State Farm is the largest insurance company in the country, offering a wide range of coverage options, including auto, home, renters, and life insurance. When it comes to auto insurance, State Farm provides competitive rates, with average annual rates of $1,657 for full coverage and $523 for minimum coverage, making it one of the most affordable insurers in the nation. The company's rates are determined by various factors, including age, driving history, vehicle type, marital status, and credit history. State Farm also offers several discounts and usage-based insurance programs to help lower rates, such as multi-policy, multi-car, good driver, and student discounts.

What You'll Learn

- State Farm's auto insurance rates for young drivers

- State Farm's auto insurance rates for drivers with a clean record

- State Farm's auto insurance rates for drivers with a recent speeding ticket

- State Farm's auto insurance rates for drivers with a poor credit score

- State Farm's auto insurance rates for drivers with a DUI

State Farm's auto insurance rates for young drivers

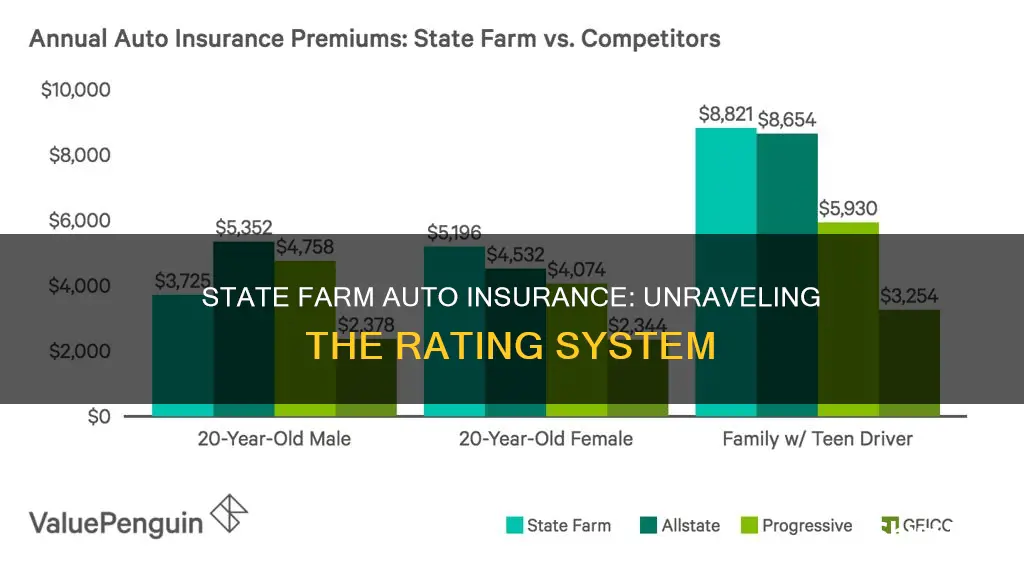

State Farm offers competitive rates for young drivers, including teens and new drivers. The company provides auto insurance for teen drivers and allows parents to add a teen driver to their auto insurance policy. State Farm also offers various discounts to help reduce the cost of insurance for young drivers.

State Farm's rates for teen drivers are lower than the national average and are more affordable when compared to competitors like Progressive and Allstate. However, their rates for young drivers are higher than those offered by Erie and USAA. On average, a 17-year-old female will pay less than a male driver of the same age.

State Farm offers several discounts that may help young drivers lower the cost of their insurance. These include:

- Good Student Discount: Students with good grades can save up to 25% on their insurance, and this discount may last until they turn 25.

- Driver Training Discount: Available for students under the age of 25 who move away to school and only use the car while at home during vacations and holidays.

- Student Away at School Discount: Applicable for students under the age of 25 who move away for school and only drive when they are back home.

- Steer Clear® program: Aimed at new drivers or those under 25, this program offers savings while helping them become better and safer drivers.

Other ways to reduce young adult insurance premiums include purchasing a safer car, reducing comprehensive/collision coverage, or increasing the deductible on their coverage.

State Farm's rates are influenced by various factors, including age, driving history, vehicle type, marital status, and credit history. Young drivers are considered higher-risk and tend to pay higher premiums.

The No-Fault Auto Insurance System in New York: What You Need to Know

You may want to see also

State Farm's auto insurance rates for drivers with a clean record

State Farm is the largest auto insurance provider in the US, offering some of the most affordable rates to various types of drivers across the nation. The company's average rates for full-coverage car insurance are $1,647 per year or $138 per month, which is 21% cheaper than the national average. State Farm also offers affordable minimum-coverage insurance, with an average rate of $523 annually or $44 monthly.

State Farm's insurance rates are influenced by several factors, including age, driving history, vehicle type, marital status, and credit history. Young drivers, for instance, typically pay higher premiums. Those with clean driving records, however, receive the best auto insurance rates. DUIs, speeding tickets, and other moving violations can significantly raise your premiums.

State Farm offers a range of discounts to help lower insurance rates, including:

- Multi-policy discount: Bundling auto insurance with renter's insurance, homeowner's insurance, or life insurance.

- Multi-car discount: Insuring multiple vehicles under the same policy.

- Good driver discount: Rewarding accident-free driving and avoidance of speeding tickets or other traffic violations.

- Good student discount: Full-time students with good grades can lower their insurance premiums by up to 25%.

- Student away at school discount: Reduced rates when a student under 25 is away at school and not using their car.

- Vehicle safety discount: Discounts for modern cars with updated safety features and anti-theft devices.

- Drive Safe & Save® program: A telematics insurance program that tracks driving behaviours and offers discounts of up to 30% for safe driving.

- Steer Clear® program: A training program for new drivers or those under 25, offering lessons, videos, and quizzes on safe driving habits.

