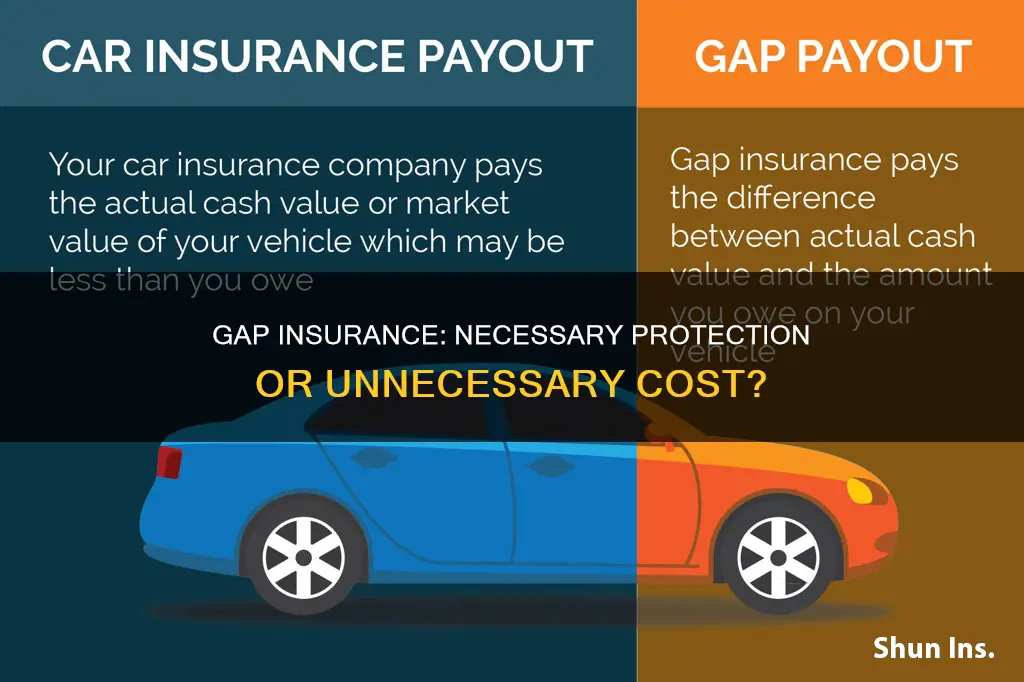

Guaranteed Asset Protection (GAP) insurance is an optional add-on to standard auto insurance policies. It covers the difference between the depreciated value of a car and the amount owed on it. In other words, GAP insurance covers the gap between the financed amount owed on a car and its actual cash value (ACV) in the event of a total loss. This type of insurance is particularly relevant for drivers who owe more on their car loan than the car is worth. GAP insurance is not mandatory, but it can provide financial protection in case of theft or a total loss of the vehicle.

| Characteristics | Values |

|---|---|

| What is auto gap insurance? | Guaranteed Asset Protection insurance. It is an optional, add-on coverage that can help certain drivers cover the “gap” between the financed amount owed on their car and their car’s actual cash value (ACV), in the event of a covered incident where their car is declared a total loss. |

| When is it necessary? | When the amount of the loan exceeds the market value of the vehicle. When the vehicle is stolen or deemed a total loss. When there is a significant difference between the car's value and what is owed on it. |

| When is it not necessary? | When the driver owns their car outright. When the driver owes less on their car than its current actual cash value. |

| Who needs it? | Drivers who owe more on their car loan than the car is worth. Drivers whose car loan or lease requires gap insurance. |

| Who doesn't need it? | Drivers who own their car outright. Drivers who owe less on their car than its current actual cash value. |

| How much does it cost? | The cost varies depending on factors including the current actual cash value (ACV) of the car, the state of residence, and previous car insurance claims. It is typically more expensive to purchase gap insurance from a dealership than from an insurer. |

| How long does it last? | For the duration of the policy. Once the driver owes less than what the car is worth, they can drop the insurance. |

What You'll Learn

When is auto gap insurance necessary?

Auto gap insurance is necessary when there is a significant difference between your car's value and the amount you owe on it. This type of insurance is designed to protect you financially when you owe more on your car loan than the car is worth, which can happen due to depreciation.

Gap insurance is typically considered necessary in the following scenarios:

- Leasing a car: Lenders often require gap coverage on leased vehicles. When you lease a car, you don't own it outright, and the difference between the car's value and the amount owed on the lease can be significant. Gap insurance helps bridge this gap and protect you from financial loss.

- Making a lower down payment on a new car: If you make a down payment of less than 20% of the car's sale price, you may end up with negative equity, especially if you're buying a brand-new car. Gap insurance can protect you from this negative equity, ensuring you don't owe more than the car is worth.

- Longer financing terms: The longer your vehicle is financed, the higher the chance of owing more on the vehicle than its actual value. Gap insurance can provide financial protection in this case.

- Faster depreciation: Some cars depreciate faster than others. If you own a vehicle that depreciates faster than average, gap insurance can help protect you from the financial impact of rapid depreciation.

- Loan rollover: If you owe more on your previous loan than your car is worth at the time of renewal, gap insurance can help cover the negative equity, ensuring you don't carry that debt into your new loan.

In summary, auto gap insurance is necessary when there is a risk of owing more on your car loan than the car's actual value. This situation can arise due to factors such as leasing, low down payments, longer financing terms, faster depreciation, or loan rollover. Gap insurance provides financial protection by covering the difference between the car's value and the amount owed, ensuring you don't incur steep out-of-pocket costs.

Uninsured Motorists: Changing Auto Insurance Laws to Protect Yourself

You may want to see also

When is it unnecessary?

Gap insurance is unnecessary if:

- You don't have a car loan or lease. Gap insurance is only required if you are still paying off your car, and even then, it is not always necessary. If you own your car outright, you do not need gap insurance.

