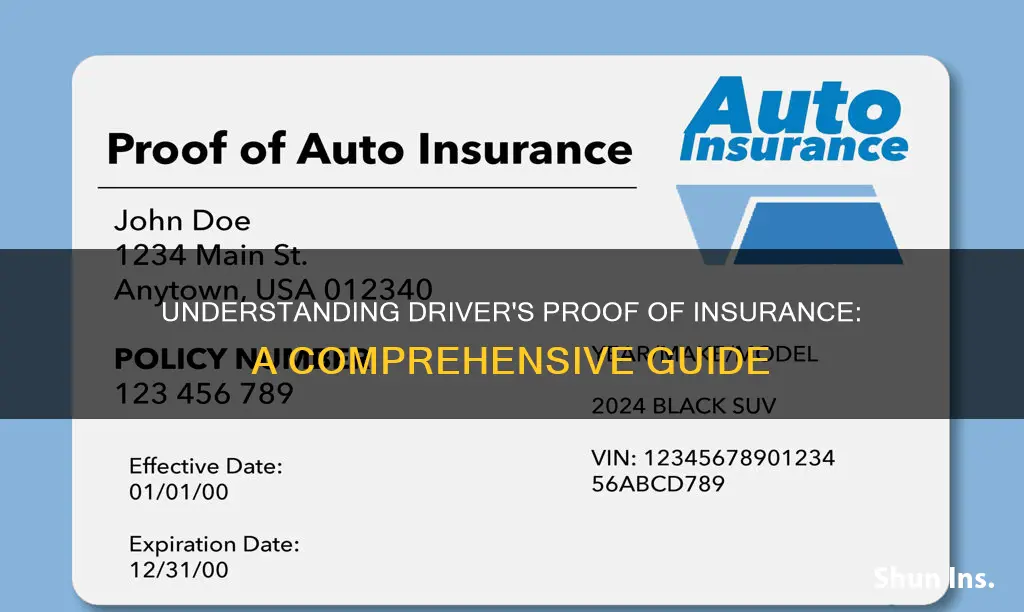

Driver's proof of insurance is a crucial document that verifies an individual's auto insurance coverage. It serves as a proof of financial responsibility, ensuring that the driver has the necessary insurance to cover potential liabilities in the event of an accident. This document typically includes details such as the insurance company's name, policy number, coverage limits, and the types of coverage provided. Obtaining and maintaining this proof is essential for drivers to comply with legal requirements and to protect themselves and others in the event of unforeseen incidents on the road.

What You'll Learn

- Definition: Proof of insurance is a document verifying a driver's insurance coverage

- Purpose: It confirms the driver's liability and coverage details

- Format: Often provided by the insurance company in paper or digital form

- Legal Requirement: Many jurisdictions mandate proof of insurance for vehicle registration

- Renewal: Drivers must periodically update their proof of insurance

Definition: Proof of insurance is a document verifying a driver's insurance coverage

Proof of insurance is a critical document for any driver, as it serves as tangible evidence of their insurance coverage. This document is typically issued by the insurance company and provides a comprehensive overview of the driver's insurance policy. It is a legal requirement in many jurisdictions, ensuring that drivers are adequately protected and that they can be held accountable in the event of an accident or other covered incidents. The primary purpose of this document is to verify the driver's insurance status, ensuring that they have the necessary coverage to operate their vehicle legally and safely.

In the event of a traffic stop or accident, law enforcement officers often request proof of insurance from drivers. This request is standard procedure to ensure that all drivers on the road have the required financial protection. The document typically includes essential details such as the driver's name, policy number, insurance company information, coverage types (e.g., liability, collision, comprehensive), and the policy's validity period. It may also outline the driver's coverage limits and any specific conditions or exclusions.

Obtaining proof of insurance is a straightforward process. When purchasing an insurance policy, the insurance company will provide this document, often in the form of a card, certificate, or digital copy. It is essential to keep this document readily accessible in the vehicle, as it may be required at any time. Some insurance providers also offer mobile apps or online portals where drivers can access their proof of insurance digitally, making it convenient to present when needed.

For new drivers or those with recently acquired policies, it is crucial to request a copy of the proof of insurance from the insurance company. This ensures that they have the necessary documentation to comply with legal requirements and can provide it during routine checks or in the event of an incident. Additionally, drivers should review their policies regularly to ensure they understand their coverage and can provide accurate information when requested.

