Changing your primary care physician (PCP) can be a stressful process, but it doesn't have to be. There are many reasons why you might want to change your PCP, such as moving to a new city or state, your doctor retiring or moving to a different location, or changes in your insurance plan. It's important to notify your health insurance company about your new PCP, especially if you're enrolled in a Medicare Advantage Plan, as this will affect insurance claims processing, network coverage status, and insurance card details. You can also use your health insurance provider's website to search for a new PCP that is covered by your plan. Once you've found a new PCP, be sure to request your medical records from your previous doctor and inform your insurance company of the change.

| Characteristics | Values |

|---|---|

| Whether insurance charges you if you change your PCP | Depends on the insurance plan |

| Action required if you change your PCP | Notify your insurance company of the change |

| Impact of changing PCP | Affects insurance claims processing, network coverage status, and insurance card details |

| Impact on insurance card | A new insurance card will be issued with the updated PCP details |

| Impact on copay amount | You may have to pay a higher copay for an office visit |

What You'll Learn

- You should notify your insurance company of a PCP change

- Your insurance company will review details like whether the doctor is in-network

- You may have to pay a higher copay for an office visit if you don't notify your insurance company

- You can ask your insurance company for recommendations for a new PCP

- Your insurance company will issue a new insurance card after updating your PCP information

You should notify your insurance company of a PCP change

It is important to notify your insurance company of a PCP change to ensure a seamless transition to a new primary care physician. While it may be a straightforward process to change your PCP, informing your insurance company is crucial, especially if you are enrolled in a Medicare Advantage Plan. Here are several reasons why you should notify your insurance company when changing your PCP:

Insurance Claims Processing and Coverage Status

Informing your insurance company about your new PCP is essential for insurance claims processing. They need to know which doctor is providing your care to manage the reimbursement of your medical expenses. Additionally, your insurance company can confirm whether your new PCP is in-network, affecting your coverage status and out-of-pocket costs. By notifying them, you can avoid unexpected charges or issues with claims processing.

Insurance Card Details

Keeping your insurance company updated about your PCP change is necessary to ensure that your insurance card reflects accurate and current information. Insurance cards typically include your copay amount and the name of your PCP. Presenting an updated insurance card at your doctor's office helps prevent confusion and ensures that you receive the benefits covered by your plan.

Avoid Higher Copayments

By notifying your insurance company of your PCP change, you can avoid potentially paying a higher copay for an office visit. If your new PCP is considered out-of-network, you may be responsible for higher out-of-pocket expenses. Informing your insurance company allows them to provide accurate information about your coverage and any applicable copayments.

Smooth Transition and Continuity of Care

Notifying your insurance company is part of ensuring a smooth transition to a new PCP. They can guide you through the process and provide any necessary forms or documentation. Additionally, they can assist with transferring your medical records, which is crucial for continuity of care. This allows your new PCP to have a complete understanding of your medical history and provide informed treatment.

Customer Support and Assistance

When you inform your insurance company of your PCP change, they can offer dedicated customer support and assistance. They may provide guidance on contacting your new PCP, scheduling appointments, and understanding your coverage. This support can be especially helpful during the transition period, ensuring that you receive timely and uninterrupted care.

Understanding Ultrasound Billing: Navigating Insurance Coverage for Diagnostic Imaging

You may want to see also

Your insurance company will review details like whether the doctor is in-network

When you contact your insurance company about changing your PCP, they will review details such as confirming whether the new doctor is in-network. This is an important step as receiving care from a provider in your health plan's network usually costs less than going to an out-of-network provider. In-network doctors have agreed to accept the insurer's rate as payment for their services, so you benefit from the lower rates your insurer has negotiated with network providers.