- You have paid off most of your car loan. If you have paid off enough of your loan that you owe less than the car is worth, then you no longer need gap insurance. This is because there is no longer a "gap" between the amount owed and the car's value. You can use resources like the National Automobile Dealers Association (NADA) guide or Kelley Blue Book to check how much your car is worth and compare it to your loan balance.

- You made a large down payment on the car (20% or more) when you bought it. In this case, there is little chance that you will owe more than the car is worth, even in the first year or so of ownership.

- You are paying off the car loan in less than five years. If you are paying off the loan relatively quickly, you are less likely to owe more than the car is worth and can therefore skip gap insurance.

- Your car is a make and model that holds its value better than average. Some cars depreciate faster than others, so if you have a car that tends to hold its value well, you may not need gap insurance.

- Your lease or loan agreement does not require it. Although gap insurance is sometimes mandatory, this is not always the case. Check the terms of your lease or loan agreement to see if gap insurance is required.

Auto Insurance in Minnesota: How Much Does It Cost?

You may want to see also

How does it work?

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It bridges the gap between what you owe on your car loan and what your car is actually worth.

When you buy a new car, it starts to depreciate in value the moment it leaves the car lot. Most cars lose 20% of their value within a year. If you finance or lease a vehicle, this depreciation leaves a gap between what you owe and the car's value.

Let's say you finance $30,000 for a new car. You've had it for a few years and have been making all your payments. It's now worth $20,000 but you owe $25,000 on your loan, representing a $5,000 gap. If the vehicle is totaled, your insurer would pay you $25,000 (minus your deductible) with gap insurance. Without it, you'd only receive $20,000 (minus your deductible).

Gap insurance covers the difference between what a vehicle is worth and what is owed on it. It covers the difference between what a vehicle is currently worth (which your standard insurance will pay) and the amount you actually owe on it.

Gap insurance is designed to pay the final amount so you don't owe money on a totaled car. But without gap insurance, you'll have to cover the balance on your loan as well as your insurance deductible.

When to consider gap insurance

- If there's a significant difference between your car's actual value and what you still owe on it.

- If you're leasing your car.

- If you made a smaller down payment on a new car or if you have a longer financing term.

- If you want to protect yourself against depreciation.

- If you have a loan rollover.

How to get gap insurance

You can generally only add gap insurance to your policy if you still owe money on the vehicle or lease. There are two main ways to buy gap insurance:

- From your auto insurer, as part of your regular insurance policy.

- Through the dealership or lender, rolled into your loan payments.

Auto insurers typically charge a few dollars a month for gap insurance or around $20 a year. Lenders charge a flat fee of around $500 to $700 for gap insurance.

Credit Freeze Conundrum: Unraveling the Myth of Auto Insurance Premiums

You may want to see also

How much does it cost?

The cost of gap insurance varies depending on several factors, including the current actual cash value (ACV) of your car, the state you live in, and your previous car insurance claims. The cost also depends on where you purchase the insurance.

In general, the least expensive option is to add gap insurance to an existing full-coverage policy, which typically costs an average of $20-$40 per year. Purchasing gap insurance independently from an insurance company will cost more, with an average rate of $200-$300 per year. However, it is still cheaper than buying it from a dealership, manufacturer, or lender, which can cost $500-$700 plus interest.

The cost of gap insurance in California specifically ranges from $2 to $30 per month, depending on the provider. Los Angeles is the most expensive city for gap insurance in the state due to high levels of traffic and vehicle theft.

It's worth noting that gap insurance is generally more expensive if purchased through a dealership than through an insurer, and it is typically only available for brand-new vehicles or models less than two to three years old.

Get Auto Insurance Fast, Anytime, Even at 2 a.m

You may want to see also

Where can I buy it?

There are two main ways to buy gap insurance: from an auto insurer or through a dealership or lender.

Buying gap insurance from an auto insurer

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. If you already have car insurance, you can check with your current insurer to determine how much it would cost to add gap coverage to your existing policy. Note that you need comprehensive and collision coverage in order to add gap coverage to a car insurance policy.

Buying gap insurance from a dealership or lender

When you buy or lease a car, the dealer will likely ask if you want to purchase gap insurance when you discuss your financing options. Buying gap insurance from a dealer can be more expensive if the cost of the coverage is bundled into your loan amount, which means you'd be paying interest on your gap coverage.

Some of the largest insurance companies that offer stand-alone gap insurance (or an equivalent) as add-ons to car insurance policies include State Farm, Nationwide, Progressive, Allstate, USAA, AAA, Esurance, Auto Club Group – ACG (AAA), Auto Club Enterprises (AAA), Frankenmuth Insurance, and CSAA Insurance (AAA).

Addressing Auto Insurance: License and Policy Address Mismatches

You may want to see also

Frequently asked questions

Auto gap insurance, also known as Guaranteed Asset Protection insurance, is an optional add-on coverage that can help certain drivers cover the difference between the financed amount owed on their car and its actual cash value in the event of a total loss.

You should consider getting auto gap insurance if you:

- Owe more on your car loan than the car is worth.

- Have a lease that requires gap insurance. Many auto leases require gap insurance as a protective measure.

- Have a car loan that requires gap insurance. Some loan providers mandate gap insurance from the outset.

Auto gap insurance covers the difference between the amount your vehicle is worth and the amount you owe on it. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap insurance will cover the $5,000 gap, minus your deductible.

You can buy auto gap insurance from car insurers or dealers. It is typically more expensive to purchase gap insurance from a dealership than from an insurer.

Auto gap insurance is not required by any insurer or state. However, it is a good idea to consider it if you fall into one of the above categories, as it can help protect you from steep out-of-pocket costs in the event of a total loss.