After receiving a traffic ticket, it's important to understand how to prove that you had liability insurance coverage at the time of the incident. This can be crucial in defending against potential legal consequences and ensuring that you're not unfairly penalized. In this guide, we'll explore the steps you can take to demonstrate your insurance coverage and provide valuable tips on how to navigate the process effectively.

What You'll Learn

- Policy Documentation: Keep and organize all insurance documents, including proof of coverage and policy details

- Payment Receipts: Store and provide proof of insurance payments made

- Coverage Verification: Confirm insurance coverage dates and types with the insurance provider

- Ticket Details: Note the ticket date, location, and any relevant information from the citation

- Consult Legal Advice: Seek legal guidance to understand your rights and insurance requirements

Policy Documentation: Keep and organize all insurance documents, including proof of coverage and policy details

When it comes to proving your liability insurance coverage after receiving a traffic ticket, having the necessary documentation readily available is crucial. This is especially important if you plan to contest the ticket or need to provide evidence of your insurance coverage to the relevant authorities. Here's a guide on how to effectively manage and organize your insurance documents:

- Obtain and Review Your Policy Documents: Start by gathering all the paperwork related to your liability insurance policy. This typically includes the insurance contract, policy summary, and any additional riders or endorsements. Carefully review these documents to understand the terms and conditions, coverage limits, and any specific requirements mentioned. Make sure you are aware of the policy's start and end dates, as well as any exclusions or limitations.

- Keep Digital and Physical Copies: It is essential to maintain both digital and physical copies of your insurance documents. Create digital copies by scanning the original documents and storing them in a secure folder on your computer or cloud storage. Ensure that the digital files are well-organized and easily searchable. Additionally, keep the original physical copies in a safe place, such as a locked filing cabinet or a fireproof safe. This way, you have a backup in case of any digital issues.

- Organize and Label Your Documents: Create a system to organize your insurance documents efficiently. You can use folders, binders, or even a digital filing system to categorize the information. Label each section clearly, such as "Policy Details," "Coverage Information," "Contact Information," and "Claims Process." Within these sections, further organize the documents by date or type. For example, you can have subfolders for annual policy renewals, claims history, and any correspondence with the insurance company.

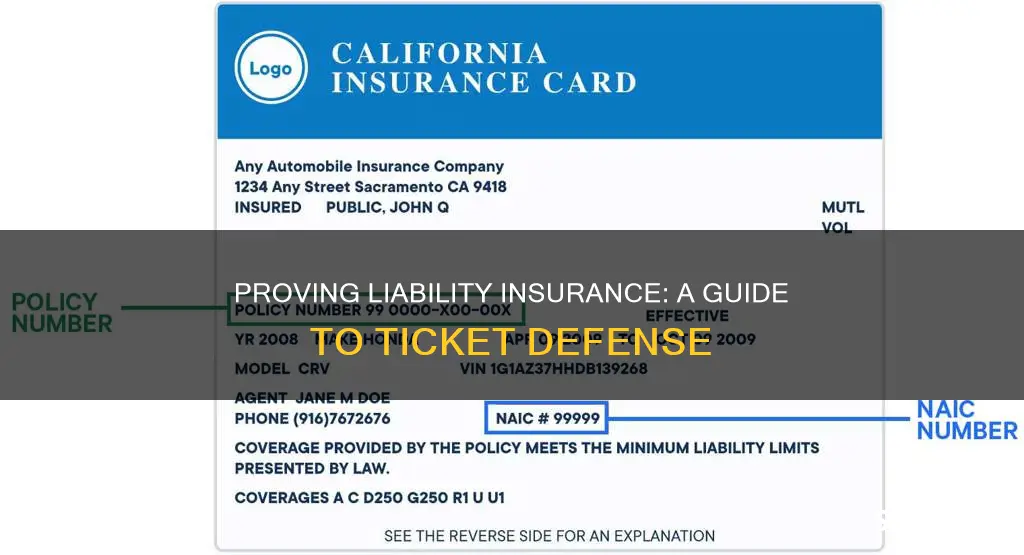

- Include Proof of Coverage: Along with the policy documentation, keep proof of your current insurance coverage. This could be a current insurance card, a certificate of insurance, or a letter from your insurance provider confirming your policy details. These documents should include your policy number, the effective dates of coverage, and the liability limits. Having this proof readily available will help you demonstrate your insurance status when needed.

- Update Your Records Regularly: Insurance policies can change over time, so it's important to update your records periodically. Review your policy documents annually to ensure the information is accurate and up-to-date. Also, make note of any changes in coverage, such as increased limits or added riders, and update your digital and physical copies accordingly. Regularly checking and updating your records will ensure that you have the most current information when proving your liability insurance.