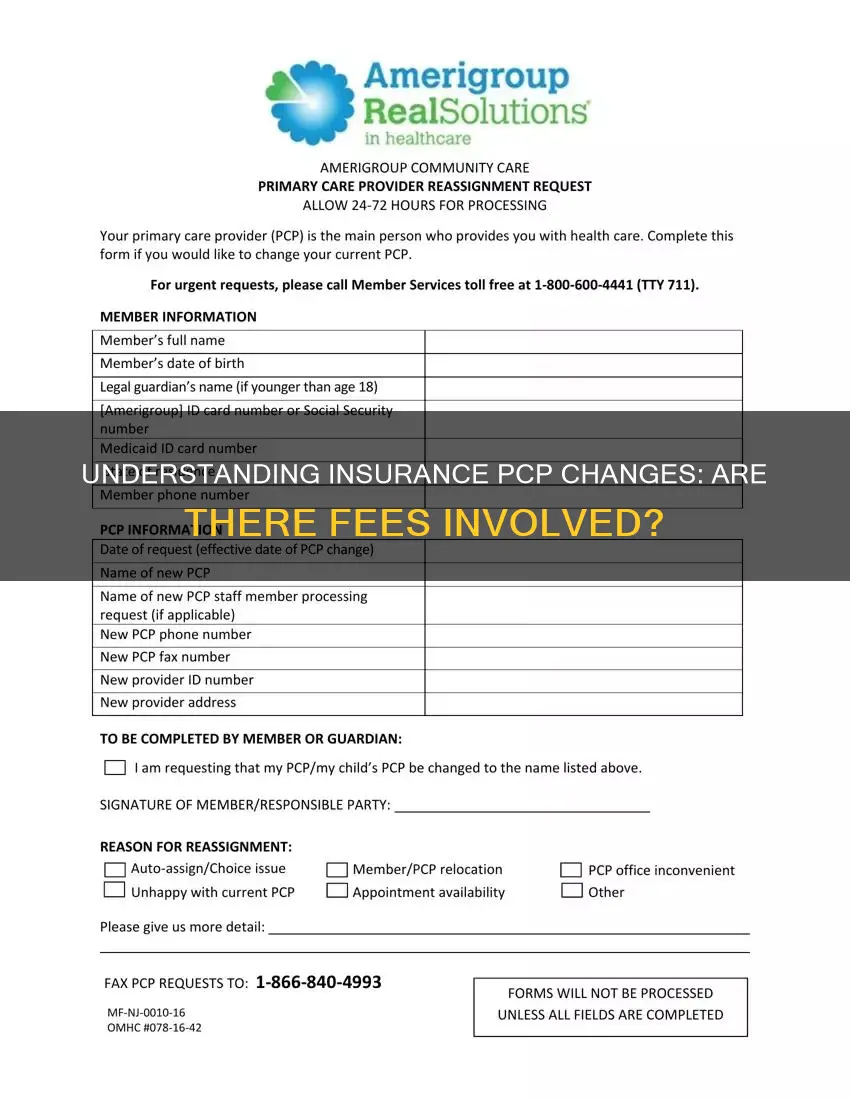

If you have a Medicare Advantage Plan, it is important to promptly share your PCP change with your health insurance company. The doctor's office will not provide your new physician's information to your health insurance company; you are responsible for notifying them of the change, which will affect insurance claims processing, network coverage status, and insurance card details. Once your insurance company has updated your PCP's information, they will issue a new insurance card with the new details.

If you are part of a Health Maintenance Organization (HMO) plan, you are usually required to choose a PCP as part of your coverage. You can change your PCP at any time by calling your plan's customer service and letting them know the name and office location of your new PCP.

If you are unsure whether your new doctor is in-network, you can check by logging into your member account on your insurance company's website. You can also call their customer support and ask them to check for you.

It is important to note that not all plans will cover you if you go out of network, and when you do, your share of costs will be higher.

The Mystery of POS in Insurance Unveiled: Understanding Point-of-Service Plans

You may want to see also

You may have to pay a higher copay for an office visit if you don't notify your insurance company

If you change your primary care physician (PCP), you may have to pay a higher copay for an office visit if you don't notify your insurance company. This is because your insurance company needs to update your PCP's information in their system, which will then be reflected on your insurance card. If you don't notify them, you may encounter issues such as a higher copay for an office visit or finding out that your new PCP is considered out-of-network.

It is important to understand that insurance companies only need to be notified of a PCP change if you are on certain plans, such as a Medicare Advantage Plan. If you have a different plan, such as a Medicare Supplement Plan, you may not need to notify them. However, it is always a good idea to check with your insurance company to confirm.

When you contact your insurance company, they will be able to review details relevant to the change, such as confirming if the new doctor is in-network. This is crucial information as seeing physicians outside of your plan's network may increase your out-of-pocket expenses significantly. Therefore, it is in your best interest to notify your insurance company of any changes to your PCP to avoid unexpected costs.

