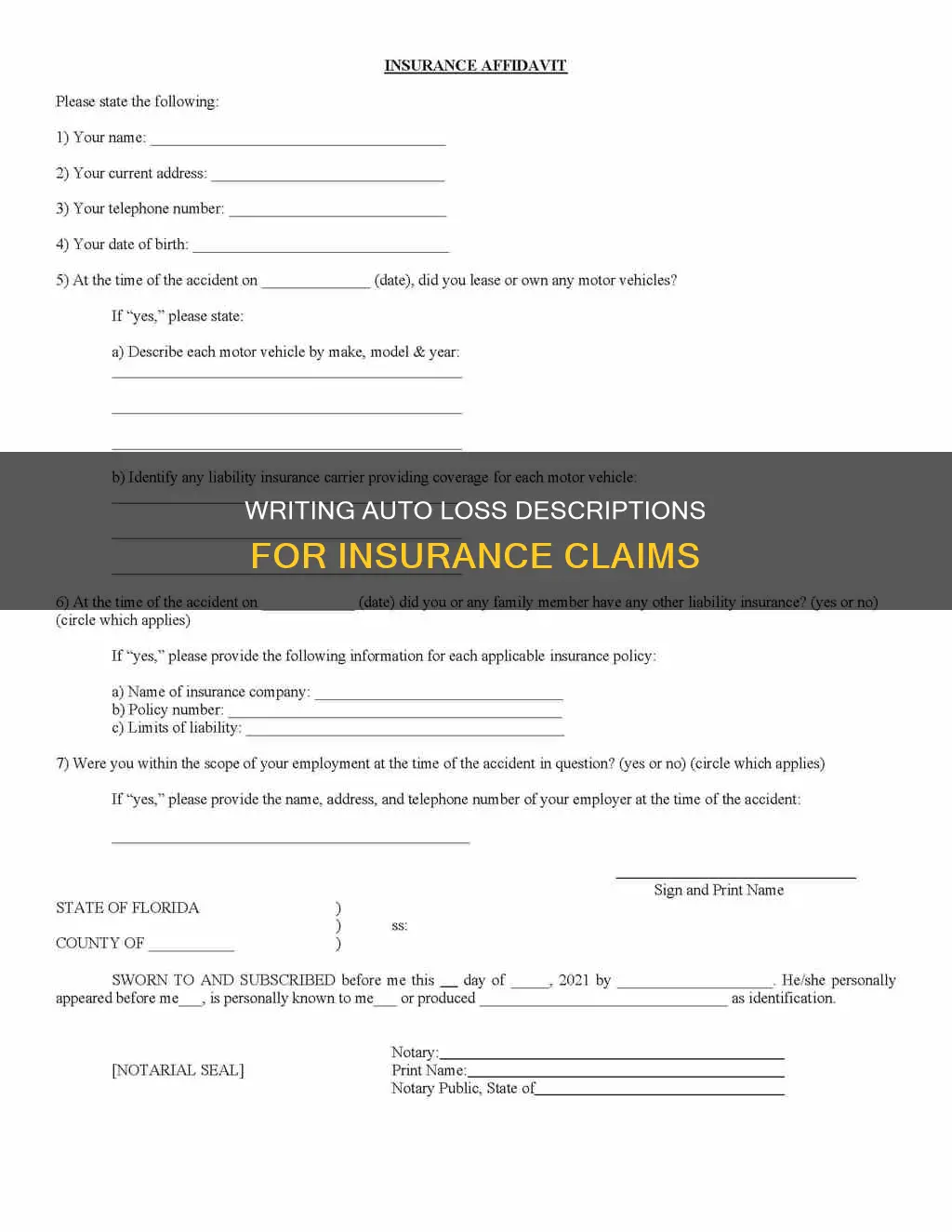

| Submit proof of loss | Submit a sworn proof of loss within 91 days, stating the date of loss, how it happened, and the purpose of the vehicle |

| Cooperate with the insurance company | Cooperate with the insurance company and submit to an examination under oath if requested |

| Review your policy | Read your policy to determine what is covered and what your responsibilities are |

| Provide documentation | Include supporting documentation such as police reports, witness statements, photographs, repair estimates, and appraisals |

| Tone | Be polite and stick to the facts |

| Be concise | Include all important facts without unnecessary details |

| Demand a specific amount | Ask for a specific, reasonable amount that is connected to your actual losses |

| Set a deadline | Include a deadline for a response to motivate timely action |

| Keep records | Make copies of your demand and all documents received in response |

