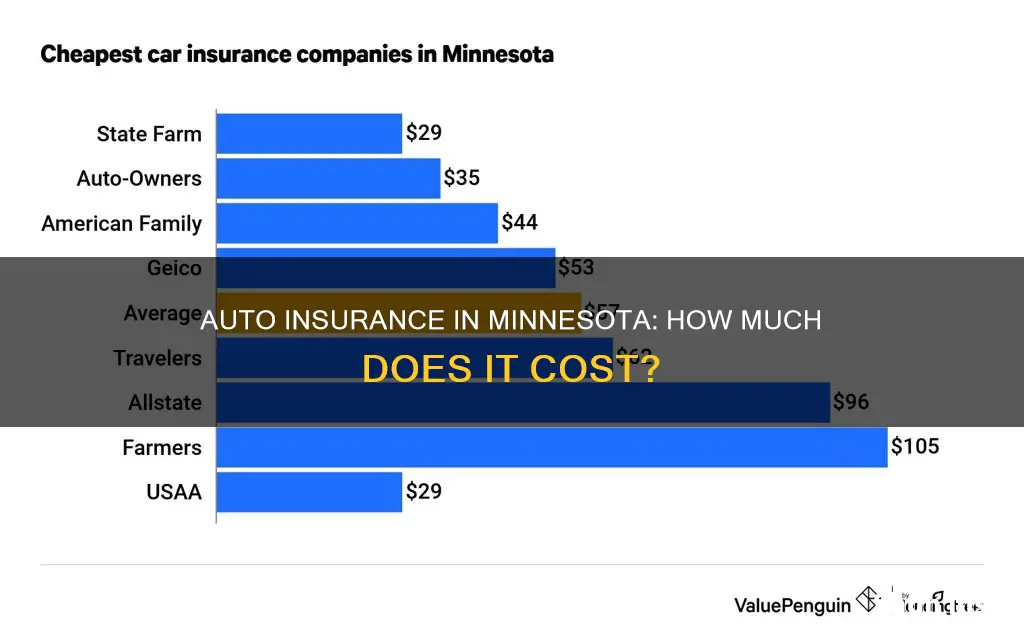

Auto insurance rates in Minnesota vary depending on factors such as age, gender, driving record, credit score, and location. The average cost of full coverage car insurance in the state is around $1,242 per year or $104 per month, while minimum coverage costs approximately $556 per year or $46 per month. The cheapest car insurance company in Minnesota is State Farm, with an average annual rate of $1,048. However, rates can differ significantly between companies, with AAA offering the cheapest full coverage at $860 per year and GEICO charging the most at $1,965 per year.

| Characteristics | Values |

|---|---|

| Average cost of full coverage car insurance per year | $1,242 |

| Average cost of full coverage car insurance per month | $104 |

| Average cost of minimum coverage car insurance per year | $556 |

| Average cost of minimum coverage car insurance per month | $46 |

| Average cost of car insurance in Minnesota per year | $1,460 |

| Average cost of car insurance in Minnesota per month | $121-$157 |

| Cheapest car insurance in Minnesota | State Farm |

| Most expensive car insurance in Minnesota | Allstate |

What You'll Learn

- How much is auto insurance in Minnesota for young drivers?

- How much is auto insurance in Minnesota for drivers with a DUI?

- How much is auto insurance in Minnesota for drivers with a ticket?

- How much is auto insurance in Minnesota for drivers with an accident?

- How much is auto insurance in Minnesota for drivers with poor credit?

How much is auto insurance in Minnesota for young drivers?

The cost of car insurance in Minnesota depends on several factors, including age, gender, driving record, and credit score.

Average Cost of Car Insurance in Minnesota

The average cost of full coverage car insurance in Minnesota is $1,242 per year, or $104 per month. The average cost of minimum coverage car insurance in Minnesota is $556 per year, or $46 per month.

Car Insurance for Young Drivers in Minnesota

Young drivers in Minnesota can expect to pay higher rates than older drivers. For example, 16-year-old male drivers added to a family policy in Minnesota pay an average of $2,553 per year, while 16-year-olds with their own policy pay an average of $4,785 per year.

Factors Affecting Car Insurance Rates for Young Drivers in Minnesota

Several factors can influence the cost of car insurance for young drivers in Minnesota, including:

- Age and Gender: In Minnesota, age and gender are factors that determine car insurance rates. Generally, younger drivers face higher premiums due to their perceived inexperience. Additionally, male drivers often pay higher rates than female drivers.

- Driving Record: A clean driving record can help lower insurance premiums, while accidents, violations, or a history of claims can increase rates.

- Credit Score: A good credit score can lead to lower insurance rates, while a poor credit score may result in higher premiums.

- Location: Urban areas in Minnesota typically have higher insurance rates due to increased risks of theft, vandalism, and accidents.

- Vehicle Type: The make, model, and value of a vehicle can impact insurance rates, with higher-value vehicles usually costing more to insure.

- Coverage Level: Opting for higher coverage levels, such as comprehensive and collision insurance, will increase premiums compared to minimum coverage policies.

Tips for Saving on Car Insurance in Minnesota

To find affordable car insurance in Minnesota, young drivers can consider the following strategies:

- Shop Around: Compare rates from multiple insurance companies to find the best deal.

- Maintain a Clean Driving Record: A clean driving record can significantly lower insurance premiums.