In summary, proof of insurance is a vital document that verifies a driver's insurance coverage, ensuring legal compliance and providing financial protection. It is a standard requirement for all drivers and should be readily available at all times. Understanding the contents and purpose of this document is essential for drivers to operate their vehicles with confidence and adhere to the regulations set by their respective jurisdictions.

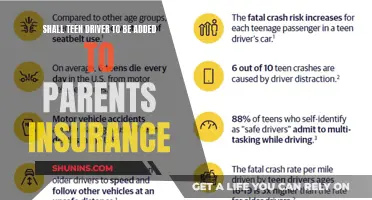

Restricted Licenses: Auto Insurance Coverage for Young Drivers

You may want to see also

Purpose: It confirms the driver's liability and coverage details

Driver's proof of insurance is a crucial document that serves as a tangible confirmation of an individual's insurance coverage and liability. Its primary purpose is to provide a clear and verifiable record of the driver's insurance details, ensuring that they meet the legal requirements for operating a vehicle. This document is essential for both the driver and the authorities, as it offers a quick and reliable way to verify the driver's insurance status, which is a fundamental aspect of road safety and legal compliance.

The proof of insurance typically includes essential information such as the driver's name, the insurance company's details, the policy number, and the coverage limits. It confirms that the driver has a valid insurance policy in place, which is a legal obligation for all vehicle owners and operators. This document is often required when registering a vehicle, obtaining a driver's license, or during routine traffic stops, allowing law enforcement officers to quickly assess the driver's insurance status.

One of the key benefits of this proof is its ability to provide liability coverage confirmation. It ensures that the driver is financially responsible for any potential claims or damages that may arise from an accident. In the event of a collision, the proof of insurance can be presented to the other party's insurance company or directly to the authorities, facilitating the claims process and providing a layer of protection for all involved. This is particularly important as it helps to minimize disputes and ensures that the legal and financial responsibilities are clearly defined.

Furthermore, it is a valuable tool for drivers to review and understand their coverage. By examining the proof, drivers can verify the extent of their insurance, including the types of coverage provided, such as liability, collision, comprehensive, or medical payments. This knowledge empowers drivers to make informed decisions, ensuring they are adequately protected and aware of their rights and obligations.

In summary, the purpose of driver's proof of insurance is to provide a clear and comprehensive overview of an individual's insurance coverage and liability. It serves as a critical document for legal compliance, road safety, and efficient claims management. By confirming the driver's insurance details, this proof ensures that all parties involved in a potential accident have the necessary information to proceed with the appropriate legal and financial procedures.

Find Auto Insurance Leads: Strategies for Success

You may want to see also

Format: Often provided by the insurance company in paper or digital form

Driver's proof of insurance is a crucial document that verifies an individual's auto insurance coverage. It serves as a testament to the insurance company's commitment to providing financial protection in the event of an accident or other covered incidents. This document is often requested by law enforcement, during vehicle inspections, or when initiating or renewing a vehicle registration.

The format of this proof of insurance can vary, but it typically includes essential details about the insurance policy. It usually consists of a certificate or a card that outlines the insurance provider's name, the policy number, and the policy's coverage limits. This information is vital as it confirms the driver's compliance with the legal requirement to have valid insurance.

In many cases, insurance companies provide this proof in both paper and digital formats to accommodate various preferences and needs. The paper version is often a physical card or certificate that can be carried in the vehicle, ensuring easy access during routine checks or emergencies. This physical copy is especially useful for drivers who prefer a tangible record of their insurance coverage.

On the other hand, the digital format offers convenience and accessibility. Many insurance providers now offer online portals or mobile apps where customers can access their proof of insurance instantly. This digital version allows drivers to quickly provide the necessary documentation when required, eliminating the need to search for physical papers.

Whether in paper or digital form, the driver's proof of insurance is a critical component of vehicle ownership, ensuring that drivers are adequately protected and legally compliant. It is essential to keep this document readily available and up-to-date to avoid any legal issues and to have peace of mind while on the road.

Liability Insurance: Auto Repair Shop's Best Friend

You may want to see also

Legal Requirement: Many jurisdictions mandate proof of insurance for vehicle registration

In many countries and regions, having proof of insurance is a legal requirement for vehicle owners and drivers. This is a crucial aspect of road safety and financial responsibility, ensuring that drivers are adequately covered in case of accidents or other unforeseen events. When registering a vehicle, authorities often demand that drivers provide evidence of their insurance coverage to obtain a valid registration certificate. This process is designed to protect both the driver and other road users by establishing a financial safety net.