What You'll Learn

- Include details of the accident, such as the date, location, and any witnesses

- Provide a clear and concise summary of the incident, including any relevant facts

- List all damages incurred and their estimated costs

- Outline any injuries sustained by yourself or other parties involved

- Attach supporting documents, such as police reports, photographs, and repair estimates

Include details of the accident, such as the date, location, and any witnesses

When writing a description of auto loss for an insurance claim, it is important to include as much detail as possible about the accident, such as the date, location, and any witnesses present. Here are some steps to follow to ensure you provide comprehensive information:

Document the Date and Time

Note the exact date and time of the accident. This information is crucial for reference purposes and can help verify the accuracy of your claim.

Describe the Location

Provide a detailed description of the accident location, including the specific address or intersection where it occurred. If there are any notable landmarks or distinct features nearby, be sure to mention them. For example, "The accident occurred on Elm Street, just past the town square, at approximately 2:45 p.m. on June 15th."

Identify Witnesses

If there were any witnesses to the accident, be sure to obtain their full names and contact information, including phone numbers and email addresses. Witness testimonies can be valuable in supporting your claim and providing additional details about the incident.

Take Photographs

Use your cell phone or camera to take photographs of the accident scene, capturing the damage to all vehicles involved, road conditions, and any relevant surrounding elements such as traffic signs or intersections. These photos will serve as visual evidence to support your written description.

Record Vehicle Information

Note the license plate numbers and vehicle identification numbers of all vehicles involved. Additionally, obtain the insurance information of the other drivers by taking pictures of their insurance ID cards. This information will be necessary when filing your claim.

File a Police Report

If the accident is severe or involves injuries, be sure to call 911 and file a police report. Obtain the name and badge number of the responding police officer, and request a copy of the official police report for your records. This report will provide an unbiased, third-party account of the incident.

Seek Medical Attention

If you or any of your passengers are injured, seek medical attention immediately. Even if the injuries seem minor, it is important to have a medical professional examine you and provide necessary treatment. Keep records of all medical expenses and treatments received as a result of the accident.

Exchange Information with Other Drivers

Obtain the names, addresses, phone numbers, and driver's license numbers of all other drivers involved in the accident. Ensure that you also exchange insurance information, including insurance company names and policy numbers. This information will be necessary when filing your insurance claim.

Contact Your Insurance Company

Don't delay in contacting your insurance company to report the accident, regardless of who was at fault. Many insurance companies now offer mobile apps that allow you to file claims conveniently. Provide them with all the information you have gathered, including witness details, photographs, and police report information.

Remember, when writing your description of auto loss for an insurance claim, it is crucial to be as detailed and accurate as possible. This information will play a significant role in the claims process and any potential negotiations or legal proceedings that may arise.

Rural Carrier Auto Insurance: Navigating the Unique Challenges

You may want to see also

Provide a clear and concise summary of the incident, including any relevant facts

When writing a description of auto loss for an insurance claim, it is important to provide a clear and concise summary of the incident, including all relevant facts. Here is a step-by-step guide on how to effectively describe your auto loss:

- Start with the basics: Begin by stating the date, time, and location of the incident. For example, "On [date] at approximately [time], an incident occurred at [address or intersection]." This sets the foundation for your description and provides crucial context for the insurance company.

- Describe the vehicles involved: Mention the type, make, model, and year of your vehicle and the other vehicle(s) involved. For instance, "My 2022 Honda Civic was involved in a collision with a 2020 Toyota Camry." Providing this information helps the insurance company understand the extent of potential damage and the specifics of the vehicles involved.

- Explain the sequence of events: Narrate the incident in chronological order, detailing the movements and actions of all vehicles involved. For example, "I was driving eastbound on Elm Street when the other vehicle ran a red light and collided with the front passenger side of my car." By explaining the sequence of events, you can paint a clear picture of what transpired and how the incident unfolded.

- Include relevant details: Mention any contributing factors such as weather conditions, road hazards, or mechanical issues. For instance, "It was raining heavily at the time, and the roads were slick." Additionally, if there were any witnesses to the incident, be sure to include their accounts. Noting these details adds depth to your description and helps in understanding the circumstances surrounding the incident.

