The cost of surgery can be incredibly high, and the billing process can be confusing. In the past, patients were expected to pay their copays at the time of service, but charges that counted towards the deductible would be billed after the fact. However, in recent years, it has become more common for hospitals to ask patients to pay their deductibles before receiving medical services. This can be stressful for patients, especially if they are facing unexpected or emergency procedures.

There are a variety of factors that contribute to the high cost of surgery, including the type of surgery, whether it is inpatient or outpatient, the use of anesthesia, the healthcare facility, and the patient's insurance coverage. Surgery costs can also be affected by the patient's health circumstances, the cost of lab tests, X-rays, medications, and other factors.

To help patients manage the financial burden, hospitals may offer payment plans or connect them to financial assistance programs. Patients can also borrow from retirement savings, take out loans, or consider medical tourism to reduce the cost of surgery. It is important for patients to understand their insurance coverage and ask questions about their bills to ensure they are being charged correctly.

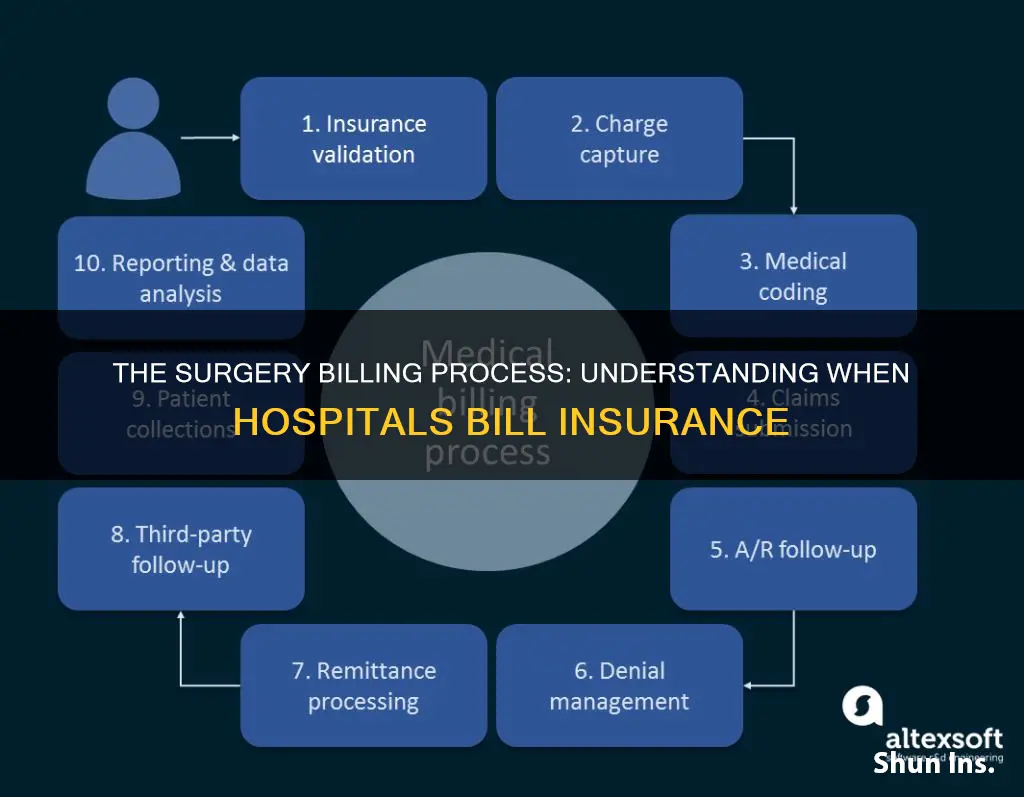

| Characteristics | Values |

|---|---|

| When hospitals bill insurance for surgery | After the surgery has been performed |

| Who does the billing | The billing department |

| When patients are billed | Before or after the surgery |

| Who does the billing | The hospital or the individual providers |

| What is included in the bill | Cost of the surgical suite, hospital care before and after surgery, X-rays and other tests, visits before and after surgery |

| How to reduce fees | Choose in-network providers, negotiate better rates, ask to pay the insurer-negotiated rate |

| Payment methods | Retirement savings, unsecured loans, home equity loans, credit cards, payment plans, health sharing programs, government or charitable assistance |

What You'll Learn

Prepaying hospital bills

Know Your Options

Before agreeing to prepay, it is important to understand your options. Hospitals often use software to estimate what you will owe after insurance pays its portion. This estimate includes your deductible, copays, and possibly coinsurance, which is a percentage of the total bill. However, these estimates may not always be accurate, so it is advisable to contact your insurance company directly to understand your out-of-pocket costs better.

Understand the Benefits and Risks

Prepaying your hospital bill can come with certain benefits and risks. On the one hand, prepaying can provide you with a discount on your bill, with some hospitals offering "prompt-pay" discounts for patients who pay their share in full in advance. This can result in significant savings, with discounts ranging from 10% to 20% or even higher.

On the other hand, prepaying can also have its drawbacks. Once the hospital has your money, they may be less inclined to offer discounts or financial assistance. Additionally, if you end up overpaying, getting a refund can be a hassle and may require multiple follow-ups with the hospital.

Assess Your Financial Situation

When considering prepayment, it is crucial to assess your financial situation. Can you afford to pay the bill upfront? Do you have the funds readily available, or will you need to take out a loan? Remember that medical loans or putting the payment on a high-interest credit card can be costly, so it is important to understand the terms and conditions before committing.

Negotiate and Ask Questions

If you decide to prepay, don't be afraid to negotiate. Ask the hospital about any discounts or financial assistance programs they offer. Find out if there are any extended payment terms that can provide you with more flexibility. Additionally, ask for a cost estimate and understand the hospital's refund policy if you end up overpaying.

