Navigating the intricacies of your insurance coverage can be challenging, especially when it comes to understanding the nuances of Flexible Spending Accounts (FSAs). Many individuals are unaware whether their insurance plans include an FSA, which can significantly impact their financial well-being. This introductory paragraph aims to shed light on the process of determining if your insurance policy offers an FSA, a valuable tool for managing healthcare expenses efficiently. By exploring the key indicators and resources available, individuals can make informed decisions about their insurance benefits and maximize their financial resources for healthcare needs.

What You'll Learn

- Understanding FSA Basics: Check if your insurance plan offers a Flexible Spending Account (FSA) for healthcare and dependent care expenses

- Review Policy Documents: Carefully read your insurance policy to identify FSA-related provisions and benefits

- Contact Insurance Provider: Reach out to your insurance company for clarification on FSA eligibility and coverage details

- Verify FSA Status: Confirm with your employer if your insurance plan includes an FSA and its specific features

- Explore FSA Options: Research and compare different FSA providers to find the best fit for your insurance coverage

Understanding FSA Basics: Check if your insurance plan offers a Flexible Spending Account (FSA) for healthcare and dependent care expenses

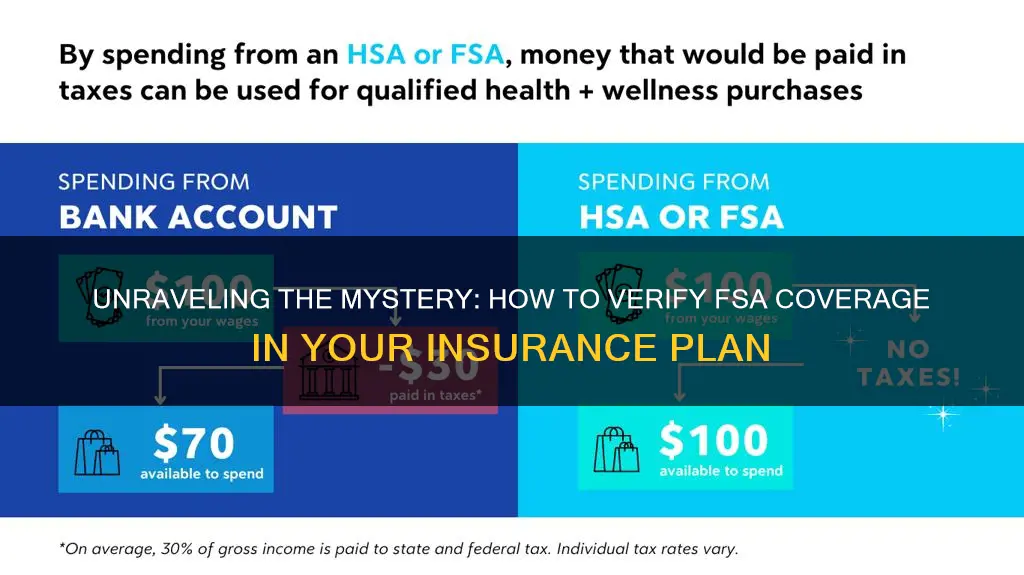

To determine if your insurance plan includes a Flexible Spending Account (FSA), it's essential to understand the basics of what an FSA is and how it works. A Flexible Spending Account is a tax-advantaged account that allows you to set aside a portion of your income before taxes for eligible healthcare and dependent care expenses. This arrangement can significantly reduce your taxable income and, consequently, your tax liability.

The first step is to review your insurance plan's summary of benefits and coverage. This document, often provided by your employer or insurance provider, outlines the various components of your health insurance plan. Look for sections related to 'Flexible Spending Accounts' or 'Health Savings Accounts' (HSAs), as these are often linked to FSAs. If your plan includes an FSA, it will typically be mentioned here, along with details about how to access and use the account.

Another way to check is to log in to your online account with the insurance provider. Many insurance companies offer a secure online portal where you can view and manage your plan details. Navigate to the 'Plan Information' or 'Benefits' section, and search for any references to 'FSA' or 'Flexible Spending'. If your plan offers an FSA, you should find relevant information, including contribution limits, reimbursement options, and eligible expense categories.

Additionally, consult your human resources (HR) department or benefits administrator. They can provide valuable insights into the specific offerings of your insurance plan. Ask about the availability of an FSA and any associated guidelines or restrictions. They may also offer guidance on how to set up and utilize the account effectively.

