Ticketmaster's ticket insurance policy can be a source of confusion for many customers. Understanding why you are being charged for this service is essential to ensure you are aware of the benefits and potential drawbacks. Ticket insurance typically covers the cost of your ticket if you are unable to attend the event due to certain unforeseen circumstances, such as illness or travel disruptions. However, it's important to carefully review the terms and conditions to know what is covered and what is not. This paragraph aims to provide a clear explanation of why Ticketmaster offers this service and how it can benefit you.

| Characteristics | Values |

|---|---|

| Purpose | To protect customers from ticket loss, damage, or non-delivery. |

| Cost | Varies depending on the event, venue, and ticket price. |

| Refund Policy | Typically non-refundable, but policies may vary. |

| Benefits | Peace of mind, guaranteed ticket delivery, and potential resale protection. |

| Eligibility | Often available for all ticket types, but may have specific event requirements. |

| Claims Process | Involves submitting proof of loss or non-delivery to Ticketmaster. |

| Alternatives | Some venues offer their own insurance options, or customers can opt for third-party insurance. |

| Legal Considerations | Ticketmaster's insurance policies are subject to terms and conditions, and may vary by region. |

| Customer Feedback | Mixed reviews, with some satisfied with coverage and others criticizing high costs. |

What You'll Learn

- Understanding Ticket Insurance: What is ticket insurance, and how does it work

- Benefits of Insurance: How does insurance protect your ticket purchase

- Refund Policies: What are Ticketmaster's refund policies for insured tickets

- Dispute Resolution: How can you dispute charges with Ticketmaster

- Alternatives to Insurance: Are there cheaper or more effective alternatives to ticket insurance

Understanding Ticket Insurance: What is ticket insurance, and how does it work?

Ticket insurance is a service offered by ticket sellers, such as Ticketmaster, to provide buyers with additional protection and peace of mind when purchasing event tickets. It is essentially a form of insurance that covers potential losses or inconveniences that may arise if the ticket buyer is unable to attend the event due to specific circumstances. This service is often optional and can be added to the ticket purchase at an extra cost, which is why you might see a charge for 'ticket insurance' on your invoice.

The primary purpose of ticket insurance is to safeguard the buyer's investment in the event of unforeseen events. These events could include illness, injury, or other personal emergencies that prevent the ticket holder from attending the event. It also covers situations where the event is canceled or postponed, ensuring that the buyer's money is not wasted. Ticket insurance typically offers financial reimbursement for the ticket price, sometimes including fees and taxes, if the covered event does not take place as scheduled.

How it works is straightforward. When you purchase tickets, you have the option to buy insurance alongside your tickets. This insurance policy will outline the specific circumstances under which you can claim compensation. For instance, it might cover cancellations due to weather, artist cancellations, venue closures, or personal emergencies. If an insured event occurs, the insurance provider will process a claim, and the buyer will receive a refund or credit for the ticket price, often including associated fees.

It's important to note that ticket insurance policies can vary widely in terms of coverage and exclusions. Some policies may offer comprehensive protection, while others might have limitations or specific conditions that must be met to qualify for a claim. Therefore, it is crucial to carefully review the terms and conditions of the insurance policy before purchasing to understand what is covered and what is not. This ensures that you are aware of your rights and the process for making a claim if needed.

In summary, ticket insurance is a valuable service that provides buyers with financial protection and peace of mind when purchasing event tickets. It offers a safety net in case of unexpected events, ensuring that ticket buyers can recover their investment in the event of cancellations or postponements. Understanding the terms and coverage of the insurance policy is essential to make an informed decision and to know your rights as a consumer.

Auto Insurance: Avoid Unnecessary Coverage and Save Money

You may want to see also

Benefits of Insurance: How does insurance protect your ticket purchase?

The concept of ticket insurance is an important aspect of purchasing event tickets, especially for high-demand events where ticket availability is limited. When Ticketmaster charges you for insurance, it is an additional service fee designed to provide peace of mind and protect your investment in the event of unforeseen circumstances. Here's how insurance can benefit your ticket purchase:

- Protection Against Non-Delivery: One of the primary concerns when buying tickets online is the risk of not receiving the tickets at all. Ticket insurance can cover you in case the event organizer fails to deliver the tickets, ensuring you get your entry pass. This is particularly relevant for sold-out events where tickets might be in high demand, and the risk of non-delivery increases. With insurance, you have a safety net, allowing you to attend the event without worrying about potential disappointments.

