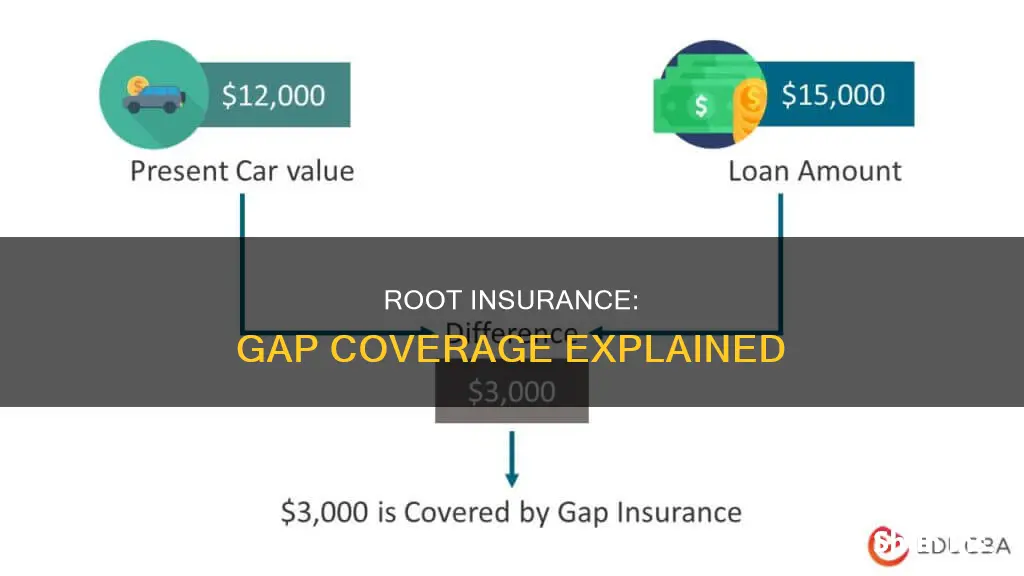

Root Insurance is a car insurance company that offers some of the lowest rates on the market. However, Root does not offer gap insurance, which could be a problem for some customers. Gap insurance covers the difference between the payout from collision or comprehensive insurance and the balance of a car loan after vehicle theft, damage, or total loss. Without gap insurance, customers could be liable to continue paying off a loan for a car that they can no longer use.

| Characteristics | Values |

|---|---|

| Does Root have gap insurance? | No |

What You'll Learn

Root does not offer gap insurance

Root is an insurance company headquartered in Columbus, Ohio. The company offers auto insurance based on how drivers drive, using an app to track driving behaviour. Root claims it can save customers up to $900 per year on car insurance, but it does not have the coverage options of more established carriers.

Root does offer standard auto insurance coverage options such as collision and comprehensive coverage, bodily injury and property damage liability, and uninsured or underinsured coverage. Root also offers roadside assistance with their policies.

Insurance Revoked: Does DMV Know?

You may want to see also

Gap insurance is essential for financed vehicles

Gap insurance is an optional form of car insurance that covers the difference between the amount owed on a car loan and the actual cash value of the car in the event of a total loss. While it is not required by law, gap insurance is essential for financed vehicles as it can protect you from financial loss.

When a car is totalled or stolen, standard car insurance will only pay up to the car's current value, which may be less than the outstanding loan amount. Gap insurance covers this difference, ensuring that you are not left with a large bill for a car that you can no longer use. This is especially important for drivers who have made a small down payment (or no down payment at all) and have a long payoff period, as they may owe more than the car's current value.

Gap insurance is typically offered by car dealerships, auto loan companies, and traditional insurance companies. It can be added to a comprehensive auto insurance policy for as little as $20 a year, according to the Insurance Information Institute. However, it is important to note that gap insurance does not cover situations where the car is not a total loss, and it also does not cover mechanical breakdowns or normal wear and tear.