Lastly, if you're self-employed or not covered by a traditional employer-sponsored plan, you can still explore the possibility of an FSA. Some insurance providers offer individual FSA plans, which can be a great way to manage healthcare expenses independently. Research insurance companies that specialize in individual FSA plans to find one that suits your needs.

The Benefits of Short-Term Insurance for Individuals: Protecting Your World

You may want to see also

Review Policy Documents: Carefully read your insurance policy to identify FSA-related provisions and benefits

When it comes to understanding your insurance coverage, especially regarding Flexible Spending Accounts (FSAs), a thorough review of your policy documents is essential. This process ensures you are aware of the specific FSA provisions and benefits included in your plan. Here's a step-by-step guide on how to navigate this important task:

Locate the Policy Documents: Start by finding the insurance policy documents provided by your employer or insurance provider. These documents typically include a summary plan description, a detailed policy statement, and any associated brochures or guides. These materials are crucial as they outline the specific FSA offerings.

Identify the FSA Section: Within the policy documents, locate the section dedicated to benefits or coverage. This section will provide an overview of the various insurance options available, including FSAs. Look for terms like "Flexible Spending Account," "Health Reimbursement Arrangement," or "Flexible Spending Arrangement" to identify the relevant provisions.

Review the Benefits and Contributions: Carefully examine the details of the FSA. Understand the contribution limits, eligibility criteria, and any restrictions. For instance, you should know how much you can contribute annually, whether there are specific categories or expenses covered, and if there are any carry-over rules. These details are vital to ensure you maximize the benefits of your FSA.

Understand the Claim Process: Familiarize yourself with the process of submitting claims for FSA-eligible expenses. This may include providing receipts, itemizing expenses, and adhering to specific timelines. Knowing these procedures will enable you to effectively manage and utilize your FSA benefits throughout the year.

Contact Your Insurance Provider: If any sections or terms are unclear, don't hesitate to reach out to your insurance provider or HR department. They can provide clarification and ensure you have a comprehensive understanding of your FSA coverage. This step is crucial to avoid any potential issues or misunderstandings regarding your insurance benefits.

By diligently reviewing your policy documents, you can ensure that you are well-informed about your FSA and take full advantage of its financial benefits. This process empowers you to make the most of your insurance coverage and provides a clear understanding of your rights and obligations.

Get Certified to Issue Insurance: Steps to Success

You may want to see also

Contact Insurance Provider: Reach out to your insurance company for clarification on FSA eligibility and coverage details

If you're unsure whether your insurance plan includes a Flexible Spending Account (FSA), it's crucial to contact your insurance provider directly. This is the most reliable way to confirm your FSA's existence and understand its specific terms and conditions. Insurance companies often provide detailed information about their plans, and reaching out to them ensures you receive accurate and up-to-date data.

When contacting your insurance provider, have your policy number and any other relevant information ready. This will help the representative quickly access your account and provide the necessary details. You can typically reach out via phone, email, or through an online portal, depending on the company's preferred methods of communication.

During the conversation or correspondence, inquire about the following: Firstly, confirm if your plan includes an FSA and, if so, what its specific name or identifier is. This information is essential for managing your FSA effectively. Secondly, ask about the coverage details, including any limitations or restrictions. Understanding these terms will help you maximize the benefits of your FSA.

Additionally, request clarification on how to utilize your FSA effectively. This may include information on eligible expenses, contribution limits, and any specific procedures for submitting claims. By having a clear understanding of these aspects, you can ensure that you're making the most of your FSA benefits.

Remember, insurance providers are there to assist you, so don't hesitate to ask questions. They can guide you through the process and provide the necessary support to help you navigate your FSA. Taking the initiative to contact your insurance company will empower you to make informed decisions regarding your healthcare expenses.

Uncover Your Sprint Phone's Insurance Status: A Quick Guide

You may want to see also

Verify FSA Status: Confirm with your employer if your insurance plan includes an FSA and its specific features

To determine if your insurance plan includes a Flexible Spending Account (FSA), the most reliable source of information is your employer. Here's a step-by-step guide on how to verify the FSA status of your insurance plan:

- Contact Your Human Resources Department: The first and most direct approach is to reach out to your company's Human Resources (HR) department. They are responsible for managing employee benefits and can provide detailed information about your insurance coverage. Inform them that you are interested in confirming the presence of an FSA in your insurance plan.