- Describe the damage: Explain the damage sustained by your vehicle and, if possible, the other vehicle(s) involved. For example, "My vehicle sustained significant damage to the front bumper, hood, and passenger-side door. The airbags deployed, and the windshield was cracked." Providing a comprehensive overview of the damage helps the insurance company assess the extent of the loss and determine the necessary repairs or compensation.

- Mention any injuries: If there were any injuries to yourself or others involved in the incident, be sure to include this information. For example, "I sustained minor whiplash and cuts from the broken glass." Including details about injuries underscores the impact of the incident and highlights the importance of prompt medical attention.

Remember to keep your description factual and objective. Avoid assigning blame or speculating about the actions of others. Stick to what you directly observed and experienced. Supporting your description with photographs, police reports, and witness statements can also strengthen your insurance claim.

Auto Insurance: Age Requirements and Purchasing Power

You may want to see also

List all damages incurred and their estimated costs

When writing a description of auto loss for an insurance claim, it's important to list all the damages incurred and provide estimated costs for each. This information will be used by the insurance company to determine the total extent of the damage and the appropriate compensation. Here are some tips to consider when listing the damages and their costs:

Detail the Damage

Provide a comprehensive list of all the damages your vehicle has sustained. Be as specific and detailed as possible. Note all the parts of the vehicle that need to be repaired or replaced, including exterior components, interior elements, and mechanical systems. Describe any damage to the body, frame, windows, lights, tires, rims, engine, transmission, and so on. If there are any fluids leaking, mention that as well.

Obtain Repair Estimates

Contact reputable auto repair shops and ask for repair estimates. It is recommended to get at least two estimates, if not more, to get a good understanding of the potential costs. Make sure the repair shops are properly licensed and registered. Ask for a detailed breakdown of the costs, including parts and labour, and be sure that the estimate is sufficient to restore your vehicle to its pre-accident condition, or as close as possible.

Compare Prices

Once you have multiple estimates, compare the prices and evaluate which repair shop offers the best value. Consider the quality of the repairs, the warranty offered, and the reputation of the shop. Remember, the goal is to get your vehicle properly repaired, so choosing the lowest bid might not always be the best option.

Consider Additional Costs

In addition to the direct repair costs, there may be other expenses to consider. For example, if your vehicle is in the shop for an extended period, you may need to rent a car or use alternative transportation, which can add up quickly. If there were any personal items damaged in the accident, such as a phone, laptop, or clothing, be sure to include those in your claim as well.

Document and Submit

Finally, compile all the information you have gathered. Create a clear and concise document that lists each item that needs repair or replacement, along with the corresponding estimated costs from the auto repair shops. Submit this document to your insurance company as part of your claim. Remember to keep all receipts and documentation organised, as you may need to refer to them during the claims process or for tax purposes.

By following these steps and providing a detailed description of the damages and their estimated costs, you can help streamline the insurance claim process and increase the likelihood of receiving fair compensation for your losses.

Underinsured: The Risk of Low Auto Coverage

You may want to see also

Outline any injuries sustained by yourself or other parties involved

When writing a description of injuries sustained in a car accident for an insurance claim, it is important to be as detailed and clear as possible. Here are some guidelines and paragraphs to help you outline any injuries sustained by yourself or other parties involved:

Provide a Detailed Account of the Injuries:

Describe the injuries you sustained in the accident clearly and comprehensively. Be sure to mention all physical injuries, such as cuts, bruises, broken bones, or any other relevant details. Also, include any emotional or psychological impacts, such as anxiety, fear, or emotional distress resulting from the accident. A comprehensive description will help the insurance company understand the extent of your injuries and the impact they have had on your life.

Example paragraph: "As a result of the accident, I sustained several injuries, including a broken left leg, multiple cuts and bruises, and whiplash. The impact of the collision caused me to experience severe whiplash, resulting in persistent neck pain and headaches. Additionally, I have been suffering from anxiety and fear whenever I get into a car, making it difficult for me to drive or even be a passenger."

Chronological Order and Medical Care:

It is essential to describe your injuries and medical care in chronological order, starting from the day of the accident. Outline the treatments and therapies you have received, including hospitalizations, surgeries, rehabilitation, and any assistive devices you have had to use, such as crutches or a wheelchair. Mention any ongoing or future medical care that has been advised by your doctor.

