Whether or not insurance is considered a security depends on the type of insurance. Variable life insurance and variable universal life insurance are considered securities and must be registered with the Securities and Exchange Commission (SEC). This is because they are permanent life insurance products with separate accounts containing various instruments and investment funds, such as stocks, bonds, equity funds, and money market funds. The benefits realised by the contract owner depend on the investment performance of the separate account, meaning that the contract owner, rather than the insurance company, bears the investment risk.

On the other hand, term life insurance, whole life insurance, and universal life insurance are not considered securities.

What You'll Learn

- Variable life insurance is considered a security

- Some life insurance policies are regulated by state insurance commissioners

- Insurance products can be complex and come with fees

- Variable universal life insurance is considered a security

- Insurance policies issued by state-regulated insurance companies are exempt from regulation under the Securities Act of 1933

Variable life insurance is considered a security

Variable life insurance is a permanent life insurance product with a cash value account that the policyholder can invest. The cash value of the policy is held in a separate account, which the policyholder can invest in stocks, bonds, equity funds, money market funds, and bond funds. The cash value of the policy can be used to increase the death benefit, withdrawn as cash, or used as collateral for a loan.

Variable life insurance policies are registered with the Securities and Exchange Commission (SEC) and are regulated by the Financial Industry Regulatory Authority (FINRA). The SEC considers variable life insurance to be a security because the contract owner, rather than the insurance company, bears the investment risk.

Variable life insurance policies are also subject to state insurance regulation. Regulators emphasize the need for companies to clearly explain the policy risks to individuals and distinguish investment accounts and policies from others.

Michigan's New Insurance Bill: Signed, Sealed, and Delivered

You may want to see also

Some life insurance policies are regulated by state insurance commissioners

Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. The basic purpose of life insurance is to provide financial support to people who depend on the insured financially, such as their spouse, partner, children, or other loved ones.

There are several types of life insurance, including term life insurance and whole life insurance. Term life insurance provides coverage over a specified period, while whole life insurance provides a fixed amount of insurance coverage over the life of the insured.

While some life insurance policies are relatively straightforward, others are more complex. Variable life insurance, for example, allows the policyholder to choose among investment options, but it usually comes with a higher cost and carries more risk. Due to the investment risks, variable policies are considered securities contracts and are regulated under federal securities laws.

In the United States, life insurance is regulated at the state level. State insurance commissioners are responsible for regulating the industry and ensuring that companies fulfil their commitments to consumers. The National Association of Insurance Commissioners (NAIC) plays a crucial role in setting best-practice standards and providing regulatory support.

State insurance departments maintain strict oversight and verify that life insurance companies have the financial resources to meet their obligations. They require insurance companies to provide financial information about their products and the company to obtain a license to sell in their state.

State regulators also review and monitor the products sold by life insurers, including term life, whole life, and annuities. While premiums and rates are typically not subject to regulatory approval, they are monitored to ensure that the benefits provided are commensurate with the premium charges.

Additionally, through the NAIC, state regulators monitor the financial health of insurance companies and intervene if a company is found to be financially unstable. Each state also has a guaranty mechanism to help pay the covered insurance obligations of insurers licensed in that state if they are unable to meet their financial obligations.

In summary, life insurance is a vital tool for financial protection, and state insurance commissioners play a crucial role in regulating the industry, protecting consumers, and ensuring that companies fulfil their commitments.

Chiropractor: Insurance Specialist Status?

You may want to see also

Insurance products can be complex and come with fees

Life insurance is designed to provide financial support to the policyholder's dependents in the event of their death. There are many types of life insurance, including term life, whole life, universal life, and variable life insurance. Each type has its own pros and cons, and it's essential to consider factors such as risk tolerance, available capital, the cost of the policy, and the extent to which dependents rely on the policyholder financially.

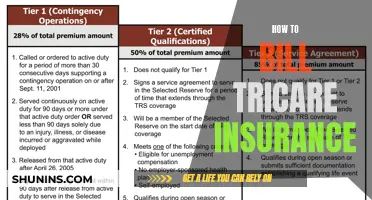

Variable life insurance and variable universal life insurance are considered securities and must be registered with the Securities and Exchange Commission (SEC). These policies are regulated under federal securities laws, and sales professionals must provide prospective buyers with a prospectus of available investment products. The policies are often more expensive than other types of life insurance due to the administrative fees and management of the plan's investments. Policyholders may need to increase their payments to maintain the policy or a specific death benefit, depending on the performance of the investment products and the premiums paid.

In addition to life insurance, there are other complex insurance products such as long-term disability income (LTD) insurance and long-term care (LTC) insurance. These products can be challenging to understand and often come with a variety of features and options that can be confusing for consumers. It's important to carefully review the terms and conditions of any insurance policy before purchasing it and to seek advice from a trusted source, such as a fee-only advisor.