- Request Plan Details: When communicating with your HR representative, specifically ask for the following:

- A confirmation of whether your insurance plan offers an FSA.

- A breakdown of the FSA's features, including any contribution limits, reimbursement options, and eligible expenses.

- Information on how to access and utilize the FSA, such as the process for submitting receipts and any associated deadlines.

- Review Your Employee Handbook: Your employer's employee handbook is a comprehensive resource that outlines all the benefits and perks provided to employees. It should include a section dedicated to insurance benefits, where the FSA's availability and specifics are detailed. If you don't have access to the latest version, request an updated copy from your HR department.

- Check Your Pay Stubs and Benefits Statements: These documents often provide a summary of your benefits and deductions. Look for any references to an FSA, such as contributions, reimbursements, or deductions. While this information might not be as comprehensive as a direct confirmation from your employer, it can offer some initial insights.

- Understand the FSA's Impact on Your Benefits: If you are already familiar with your insurance plan's details, you can verify the FSA's presence by cross-referencing it with other benefits. For instance, if you have a Health Savings Account (HSA) or a Health Reimbursement Arrangement (HRA), understanding the FSA's role in your overall benefits package can help you confirm its inclusion.

Remember, the employer's HR department is the primary source of accurate and up-to-date information regarding your insurance plan's FSA. By taking the initiative to contact them, you can ensure that you have the correct details about your benefits and make the most of your FSA if it is available.

Understanding Short-Term Insurance: Temporary Coverage, Long-Term Peace of Mind

You may want to see also

Explore FSA Options: Research and compare different FSA providers to find the best fit for your insurance coverage

When it comes to finding the right Flexible Spending Account (FSA) provider for your insurance coverage, thorough research and comparison are essential. This process ensures that you make an informed decision that aligns with your specific needs and preferences. Here's a step-by-step guide to help you navigate this important task:

Understand Your Insurance Coverage: Begin by reviewing your insurance policy documents. Look for sections that mention FSA or flexible spending options. Insurance providers often offer FSAs as a way to manage and reimburse certain healthcare expenses. Understanding the terms and conditions of your insurance coverage will help you identify if an FSA is included and what specific expenses it covers.

Research FSA Providers: There are numerous companies that specialize in offering FSA services. These providers act as intermediaries between you and your insurance company, managing the administration of your FSA. Search for reputable FSA administrators online or consult your insurance broker to get recommendations. Make a list of potential providers and gather information about their services, fees, and coverage options.

Compare Features and Benefits: Each FSA provider may offer different features and advantages. Compare the following aspects: contribution limits, eligible expense categories, reimbursement processes, and any additional perks or discounts. For example, some providers might offer a higher annual contribution limit or cover a broader range of healthcare expenses. Choose a provider whose offerings align with your expected healthcare costs and preferences.

Review Customer Support and Reviews: Consider the quality of customer support provided by each FSA provider. Look for companies that offer multiple support channels, such as phone, email, and live chat, to ensure prompt assistance when needed. Additionally, read reviews and testimonials from current or past users to gauge their satisfaction with the provider's services. Positive feedback regarding customer support can be a strong indicator of a reliable FSA provider.

Consider Integration and Compatibility: If you already have a preferred insurance provider, check if the FSA provider you're considering offers seamless integration with their systems. Compatibility ensures that your FSA administration and reimbursement processes are efficient and aligned with your existing insurance infrastructure. This can simplify the management of your healthcare expenses and streamline the overall experience.

By following these steps, you can effectively explore and compare different FSA options, ultimately finding a provider that best suits your insurance coverage needs. Remember, a well-researched decision will contribute to a positive and efficient experience with your FSA.

Family Insurance: Per-Person Coverage

You may want to see also

Frequently asked questions

To find out if your insurance plan offers an FSA, you should review your benefits summary or contact your insurance provider directly. They will provide you with detailed information about the coverage options available, including any FSAs that are part of your plan.

A Flexible Spending Account allows you to set aside pre-tax dollars for qualified medical expenses. It's a great way to save on healthcare costs. Knowing if your insurance includes an FSA ensures you can utilize this benefit effectively and manage your healthcare expenses efficiently.

If your insurance plan offers an FSA, you typically need to enroll in the program during the open enrollment period. This may involve choosing the appropriate FSA provider, selecting the contribution amount, and providing necessary documentation. Your insurance company or benefits administrator will guide you through the activation process.