Hailstorm Headache: Understanding Auto Insurance Rate Hikes After Hail Claims

You may want to see also

State Farm's auto insurance rates for drivers with a recent speeding ticket

State Farm is the top car insurance company in the country. However, that doesn't mean it's the cheapest. The cost of State Farm car insurance depends on several factors, including your driving record. State Farm uses your driving record to determine how risky you are as a driver, and risky drivers pay much higher insurance rates.

Speeding tickets are common, but they can cost you. In addition to the ticket fine, you'll also pay higher State Farm rates. State Farm car insurance rates increase by about $30 a month with one ticket. Multiple speeding tickets, accidents, or DUIs will cause rates to skyrocket.

The exact amount that your insurance rate increases after a speeding ticket depends on how the violation is treated by your chosen insurer and the state where you live. In general, speeding tickets can affect your car insurance costs for three to five years, the amount of time they remain on your motor vehicle report.

If you have a pretty clean record, chances are that a minor speeding ticket (under 10 mph over the limit) won't cause much pain, aside from the cost of the ticket. In many states, a driver, particularly a first-time offender, can keep minor infractions off their driving record by going to traffic school or taking a driver improvement course. However, if you have a history of violations or are a very young driver, the impact may be more serious.

If you have State Farm car insurance and get a speeding ticket, expect to pay about $30 more than if you had a clean driving record. However, the ticketed fine, driver's license points, and insurance rate increase will depend on how fast you were going and the state where you live. Each state assigns different fines and points for each infraction.

Unveiling the Mystery: Navigating Credit Score's Impact on Auto Insurance

You may want to see also

State Farm's auto insurance rates for drivers with a poor credit score

State Farm is the largest insurer of auto insurance products in the US. It offers a long list of discounts and programs to help customers save money on their auto insurance policies.

State Farm considers a variety of factors when determining auto insurance rates, including coverage options, deductibles, and discounts. Credit scores can also impact auto insurance rates, as insurance companies use "Credit-Based Insurance Scores" to help determine rates. This is because research shows that individuals with better credit histories are less likely to file insurance claims.

In most states, drivers with poor credit pay significantly more for full-coverage auto insurance than those with excellent credit. On average, drivers with poor credit pay 114% more than those with excellent credit. For example, someone with an excellent credit score of 800 or above pays an average annual rate of $1,988 for full-coverage auto insurance, while someone with a poor credit score may pay an average of $4,262 or more.

State Farm's website states that certain credit information can be predictive of future insurance claims, and many insurance companies use credit history to help determine the cost of auto insurance. Maintaining good credit may positively impact auto insurance costs.

While State Farm does consider credit scores when determining auto insurance rates, they also take into account other factors such as driving history, age, gender, and marital status. State Farm offers affordable rates for drivers with less-than-perfect driving histories and is known for its high marks in claims handling and customer service.

To get a quote from State Farm, individuals can go online, call, or meet with one of their local insurance agents. The quote process takes into account various factors, including the desired policy start date, vehicle information, primary vehicle use, yearly mileage, driving history, and license information.

State Farm offers several types of auto insurance coverage, including liability coverage, collision coverage, comprehensive coverage, medical payments coverage, personal injury protection, and uninsured motorist coverage. They also offer additional optional coverages, such as car rental and travel expense coverage, emergency road service coverage, and rideshare driver coverage.

In addition to auto insurance, State Farm offers other types of vehicle insurance, such as commercial auto insurance, motorcycle insurance, antique car insurance, and travel trailer insurance. They also provide a range of other insurance products, including homeowners, life, rental property, condominium, and personal liability insurance.

State Farm has a large network of local insurance agents and offers insurance in all 50 states and Washington, D.C. They are known for their customer service and have received high ratings in customer satisfaction in several regions.

Eviction History: A Surprising Factor in Auto Insurance Rates

You may want to see also

State Farm's auto insurance rates for drivers with a DUI

State Farm is one of the largest auto insurance providers in the US, offering affordable rates to various types of drivers. The company's rates are determined by several factors, including age, driving history, vehicle type, marital status, and credit history.

For drivers with a DUI, State Farm's rates may be lower than the national average. According to US News, State Farm's sample rate for drivers with a DUI is lower than the national average. However, Progressive offers a lower rate for this category, with an annual premium of $2,296.

State Farm's rates for high-risk drivers, including those with a DUI, can be up to 20% higher than for those with a clean driving record. The company considers recent history the most important factor when determining rates for high-risk drivers.

State Farm also offers various discounts that can help lower insurance costs. These include the Drive Safe & Save® program, which offers an initial discount for enrolling, and additional savings of up to 30% based on driving behaviour. The Steer Clear® program is aimed at new and young drivers under 25, offering savings while they improve their driving skills.

Other discounts include good student discounts, student away at school discounts, vehicle safety discounts, and multi-policy and multi-car discounts.

In conclusion, State Farm's rates for drivers with a DUI may be lower than the national average, but they can still vary depending on other factors and the specific circumstances of the driver. The company offers various discounts to help offset the costs, making their insurance more accessible to a wider range of customers.

Auto Insurance: Teens' Independence

You may want to see also

Frequently asked questions

Coverage options, deductibles, and discounts may affect your policy cost, along with such things as your driving history, credit score (where permitted by law), and other third-party reports.

Your driving record determines it. You may be considered a high-risk driver if convicted of a DUI or have multiple violations such as speeding tickets. Recent history is the most important factor.

California has some of the lowest minimum insurance requirements in the country. California drivers must have at least: Bodily injury liability: $15,000 per person / $30,000 per accident; Property damage liability: $5,000 per accident.

State Farm offers average annual rates of $1,657 for full coverage and $523 for minimum coverage.