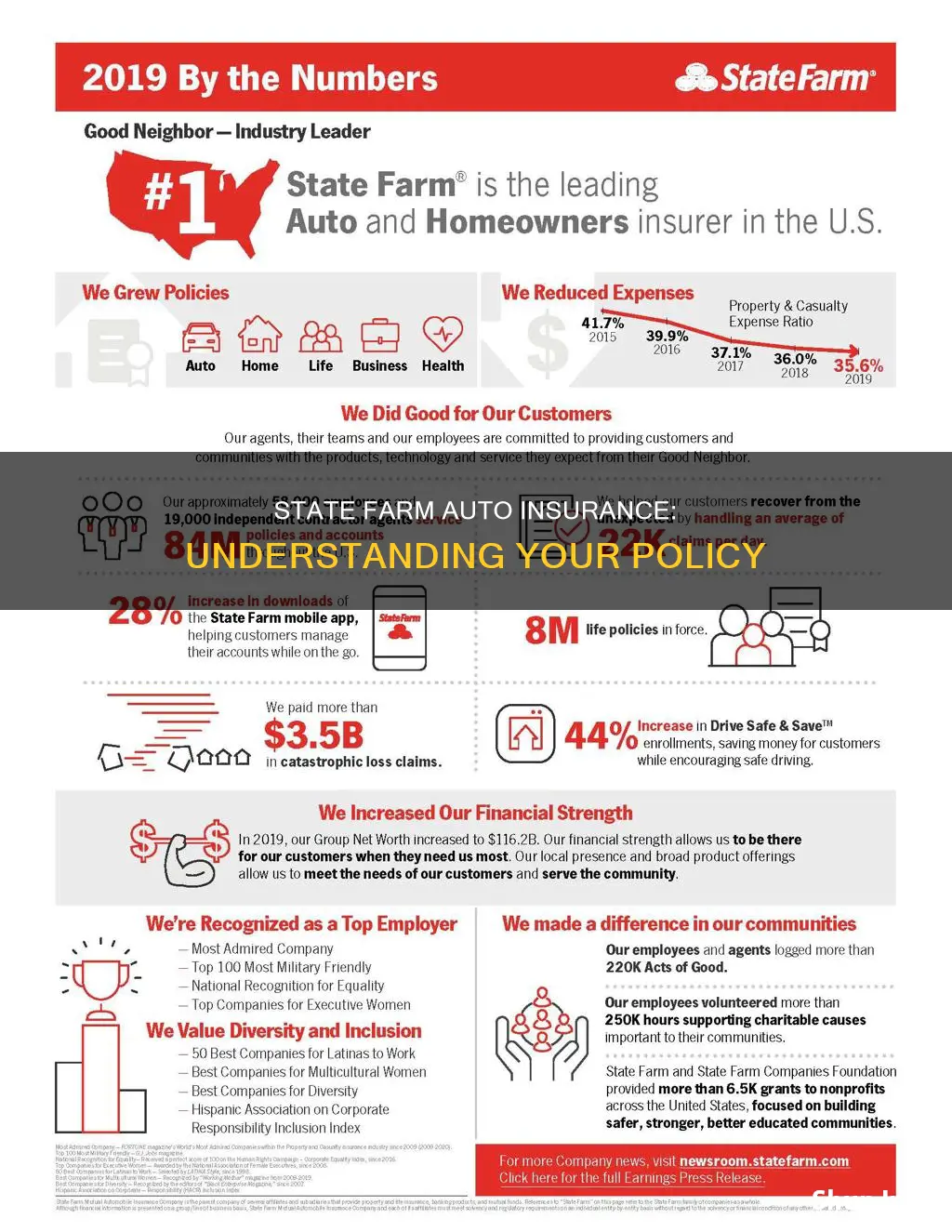

State Farm offers a range of auto insurance coverage options, from insurance for teen drivers to rental cars and more. They provide simple definitions for complicated insurance terms to help customers determine the right type of car insurance coverage for their needs. State Farm's website outlines various types of insurance coverage, including collision coverage, comprehensive coverage, liability coverage, uninsured and underinsured motor vehicle coverage, and medical payments coverage. It is important to understand the different coverage options, deductibles, and discounts that may affect your policy cost, along with factors such as your driving history and credit score.