- Bundle Insurance Policies: Combining auto insurance with other policies, such as home insurance, from the same company can often lead to discounts.

- Increase Your Deductible: Choosing a higher deductible can lower your monthly premium, but ensure you have enough savings to cover the deductible if needed.

- Leverage Discounts: Insurance companies offer various discounts, such as good student discounts, safe driving discounts, and discounts for having anti-theft devices installed in your vehicle.

- Consider Vehicle Type: Choosing a vehicle that is cheaper to insure, typically those with good safety ratings, can help lower insurance costs.

Auto Insurance: Lost and Found

You may want to see also

How much is auto insurance in Minnesota for drivers with a DUI?

Minnesota drivers with a DUI pay around $2,319 yearly for full coverage insurance, compared to an average of $1,165 per year for drivers without a DUI. This means that a DUI conviction can increase your insurance premium by an average of $749, or 47% less than the national average premium increase after a DUI.

The cheapest companies for DUI offenders in Minnesota are State Farm, American Family, and Nationwide. However, it's important to note that DUI convictions may also result in fines, jail time, suspended licenses, and other penalties, depending on the severity of the offense.

After a DUI, it's essential to shop around for insurance and compare quotes from different companies. This is because there is no auto insurance company offering inexpensive DUI auto insurance. The most effective way to limit your losses after a DUI is to compare policies from various providers.

New Mexico's Auto Insurance Rates: Why So High?

You may want to see also

How much is auto insurance in Minnesota for drivers with a ticket?

The cost of car insurance in Minnesota varies depending on several factors, including age, driving record, and location. On average, drivers with a ticket can expect to pay around $1,512 per year or $126 per month for car insurance. However, the cost can vary depending on the severity of the violation and the driver's age.

For example, according to MoneyGeek, a speeding ticket can increase your insurance rate by up to 34%, while a DUI conviction can increase it by 98%. Additionally, younger drivers with a ticket will typically pay higher rates than more experienced drivers. For instance, a teen driver with a speeding ticket can expect to pay around $2,440 per year for car insurance, while a 35-year-old driver with a clean record may pay around $1,027 per year.

Location also plays a significant role in determining insurance rates. For instance, drivers in Brooklyn Center, one of the most expensive cities for insurance in Minnesota, pay an average of $2,232 per year. In contrast, drivers in Mankato, one of the cheapest cities, pay around $1,625 per year.

It's important to note that insurance rates are highly personalized, and the best way to determine the cost of car insurance with a ticket in Minnesota is to compare quotes from multiple insurance companies. By shopping around and considering factors such as age, location, and driving record, drivers can find the most affordable option for their specific needs.

Payoff Protector GAP Insurance: What's the Deal?

You may want to see also

How much is auto insurance in Minnesota for drivers with an accident?

Minnesota is a "no-fault" car insurance state, which means your own car insurance pays for certain losses after an accident, regardless of who caused the crash. However, the cost of car insurance in Minnesota can vary significantly based on your driving record.

According to MoneyGeek, the average cost of car insurance in Minnesota with an at-fault accident on your record is $1,724 per year, or $144 per month. This is significantly higher than the average cost of car insurance in the state without an accident, which is $1,242 per year, or $104 per month.

The cost of car insurance can also vary depending on the level of coverage selected. For example, the average monthly cost for minimum coverage in Minnesota is $46, while the average annual cost for full coverage with a $1,000 deductible is $1,183.

It's important to note that car insurance rates can vary between companies, so it's recommended to compare quotes from different insurers to find the cheapest car insurance rates. Other factors that can influence the cost of car insurance in Minnesota include age, credit score, location, vehicle type, and claims history.

U.S. Travel to Canada: Is Your USAA Auto Insurance Enough?

You may want to see also

How much is auto insurance in Minnesota for drivers with poor credit?

The cost of car insurance in Minnesota is influenced by various factors, including age, driving record, location, and credit score. Drivers with poor credit may face higher insurance rates as insurers consider them higher-risk.

According to ValuePenguin, drivers with poor credit in Minnesota pay around $251 per month for full coverage from American Family, which is 36% less than the state average. The Zebra reports that Minnesota drivers with poor credit pay 162% more per year than those with excellent credit.

NerdWallet's analysis reveals that the cheapest car insurance company in Minnesota for drivers with poor credit is American Family, with an average annual rate of $992, or $83 per month. Westfield also offers competitive rates for minimum coverage, with an average annual cost of $297.

It is worth noting that insurance rates can vary, and drivers with poor credit are advised to shop around and compare quotes from multiple insurers to find the most affordable coverage.

Auto Insurance Injury Claims: Settling the Score

You may want to see also

Frequently asked questions

The average cost of auto insurance in Minnesota is $1,460 per year, or $121 per month. However, this can vary depending on factors such as age, location, driving record, and credit score.

State Farm is the cheapest auto insurance company in Minnesota, with an average annual rate of $1,048.

Allstate is the most expensive auto insurance company in Minnesota, with an average annual rate of $2,124.

Minnesota requires drivers to have bodily injury liability coverage of $30,000 per person and $60,000 per accident, property damage liability coverage of $10,000 per accident, personal injury protection (PIP) coverage of $40,000, and uninsured/underinsured motorist coverage of $25,000 per person and $50,000 per accident.