Teenagers often face unique challenges when it comes to obtaining their own insurance policies, and many parents are faced with the decision of whether to include their teen driver on their existing insurance plan. This decision can have significant implications for both the parent and the teen, and it's important to consider the various factors involved. In this paragraph, we will explore the considerations and benefits of adding a teen driver to a parent's insurance policy, as well as the potential challenges and alternatives that may be worth exploring.

What You'll Learn

- Legal Requirements: Understanding the legal obligations for adding a teen driver to a parent's insurance policy

- Policy Coverage: Exploring the impact on existing coverage and potential adjustments needed

- Premium Costs: Analyzing the financial implications and factors influencing insurance premiums for teen drivers

- Driving Record Impact: How a teen's driving record affects insurance rates and policy terms

- Discounts and Incentives: Discovering available discounts and incentives for responsible teen driving

Legal Requirements: Understanding the legal obligations for adding a teen driver to a parent's insurance policy

When a teenager begins to drive, one of the most important decisions parents need to make is how to handle their teen's insurance. While it might be tempting to simply add the teen to the parent's existing policy, there are legal requirements and considerations that come into play. Understanding these obligations is crucial to ensure compliance with the law and to protect both the teen and the parent's interests.

In most jurisdictions, there are specific legal requirements for adding a teen driver to a parent's insurance policy. These requirements often include age restrictions, residency criteria, and proof of the teen's driving eligibility. For instance, many insurance companies mandate that the teen driver must be at least 16 years old and have a valid driver's license. Additionally, the teen's residence and the parent's insurance coverage must be in the same state or country. It is essential to review the insurance company's policies and local regulations to ensure compliance.

One of the key legal obligations is the requirement to provide accurate and up-to-date information. When adding a teen driver to a policy, parents must disclose all relevant details, including the teen's age, driving experience, and any previous violations or accidents. Insurance companies often use this information to determine the premium rates and assess the risk associated with the teen driver. Failing to provide accurate information can result in legal consequences and may even lead to the denial of coverage in case of an accident.

Furthermore, parents should be aware of the implications of adding a teen driver to their policy regarding coverage limits and exclusions. Teen drivers often require higher coverage limits due to their lack of experience and the potential for increased risk. Insurance companies may offer different coverage options, such as a separate policy for the teen or a policy endorsement. Understanding these options and choosing the appropriate coverage is essential to ensure adequate protection for the teen and the parent.

Lastly, it is important to note that adding a teen driver to a parent's insurance policy may have tax implications. In some cases, the cost of the teen's insurance may be deductible from the parent's income, providing a financial benefit. However, this can vary depending on the jurisdiction and the specific insurance company's policies. Consulting with a tax advisor or insurance professional can help parents navigate these potential tax considerations.

In summary, adding a teen driver to a parent's insurance policy involves understanding and adhering to legal requirements, providing accurate information, and making informed decisions about coverage. By being aware of these legal obligations, parents can ensure a smooth transition for their teen driver and maintain compliance with the law.

Using Pip Auto Insurance: A Comprehensive Guide

You may want to see also

Policy Coverage: Exploring the impact on existing coverage and potential adjustments needed

When a teenager is added to a parent's insurance policy, it can significantly impact the existing coverage and may require careful consideration and adjustments to ensure adequate protection for all family members. Here's an exploration of the policy coverage implications and the necessary adjustments:

Understanding the Impact: Adding a teen driver to a parent's insurance policy can have several consequences. Firstly, it increases the number of insured individuals, which may lead to higher premiums. Insurance companies often consider the risk associated with additional drivers, especially teenagers, who are statistically more prone to accidents and traffic violations. This increased risk can result in a premium hike to compensate for potential claims. Secondly, the inclusion of a teen driver might affect the coverage limits and deductibles. The insurance policy may need to be reviewed to ensure it provides sufficient coverage for the additional driver and the family's overall needs.

Policy Adjustments: To address the potential challenges, several adjustments can be made to the insurance policy:

- Increasing Coverage Limits: The parent's insurance policy should be reviewed to ensure the coverage limits are adequate. This includes checking the liability coverage, which protects against claims from other parties in case of an accident, and considering raising the limits to accommodate the teen driver's potential risks.

