Knowing who currently insures your assets or possessions is an important step in managing your insurance coverage effectively. Whether it's your home, car, or other valuable items, understanding the details of your insurance policies can help ensure you're adequately protected. This knowledge is crucial for making informed decisions about renewals, policy changes, or claims, and it can also help you identify any gaps in your coverage. In this guide, we'll explore the steps you can take to determine who currently insures your belongings and how to verify the details of your insurance policies.

What You'll Learn

- Check Policy Documents: Review your insurance policy documents for the insurer's name and contact information

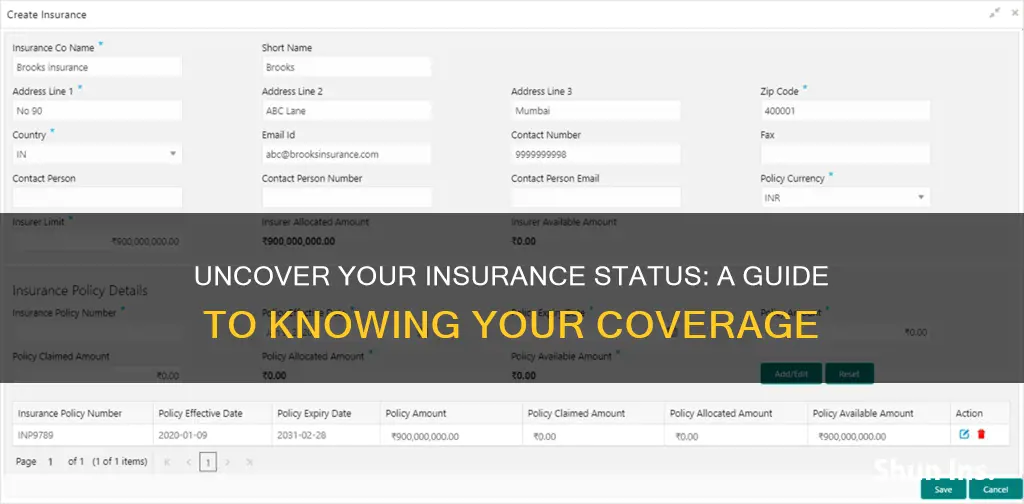

- Online Account Access: Log in to your online account to view policy details and insurer information

- Contact Your Broker: Reach out to your insurance broker for confirmation of the current insurer

- Review Bank Statements: Check bank statements for insurance premium payments to identify the insurer

- Ask Your Agent: Contact your insurance agent for a list of current insurance providers

Check Policy Documents: Review your insurance policy documents for the insurer's name and contact information

To determine who currently insures you, a crucial step is to review your insurance policy documents. These documents contain essential information about your insurance coverage, including the name of the insurance company and their contact details. Here's a detailed guide on how to check your policy documents:

Locate Your Policy Documents: Start by finding all the documents related to your insurance policies. These typically include insurance certificates, policy summaries, and any other paperwork you've received from the insurance provider. They might be in physical form or stored digitally, so check your email, insurance company portals, and physical mail.

Identify the Insurer: Within the policy documents, look for sections that provide details about the insurance company. This information is usually found in the 'Insurer's Information' or 'Insurance Company' section. It may include the name of the insurance company, their address, and contact numbers. For instance, it might state, "Insured by: ABC Insurance Company, 123 Main Street, Contact: 555-1234."

Verify Contact Information: Ensure that the contact details provided in the policy documents are accurate and up-to-date. This includes the phone number, email address, and any other communication channels the insurer provides. Having the correct contact information is vital in case you need to file a claim or make changes to your policy.

Online Resources: Many insurance companies now offer online portals where you can access your policy information. Log in to your account on their website to view your policy details, including the insurer's name and contact information. This can be a convenient way to quickly access the information you need.

By thoroughly reviewing your policy documents, you can easily identify the insurance company and their contact details, ensuring you have the necessary information readily available when you need it.

E-Cigs: Insurance's Tobacco Conundrum

You may want to see also

Online Account Access: Log in to your online account to view policy details and insurer information

To determine who currently insures your policy, one of the most straightforward methods is to access your online account. This process is often quick and provides immediate access to the necessary information. Here's a step-by-step guide on how to do this:

First, locate your online account login credentials. These are typically provided when you initially set up your account or can be found in your policy documents. If you've misplaced them, contact your insurance provider's customer support for assistance. Once you have the login details, open your preferred web browser and enter the URL of your insurance company's website. Look for the 'Customer Login' or 'Account Access' section on the homepage. Enter your username and password to log in. After a successful login, you will be directed to your account dashboard, which is a personalized page that displays various policy-related information.

On the dashboard, navigate to the 'Policy Details' or 'Coverage Information' section. Here, you should find all the relevant policy information, including the name of the insurance company and the policyholder's details. The insurer's name might be listed as the 'Insurer' or 'Underwriter' and will be clearly displayed. Additionally, you can often find contact information for the insurer, such as a phone number or email address, which can be useful if you need to reach out for any reason.

If you encounter any issues during the login process or cannot find the required information, the online account system usually provides a 'Forgot Password' or 'Contact Support' option. Utilize these features to reset your password or seek assistance from the insurance company's customer service team. They can guide you through the process and ensure you have access to the necessary details.

Online account access is a convenient way to stay informed about your insurance policies and quickly identify the insurer. It empowers you to take control of your insurance information and make any necessary updates or inquiries. Remember, keeping your login credentials secure and up-to-date is essential to ensure uninterrupted access to your policy details.