- Coverage for Ticket Loss or Damage: Sometimes, despite your best efforts, tickets can get lost, damaged, or misplaced. Insurance can provide financial compensation if your ticket is lost or damaged, ensuring you don't miss out on the event due to a technical glitch. This coverage is especially useful for digital tickets, as physical tickets can be easily misplaced or damaged. With insurance, you can focus on enjoying the event rather than worrying about potential ticket-related issues.

- Reimbursement for Ticket Cancellation: Life can be unpredictable, and sometimes, you might need to cancel your attendance at an event due to unforeseen circumstances. Ticket insurance can offer reimbursement if you need to cancel your ticket purchase. This coverage can be a lifesaver if you have to cancel due to illness, travel restrictions, or other legitimate reasons. It ensures that your money is protected, and you can rebook for a future event without incurring significant financial losses.

- Peace of Mind and Convenience: Perhaps the most significant benefit of ticket insurance is the peace of mind it provides. Knowing that your investment is protected against various risks allows you to relax and enjoy the anticipation of the event. Insurance simplifies the process of claiming compensation, ensuring you don't have to navigate complex procedures to get your money back. This convenience factor is especially valuable for last-minute purchases or when dealing with high-stress situations.

In summary, Ticketmaster's insurance charge is a strategic investment in your event experience. It safeguards your ticket purchase, providing coverage for non-delivery, loss, damage, and cancellation. By opting for insurance, you gain a sense of security, ensuring that your event attendance is not compromised by unforeseen events. This additional fee is a small price to pay for the reassurance and convenience it offers.

Understanding Auto Insurance: What is NCB and How it Works

You may want to see also

Refund Policies: What are Ticketmaster's refund policies for insured tickets?

When it comes to Ticketmaster's refund policies for insured tickets, it's important to understand the terms and conditions that come with purchasing insurance. Ticketmaster offers ticket insurance as an additional service, typically at an extra cost, and the refund process can vary depending on the specific circumstances. Here's a breakdown of what you need to know:

Insurance Coverage and Exclusions: Ticketmaster's insurance policies generally cover ticket losses, damage, or cancellations due to unforeseen events. However, it's crucial to review the policy details as there may be certain exclusions. For instance, if the cancellation is due to a venue change or a rescheduled event, the insurance might not provide a full refund. Understanding these exclusions is essential to manage your expectations.

Refund Process: If you have purchased insured tickets and need a refund, the process typically involves contacting Ticketmaster's customer support. They will guide you through the necessary steps, which may include providing proof of the issue (e.g., lost ticket, venue closure). The refund amount will depend on the insurance coverage and the specific situation. In some cases, you might receive a full refund, while in others, it could be a partial refund based on the insurance policy's terms.

Timeframe and Deadlines: Ticketmaster's refund policies often have time constraints. For instance, if a ticket is lost or damaged, you must report the issue promptly to the insurance provider. Delays in reporting may result in reduced or no coverage. Similarly, for cancellations, there might be a deadline for requesting a refund, and late submissions may not be honored. It's advisable to familiarize yourself with these deadlines to ensure a smooth refund process.

Documentation and Proof: To successfully obtain a refund, you will likely need to provide supporting documents. This could include photos of the damaged ticket, a police report for lost tickets, or any relevant communication from the event organizers or Ticketmaster regarding the cancellation. Having these documents ready will streamline the refund process and increase the chances of a successful outcome.

Remember, Ticketmaster's refund policies for insured tickets are designed to provide protection and peace of mind. However, it's essential to be proactive and review the insurance terms before purchasing tickets. Understanding the coverage, exclusions, and refund process will help you navigate any issues that may arise, ensuring a more efficient resolution when needed.

Navigating Auto Insurance Adjustments: Post-Accident Calculations Explained

You may want to see also

Dispute Resolution: How can you dispute charges with Ticketmaster?