By following these steps, you can effectively manage and organize your insurance documents, making it easier to prove your liability insurance coverage when required. Having a well-structured system will not only help you stay organized but also provide peace of mind, knowing that you have the necessary documentation readily available.

Good2Go Auto Insurance: Legit or a Scam?

You may want to see also

Payment Receipts: Store and provide proof of insurance payments made

When it comes to proving that you had liability insurance after receiving a traffic ticket, payment receipts play a crucial role. These documents serve as tangible proof of your insurance coverage and can be essential in demonstrating your compliance with insurance requirements. Here's a guide on how to effectively manage and utilize payment receipts:

Storing Payment Receipts: It is imperative to maintain a safe and organized storage system for your insurance payment receipts. Consider the following options:

- Digital Storage: Scan or take a clear photo of the receipt and store it in a dedicated folder on your computer or cloud storage. Ensure that the digital copy is easily accessible and consider creating a backup for added security.

- Physical Filing: Keep the original or a copy of the receipt in a designated file folder. You can use a binder or a filing cabinet to organize your documents chronologically or by insurance provider.

- Online Storage Services: Utilize online document storage platforms that offer secure cloud storage. These services often provide easy search and sharing capabilities, making it convenient to access your receipts when needed.

Organizing Payment Records: Proper organization is key to efficient record-keeping. Here's how you can manage your insurance payment receipts:

- Chronological Order: Arrange the receipts in the order of payment dates. This simple method makes it easier to track payments over time and quickly identify the coverage period relevant to the traffic ticket incident.

- Category by Insurance Provider: If you have multiple insurance policies, categorize the receipts accordingly. This approach is especially useful if you switch insurance companies or need to provide proof of different policies.

- Include Relevant Details: Ensure that each receipt includes essential information such as the policy number, payment amount, date, and any other pertinent details. This information will be valuable when you need to provide proof of insurance.

Providing Proof of Insurance Payments: In the event of a traffic ticket, you may be required to provide proof of insurance to the relevant authorities. Here's how you can do it effectively:

- Present Physical Receipts: If you have the original or a physical copy of the receipt, you can submit it directly to the court or traffic authority. This method provides immediate proof of your insurance coverage.

- Digital Submission: If digital storage is your preferred method, you can easily share the scanned or photographed receipt via email or through online portals provided by the court or insurance company.

- Insurance Company Verification: Contact your insurance provider and request a formal verification letter or certificate of insurance. This official document can be a powerful proof of your insurance coverage.

Remember, maintaining a well-organized record of insurance payments is not only helpful in proving your insurance status but also ensures that you have easy access to this information when needed. By storing and providing payment receipts, you can efficiently demonstrate your liability insurance coverage, which may be crucial in legal proceedings or when dealing with insurance-related matters.

Uninsured Driving: Risks, Fines, and Legal Consequences

You may want to see also

Coverage Verification: Confirm insurance coverage dates and types with the insurance provider

When you receive a traffic ticket, it's crucial to understand the insurance coverage you had at the time of the incident. Proving your insurance coverage can be a straightforward process if you follow the right steps. One of the most effective ways to verify your insurance is by directly contacting your insurance provider. Here's a detailed guide on how to do this:

Contact Your Insurance Provider: Reach out to your insurance company as soon as possible after receiving the ticket. Most insurance providers have a dedicated customer service team that can assist with such inquiries. Provide them with the details of the incident, including the date, location, and the type of ticket you received. Explain that you are verifying your insurance coverage for that specific period.

Request Coverage Verification: Clearly state your request for coverage verification. Ask the insurance representative to confirm the dates and types of insurance coverage you had during the time of the ticket. Inquire about the specific policy details, such as the liability coverage limits and any additional benefits. This information is essential to ensure that your insurance meets the requirements for the incident.

Obtain Written Confirmation: Request a written confirmation of your insurance coverage for the relevant period. This could be in the form of a letter or a document outlining the coverage details. Having a written record will provide tangible proof of your insurance status, which can be useful if there are any disputes or further inquiries.

Review Your Policy Documents: After receiving the confirmation, carefully review your insurance policy documents. Ensure that the coverage dates and types match the information provided by the insurance provider. If there are any discrepancies, contact the provider immediately to clarify and resolve the issue.

Keep Records: Maintain a record of all communication and documentation related to the insurance verification process. This includes phone call notes, emails, and any written correspondence. These records will be valuable if you need to provide proof of insurance coverage in court or during any legal proceedings.

By following these steps, you can effectively confirm your insurance coverage and provide the necessary proof when dealing with traffic tickets. Remember, prompt action and clear communication with your insurance provider are key to resolving such matters efficiently.