In addition to notifying your insurance company, there are a few other steps you should take when changing your PCP. Firstly, request your medical records from your previous doctor and have them sent to your new PCP. You are entitled to either a paper or electronic copy of your records, and your previous doctor must provide them to you within a certain timeframe, usually around 30 days. Secondly, make sure your new PCP is covered by your health insurance and is accepting new patients. You can usually check this information on your insurance plan's website or by calling their customer support. Finally, once your insurance company has updated your PCP information, they will issue a new insurance card. It is important to have this updated card to present at your doctor's office to ensure you receive the correct coverage and avoid any issues with billing.

Transamerica's Medigap Insurance Billing Cycle: Understanding the Payment Process

You may want to see also

You can ask your insurance company for recommendations for a new PCP

If you're unsure about where to start looking for a new PCP, you can ask your insurance company for recommendations. Many insurance companies have online tools that allow you to search for in-network doctors, or you can call their customer support line and ask them to check for you.

When you contact your insurance company, they will be able to provide you with details relevant to the change, such as confirming whether the doctor is in-network. This is important because seeing an out-of-network doctor may increase your out-of-pocket expenses significantly.

If you are enrolled in a Medicare Advantage Plan, it is particularly important that you share your PCP change with your insurance company, as this will affect insurance claims processing, network coverage status, and insurance card details.

When selecting a new PCP, it is important to consider your care needs. For example, you may want to consider the provider's location, their areas of specialisation, their availability, and whether they accept your insurance plan. It is also a good idea to research the doctor's office policies, such as their approach to scheduling appointments and handling after-hours medical problems.

You can also ask your current doctor, friends, family, or coworkers for recommendations. Additionally, you can research new candidates online and check whether they are board-certified, affiliated with trusted hospitals, and whether they accept your insurance plan.

Unraveling the Mystery of Term Insurance: A Step-by-Step Guide to Navigating Your Options

You may want to see also

Your insurance company will issue a new insurance card after updating your PCP information

Changing your primary care physician (PCP) can be a stressful process, but it's important to remember that you have the freedom to choose a doctor that suits your needs and preferences. Whether you're moving to a new city, switching health plans, or facing retirement, there are a few steps you can take to ensure a smooth transition.

Firstly, it's crucial to notify your health insurance company about your new PCP, especially if you're enrolled in a Medicare Advantage Plan. This step is necessary as it affects insurance claims processing, network coverage status, and insurance card details. By sharing this information, your insurance company can review relevant details such as confirming if your new PCP is in-network. It's worth noting that this notification is only required if you have a Medicare Advantage Plan and not a Medicare Supplement Plan.

Once your insurance company has updated your PCP's information, they will issue a new insurance card reflecting this change. This updated card is essential, as insurance cards typically include your copay amount and PCP's name. Having an accurate card to present at your doctor's office can help you avoid potential issues, such as paying a higher copay for a visit or discovering that your new PCP is considered out-of-network.

When scheduling an appointment with your new PCP, remember to share the specific details of your Medicare Advantage plan and reconfirm if the doctor's office accepts it. This proactive step will ensure a seamless transition and help you avoid unexpected costs or coverage issues.

Additionally, it's important to request your medical records from your previous PCP and provide them to your new doctor. You have the right to obtain a copy of your medical records, either in paper or electronic format, and your previous doctor is obligated to forward them to you or your new PCP within the specified timeframe. This ensures that your new PCP has a comprehensive understanding of your medical history and needs.

While changing your PCP, it's also worth considering factors such as the doctor's location, their specialization or expertise, and whether they are accepting new patients. You can ask your previous doctor for referrals or reach out to friends and family for recommendations. Moreover, researching your potential new PCP's online and checking their board certifications can provide valuable insights.

In conclusion, by following these steps and staying proactive, you can ensure that your insurance company updates your PCP information and issues a new insurance card, facilitating a smooth transition to your new primary care physician.

**Understanding Insurance Reimbursement: The Insured's Path to Payment**

You may want to see also

Frequently asked questions

Changing your PCP does not incur a direct fee, but you may have to pay more if your new PCP is considered out-of-network.

Yes, if you are enrolled in a Medicare Advantage Plan, you must inform your insurance company of the change. This is so they can update your insurance card with the new PCP's details, including the copay amount, and ensure the new doctor is in-network.

You can change your PCP by visiting your insurance company's website or calling their customer support team.

After changing your PCP, you should request your medical records from your previous doctor and ask for them to be sent to your new PCP.