MaxCare Service Insurance is a comprehensive insurance plan designed to provide extensive coverage for various services and needs. This insurance offers a wide range of benefits, including coverage for medical expenses, home repairs, auto services, and more. With MaxCare, policyholders can enjoy peace of mind knowing that their essential services and everyday needs are protected. The plan is tailored to meet diverse requirements, ensuring that individuals and families can access reliable and efficient services without financial strain. Whether it's unexpected medical bills, home maintenance issues, or auto-related repairs, MaxCare Service Insurance aims to deliver comprehensive support, making it a valuable asset for anyone seeking reliable and all-encompassing coverage.

What You'll Learn

- Coverage Details: MaxCare offers comprehensive insurance with specific coverage details

- Customer Service: Efficient and friendly customer service is a key feature

- Claims Process: Streamlined claims process ensures quick resolution and support

- Network Providers: Access to a wide network of healthcare providers

- Cost Management: MaxCare helps manage healthcare costs effectively

Coverage Details: MaxCare offers comprehensive insurance with specific coverage details

MaxCare Service Insurance provides a wide range of coverage options to meet various insurance needs. This comprehensive insurance plan is designed to offer peace of mind and financial protection for individuals and families. Here are the key coverage details to understand:

Medical Expenses: MaxCare covers a broad spectrum of medical expenses, ensuring that policyholders can access necessary healthcare services without financial burden. This includes coverage for doctor visits, hospital stays, emergency room visits, and various medical procedures. The policy typically has a set of covered services, and any medical treatment not listed may require additional coverage or a separate policy.

Prescription Drugs: One of the critical aspects of MaxCare is its prescription drug coverage. It provides financial assistance for medications prescribed by healthcare professionals. This coverage ensures that individuals can afford their necessary medications, especially those with chronic conditions requiring long-term medication. MaxCare may offer a network of preferred pharmacies, offering discounted rates or additional benefits for prescription pickups.

Preventive Care and Wellness: MaxCare emphasizes the importance of preventive care and includes coverage for routine check-ups, vaccinations, and wellness programs. This aspect of the insurance encourages policyholders to take a proactive approach to their health. By covering preventive care, MaxCare aims to reduce the risk of developing severe health issues and promote overall well-being.

Specialist Referrals and Second Opinions: The insurance plan may also cover specialist referrals, allowing policyholders to access expert medical opinions and treatments. This feature ensures that individuals can receive specialized care when needed, promoting better health outcomes. Additionally, MaxCare might offer coverage for second opinions, empowering individuals to make informed decisions about their treatment plans.