Insuring Your New Vehicle: Timely Tips

You may want to see also

Ticket Details: Note the ticket date, location, and any relevant information from the citation

When dealing with a traffic ticket, it's crucial to carefully document all relevant details, especially if you want to prove that you had liability insurance at the time of the incident. Here's a step-by-step guide on how to approach this:

Ticket Documentation: Start by gathering all the information provided on your ticket. This includes the ticket number, date, and location of the violation. For instance, if you received a ticket for speeding on the highway on June 15th, 2023, in the city of Elmwood, make a note of this. Additionally, check if there are any specific details mentioned in the citation, such as the time of the violation, the type of vehicle involved, or any witness statements. These details can be crucial in establishing your case.

Insurance Policy Verification: Proving insurance coverage can be done by verifying your insurance policy documents. Contact your insurance provider and request a copy of your policy or a recent statement. This should include the policy number, the type of coverage (liability, comprehensive, etc.), and the coverage limits. Ensure that the policy is up-to-date and valid at the time of the ticket. You might also want to confirm with your insurance agent or broker to ensure there are no discrepancies.

Proof of Payment: In some cases, simply having insurance might not be enough. You may need to provide proof of payment for the insurance premium. This can be in the form of a recent premium receipt or a statement showing that the insurance was active at the time of the ticket. This additional step ensures that you have not only the coverage but also the financial responsibility associated with it.

Record of Driving Behavior: It's also beneficial to maintain a record of your driving behavior and any previous incidents. If you have a clean driving record with no previous violations, this can support your claim that you were a responsible driver. You can provide this information to your insurance company or legal representative to strengthen your case.

Remember, the key is to be thorough and organized when documenting these details. This information will be essential if you need to dispute the ticket or provide evidence of your insurance coverage to relevant authorities.

State Farm: Grace Period for Auto Insurance?

You may want to see also

Consult Legal Advice: Seek legal guidance to understand your rights and insurance requirements

When faced with a traffic ticket, it's crucial to understand your legal rights and the implications for your insurance coverage. Consulting a legal professional can provide you with the necessary guidance to navigate this process effectively. Here's why seeking legal advice is essential:

Understanding Insurance Requirements: Insurance companies often have specific criteria and procedures for handling claims related to traffic violations. A legal advisor can help you comprehend the insurance requirements and ensure you meet them. They can explain the potential impact of the ticket on your insurance premiums and coverage, allowing you to make informed decisions.

Proving Insurance Coverage: In the event of a ticket, you might need to prove that you had liability insurance at the time of the incident. Legal experts can assist in gathering and presenting the required documentation. This may include policy documents, proof of payment, or any other relevant evidence to establish your insurance coverage. They can guide you through the process, ensuring you have the necessary paperwork in order.

Legal Rights and Defenses: Traffic laws and regulations can vary, and understanding your legal rights is vital. A lawyer can advise you on potential defenses or arguments you can present to challenge the ticket. They can also explain the potential consequences of a conviction, such as fines, license points, or even jail time. By providing legal counsel, they empower you to make strategic decisions regarding your case.

Negotiation and Resolution: Legal professionals often have experience negotiating with insurance companies and the legal system. They can advocate on your behalf to ensure a fair resolution. Whether it's negotiating a reduced fine, contesting the ticket, or dealing with insurance claims, a lawyer can provide the necessary support and guidance to protect your interests.

Remember, consulting a legal advisor is a proactive step towards managing the consequences of a traffic ticket. They can provide clarity, protect your rights, and help you make informed choices regarding your insurance and legal matters. It is always advisable to seek professional advice to ensure a smooth and successful outcome.

Gap Insurance: When It's Needed

You may want to see also

Frequently asked questions

After receiving a traffic ticket, it's important to gather evidence to support your insurance coverage. You can request a copy of your insurance policy or proof of insurance from your insurance provider. This document should include your policy number, coverage details, and the name of the insurance company. Keep this information in your vehicle or have it readily available for any follow-up inquiries.

In most cases, a simple letter or affidavit from your insurance company stating the dates of your coverage and the type of insurance (liability) you had at the time of the incident should suffice. This document should be addressed to the court or the relevant authorities and provide clear and concise information.

If you've misplaced your insurance documents, contact your insurance provider immediately. They can provide you with a copy of your policy or a certificate of insurance. You may also be able to verify your coverage through your insurance company's online portal or by speaking to a representative. It's essential to act quickly to ensure you have the necessary proof.

Yes, digital copies of your insurance documents can be accepted as evidence. Take a clear photo or scan of your insurance policy or certificate and save it as a digital file. Ensure that the digital copy is legible and easily readable. You can then provide this digital evidence to the court or authorities as part of your defense.