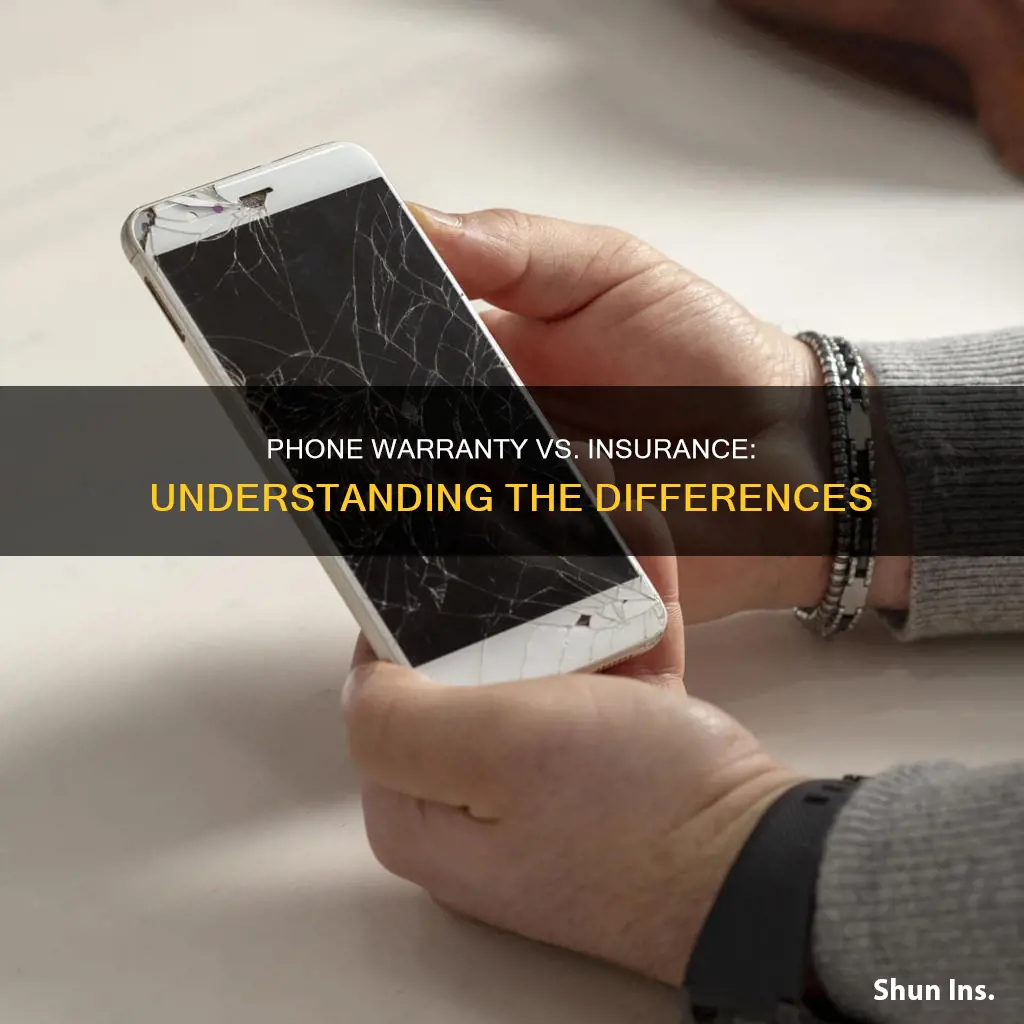

When it comes to protecting your smartphone, understanding the difference between a warranty and insurance is crucial. While both offer coverage for your device, they operate under distinct principles. A warranty typically covers manufacturing defects and manufacturing-related issues, ensuring that your phone functions as it should. On the other hand, insurance provides broader protection, covering accidental damage, theft, and other unforeseen events. This distinction is essential for consumers to make informed decisions about how best to safeguard their valuable electronic devices.

