A careless driving ticket can significantly impact your insurance rates and coverage. When you receive a ticket for careless driving, it indicates to insurance companies that you may be considered a higher-risk driver. As a result, insurance providers may increase your premiums or even refuse to renew your policy. The ticket can also lead to a higher deductible, which means you'll have to pay more out of pocket when making a claim. Additionally, some insurance companies may require you to complete a safe driving course or install a usage-based insurance device to regain favorable rates. Understanding these consequences is crucial for drivers to make informed decisions and take steps to improve their driving record and insurance profile.

What You'll Learn

- Increased Premiums: A ticket can lead to higher insurance costs due to increased risk perception

- Rate Increases: Insurance companies may raise rates for at-fault accidents, including careless driving

- Policy Cancellation: Some insurers may cancel policies or refuse coverage after a ticket

- Points on Record: Tickets often result in points on your driving record, affecting future premiums

- Legal Consequences: Careless driving can lead to fines, license suspension, and other legal issues

Increased Premiums: A ticket can lead to higher insurance costs due to increased risk perception

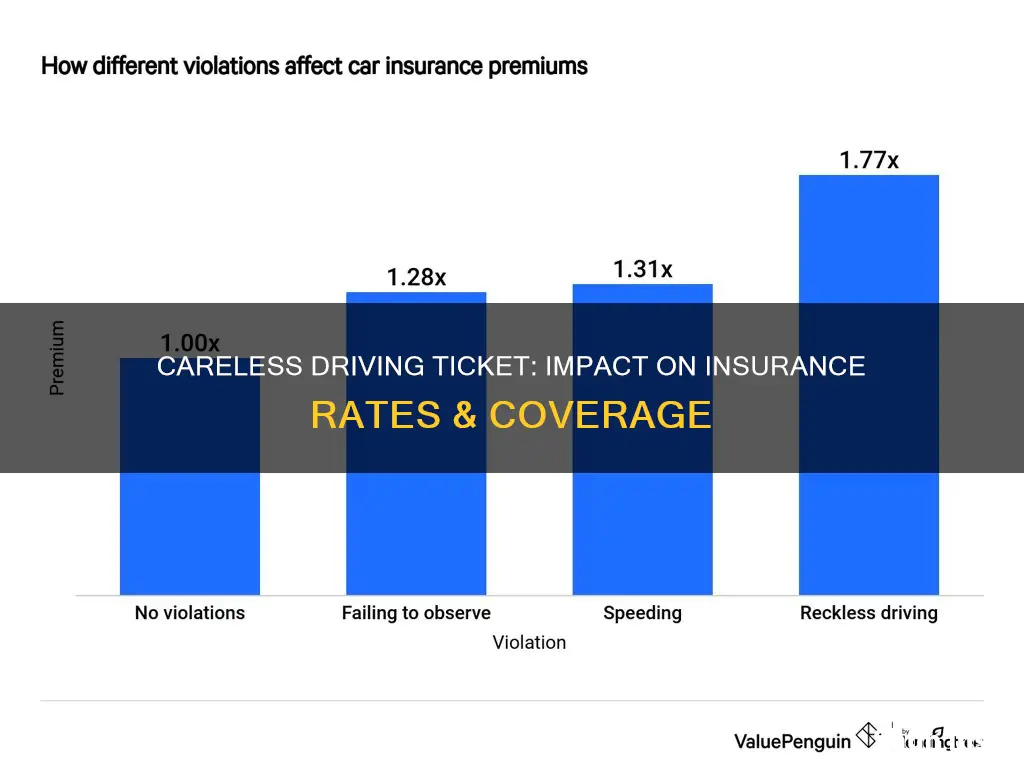

A careless driving ticket can have a significant impact on your insurance premiums, and understanding this relationship is crucial for any driver. When an insurance company assesses your risk as a driver, they consider various factors, and a ticket for careless driving is a red flag that indicates a higher likelihood of future claims. This increased risk perception directly translates to higher insurance costs for you.

The insurance industry operates on the principle of risk-based pricing. When you receive a ticket, it signals to the insurer that you may be more prone to accidents or risky behavior. As a result, they may view you as a higher-risk driver, which can lead to an adjustment in your premium rates. The ticket serves as a marker, suggesting that your driving habits or decisions may not align with the company's risk profile, and thus, they need to charge more to cover potential liabilities.

The impact of a careless driving ticket on premiums can vary depending on the insurance company's policies and your overall driving record. In some cases, the increase might be substantial, while in others, it may be more moderate. However, it is essential to recognize that the ticket is not the sole factor in determining your premium; other variables, such as your age, driving experience, and the type of vehicle you own, also play a role. Nonetheless, the ticket's influence is significant enough to warrant attention.

To mitigate the potential increase in premiums, drivers with a careless driving ticket should consider several strategies. Firstly, shopping around for insurance quotes from different providers can help you find more competitive rates. Additionally, reviewing your policy and understanding the factors that influence your premium can empower you to make informed decisions. Some insurance companies also offer defensive driving courses or safe driver programs that might result in reduced premiums for policyholders.