The Surgery Billing Process: Understanding When Hospitals Bill Insurance

You may want to see also

Contact Your Broker: Reach out to your insurance broker for confirmation of the current insurer

If you're unsure about who is currently insuring your vehicle or property, a practical step is to contact your insurance broker. This individual acts as an intermediary between you and insurance companies, providing guidance and support throughout the insurance process. Here's how you can utilize their expertise to confirm the current insurer:

Reach out to your broker and inquire about the insurance coverage for your specific policy. Provide them with all the necessary details, including your policy number, the type of insurance (e.g., auto, home), and any relevant personal information. Brokers have access to your policy information and can quickly retrieve the current insurer's name and contact details. They can also explain the terms and conditions of your policy, ensuring you understand the coverage and any potential changes.

During the conversation, ask for a confirmation of the current insurer and their contact information. Your broker should be able to provide you with the name of the insurance company, the policy number, and the specific contact person or department to reach out to. This information will enable you to directly communicate with the insurer if needed.

Additionally, brokers can offer valuable insights into the insurance market and may be able to provide recommendations or suggestions for policy upgrades or changes if necessary. They can also assist in negotiating premiums or policy terms on your behalf, ensuring you receive the best value for your insurance needs.

Remember, insurance brokers are a valuable resource and can simplify the process of confirming your insurance coverage. They can provide clarity and guidance, ensuring you have the most up-to-date information about your insurance policies.

Unraveling the Mystery: Understanding U.S. Insurance Services

You may want to see also

Review Bank Statements: Check bank statements for insurance premium payments to identify the insurer

To determine who currently insures you, one of the most straightforward methods is to review your bank statements. This approach is particularly useful if you have been paying insurance premiums through direct debit or online payments. Here's a step-by-step guide on how to do this:

- Access Your Bank Statements: Start by logging into your online banking portal or opening your physical bank statement. Ensure you have access to statements covering the period you believe your insurance premiums were paid.

- Search for Insurance Premium Payments: Navigate through the statements to find transactions related to insurance. These payments often appear as 'Insurance Premium,' 'Insurance Payment,' or similar descriptions. They might also include the name of the insurance company or a reference number.

- Identify the Insurer: Once you locate the insurance premium payments, take note of the merchant or payee name associated with those transactions. This information will reveal the insurance company or provider you are currently paying. For example, if the payment is listed as 'ABC Insurance Co.,' then that is your insurer.

- Verify Multiple Payments: If you have multiple insurance policies, you might find several premium payments on your statements. In such cases, review the payment amounts and dates to ensure they match the policy terms. This step is crucial to confirm that you are paying the correct insurer for each policy.

- Cross-Reference with Policy Documents: While reviewing bank statements is a convenient way to identify insurers, it's also beneficial to cross-reference this information with your insurance policy documents. Compare the names and details of the insurers mentioned in your statements with those in your policy paperwork to ensure accuracy.

By following these steps, you can efficiently use your bank statements to identify the insurers for your various insurance policies, providing you with a clear overview of your insurance coverage and payment history. This method is especially helpful when you are unsure about the insurers or when you need to update your records for any reason.

Ask Your Agent: Contact your insurance agent for a list of current insurance providers

If you're unsure about who is currently insuring your assets, vehicle, or health, a great starting point is to reach out to your insurance agent. They are your primary point of contact and have a comprehensive understanding of your insurance portfolio. Here's how you can leverage this relationship to get the information you need:

Initiate a Conversation: Start by scheduling a meeting or phone call with your insurance agent. This direct approach ensures you receive personalized attention and accurate details. During the conversation, clearly communicate your request for a list of current insurance providers. Be specific about the types of insurance you're inquiring about (e.g., auto, home, health).

Ask for a Comprehensive Overview: Encourage your agent to provide a detailed breakdown of your insurance coverage. This may include a list of companies that underwrite your policies, along with policy numbers and contact information for each insurer. By gathering this information, you'll have a clear picture of who is involved in your insurance coverage.

Inquire About Policy Details: While discussing with your agent, don't hesitate to ask about the specific terms and conditions of each policy. This includes coverage limits, deductibles, and any unique features or exclusions. Understanding these details will help you assess the adequacy of your coverage and make informed decisions if adjustments are needed.

Review and Compare: Once you receive the list of insurers, take the time to review their offerings. Compare policies, coverage options, and premiums to identify any discrepancies or areas where you might be over-insured or under-insured. This process empowers you to make necessary adjustments and optimize your insurance strategy.

Maintain Open Communication: Regularly engaging with your insurance agent is essential. They can provide valuable insights and recommendations based on your specific circumstances. By staying in touch, you ensure that your insurance coverage remains relevant and aligned with your evolving needs.

PMI Insurance: Changing Your Policy

You may want to see also

Frequently asked questions

To determine your current insurance provider, you can start by checking your insurance documents. These documents often include the name of the insurance company and their contact information. If you no longer have the physical documents, you can reach out to your insurance agent or broker, who should be able to provide you with this information. Alternatively, you can log in to your online account with the insurance company, where you can usually find details about your policies and the insurer.

If you've recently moved and can't locate your insurance documents, don't worry. You can still find out who your insurer is by contacting your previous address's insurance agent or broker. They should have records of your policies and can provide you with the necessary information. Additionally, you can use online resources or search tools to look up your insurance policies by providing your personal details, such as your name, address, and policy numbers.

Yes, there are a few other methods to verify your insurance coverage. You can contact your current insurance provider directly and ask for a list of your active policies. They might also provide you with a summary of your coverage and the associated policy numbers. Another approach is to use a third-party service or website that aggregates insurance information. These platforms allow you to input your personal details and may display your current insurance policies, including the insurer's name.