The primary purpose of this legal mandate is to ensure that drivers are financially responsible for any damages or injuries they may cause while operating their vehicles. Insurance companies provide coverage for various risks, including bodily injury, property damage, and liability, which can be substantial in the event of a serious accident. By requiring proof of insurance, governments aim to minimize the financial burden on public resources and encourage drivers to maintain appropriate coverage.

The specific requirements for proof of insurance can vary depending on the jurisdiction. In some places, a simple certificate or document from the insurance company may be sufficient. This document typically outlines the policy details, coverage amounts, and the period of validity. In other regions, a more comprehensive approach might be taken, where drivers must provide a digital or physical copy of their insurance policy, along with proof of payment. This ensures that the insurance coverage is active and valid during the registration period.

Non-compliance with the insurance proof requirement can result in severe consequences. Drivers who fail to provide the necessary documentation may face delays in vehicle registration, fines, or even the suspension of their driving privileges. These penalties are in place to encourage drivers to maintain the required insurance coverage, which is essential for their safety and the safety of others on the road. It is, therefore, a legal obligation that drivers must take seriously.

Obtaining and maintaining proof of insurance is a straightforward process. Drivers can typically request a certificate from their insurance provider, which can be presented during the vehicle registration process. Many insurance companies also offer digital certificates or online portals where drivers can access and download the required documentation. By fulfilling this legal requirement, drivers can ensure a smooth registration process and contribute to a safer road environment.

Auto Insurance and Intentional Acts: What's Covered?

You may want to see also

Renewal: Drivers must periodically update their proof of insurance

When it comes to maintaining a valid driver's license and a safe driving record, one crucial aspect often overlooked is the need to periodically update your proof of insurance. This document is essential as it provides evidence of your insurance coverage, which is a legal requirement for all drivers. The process of renewal is a critical step to ensure that you remain compliant with the law and are adequately protected in case of any unforeseen incidents on the road.

The frequency of these renewals can vary depending on the insurance company's policies and the jurisdiction's regulations. However, it is generally recommended that drivers review and update their proof of insurance annually or whenever there are significant changes in their personal or vehicle-related circumstances. For instance, if you've recently purchased a new car, moved to a different state, or experienced a change in your employment status, these updates should be reflected in your insurance documentation.

The process of renewal typically involves contacting your insurance provider and providing them with the necessary information. This may include details about your current policy, any changes in coverage, and personal information that could impact your insurance rates. During this update process, you might also be required to pay any outstanding premiums or fees, ensuring that your policy remains active and valid.

It is essential to understand that failing to update your proof of insurance can lead to severe consequences. You may face legal penalties, including fines and license suspension, if you are caught driving without valid insurance coverage. Moreover, in the event of an accident, not having up-to-date insurance information could result in significant financial burdens and complications in claiming compensation.

In summary, periodic renewal of your proof of insurance is a vital responsibility for all drivers. It ensures that you remain legally compliant and financially protected. By staying proactive and updating your insurance information regularly, you can avoid potential legal issues and have peace of mind knowing that you are adequately covered for any driving-related incidents.

Top Auto Insurance Companies in New Jersey

You may want to see also

Frequently asked questions

The driver's proof of insurance is a document that confirms your auto insurance coverage. It is typically a card or certificate provided by your insurance company, which outlines the details of your policy, including the insurance provider's name, policy number, coverage types, and coverage limits. This proof is essential to present when requested by law enforcement or in the event of an accident to ensure you are legally covered to drive.

Providing proof of insurance is a legal requirement in most jurisdictions. It serves as a way for authorities to verify that you have the necessary coverage to operate a vehicle safely. In the event of an accident, insurance proof helps identify the insurance provider and ensures that the policyholder is covered for any damages or injuries. It also protects you from potential financial liabilities if you are found to be at fault in an accident.

You can obtain your proof of insurance from your insurance company or broker. They will provide you with a physical card or a digital copy of your insurance certificate. If you are a new policyholder, the insurance provider will issue this document to you upon policy activation. You can also request a copy if you need a replacement or an additional copy for your records.

Driving without proof of insurance is illegal and can result in severe consequences. You may face fines, license suspension, or even imprisonment, depending on the jurisdiction. In the event of an accident, not having insurance proof can lead to difficulties in claiming compensation and may result in financial losses. It is essential to maintain valid insurance coverage and keep the proof easily accessible while driving.