| Characteristics | Values |

|---|---|

| Collision coverage | Helps pay to repair or replace your vehicle if it overturns or collides with another vehicle or object |

| Comprehensive coverage | Helps pay to repair or replace your vehicle if it's damaged by something other than a collision, including theft, fire, vandalism, or hitting an animal |

| Liability coverage | Pays another party's medical expenses, vehicle repairs, and property damage if you were responsible for the accident |

| Uninsured & underinsured motor vehicle coverage | Helps pay for medical expenses, pain and suffering, and lost wages if you're injured in an accident caused by someone who doesn't have enough liability insurance or any at all |

| Medical payments coverage | Helps pay medical and funeral expenses if an insured person is injured or killed in an accident |

| Rideshare driver coverage | Competitively-priced rideshare insurance for drivers and passengers for State Farm Auto insurance customers |

| Emergency road service coverage | Helps get you moving again with a tow or a roadside repair |

| Car rental reimbursement and travel expenses coverage | Helps pay the cost of renting a replacement vehicle while your car is in the shop; travel expense coverage helps pay for meals, lodging, and transportation if you're in an accident more than 50 miles from home |

What You'll Learn

Collision coverage

When deciding whether to add collision coverage to your policy, consider the value of your car. Many people prefer to cover newer cars, but as cars get older and decrease in value, you might consider omitting or dropping this coverage to save money on your auto insurance. You can estimate the approximate value of your vehicle through an online resource or with the help of a State Farm agent.

If you sustain a loss, your collision coverage will pay to repair the vehicle or provide the actual cash value of the vehicle minus the deductible that you choose. You determine how much you want to pay out of pocket. For example, if you file an insurance claim for $2,000 and your policy has a $500 deductible, you will be responsible for the $500 before the remaining $1,500 is paid by your insurer.

Gap Health Insurance: Filling Coverage Gaps

You may want to see also

Comprehensive coverage

Comprehensive insurance covers a vehicle that’s stolen or damaged by such things as fire, windstorm, hail, flood, theft, vandalism, falling objects, and/or hitting an animal. It may also cover damage to another's property or medical bills, but this requires the cost of a policy addition and may require a deductible.

When deciding whether to get comprehensive coverage, consider the following:

- Is your car a high-value vehicle?

- Do you live in an area prone to weather-related disasters?

- Is there a high rate of car theft where you live?

- How much can you afford to pay, or are willing to pay, out of your own pocket if you experience an accident that isn’t covered by collision insurance?

Gap Insurance: Theft and Accident Protection

You may want to see also

Liability coverage

Liability insurance for automobiles falls into two categories: Bodily Injury (BI) coverage and Property Damage (PD) coverage. BI coverage assists in paying for the bodily injuries of another person if you are found legally liable. This means that if your actions cause injury to someone else, your BI coverage will help cover their medical expenses and other associated costs. Additionally, it can assist with defence and court costs if a legal case arises.

On the other hand, PD coverage addresses damage caused to another person's or company's property during a covered event. This includes not only repairs to the property but also the loss of use of that property. For example, if you crash into someone's building, PD coverage will help pay for the repairs to the building wall as well as any costs incurred due to the temporary loss of use of that wall or building. Similar to BI coverage, PD coverage can also assist with defence and court costs if a lawsuit is filed.

It is important to note that liability coverage does not extend to repairs to your own vehicle or injuries you sustain in an accident. To ensure coverage for these scenarios, you will need separate coverages, such as collision coverage, comprehensive coverage, and medical payments coverage.

The minimum amount of liability coverage required by law varies from state to state, and it is recommended to consider purchasing coverage limits higher than the state-mandated minimums. By doing so, you can better protect yourself and your assets in the event of an accident. To fully understand your state's requirements and determine the appropriate level of coverage, it is advisable to consult with a State Farm agent, who can provide personalised guidance based on your specific circumstances.