| Characteristics | Values |

|---|---|

| Warranty vs. Insurance | Warranty is a manufacturer's guarantee that covers defects in materials and workmanship for a specific period. Insurance provides financial protection against accidental damage, theft, or loss. |

| Coverage | Warranty typically covers manufacturing defects, while insurance covers accidental damage, theft, and loss. |

| Duration | Warranty periods vary by manufacturer and model, often ranging from 1 to 2 years. Insurance coverage can be for a specific period or until the device is replaced. |

| Cost | Warranty is usually included with the purchase of a phone and is free. Insurance is an additional cost, often calculated as a percentage of the device's value. |

| Claims Process | Warranty claims are typically handled by the manufacturer or authorized service centers. Insurance claims involve filing a report and may require proof of loss. |

| Exclusions | Both may have exclusions, such as cosmetic damage, user-induced damage, and water damage. |

| Transferability | Warranty is non-transferable, while insurance policies may allow transfer or assignment. |

| Value Retention | Warranty does not typically increase the phone's resale value. Insurance may help retain some value by covering repairs or replacements. |

| Legal Obligations | Manufacturers are legally obligated to provide a warranty. Insurance companies are not legally required to provide coverage. |

| Customer Satisfaction | Warranty can improve customer satisfaction by providing peace of mind. Insurance may be preferred for those who want comprehensive protection. |

What You'll Learn

- Warranty Duration: Phone warranties typically last 1-2 years, covering manufacturing defects

- Coverage Scope: Warranties cover hardware issues, while insurance covers accidental damage and theft

- Cost Implications: Warranties are often free, while insurance can be an additional cost

- Claim Process: Warranty claims are usually direct with the manufacturer, insurance involves a third party

- Exclusions: Both may exclude certain repairs or replacements, requiring customer involvement

Warranty Duration: Phone warranties typically last 1-2 years, covering manufacturing defects

When it comes to protecting your smartphone, understanding the difference between a warranty and insurance is essential. A warranty is a legal guarantee provided by the manufacturer or seller, ensuring that the device will perform as expected and covering any defects that arise due to manufacturing issues. Typically, phone warranties last for a period of 1 to 2 years from the date of purchase. This duration provides a comprehensive safety net for consumers, allowing them to seek repairs or replacements if any manufacturing defects are discovered within this timeframe.

During the warranty period, if you encounter any issues with your phone, such as a malfunctioning screen, faulty battery, or software problems, the manufacturer or authorized service centers will typically offer repairs or replacements at no additional cost. This coverage is specifically designed to address defects that are a result of the manufacturing process, ensuring that the device functions as intended. It's important to note that warranties often have specific terms and conditions, including limitations on the number of repairs or replacements provided, and they may not cover damage caused by accidents, misuse, or unauthorized modifications.

The duration of a phone warranty is strategically set to align with the typical lifespan of a smartphone. Most manufacturers aim to provide coverage for the initial years when the device is most susceptible to manufacturing defects. After the warranty period, consumers may need to rely on insurance or other repair options, which often come at an additional cost.

In contrast, insurance plans for phones typically offer coverage for a broader range of issues, including accidental damage, theft, and loss. These plans usually have a separate duration and terms, often requiring a monthly or annual fee. While insurance provides more comprehensive protection, it may not cover all manufacturing defects, and the claims process can be more complex.

Understanding the warranty duration and its limitations is crucial for consumers to make informed decisions about their phone's protection. By knowing the warranty period, you can take advantage of the manufacturer's guarantee and ensure that any manufacturing defects are promptly addressed.

Unraveling the Mystery: Does Addition Ensure Blue Phones?

You may want to see also

Coverage Scope: Warranties cover hardware issues, while insurance covers accidental damage and theft

When it comes to protecting your smartphone, understanding the difference between a warranty and insurance is crucial. These two terms often get used interchangeably, but they serve distinct purposes and cover different aspects of your device.

A warranty is a legal guarantee provided by the manufacturer or seller, typically covering hardware defects and malfunctions. It ensures that the phone will perform as expected within a certain period, usually one year from the date of purchase. If a covered issue arises, the manufacturer or retailer will repair or replace the faulty part at no additional cost to the consumer. This coverage is often limited to manufacturing defects and does not include accidental damage, which is a common point of confusion. For example, if your phone's screen cracks due to a manufacturing defect, the warranty will cover the repair or replacement. However, if you drop your phone and break the screen, the warranty might not apply, and you'd need to consider other options.

