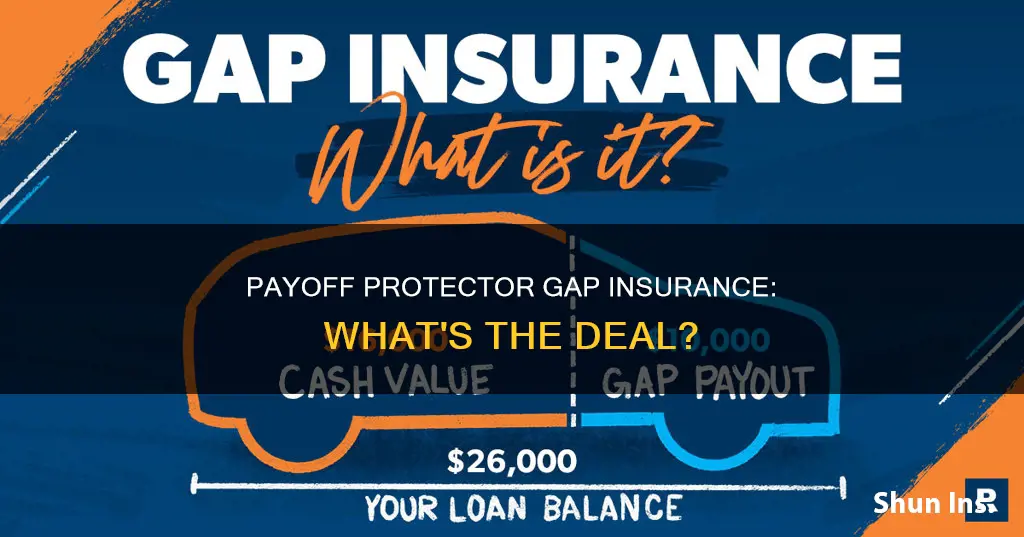

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance will cover the $5,000 gap, minus your deductible.

| Characteristics | Values |

|---|---|

| Type of insurance | Optional car insurance |

| What it covers | Difference between car's value and loan amount |

| When it applies | When car is stolen or deemed a total loss |

| Who it is for | People who lease a vehicle or have a loan |

| Who it is not for | People who don't have a car loan or lease |

| Cost | $20-$40 per year when added to car insurance policy; $400-$700 when purchased from a dealership |

What You'll Learn

- Gap insurance covers the difference between the compensation received and the loan amount owed if a vehicle is written off

- It is optional but may be required by lenders or lessors

- It is worth purchasing gap insurance if you owe more on your car loan than the car is worth

- It is not needed if you have paid off most of the loan, made a large down payment, or could cover the cost of the gap yourself

- It can be purchased from car insurance companies, loan providers, or dealerships

Gap insurance covers the difference between the compensation received and the loan amount owed if a vehicle is written off

Gap insurance, also known as guaranteed auto protection (GAP), is a type of optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the compensation received and the loan amount owed if a vehicle is written off. This type of insurance is particularly useful if you owe more on your car loan than the car is worth, which can happen if you didn't make a down payment or chose a long loan term.

Here's how gap insurance works: when you file a qualifying claim, your comprehensive or collision coverage will pay the actual cash value (ACV) of your vehicle, minus your deductible. Gap insurance then comes into play, covering the difference between the ACV of your vehicle and the outstanding balance of your loan or lease. It's important to note that gap insurance doesn't cover additional charges related to your loan, such as finance or excess mileage charges.

For example, let's say you owe $25,000 on your car loan, but your car is only worth $20,000. Without gap insurance, if your car is written off, you would only receive $20,000 (minus your deductible) from your insurance company. However, with gap insurance, the $5,000 gap would be covered, ensuring you can pay off your loan in full.

The cost of gap insurance varies depending on factors such as your state, driving record, age, and vehicle. You can purchase it as an endorsement on your car insurance policy or buy separate coverage from a dealer. It's a good idea to compare the costs of both options to see which one best suits your needs.

In summary, gap insurance provides valuable protection if your vehicle is written off and you owe more than its current value. It ensures that you're not left with a financial shortfall and can help give you peace of mind when it comes to managing your car-related finances.

Insurable Vehicles: Economy vs Cost

You may want to see also

It is optional but may be required by lenders or lessors

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It is designed to pay the difference between what your vehicle is worth and how much you owe on your car loan at the time it is stolen or totalled. This type of insurance is particularly useful if you have a low down payment, a long-term loan, or a car that depreciates in value quickly.

Although gap insurance is never required by state law, it may be required by lenders or lessors. This is especially true if you have a low down payment (less than 20%, for example) on a large loan, or if you have a long-term loan (for example, a term that is 60 months or longer). In these cases, gap insurance can protect you from having to pay out of pocket for a vehicle you can no longer drive.