Example paragraph: "Immediately after the accident, I was transported to the nearest hospital, where I was diagnosed with a fractured left tibia and received initial treatment. Over the following weeks, I underwent surgery to stabilize my leg and began a course of physical therapy to regain my mobility. I have also been experiencing severe anxiety and have been attending therapy sessions to address the psychological impact of the accident. My doctor has advised that I may require ongoing therapy and additional surgeries in the future."

Impact on Daily Life and Work:

Explain how your injuries have affected your daily life and ability to work. Detail any alterations you have had to make to your home or lifestyle to accommodate your injuries. Mention any assistance you have required for daily activities, such as bathing, dressing, or household chores. If you have been unable to work, provide details on the impact on your income and employment.

Example paragraph: "The injuries I sustained in the accident have significantly impacted my daily life. I have been unable to perform basic tasks such as cooking, cleaning, and running errands without assistance. I have had to make modifications to my home, including installing a ramp for my wheelchair and adding grab bars in the bathroom. Furthermore, I have not been able to return to work since the accident. As a self-employed individual, this has resulted in a substantial loss of income and business opportunities."

Outline Injuries of Other Parties:

If there were other individuals involved in the accident, provide a description of their injuries as well. Include any details you have on their medical care, impact on their daily lives, and any conversations you may have had with them about their injuries. This information will help the insurance company understand the full scope of the accident's impact.

Example paragraph: "The driver of the other vehicle also sustained injuries in the accident. I recall them complaining of severe neck and back pain immediately following the collision. They were transported to the hospital by ambulance, and I later learned that they had suffered a concussion and several herniated discs in their spine. Our conversation at the scene indicated that they were experiencing difficulty moving their neck and had to wear a neck brace for several weeks."

Remember to be as detailed and accurate as possible when describing the injuries sustained by yourself or others. This information will play a crucial role in the insurance claim process and ensure that you receive the necessary support and compensation for your losses.

State Farm Claims: How to Check Your Auto Insurance Status

You may want to see also

Attach supporting documents, such as police reports, photographs, and repair estimates

When making an insurance claim after a car accident, it is important to support your claim with various documents, such as police reports, photographs, and repair estimates. These documents provide detailed information about the accident, the extent of damage, and the necessary repairs, helping insurance companies assess and settle claims more efficiently. Below are some guidelines on how to effectively obtain and utilise these supporting documents.

Police Reports

The first step after a car accident is to notify the police and file an official report, known as a First Information Report (FIR). This report serves as a detailed and unbiased account of the incident, including information about the parties involved, witness testimonies, and initial assessments of the accident scene. Obtaining a police report is crucial, as insurance companies often require a copy of the FIR to process claims. It provides an independent perspective of the incident, which can be valuable in determining fault and liability.

Photographs

Photographs are powerful tools in supporting insurance claims. They offer visual evidence of the accident scene, capturing details such as vehicle damage, positioning, and surrounding conditions. It is recommended to take photographs from different angles and distances, ensuring close-ups of dents, scratches, and other damage. Additionally, including road signs, skid marks, and weather conditions in the photographs can provide valuable context for the insurance company. Remember to take photos as soon as possible after the accident, prioritising your safety, and delegating the task to a passenger or witness if necessary.

Repair Estimates

Obtaining repair estimates is a critical step in the insurance claim process. It involves seeking quotes from reputable auto repair shops to determine the cost of fixing the vehicle damage. Most insurance companies will recommend local shops or involve their own adjusters in the inspection and estimation process. It is advisable to get multiple estimates to ensure a fair assessment. However, be cautious of insurance companies pushing for specific repair shops, as they may have deals in place that could compromise the quality of the repairs. Ultimately, the choice of the repair shop should lie with the vehicle owner.

When attaching supporting documents to your insurance claim, ensure that all relevant information is included. This may include additional details such as medical reports, witness statements, and other documentation specific to your insurance provider's requirements. Remember to review your insurance policy and understand the types of claims you can make, as this will guide you in gathering the necessary supporting documents.

Understanding CDW Auto Insurance Coverage: Are You Protected?

You may want to see also

Frequently asked questions

You should report the accident to your insurance company and the local police department. If the damage is over $1,000, or if anyone is injured, you must file an accident report with the Department of Motor Vehicles.

You should include the date of loss, how it happened, and what the vehicle was being used for. You should also include supporting documentation, such as police reports, witness statements, photographs, repair estimates, and appraisals.

Your insurance company has three options: replace the damaged or stolen property, repair the damaged property, or pay for the loss in cash.