On the other hand, insurance provides financial protection against various risks associated with your device. It covers accidental damage, theft, and sometimes even natural disasters. When you purchase insurance, you're essentially paying for peace of mind, knowing that you won't face significant financial burdens if your phone encounters unforeseen circumstances. Insurance policies can vary widely, so it's essential to read the fine print to understand what is covered. For instance, some insurance plans might cover accidental damage but exclude theft, while others may provide comprehensive coverage. If your phone is stolen, insurance can help recover the cost of the device, and in case of accidental damage, it will cover the repair or replacement expenses.

The key difference lies in their scope and purpose. Warranties are designed to address inherent manufacturing issues, ensuring that the product functions as intended. They provide a safety net for consumers, offering repairs or replacements without any additional costs. On the contrary, insurance is a financial safeguard, protecting you from unexpected events that could damage or lose your phone. It's important to note that while warranties are often included with the purchase of a phone, insurance can be purchased separately to extend coverage beyond the manufacturer's warranty period.

In summary, when considering the protection of your smartphone, it's essential to differentiate between warranties and insurance. Warranties focus on hardware issues and defects, while insurance provides financial coverage for accidental damage and theft. Understanding these distinctions will enable you to make informed decisions about safeguarding your valuable device.

Key Considerations for Choosing an Insurance Carrier

You may want to see also

Cost Implications: Warranties are often free, while insurance can be an additional cost

When it comes to protecting your smartphone, understanding the cost implications of warranties and insurance is crucial. Warranties are typically included with the purchase of a device and are often free of charge. This means that when you buy a new phone, the manufacturer or retailer provides a warranty as a standard part of the deal. These warranties usually cover defects in materials and workmanship for a specified period, often ranging from one to three years. During this time, if your phone encounters any issues, you can expect repairs or replacements without incurring additional expenses.

On the other hand, insurance is an additional cost that you may choose to add to your purchase. It provides financial protection against various risks, such as theft, damage, or accidental loss. Insurance plans can be offered by the manufacturer, retailer, or a third-party provider. While insurance can offer peace of mind, it typically comes at a price, and the cost can vary depending on the coverage, the device's value, and the insurance provider. Some insurance plans may even require you to pay a deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in.

The decision to purchase insurance or rely solely on the warranty depends on your personal preferences and risk tolerance. If you're someone who tends to drop their phone or lives in an area with a high risk of theft, insurance might be a wise investment. It can provide financial relief in case of an accident or loss, ensuring you don't have to bear the full burden of repairs or replacements. However, for those who are cautious and take good care of their devices, the standard warranty might be sufficient to cover any manufacturing defects.

It's important to carefully review the terms and conditions of both warranties and insurance policies. Some warranties may have specific exclusions or limitations, and understanding these can help you make an informed decision. Additionally, comparing prices and coverage options from different providers can help you find the best value for your money. Ultimately, being aware of the cost implications allows you to choose the protection plan that best suits your needs and budget.

Understanding the Term Insurance Calculator: A Guide to Unlocking Its Potential

You may want to see also

Claim Process: Warranty claims are usually direct with the manufacturer, insurance involves a third party

When it comes to resolving issues with your smartphone, understanding the difference between warranty claims and insurance claims is essential. The claim process can vary significantly, and being aware of these differences can help you navigate the process more effectively.

Warranty Claims:

Warranty claims are typically a direct process with the manufacturer. When you purchase a phone, the manufacturer often provides a warranty that covers defects in materials and workmanship for a specified period. If your phone encounters a covered issue, such as a faulty screen or hardware malfunction, you can initiate a warranty claim by contacting the manufacturer's customer support. They will guide you through the process, which may involve providing proof of purchase, describing the issue, and arranging for the device to be inspected or repaired. Warranty claims are generally straightforward and aim to resolve the problem without any additional costs to the consumer.