Root, a relatively new car insurance company, does not currently offer gap insurance. Root uses an app to track driving behaviour and sets rates based on driving habits rather than the usual factors. While Root offers some of the lowest rates on the market, the lack of gap insurance may be a problem for some people, particularly those who have a loan or lease and are required to have gap insurance.

Insured Drivers or Vehicles: What's the Law?

You may want to see also

Root's limited coverage options

Root Insurance is a Columbus, Ohio-based company that offers auto insurance based on how drivers drive. They use usage-based insurance (UBI) to collect information about driving habits through telematics captured by a driver's smartphone. Root's biggest strength is its low rates. However, it also has a reputation for poor customer service and limited coverage options.

Root offers standard auto insurance coverage options such as collision and comprehensive coverage, bodily injury and property damage liability, and uninsured or underinsured coverage. Root also offers coverage for drivers in states with specific auto insurance requirements, such as medical payment coverage and personal injury coverage. In addition, Root includes roadside assistance with their policies.

Root does not offer gap insurance for new cars, so you might consider another company if that is a priority for you. Gap insurance provides essential coverage for financed vehicles in the event of a total loss. It covers the difference between your collision or comprehensive insurance payout and the balance on your auto loan after vehicle theft, damage, or total loss.

Root also does not offer insurance for motorcycles, ATVs, exotic, or commercial vehicles. Root's limited coverage options may not be suitable for drivers who require additional coverage, such as those with a loan or lease that requires gap insurance.

Vehicle Service Contracts: Insured?

You may want to see also

What is gap insurance and who needs it?

Gap insurance, also known as guaranteed auto protection, is an optional, supplemental auto policy that covers the difference between the compensation received after a total loss of a vehicle and the amount still owed on the car loan. This type of insurance is useful for those who have financed or leased a vehicle and are at risk of negative equity.

Gap insurance is particularly beneficial for those who:

- Made a small down payment (less than 20%) on their car

- Have a long finance period (over 60 months)

- Purchased a vehicle that depreciates quickly

- Rolled over negative equity from an old car loan into a new loan

- Are leasing a vehicle

Gap insurance is not necessary for those who have already paid off a significant portion of their car loan or those who own their car outright. It is also not required if you have made a substantial down payment on your vehicle or if you are paying off your car loan in less than five years.

The cost of gap insurance varies depending on factors such as the current value of the car, the state of residence, and previous insurance claims. It can be purchased independently or added to an existing insurance policy. When deciding whether to purchase gap insurance, it is important to consider your financial situation and the potential risks associated with negative equity.

Affordable Auto Insurance: Finding the Cheapest Rates

You may want to see also

How to get a quote from Root

To get a quote from Root, you will need to undergo a two-week to one-month driving test. Here's how to do it:

Download the Root App

You can download the Root app from the App Store or Google Play Store.

Sign Up

Sign up in the app. This should only take about a minute.

Enable GPS

Allow the app to access your phone's GPS so that it can measure your driving behaviours.

Drive as Normal

Now, drive as you normally would, keeping your phone with you. The app will monitor your driving behaviour, including how smoothly you drive, your turn speed and sharpness, braking, speed of turns, driving times, and route consistency. The app can tell whether you are the driver or a passenger, so other drivers' behaviours won't be measured as your own.

Receive Your Quote

After the test period, Root will use the information it has gathered to decide whether to offer you auto insurance coverage. If you are considered a safe driver, you will get a good rate. If not, your estimates will be higher, or you may not be offered coverage at all.

Loan Lease Payoff vs. Gap Insurance: What's the Difference?

You may want to see also

Frequently asked questions

No, Root does not offer gap insurance.

Gap insurance provides essential coverage for financed vehicles in the event of a total loss. It covers the difference between your collision or comprehensive insurance payout and the balance on your auto loan after vehicle theft, damage, or total loss.

Root offers standard auto insurance coverage options such as collision and comprehensive coverage, bodily injury and property damage liability, and uninsured or underinsured coverage. Root also offers roadside assistance with their policies.