Toyota: Insuring Your Vehicle

You may want to see also

Uninsured and underinsured motor vehicle coverage

Uninsured and underinsured motorist coverage is an important aspect of auto insurance, providing financial protection in the event of an accident with an uninsured or underinsured driver. This type of coverage is especially relevant given that a significant number of drivers on the road may not have sufficient insurance. State Farm, as the largest insurer of automobiles in the U.S., offers uninsured and underinsured motorist coverage as part of its comprehensive auto insurance policies.

Uninsured motorist coverage comes into effect when you are hit by a driver who does not have any auto insurance. This coverage ensures that you are not left financially burdened by medical bills or vehicle repairs, which you would otherwise have to pay out of pocket. Underinsured motorist coverage, on the other hand, protects you when the at-fault driver does not have adequate insurance to cover the damages or injuries they caused. This type of coverage is crucial, as even if the other driver has some insurance, it may not be sufficient to cover the full extent of the damages.

State Farm's uninsured and underinsured motorist coverage can provide compensation for a range of expenses resulting from an accident. This includes medical expenses, pain and suffering, lost wages, and damage to your vehicle. This coverage is particularly valuable if you or your passengers require extensive medical treatment or time away from work to recover from injuries. Additionally, it can cover the cost of a rental car and the diminished value of your vehicle after an accident.

The necessity of uninsured and underinsured motorist coverage depends on various factors, including your state's requirements. Some states mandate this coverage, while others make it optional. However, even if it is not required in your state, it is highly recommended, as it provides financial protection in case of an accident with an uninsured or underinsured driver. Without this coverage, you may be responsible for covering all the expenses yourself.

State Farm allows you to customize your coverage limits based on your specific needs. It is recommended to choose coverage limits that match your liability coverage. For example, if your liability coverage is $50,000 per person and $100,000 per accident, you should consider selecting the same limits for your uninsured and underinsured motorist coverage. This ensures that you have sufficient protection in the event of a claim.

Luxury Cars: Higher Insurance Costs?

You may want to see also

Medical payments coverage

Med Pay does not cover expenses that exceed the policy's coverage amount, damage to vehicles or other property, or injuries to the driver and passengers in another vehicle if the policyholder is at fault. In the latter case, separate bodily injury liability coverage is available.

Unlike health insurance, medical payments coverage does not require deductibles or co-payments. It pays out from the first dollar of incurred expenses, and it will also cover expenses that health insurance may not, such as chiropractic visits or ambulance rides.

The cost of adding Med Pay to an auto policy is relatively inexpensive, with many policyholders adding coverage for $5 to $8 per month. The cost increases with higher coverage limits.

Gap Insurance: NMAC Refund Policy Explained

You may want to see also

Frequently asked questions

You will need to provide some vehicle and personal information, along with a brief driving history, to determine your coverage needs, deductible, and policy cost. This includes the year, make, model, body style, or VIN (Vehicle Information Number), the name of the registered owner, prior insurance carrier and expiration date, driver information and history, driver's license number(s) and state of issue, ticket and accident history, and license suspension information.

State Farm offers collision coverage, comprehensive coverage, liability coverage, uninsured and underinsured motor vehicle coverage, medical payments coverage, rideshare driver coverage, emergency road service coverage, and car rental reimbursement and travel expenses coverage.

State Farm accepts VISA®, MasterCard®, American Express®, Discover®, Diners Club®, and JCB® credit and debit cards. You can pay online, by phone, or by mail.

You can view, print, and email a new insurance card or request a mailed ID card online. Log in to your online account on statefarm.com, click on the Auto Policy above the vehicle description, and then click on Request Insurance Cards. Indicate how you want to receive your insurance cards and if you need cards for additional vehicles.

You may request changes to your coverages online, and they will be forwarded to your agent for processing. Log into your account, select the policy you want to change, click Quote/Change Coverages, select the coverages you would like to change and click Continue, review the changes and click Submit, and then enter your contact information and click Continue again.