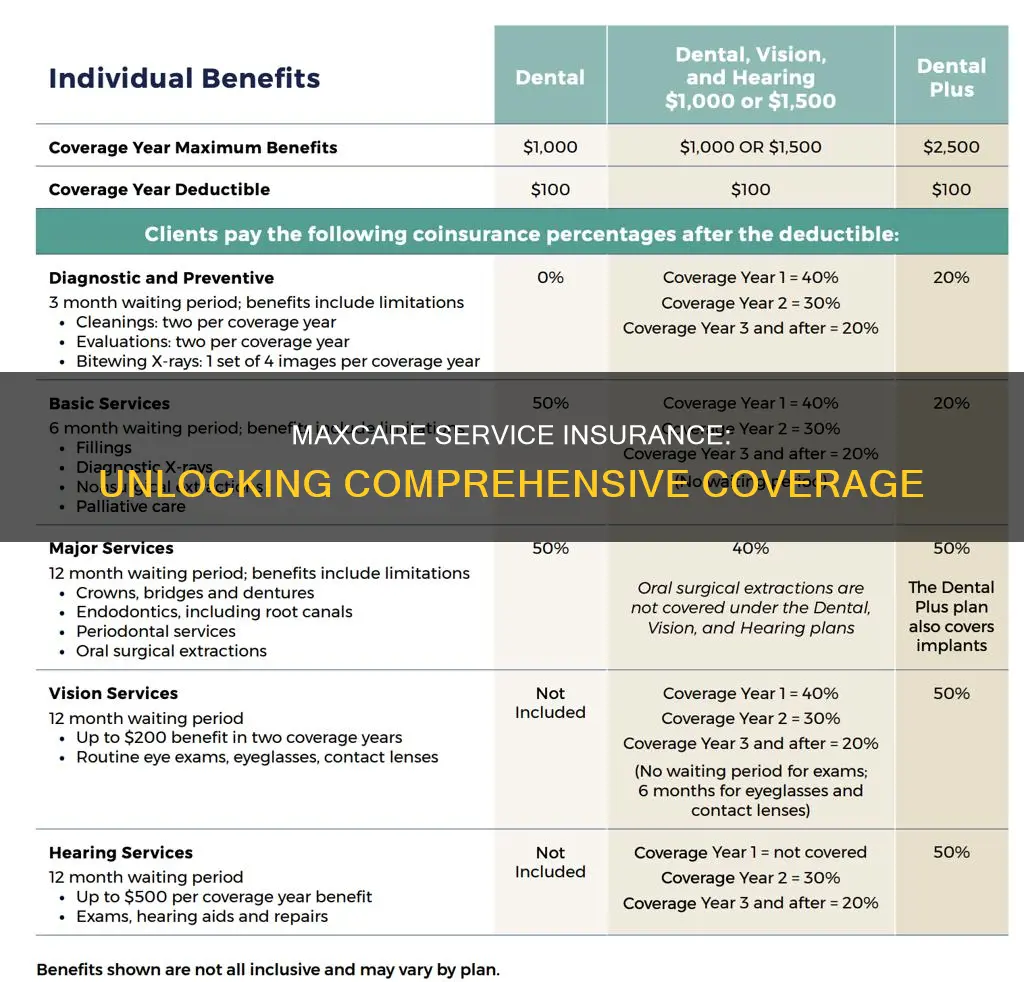

Additional Benefits: MaxCare's comprehensive nature may include other benefits such as coverage for dental care, vision care, and alternative therapies. These additional benefits can vary depending on the specific plan chosen, so it's essential to review the policy details to understand the extent of coverage for these services.

Understanding the coverage details of MaxCare Service Insurance is crucial for making informed decisions about your healthcare and financial protection. It is recommended to review the policy documents or consult with insurance representatives to ensure you have a comprehensive understanding of the benefits and any potential limitations.

Root Your Phone Safely: Asurion Insurance Tips

You may want to see also

Customer Service: Efficient and friendly customer service is a key feature

MaxCare Service Insurance prides itself on offering an exceptional customer service experience, ensuring that every interaction is efficient, friendly, and tailored to meet the needs of our valued customers. We understand that insurance can be a complex and often stressful topic, so our primary goal is to provide a seamless and positive experience from the moment a customer reaches out to us.

Our customer service team is the cornerstone of this commitment. They are trained to handle a wide range of inquiries, from policy explanations to claims processing, with the utmost professionalism and expertise. When a customer contacts us, they are greeted by a knowledgeable representative who listens attentively to their concerns and queries. This personalized approach ensures that each customer feels valued and understood, fostering a sense of trust and loyalty.

Efficiency is a key aspect of our customer service philosophy. We strive to minimize wait times and resolve issues promptly. Our representatives are equipped with the necessary tools and resources to provide quick solutions, ensuring that customers don't have to endure long hold times or repetitive explanations. Whether it's assisting with policy updates, providing quotes, or guiding customers through the claims process, our team is dedicated to streamlining every step to make the experience as smooth as possible.

Friendliness is another essential element of our customer service culture. We believe that a positive and approachable attitude can significantly impact the overall customer experience. Our representatives are encouraged to use a friendly tone, ask relevant questions, and offer helpful suggestions. By creating a warm and welcoming environment, we aim to build long-lasting relationships with our customers, making them feel at ease and confident in their insurance choices.

Furthermore, we go the extra mile to ensure customer satisfaction by offering multiple communication channels. In addition to phone support, we provide live chat and email services, allowing customers to choose their preferred method of contact. This flexibility ensures that our customers can reach out whenever and however they prefer, receiving prompt responses and personalized assistance.

In summary, MaxCare Service Insurance's customer service is designed to be a seamless blend of efficiency and friendliness. By prioritizing customer satisfaction, we aim to build a strong reputation as a reliable and approachable insurance provider, ensuring that our customers feel supported and valued throughout their insurance journey.