Understand Your Rights

It is important to know your rights when it comes to prepaying hospital bills. In most cases, you cannot be required to pay upfront, especially if you have government-sponsored insurance like Medicare, Medicaid, or Tricare military insurance. While it is not illegal to be asked about paying in advance, withholding treatment for non-payment is unethical and generally not done.

Weigh the Pros and Cons

Finally, weigh the pros and cons of prepaying. Consider the potential savings and the convenience of having your bill settled upfront. However, also think about the possibility of overpayment and the potential challenges of getting a refund. Ultimately, the decision to prepay depends on your financial situation, the hospital's policies, and your comfort level with the arrangement.

Out-of-pocket costs

For example, the cost of surgery without insurance can range from $4,000 to $170,000, depending on the procedure. More intensive and complex surgeries, such as organ transplants or heart bypasses, tend to be more expensive due to factors such as pre and post-operative hospital stays, pre-surgical treatments, and anti-rejection medications. On the other hand, less intensive procedures like LASIK eye surgery may cost around $4,000.

The location of the surgery can also impact the cost. Procedures performed in outpatient hospitals or ambulatory surgical centers tend to have higher out-of-pocket costs compared to office-based procedures. Additionally, the type of anesthesia used can affect the cost, with general anesthesia typically being more expensive than local or regional anesthesia.

It is important to note that out-of-pocket costs have been increasing at a faster rate than the total insurance reimbursement paid to the provider and facility. This means that patients are bearing a greater financial burden for their surgical care. To mitigate this, patients should discuss cost concerns with their providers and ask about possible ways to reduce fees. Additionally, patients should review their insurance coverage and understand their out-of-pocket maximums to avoid unexpected expenses.

If a patient does not have insurance or their insurance does not cover the surgery, there are alternative financing options available, such as borrowing from retirement savings, taking out loans, or arranging payment plans with the hospital. However, these options should be carefully considered as they may come with their own set of risks and challenges.

Understanding Your Insurance Bill: Decoding the Contracted Amount

You may want to see also

Coinsurance

It is important to understand the coinsurance requirements of your insurance plan, as well as any other applicable costs such as deductibles, copays, and out-of-pocket maximums. These factors will determine how much you will have to pay for surgery and other medical procedures.

Unraveling the Intricacies of Insurance: Exploring Trade Dress Infringement

You may want to see also

In-network providers

However, even if you go to an in-network hospital for surgery, you may still receive a "surprise" or "balance" bill from out-of-network providers who treated you at the hospital. This can include radiologists, anesthesiologists, pathologists, and surgeons assisting your in-network surgeon. In such cases, your insurance plan may not cover any out-of-network care, leaving you to pay the full cost, or they may cover part of it but at a lower rate than the provider charges, and you will be responsible for the difference.

To avoid surprise billing, it is important to inform your doctor in advance that you only want to use in-network providers. Check with your insurer to ensure that the specific providers involved in your care are indeed in your network. Ask your insurer what you can do to avoid being balance billed, and request that any doctors assigned to your case by the hospital are in your plan's network.

If you do receive a surprise bill, you may try to negotiate with the provider or your insurer, although they are not obligated to accept a lower payment. In some states, such as New York, there are special protections for consumers who are balance billed. Additionally, the No Surprises Act, which went into effect on January 1, 2022, protects you from unexpected out-of-network bills in certain situations, such as emergency room visits and non-emergency care related to a visit to an in-network facility.

Understanding Insurance Coverage for Wheelchairs: A Guide to Billing and Costs

You may want to see also

Billing errors

Duplicate Billing

This occurs when a patient is billed twice for the same test, exam, treatment, or procedure. This can create extra administrative work and can make it look like the patient received multiple services in one day.

Incorrect Billing

This happens when a patient is billed for incorrect services or for services they never received. It can also include billing a patient for a service that was scheduled but later cancelled. Incorrect billing can also include omitting vital information on a claim, such as incorrect patient or provider information.

Unbundling

This occurs when services that are typically performed together are billed under separate codes, which can inflate the profits for the practice or centre.

Upcoding and Undercoding

Upcoding occurs when a diagnosis is upgraded to a more serious condition, requiring a more expensive treatment. Undercoding happens when a provider leaves off a billing code for a less expensive procedure, possibly to save money for the patient. Both practices can be considered fraudulent and can result in penalties and damage to the practice's reputation.

Confusing a Denied Claim with a Rejected Claim

A denied claim is one that has been found to be unpayable by the insurance company, usually due to billing errors or omitted information. A rejected claim, on the other hand, is one that has been declined due to incorrect or incomplete information, such as transposed digits in a patient's identification number.

To avoid billing errors, it is important for medical practices to use electronic software that categorizes billing and to ensure that staff are trained on billing procedures and codes. Patients should also be vigilant in reviewing their medical bills and should not be afraid to ask for an itemized bill if something seems off.

Unraveling the Billing Process: Navigating Copays and Secondary Insurance

You may want to see also

Frequently asked questions

The cost of surgery varies depending on the type of surgery, the facility, and the patient's insurance coverage. Some common surgeries can cost over $100,000, with heart valve replacement being one of the most expensive at $170,000 on average.

It can take a few weeks to several months to receive a bill for surgery, as the hospital first has to send a claim to your insurer and wait for their payment before billing you for the remaining amount.

Yes, you may be able to negotiate a lower rate for your surgery, especially if you are paying out-of-pocket. It is best to discuss this with the billing department before the procedure.

If you are unable to pay your surgery bill, you can try contacting the hospital's billing department to set up a payment plan or apply for financial assistance programs, sometimes called "charity care," which offer free or discounted care to those who qualify.