- Adding a Teen Driver Endorsement: Many insurance companies offer endorsements specifically tailored for teen drivers. These endorsements can provide additional coverage and discounts. For instance, a 'Good Student' endorsement might offer reduced rates if the teen maintains a certain GPA, encouraging good academic performance.

- Reviewing Deductibles: Adjusting the deductibles can help manage the impact on premiums. Parents might consider increasing their deductibles, which would lower the monthly premium but require a higher out-of-pocket payment in case of a claim. This strategy can be particularly useful if the teen driver is less likely to file frequent claims.

- Considering a Separate Policy: In some cases, if the teen driver's usage of the vehicle is significant, it might be more cost-effective to provide them with a separate insurance policy. This ensures that their driving record and usage patterns do not affect the parent's policy, potentially maintaining lower premiums for the family.

Additional Considerations: It is essential to review the policy's terms and conditions, including any exclusions or limitations. Some policies may have specific requirements or restrictions when adding a teen driver. Understanding these details can help parents make informed decisions and ensure they have the appropriate coverage. Moreover, discussing the situation with an insurance agent can provide valuable insights and guidance tailored to the family's circumstances.

By carefully evaluating the policy coverage and making the necessary adjustments, parents can ensure that their insurance policy adequately protects their family, including the newly added teen driver, while managing the potential financial implications. This proactive approach allows for a well-informed decision-making process regarding insurance coverage.

Florida's Mandatory Pre-Inspection: A Necessary Evil for Auto Insurance Claims?

You may want to see also

Premium Costs: Analyzing the financial implications and factors influencing insurance premiums for teen drivers