Becoming an Insurance Underwriter: A Step-by-Step Guide

You may want to see also

Claims Process: Streamlined claims process ensures quick resolution and support

MaxCare Service Insurance offers a comprehensive claims process designed to provide a seamless and efficient experience for policyholders. This streamlined approach aims to minimize the time and effort required to resolve claims, ensuring that customers receive the support they need promptly. Here's an overview of the claims process:

When a policyholder needs to file a claim, they can initiate the process by contacting MaxCare's dedicated claims department. This can be done via phone, email, or through the company's online portal, which is user-friendly and secure. The claims team is trained to handle various claim types, including medical, property damage, and liability claims. Upon receiving the claim, the adjuster will review the policy details, gather relevant information, and assess the validity and coverage of the claim. This initial step is crucial to ensure that all necessary documentation and evidence are obtained to support the claim.

The next phase involves a thorough investigation and verification process. Adjusters will collect and analyze all available information, including medical records, repair estimates, police reports, and witness statements. This step is essential to determine the accuracy and validity of the claim. MaxCare's team is committed to maintaining the highest standards of professionalism and confidentiality throughout this process. They will keep the policyholder informed about the progress of their claim, providing updates and addressing any concerns promptly.

Once the claim is fully assessed and all necessary documentation is verified, MaxCare initiates the payment process. The company aims to provide quick settlements, ensuring that policyholders receive their rightful compensation without unnecessary delays. The payment methods vary depending on the claim type, and MaxCare offers flexibility in accommodating the policyholder's preferences. Whether it's a direct deposit, check, or another agreed-upon method, the company strives to make the payment process as smooth as possible.

Throughout the entire claims process, MaxCare Service Insurance maintains open communication with its policyholders. They provide regular updates, ensuring that customers are well-informed about the status of their claim. This transparent approach helps build trust and confidence in the company's services. Additionally, MaxCare offers support and guidance to policyholders, especially during challenging times, to ensure a positive and stress-free experience.

In summary, MaxCare Service Insurance's streamlined claims process is designed to be efficient, transparent, and supportive. By following a structured approach, the company ensures that policyholders receive the necessary assistance promptly. This includes a thorough investigation, verification, and payment process, all while maintaining open communication and providing a positive customer experience.

Safeco Insurance Low-Mileage Coverage

You may want to see also

Network Providers: Access to a wide network of healthcare providers

MaxCare Service Insurance offers a comprehensive network of healthcare providers, ensuring that policyholders have access to a wide range of medical professionals and services. This network is designed to provide efficient and convenient healthcare solutions, catering to various medical needs. Here's a detailed breakdown of the benefits:

The insurance plan's network includes an extensive list of doctors, specialists, and healthcare facilities across different medical fields. From primary care physicians to specialists in cardiology, neurology, and pediatrics, the network covers a broad spectrum of medical expertise. This extensive coverage ensures that individuals can access the right healthcare professionals for their specific needs, promoting efficient and effective treatment. Whether it's a routine check-up, a specialist consultation, or a complex medical procedure, MaxCare Service Insurance provides access to a diverse range of healthcare providers.

In addition to doctors and specialists, the network also comprises various healthcare facilities, including hospitals, clinics, and diagnostic centers. These facilities are strategically located to ensure easy access for policyholders. The insurance plan aims to reduce the hassle of searching for suitable healthcare providers by offering a centralized network, making it convenient for individuals to find and access the necessary medical services. With this network, individuals can receive comprehensive care, from initial consultations to specialized treatments and follow-up care, all within a well-connected healthcare ecosystem.

One of the key advantages of MaxCare Service Insurance's network is the emphasis on quality and coordination of care. The network providers are carefully selected based on their expertise, reputation, and commitment to providing high-quality healthcare. This ensures that policyholders receive the best possible treatment and that their healthcare journey is seamless and well-managed. The network also promotes collaboration between healthcare providers, allowing for better coordination and continuity of care, which is essential for managing complex medical conditions and ensuring optimal health outcomes.

Furthermore, the insurance plan's network provides access to preventive care and wellness services. This includes regular health screenings, vaccinations, and wellness programs aimed at promoting a healthy lifestyle. By encouraging preventive care, MaxCare Service Insurance helps policyholders take proactive measures to maintain their health and well-being, potentially reducing the risk of more serious medical issues in the future. This aspect of the network highlights the insurance company's commitment to long-term health management and disease prevention.