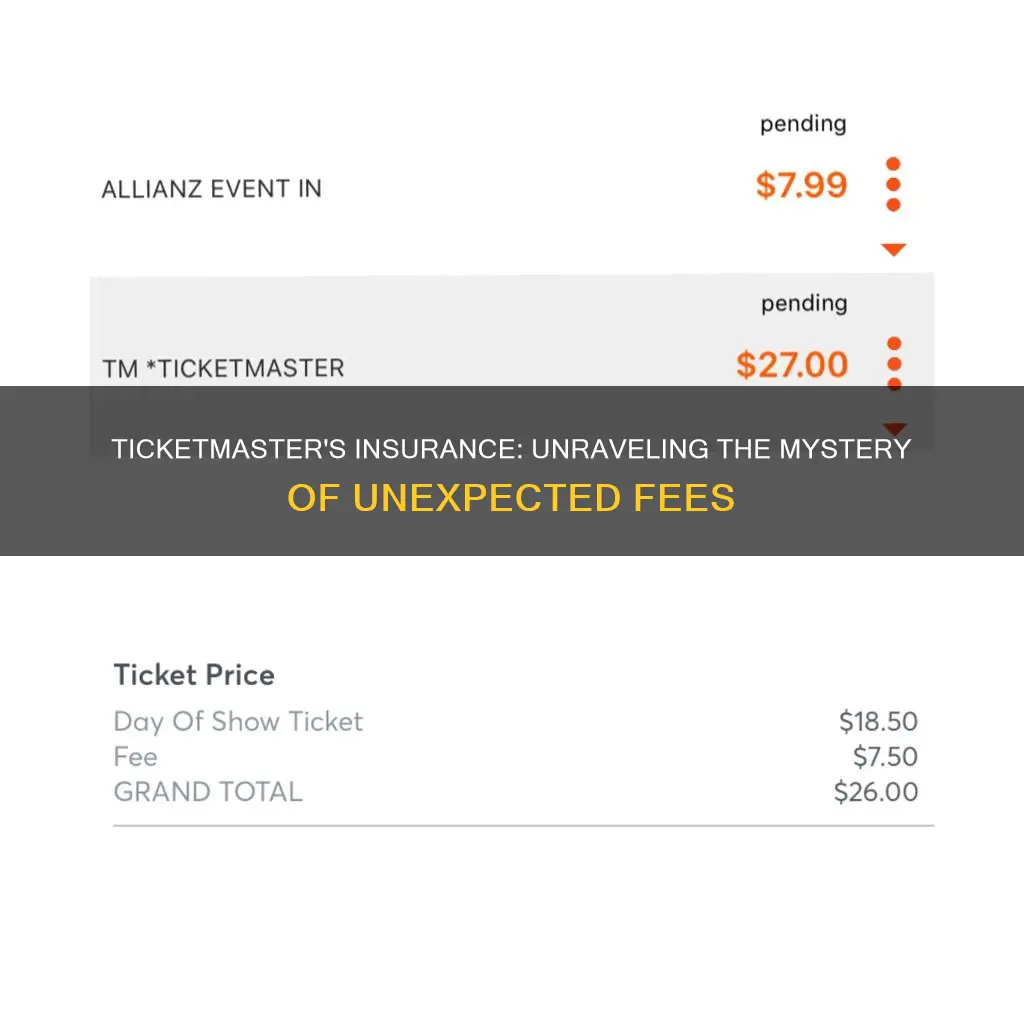

If you've encountered unexpected charges for ticket insurance when purchasing event tickets through Ticketmaster, you're not alone. Many customers have reported similar issues, often feeling misled or confused about the additional costs. Here's a guide on how to dispute these charges and potentially get a refund or resolution.

Understand the Policy: Before initiating a dispute, familiarize yourself with Ticketmaster's ticket insurance policy. This can usually be found in the fine print of your ticket purchase confirmation email or on their website. Look for sections related to "Protection Plans," "Ticket Insurance," or "Refund Policies." Understanding the terms and conditions will help you identify any potential loopholes or justifications for the charges.

Contact Ticketmaster Support: Ticketmaster provides customer support channels, including phone, email, and online chat. Reach out to their support team and clearly explain the situation. Provide details such as your order number, the event date, and the amount charged for insurance. Be prepared to discuss why you believe the insurance was not necessary or was not clearly communicated.