Insurance Claims:

Insurance, on the other hand, involves a third-party insurance provider. Phone insurance plans are often offered by the manufacturer or a separate insurance company. When you purchase insurance, you agree to pay a premium in exchange for coverage against various risks, such as accidental damage, theft, or loss. If you need to make an insurance claim, you typically contact the insurance provider directly. They will assess the situation, which may include providing evidence of the incident and, in some cases, having the device inspected. The insurance provider will then decide whether to repair, replace, or compensate you for the damaged or lost phone. Insurance claims often require more documentation and may have specific conditions and limitations.

The key difference lies in the involvement of the manufacturer versus a third-party insurer. Warranty claims are designed to address manufacturing defects and are usually free of charge to the consumer. Insurance claims, however, are for managing risks and may come with associated costs and conditions. Understanding these distinctions is crucial for effectively managing any issues with your smartphone.

The Surprise Bill Law: Unraveling the Insurance Coverage

You may want to see also

Exclusions: Both may exclude certain repairs or replacements, requiring customer involvement

When it comes to the differences between a phone warranty and insurance, one of the key areas of distinction lies in the exclusions and customer involvement required for repairs or replacements. Both warranties and insurance policies have their own set of terms and conditions that may limit coverage, often leaving customers to bear the costs of certain repairs or replacements.

Warranties, typically provided by manufacturers, often come with specific exclusions that outline what is not covered. For instance, a warranty might exclude damage caused by accidents, water exposure, or user error. In such cases, the customer is responsible for bearing the repair or replacement costs, as these incidents are deemed to be beyond the scope of the warranty. This can be a significant point of difference from insurance, which often provides coverage for a broader range of incidents, including accidental damage and theft.

Similarly, insurance policies also have their own set of exclusions. For example, a phone insurance policy might not cover damage caused by user negligence or intentional acts. In these instances, the customer may be required to pay a deductible or a portion of the repair costs, as the insurance company deems these incidents as avoidable risks. This can be a source of frustration for customers, especially when they are unaware of these exclusions and end up paying for repairs that were not covered.

The involvement of the customer in the repair or replacement process is another critical aspect. With warranties, customers often need to provide proof of purchase and may be required to ship their device to an authorized service center for repairs. This process can be time-consuming and may involve additional costs, such as shipping fees. In contrast, insurance policies might require customers to file a claim, which can involve providing detailed documentation and often necessitates an inspection of the damaged device. This process can be more complex and may delay the repair or replacement, leaving customers without a fully functional device for an extended period.

Understanding these exclusions and the level of customer involvement is crucial for consumers. It empowers individuals to make informed decisions when purchasing a phone and choosing between warranty and insurance coverage. By being aware of what is and isn't covered, customers can better manage their expectations and financial responsibilities, ensuring they are not caught off guard by unexpected costs.

Insurers: Protecting People's Interests

You may want to see also

Frequently asked questions

No, the warranty and insurance for a phone are distinct concepts. A warranty is a legal guarantee provided by the manufacturer or seller, ensuring that the product will perform as expected and covering defects or malfunctions within a specified period. It typically covers manufacturing issues and may include repairs or replacements. On the other hand, insurance provides financial protection against accidental damage, theft, or loss. It is a separate service that you can purchase to safeguard your device, often offering coverage for a specific period and various repair or replacement options.

Warranties usually cover manufacturing defects, such as faulty hardware or software, and may include labor costs for repairs. The duration of a warranty can vary, often ranging from 1 to 2 years, depending on the manufacturer and model. Insurance, however, focuses on accidental damage, theft, or loss, providing financial compensation or device replacement. It often has a deductible, and the coverage period can be customized based on your preferences and budget.

Yes, you can have both a warranty and insurance for your phone. The warranty provided by the manufacturer covers manufacturing issues, while insurance offers protection against accidental damage, theft, or loss. Having both ensures comprehensive coverage, addressing both the manufacturer's responsibility and potential external factors that may affect your device. It's essential to understand the terms and conditions of each to maximize your protection and know your rights as a consumer.