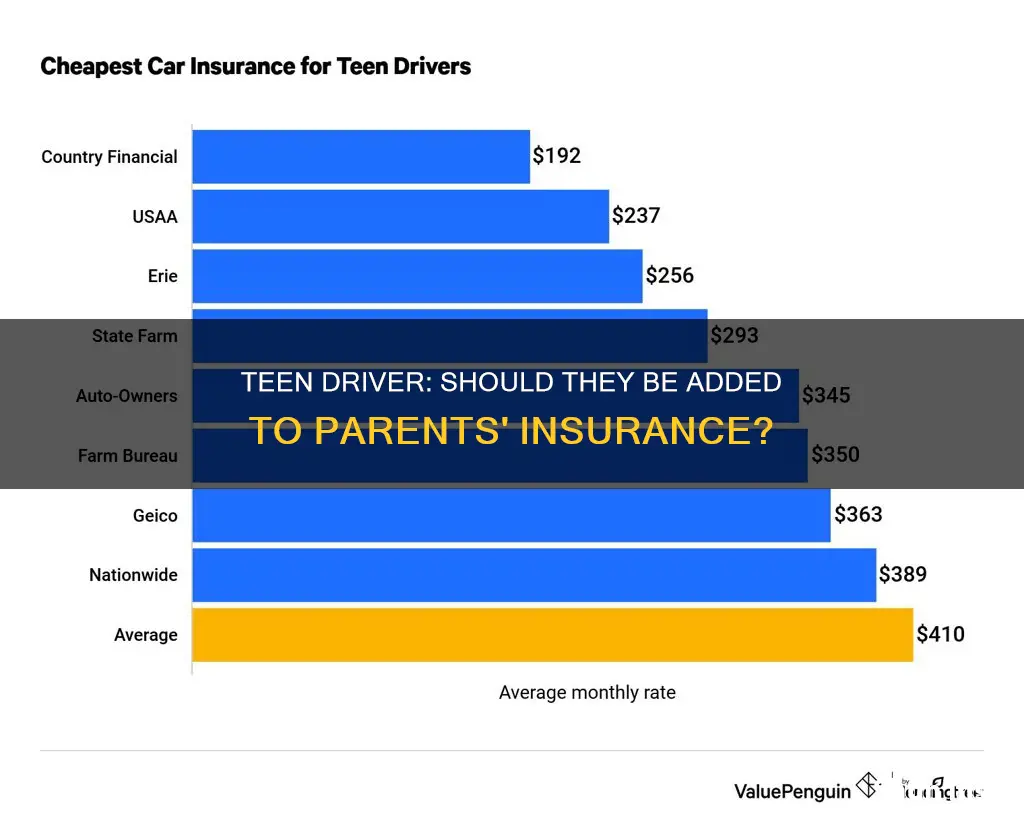

When it comes to adding a teen driver to a parent's insurance policy, understanding the financial implications is crucial. Insurance premiums for young drivers are often significantly higher compared to adults, and this can be attributed to several factors. Firstly, statistics show that teens are more prone to accidents and traffic violations due to their lack of experience and maturity. Insurance companies consider this increased risk when setting premiums, as they need to account for potential claims. The age of the driver is a primary factor, as younger drivers are statistically more likely to be involved in accidents, which directly impacts the insurance provider's financial risk.

The vehicle being insured also plays a role in premium calculations. Sports cars, luxury vehicles, or those with higher performance capabilities tend to have higher insurance rates. These cars are often associated with riskier driving behaviors and can be more expensive to repair in the event of an accident. Additionally, the type of coverage chosen by the parent can influence costs. Comprehensive and collision coverage, which provide extensive protection, typically result in higher premiums compared to liability-only policies.

Another critical factor is the teen's driving record and behavior. Insurance companies closely examine the driving history of the young driver being added to the policy. Any previous accidents, traffic violations, or even speeding tickets will significantly impact the premium rate. Moreover, the parent's driving record is also taken into account, as a history of accidents or violations can lead to higher premiums for both the parent and the teen. This is because insurance providers assess the overall risk associated with the household.

Furthermore, the geographic location can influence premium costs. Urban areas with higher traffic congestion and accident rates often result in increased insurance premiums for teen drivers. Insurance companies consider the local driving conditions and the likelihood of claims when setting rates. Additionally, the parent's credit score and employment status might also play a role, as these factors can indirectly affect the financial stability and responsibility associated with the household.

In summary, adding a teen driver to a parent's insurance policy involves a comprehensive analysis of various factors. Insurance companies consider the teen's age, driving behavior, the vehicle, and the parent's driving record to determine premium costs. Understanding these factors can help parents make informed decisions and potentially explore ways to reduce their insurance expenses while ensuring their teen's coverage. It is essential to review and compare different insurance providers' offers to find the best value for money.

Motorcycle Coverage: Auto Insurance Options

You may want to see also

Driving Record Impact: How a teen's driving record affects insurance rates and policy terms

A teen's driving record is a critical factor in determining insurance rates and policy terms for parents who add their teenage children to their auto insurance policies. Insurance companies view teens as high-risk drivers due to their lack of experience and the associated higher likelihood of accidents and traffic violations. As a result, teens often face higher insurance premiums and more restrictive policy conditions.

The impact of a teen's driving record on insurance rates is significant. Insurance providers typically offer lower rates to drivers with clean records, free of accidents, traffic violations, or claims. When a teen is added to a parent's policy, the insurance company will review the teen's driving history, and any incidents or violations will directly influence the premium amount. For instance, a single at-fault accident can lead to a substantial increase in insurance rates, sometimes doubling or even tripling the cost. Similarly, traffic violations like speeding tickets or driving under the influence (DUI) can result in higher premiums and may even require the teen to pay a higher deductible.

The duration of the policy and the coverage terms can also be affected by a teen's driving record. Insurance companies often impose more stringent conditions on teen drivers, such as limiting the types of vehicles they can drive or restricting the use of the car during certain hours. These restrictions aim to minimize the risk associated with teen drivers. Additionally, some insurers offer usage-based insurance programs, where the teen's driving behavior is monitored through a device or app, and their rates can be adjusted based on safe driving habits.

Parents should also be aware that the teen's driving record will remain on their insurance policy for a certain period, which can impact future premiums. Insurance companies often consider the teen's driving history over a specific period, and any improvements or deterioration in their record will be reflected in subsequent policy renewals. This means that a single accident or violation could have long-term consequences on the teen's insurance rates.