In summary, a careless driving ticket can lead to higher insurance premiums due to the increased risk perception it conveys. It is a reminder for drivers to maintain a safe and responsible driving record to avoid such consequences. By being mindful of their driving behavior and exploring insurance options, drivers can work towards minimizing the financial impact of a ticket on their insurance costs.

State Farm Auto Insurance: Unraveling the Rating System

You may want to see also

Rate Increases: Insurance companies may raise rates for at-fault accidents, including careless driving

A careless driving ticket can significantly impact your insurance rates and premiums, often leading to increases that can be substantial and long-lasting. When insurance companies assess your risk as a driver, they consider various factors, and a ticket for careless driving is a serious red flag. This type of ticket indicates that you have engaged in behavior that could potentially cause harm to others or property, and as a result, your insurance provider may view you as a higher-risk driver.

The primary reason for the rate increase is the potential for future claims. Insurance companies believe that drivers with a history of careless driving are more likely to be involved in accidents, especially if they have not learned from their previous mistakes. This perception is based on the assumption that careless driving often leads to reckless behavior, which can result in more frequent and severe accidents. As a consequence, insurers may increase your premiums to account for this perceived higher risk.

The impact of a careless driving ticket on your insurance rates can be immediate and long-lasting. In the short term, you may experience a rate hike as soon as the ticket is processed and reported to your insurance company. This immediate increase is often a result of the company's risk assessment and the potential for future claims. Over time, if you continue to drive safely and do not accumulate additional violations, your rates may stabilize, but the initial hike can be substantial.

Moreover, the effects of this ticket can linger for an extended period. Insurance companies typically review your driving record for a certain number of years, and a careless driving ticket will remain on your record during this time. This means that even if you improve your driving habits and maintain a clean record, the initial rate increase may persist. It could take several years for your premiums to return to their pre-ticket levels, and during this period, you may be paying higher rates than your peers who have never faced such violations.

To mitigate the impact of a careless driving ticket on your insurance rates, it is essential to take responsibility for your actions and demonstrate a commitment to safe driving. Consider enrolling in a defensive driving course, which can help you improve your skills and show insurers that you are taking steps to enhance your driving behavior. Additionally, maintaining a good driving record by avoiding any further violations will be crucial in gradually reducing your insurance premiums over time.

Factors Affecting Insurance Costs for Class B Motorhomes

You may want to see also

Policy Cancellation: Some insurers may cancel policies or refuse coverage after a ticket

A careless driving ticket can have significant implications for your insurance policy, and one of the most direct consequences is the potential for policy cancellation or refusal of coverage. When an insurance company assesses the risk associated with an individual or vehicle, traffic violations, especially for driving carelessly, are taken very seriously. This is because such violations indicate a pattern of reckless behavior behind the wheel, which can lead to increased accident risks and, consequently, higher insurance claims.

Insurers often have specific guidelines and thresholds for handling policyholders with traffic violations. If a driver receives a ticket for careless driving, the insurance company may review the policy and decide to cancel it or refuse to renew it. This decision is typically based on the severity of the violation and the insurer's internal risk assessment. For instance, a single ticket might not automatically lead to cancellation, but a history of such violations or a more serious offense could trigger this action.

The process of policy cancellation can vary depending on the insurance provider and the jurisdiction. Some companies may send a notice of cancellation, informing the policyholder of the decision and providing a specific date by which the policy will no longer be in effect. Others might simply refuse to renew the policy when it comes up for renewal. In either case, the policyholder will need to find alternative insurance coverage, which can be challenging, especially if they have a poor driving record.

If your policy is canceled or not renewed, you will likely need to shop around for new insurance. This process can be time-consuming and may result in higher premiums due to the increased risk associated with your driving record. Additionally, some insurers may require a period of good driving behavior before they are willing to offer coverage again, which can further complicate the situation.

It is essential to understand that the impact of a careless driving ticket on your insurance can vary widely. Some insurers might offer a chance to contest the cancellation or provide a defensive driving course as an alternative to cancellation. Others may simply refuse to do so, emphasizing the importance of maintaining a clean driving record to avoid such issues. Being proactive and reviewing your insurance policy's terms and conditions regarding traffic violations can help you understand your rights and options in such situations.

Auto Insurance Brokerage Fees: Are They Refundable?

You may want to see also

Points on Record: Tickets often result in points on your driving record, affecting future premiums

A careless driving ticket can have significant consequences for your insurance rates and driving record. One of the primary impacts is the addition of points to your driving record, which is a critical factor in determining your insurance premiums. When you receive a ticket, the relevant authorities will assign points based on the severity of the offense. These points are recorded on your driving record, and insurance companies use this information to assess your risk as a driver.