In summary, MaxCare Service Insurance's network of healthcare providers is a robust and comprehensive system designed to cater to various medical needs. With access to a wide range of specialists, facilities, and preventive care services, policyholders can benefit from efficient, high-quality healthcare. The insurance plan's focus on a well-connected network ensures that individuals can navigate the healthcare system with ease, receiving the necessary care and support for their overall well-being.

Understanding Insurance Billing with Quest Diagnostics: A Guide to Navigating the Process

You may want to see also

Cost Management: MaxCare helps manage healthcare costs effectively

MaxCare is a comprehensive insurance service designed to manage healthcare costs efficiently and provide a wide range of benefits to its members. One of its key strengths lies in its ability to help individuals and families navigate the complex landscape of healthcare expenses, ensuring that they receive the necessary care without breaking the bank. Here's how MaxCare excels in cost management:

Preventive Care and Wellness Programs: MaxCare emphasizes preventive care, which is a cost-effective strategy to maintain health. The insurance plan encourages members to participate in wellness programs, regular check-ups, and screenings. By investing in preventive care, MaxCare aims to identify potential health issues early on, reducing the need for costly treatments later. This proactive approach can significantly lower healthcare costs for individuals and the healthcare system as a whole.

Negotiated Rates and Discounts: MaxCare has established strong relationships with healthcare providers, including hospitals, clinics, and doctors. Through these partnerships, they negotiate discounted rates for their members. When individuals access care through the MaxCare network, they benefit from reduced prices for services, procedures, and medications. This network-based approach ensures that members receive quality care at more affordable rates, making it an excellent choice for those seeking cost-conscious healthcare options.

Customized Plans: Understanding that different individuals have unique healthcare needs and budgets, MaxCare offers customizable insurance plans. Members can choose from various coverage options, ensuring they only pay for the benefits they require. This flexibility allows MaxCare to cater to a diverse range of members, from young, healthy individuals to those with specific medical conditions. By providing personalized plans, MaxCare ensures that cost management is tailored to each member's circumstances.

Financial Assistance and Support: MaxCare is committed to ensuring that financial barriers do not prevent individuals from accessing necessary healthcare. They offer financial assistance programs and support services to help members manage their out-of-pocket expenses. This may include financial counseling, assistance with copayments, and other cost-sharing mechanisms. By providing these resources, MaxCare ensures that cost management is not just about reducing expenses but also about making healthcare accessible and affordable.

Transparency and Education: MaxCare believes in transparency regarding healthcare costs. They provide members with clear and detailed information about their coverage, costs, and benefits. Additionally, MaxCare offers educational resources to help members understand their healthcare expenses and make informed decisions. Empowered with knowledge, individuals can take control of their healthcare costs and make choices that align with their financial goals.

In summary, MaxCare's approach to cost management is multi-faceted, focusing on preventive care, negotiated rates, customization, financial support, and transparency. By implementing these strategies, MaxCare aims to provide its members with a robust insurance solution that not only covers essential healthcare needs but also helps them manage costs effectively. This comprehensive cost management approach sets MaxCare apart as a valuable insurance service in the healthcare industry.

Mastering the Art of Phone Insurance Sales: Tips for Success

You may want to see also

Frequently asked questions

MaxCare Service Insurance is a comprehensive insurance plan designed to cover various services and benefits for individuals and families. It provides coverage for a wide range of healthcare needs, including preventive care, routine check-ups, specialist referrals, and more. This insurance plan aims to offer a holistic approach to healthcare, ensuring that policyholders have access to quality medical services and support.

MaxCare Service Insurance stands out by offering a unique combination of features. It includes a dedicated care team that provides personalized support, helping policyholders navigate the healthcare system. The plan also offers a comprehensive network of healthcare providers, ensuring access to a wide range of medical professionals. Additionally, MaxCare provides coverage for various services, such as home health care, telemedicine, and wellness programs, which are often not included in standard insurance plans.

Enrolling in MaxCare Service Insurance offers numerous advantages. Policyholders can enjoy the peace of mind that comes with having a comprehensive insurance plan. The dedicated care team provides assistance with finding in-network providers, scheduling appointments, and managing healthcare needs. MaxCare also offers a range of preventive care services, which can help individuals stay healthy and potentially reduce out-of-pocket expenses. Furthermore, the plan's coverage for various services ensures that policyholders have access to the care they need, promoting overall well-being and a healthier lifestyle.