Provide Evidence: Support your claim with evidence. If you feel the insurance was unnecessary, provide documentation or proof that you had alternative arrangements for ticket protection. For example, you could have purchased separate insurance from another provider or had existing coverage through a different company. Screenshots of emails or chat conversations with Ticketmaster representatives can also be useful.

Follow the Dispute Process: Ticketmaster may have a specific dispute resolution process in place. They might ask you to fill out a form or provide additional information. Be thorough and provide all the necessary details to support your case. The company may investigate the issue and, if they find in your favor, refund the insurance charges or offer an alternative resolution.

Consider External Dispute Resolution: If Ticketmaster's support team is unresponsive or unable to resolve your issue, you can explore external dispute resolution options. Many credit card companies and payment processors offer dispute resolution services. You can file a dispute through your bank or credit card issuer, who may investigate the charges and potentially refund the amount charged. Make sure to follow the specific procedures and timelines provided by your financial institution.

Auto Insurance Basics: What Every Driver Should Know

You may want to see also

Alternatives to Insurance: Are there cheaper or more effective alternatives to ticket insurance?

The concept of ticket insurance is often a point of contention for many consumers, as they question its necessity and value. When Ticketmaster or similar platforms offer insurance as an add-on service, it can be an additional cost that some may consider unnecessary. The primary argument against ticket insurance is that it often provides limited benefits, especially in the context of event cancellations or rescheduling, which are typically covered by the event organizers or the venue.

One alternative to ticket insurance is to purchase tickets directly from the event organizers or the venue. Many events now offer an option to buy tickets without the insurance add-on, allowing customers to avoid the extra charge. This direct purchase method can sometimes be more cost-effective, especially if the event organizers have a policy to cover cancellations or rescheduling. By buying directly, you also gain a better understanding of the event's policies and any potential risks associated with the purchase.

Another strategy is to research and compare different ticket sellers and their policies. Some ticket resellers or secondary market platforms may offer more comprehensive protection or even waive the insurance fee if you buy tickets through them. It's worth exploring these options, as they might provide better coverage or more flexibility in case of unforeseen circumstances. For instance, some platforms might offer a full refund if an event is canceled, which could be a more appealing and cost-effective solution compared to insurance.

Additionally, consumers can consider the following:

- Event Cancellation Policies: Before purchasing tickets, review the event's cancellation and rescheduling policies. Many events have built-in protections, and understanding these policies can help you decide if insurance is necessary.

- Resale Market Options: If you're concerned about potential issues, consider buying tickets from the resale market, where sellers might offer better protection or refunds in case of event changes.

- Group Purchases: When buying tickets in groups, some platforms or organizers might provide group discounts or additional benefits that could offset the insurance cost.

In summary, while ticket insurance might seem like a safety net, it's essential to explore alternatives and make informed decisions. By purchasing tickets directly, comparing sellers, and understanding event policies, consumers can potentially avoid unnecessary fees and have more control over their ticket purchases. This approach can lead to significant savings and a more satisfying ticket-buying experience.

Fleet Auto Insurance: Understanding Commercial Vehicle Coverage

You may want to see also

Frequently asked questions

Ticket insurance is often added to your order automatically by Ticketmaster as a default option to protect your ticket purchase. This is a common practice to ensure that you have coverage in case of ticket loss, damage, or inability to attend the event. If you feel this was not your intention, you can review your purchase history and contact Ticketmaster support to address any concerns or discrepancies.

Ticketmaster's insurance typically provides protection against various scenarios, such as ticket loss, theft, or damage. It may also offer coverage if you are unable to attend the event due to certain unforeseen circumstances, such as illness or travel issues. The specific terms and conditions of the insurance can vary, so it's essential to review the policy details provided by Ticketmaster during the purchase process.

Yes, you usually have the option to decline the insurance offer during the checkout process. If you choose not to purchase insurance, your ticket price will be adjusted accordingly. Keep in mind that without insurance, you may be responsible for the full cost of the ticket if any issues arise. It's a personal decision based on your preferences and risk tolerance.

If you realize you no longer require the insurance coverage, you can contact Ticketmaster's customer support team. They may provide a process to cancel or adjust the insurance portion of your purchase. However, please note that insurance policies often have specific terms and conditions, and cancellations might be subject to certain fees or limitations.