Strategies for Managing a Hefty Insurance Bill

You may want to see also

Variable universal life insurance is considered a security

Variable universal life insurance policies allow the policyholder to choose how the cash value of the account is invested. The cash value is segregated into one or more separate accounts, rather than in the carrier's general account. Policyholders can typically choose from a wide range of separate account investment options, including fixed-income investments, stocks, mutual funds, bonds, and money market funds. The cash value of the policy is influenced by the performance of these investments, which can lead to higher returns but also comes with higher risks.

Due to the investment risks associated with variable universal life insurance, these policies are considered securities contracts and are regulated under federal securities laws. Sales professionals are required to register to sell securities and must provide a prospectus of available investment products to potential buyers. The Financial Industry Regulatory Authority (FINRA) has stated that "a variable life insurance policy is a security, and the sale of such a product in the secondary market is a securities transaction subject to [FINRA] rules."

Variable universal life insurance policies offer flexibility in premium payments and death benefits. Policyholders can adjust their premium payments based on their needs and investment goals. The death benefit can also be increased or decreased, depending on the performance of the investments.

Proper Billing Practices for Physical Therapy: Navigating Insurance Claims

You may want to see also

Insurance policies issued by state-regulated insurance companies are exempt from regulation under the Securities Act of 1933

The Securities Act of 1933, also known as the 1933 Act, was enacted by the United States Congress in 1933 to protect investors after the stock market crash of 1929. The Act requires that investors receive financial information from securities being offered for public sale. This means that before going public, companies have to submit information that is readily available to investors.

The exemption of insurance policies from the 1933 Act is outlined in Section 3(a)(8) of the Act, which reflects a Congressional determination that certain types of instruments that would otherwise meet the statutory definition of a security are to be left to the sole regulation of state insurance regulators. The purpose of this statutory exemption has been described by the Supreme Court as follows:

> "The point must have been that there then was a form of 'investment' known as insurance (including 'annuity contracts') which did not present very squarely the sort of problems that the Securities Act and the Investment Company Act were devised to deal with, and which were, in many details, subject to a form of state regulation of a sort which made the federal regulation even less relevant."

The courts and the SEC have fashioned a two-part test under which the status of a contract as a "security" or "insurance" for purposes of Section 3(a)(8) depends on:

- The degree of investment risk under the product

- The degree of marketing emphasis placed on the investment aspects of the product

This test derives from SEC v. Variable Annuity Life Insurance Co. of America ("VALIC") and SEC v. United Benefit Life Insurance Co. ("United Benefit"). It is the basis for Rule 151, which, together with the related SEC Releases proposing and adopting Rule 151, is customarily used as the basis for analysing whether an insurance product is required to be registered with the Commission as a security.

However, it has been argued that this analysis obscures the core regulatory issues posed by insurance products. All cash value insurance products place some investment risk upon the contract owner, and this was true in 1933 when Section 3(a)(8) was enacted, and it is true today. Consistent with this reality, Rule 151 provides a safe harbour from securities registration with the SEC for insurance contracts under which the contract owner bears a not insignificant amount of investment risk.

Accordingly, while an inquiry into how much "investment risk" is too much may be useful in analysing some insurance products, it does not provide guidance as to the status of many products because of the difficulty of drawing lines between degrees of "investment risk" in the absence of Congressional guidance. Likewise, in view of the foregoing, it naturally follows that marketing materials for any cash value insurance product must describe the investment aspects of the product.

In summary, insurance policies issued by state-regulated insurance companies are exempt from regulation under the Securities Act of 1933. This is due to the historical context in which the Act was passed, the nature of insurance as a product, and the subsequent creation of a two-part test by the courts and the SEC which has resulted in a safe harbour for insurance contracts under which the contract owner bears a significant amount of investment risk.

Florida's Shift Away from No-Fault Insurance: A New Era for Motorists

You may want to see also

Frequently asked questions

In the world of finance and investing, securities are financial instruments that hold value and can be traded between parties. They include stocks, bonds, mutual funds, and exchange-traded funds.

Not all insurance is considered a security. Traditional insurance products are exempt from securities laws. However, variable insurance products, which include variable annuities and variable life insurance, are considered securities.

Variable life insurance is a permanent life insurance product with separate accounts made up of various instruments and investment funds, such as stocks, bonds, equity funds, money market funds, and bond funds.

Variable life insurance is considered a security because of the investment risks involved. The cash value of the policy is directly linked to the performance of the separate investment accounts.

Variable life insurance policies must be registered with the Securities and Exchange Commission (SEC) and are regulated by the Financial Industry Regulatory Authority (FINRA). Sales professionals must have the appropriate licenses and provide a prospectus of available investment products to potential buyers.