If you decide to purchase gap insurance, you can buy it from your car insurance company, loan provider, or dealership. It typically costs between $400 and $700 when purchased from a dealership and between $20 and $40 per year when added to a car insurance policy. Keep in mind that you should cancel your gap insurance once you owe less than your car's value, as this type of insurance is only necessary when there is a gap between the value of your car and the amount you owe.

Insuring Old Vehicles in Florida

You may want to see also

It is worth purchasing gap insurance if you owe more on your car loan than the car is worth

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance covers the $5,000 gap, minus your deductible.

Gap insurance is worth purchasing if you owe more on your car loan than the car is worth. It can help protect you from depreciation, which leaves a gap between what you owe and the car's value. This gap can be significant if you made a smaller down payment on a new car or have a longer financing term. Gap insurance can also be beneficial if you lease your car, as it may be required by the leasing company.

When deciding whether to purchase gap insurance, consider the difference between the value of your car and the amount you owe on it. If there is a significant difference, gap insurance can be a valuable safeguard. Additionally, calculate how much you will pay in gap coverage and compare it to the potential value of the insurance. If the difference between your car's value and the amount you owe is greater than the cost of gap coverage, it may be worth purchasing.

It's important to note that gap insurance is not required and can be added to your existing policy if needed. It is usually inexpensive, with an average cost of around $60 per year. However, if you buy gap insurance from a dealership, it can cost hundreds of dollars a year.

Root Insurance: Gap Coverage Explained

You may want to see also

It is not needed if you have paid off most of the loan, made a large down payment, or could cover the cost of the gap yourself

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the compensation you receive and the amount you still owe on a car loan. It is not needed if you have paid off most of the loan, made a large down payment, or could cover the cost of the gap yourself.

Gap insurance is designed to protect you from depreciation. Once you buy your car, its value starts to decrease, and if you finance or lease a vehicle, this depreciation leaves a gap between what you owe and the car's value. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance covers the $5,000 gap, minus your deductible. However, if you have paid off most of your loan, the gap between what you owe and the car's value decreases, and gap insurance becomes less necessary.

Similarly, if you make a large down payment, you reduce the gap between the car's value and the loan amount from the start, and gap insurance becomes less essential. For instance, if you make a 20% down payment on a $25,000 car, you only need to borrow $20,000. This reduces the risk of the car depreciating below the loan amount, making gap insurance less crucial.

Lastly, if you have the financial means to cover the cost of the gap yourself, you may not need gap insurance. Gap insurance is intended to protect you from financial strain in the event of a total loss. However, if you have the funds to cover the difference between the car's value and the loan amount, you may choose to forgo gap insurance.

In conclusion, while gap insurance can provide valuable protection against depreciation and financial loss, it may not be necessary if you have paid off most of the loan, made a large down payment, or can afford to cover the cost of the gap. It is essential to assess your individual circumstances, the value of your car, and your financial situation to determine if gap insurance is needed.

When is a Car Considered Totaled?

You may want to see also

It can be purchased from car insurance companies, loan providers, or dealerships

Gap insurance, or Guaranteed Asset Protection, is an optional form of auto insurance that covers the difference between the amount owed on a car loan and the car's actual worth in the event of theft or total loss. It is available from car insurance companies, loan providers, and dealerships.

When purchasing or leasing a new car, dealerships often offer gap insurance as part of the financing options. However, buying gap insurance from a dealer can be more expensive as the cost of coverage may be bundled into the loan amount, resulting in interest payments on the gap coverage. It is important to note that gap products offered by dealerships may not always be insurance, and regulations may not cover issues with these products.

Car insurance companies also provide gap insurance, often as an add-on to an existing policy. Purchasing gap insurance from an insurance company may be more cost-effective, and interest is not charged on the coverage. It is worth checking with your current insurer to determine the cost of adding gap coverage to an existing policy.

Loan providers, such as banks and credit unions, also offer gap insurance. This coverage is typically added to an existing auto loan or included during the loan application process. Some providers offer refunds if the coverage is cancelled within a certain period, usually around 60 days.

While gap insurance is not mandatory, it is a valuable option for those who want protection against the financial gap that may arise if their car is stolen or totalled and they owe more than the car's depreciated value.

Gap Insurance: Maryland's Cost and Benefits

You may want to see also

Frequently asked questions

Gap insurance, or guaranteed asset protection, is an optional form of auto insurance that covers the difference between the amount owed on a car loan and the car's market value in the event of theft or total loss.

If your car is stolen or written off, gap insurance will cover the difference between the amount your comprehensive insurance pays out and the remaining balance on your car loan.

Gap insurance is not required by law but may be required by your lender or lessor. It is generally recommended if you have a car loan or lease, a small down payment, a long-term loan, or a car that depreciates quickly.

The cost of gap insurance varies depending on the provider and your vehicle. Dealerships typically charge a one-time fee of $400 to $700, while insurance companies may charge as little as $3 per month or $20 to $40 per year.

You can purchase gap insurance from car dealerships, lenders, or insurance companies. It is generally recommended to buy gap insurance from an insurance company as it tends to be cheaper and more flexible.