In summary, when adding a teen driver to a parent's insurance policy, it is essential to understand the direct correlation between the teen's driving record and insurance rates. Parents should encourage their teens to maintain a clean driving record by practicing safe driving habits, as this will ultimately benefit both the teen and the family's insurance finances. Regular communication between parents and teens about driving responsibilities and the impact of their actions on insurance costs is crucial in fostering responsible driving behavior.

Night Driving Tickets: Impact on Insurance Premiums

You may want to see also

Discounts and Incentives: Discovering available discounts and incentives for responsible teen driving

When it comes to insuring a teen driver, parents often seek ways to manage costs while ensuring their child's safety on the road. One effective strategy is to explore the various discounts and incentives offered by insurance companies for responsible teen driving. These programs are designed to encourage good driving habits and reward teens for their efforts. Here's a guide to understanding and taking advantage of these opportunities:

Good Student Discounts: Many insurance providers offer discounts to students who maintain a certain grade point average (GPA). This incentive is particularly beneficial for teens who are academically inclined. By presenting proof of their grades, teens can often secure a reduced premium. It's a simple yet effective way to lower insurance costs while acknowledging the importance of academic achievement.

Safe Driving Courses: Enrolling in defensive driving or safe driving courses can be a powerful way for teens to learn and demonstrate their commitment to safe practices. Insurance companies often provide discounts to teens who complete these courses. These programs typically cover topics such as hazard perception, emergency maneuvers, and road sign recognition. By completing such courses, teens not only gain valuable skills but also become eligible for reduced insurance rates.

Driver's Education Programs: Insurance companies often have partnerships with driver's education programs or schools. These programs may offer discounts or incentives to teens who participate in approved driver's education courses. This approach ensures that teens receive comprehensive training and can apply for discounts as a result. It's a win-win situation, as teens gain essential driving skills and insurance companies promote responsible driving.

Good Driving Records: Insurance companies often provide discounts for teens who maintain a clean driving record. This means no traffic violations, accidents, or claims during the policy period. By encouraging responsible behavior, teens can earn significant savings. It's a powerful motivator for teens to stay focused on safe driving and avoid any incidents that could lead to increased premiums.

Loyalty and Multi-Policy Discounts: Some insurance companies offer discounts for long-term customers or those with multiple policies. If a teen driver is already covered under a parent's existing insurance policy, they may be eligible for these discounts. Additionally, combining auto insurance with other policies, such as home or renters insurance, can also lead to savings. It's worth reviewing the parent's insurance policies to see if these discounts apply.

Exploring these discounts and incentives can significantly impact the cost of insuring a teen driver. It's essential for parents to research and compare different insurance providers to find the best deals. Additionally, open communication with the teen about the importance of responsible driving can lead to a better understanding of the financial implications and encourage safer driving habits.

Lower Auto Insurance Costs: Keep Your Plan, Save Money

You may want to see also

Frequently asked questions

Yes, it is common for parents to include their teenage children as an additional driver on their insurance policy. This allows the teen to have access to a vehicle and build their driving record while being covered under the parent's policy.

Adding a teen driver to your insurance policy can provide several advantages. Firstly, it ensures that the teen is legally covered to drive the vehicle. Secondly, it can be more cost-effective for the parent as the teen's premium may be lower compared to having a separate policy. Additionally, it allows the parent to monitor and manage the teen's driving record and any associated claims.

Insurance companies often consider the age and driving experience of additional drivers when calculating premiums. Teenagers typically have higher risk profiles due to their lack of experience, which can result in increased insurance costs for the parent. The impact on rates may vary depending on the insurance provider and the specific circumstances of the teen driver.

Yes, there are usually certain conditions and restrictions. These may include age limits, geographic restrictions, and requirements for the teen to have a valid driver's license. Some insurance companies also offer good student discounts or safe driver programs that can further reduce premiums for responsible teen drivers. It's important to review the policy terms and conditions to understand the specific requirements and benefits.