The number of points assigned can vary depending on the jurisdiction and the specific circumstances of the ticket. For instance, a minor infraction might result in a few points, while a more serious offense, such as reckless driving or a hit-and-run, could lead to a higher point allocation. It's essential to understand that the accumulation of points can have long-lasting effects on your driving record.

Insurance companies often have point-based systems to determine insurance rates. A higher number of points on your record typically translates to increased premiums. This is because insurance providers view multiple tickets or points as an indicator of a higher risk of accidents or traffic violations. As a result, they may consider you a high-risk driver and adjust your insurance rates accordingly.

Moreover, the impact of points on your record can extend beyond the immediate increase in insurance costs. Some insurance companies may require policyholders to file for rate increases annually, and having points on your record can significantly contribute to these adjustments. Additionally, certain insurance policies, especially those for high-risk drivers, might be more expensive or even unavailable if you have a history of traffic violations and points on your record.

In summary, a careless driving ticket can lead to points on your driving record, which, in turn, can result in higher insurance premiums and potential challenges in obtaining affordable coverage. It is crucial for drivers to understand the implications of traffic tickets and take steps to minimize their impact, such as attending traffic school or improving their driving record over time. Being proactive in addressing these issues can help mitigate the long-term consequences on your insurance rates and overall driving record.

Safeco Auto Insurance: Canceling Your Policy, Step by Step

You may want to see also

Legal Consequences: Careless driving can lead to fines, license suspension, and other legal issues

Careless driving is a serious offense that can have significant legal consequences, and it's important to understand the potential impact on your insurance and overall financial situation. When you receive a ticket for careless driving, it triggers a series of legal processes that can affect your driving record and, consequently, your insurance premiums. Here's an overview of the legal consequences and how they might influence your insurance:

Fines and Penalties: One of the most immediate legal consequences is the imposition of fines. The amount of the fine can vary depending on the jurisdiction and the severity of the offense. In many places, a careless driving ticket may result in a fixed penalty fine, which is a set amount that you must pay. These fines can range from a few hundred to several thousand dollars, depending on the circumstances. For example, if you were driving recklessly at high speeds or caused a minor accident, the fine could be substantial. It's crucial to pay these fines promptly to avoid additional legal fees and potential legal complications.

License Suspension or Points on Your Record: Careless driving can also lead to more severe legal actions, such as license suspension or the addition of demerit points to your driving record. When you receive a ticket, the authorities may impose a temporary suspension of your driver's license, especially if it's your first offense. This suspension can vary in duration, and during this period, you may be required to surrender your license or face further penalties. In some regions, careless driving results in the addition of points to your driving record, which can have long-term implications. Accumulated points may lead to license suspension or even the requirement to take a driving improvement course.

Legal Court Proceedings: In more serious cases or if you fail to pay fines, legal court proceedings may be initiated. This could involve appearing in court to answer to the charges, where a judge will determine the appropriate legal action. If found guilty, you may face additional penalties, including community service, mandatory driving improvement courses, or even jail time, depending on the jurisdiction and the specifics of the case. These legal processes can be complex and time-consuming, requiring the assistance of a legal professional.

Impact on Insurance Premiums: The legal consequences of a careless driving ticket can significantly affect your insurance rates. Insurance companies often consider your driving record when determining premiums. A single careless driving ticket can lead to increased insurance costs, as it indicates a higher risk to the insurer. The severity of the impact depends on the insurance provider and the jurisdiction's regulations. In some cases, you may be classified as a high-risk driver, resulting in substantial premium increases for a period. Additionally, the ticket may also affect your ability to obtain insurance coverage, as some companies may deny coverage or charge higher rates for drivers with a history of careless driving.

Understanding these legal consequences is essential for drivers to make informed decisions and take appropriate actions after receiving a careless driving ticket. It's advisable to consult with legal professionals and insurance advisors to navigate the legal process and minimize the potential long-term effects on your insurance and financial well-being.

Switching Auto Insurance Agents: A Step-by-Step Guide

You may want to see also

Frequently asked questions

A ticket for careless driving can significantly impact your insurance premiums. Insurance companies often view such tickets as a sign of reckless behavior and increased risk. As a result, they may increase your insurance rates to compensate for the higher likelihood of future claims. The exact increase will depend on various factors, including your location, the insurance company's policies, and your current driving record.

While a careless driving ticket is a serious matter, insurance companies typically do not cancel policies solely based on this offense. However, they may choose to review your policy and may offer a higher premium or even deny coverage, especially if you have a clean record otherwise. It's essential to maintain a good relationship with your insurance provider and ensure you understand their specific policies regarding traffic violations.

Yes, it is possible to continue receiving discounts on insurance even after a careless driving ticket. Many insurance companies offer safe driver discounts or good student discounts, which can help offset the increased rates. Additionally, completing a defensive driving course or maintaining a good driving record over time can also lead to premium reductions. It's advisable to review your policy and discuss available options with your insurance agent to find the best approach to manage your insurance costs.