A captive insurer is a wholly-owned subsidiary insurer that provides insurance to its parent company or related entities. Captive insurance is a form of self-insurance, where a company creates a subsidiary insurer to provide insurance coverage for itself. It is primarily used to insure against the company's own specific risks and to take financial control of insurance allocations. Captive insurance companies are subject to regulatory requirements, including financial reporting, capital and reserve requirements, and solvency levels. They can be domiciled in the US or offshore jurisdictions, such as Bermuda or the Cayman Islands, to take advantage of favourable tax laws.

| Characteristics | Values |

|---|---|

| Definition | A "captive insurer" is an insurance company that is wholly owned and controlled by its insureds. |

| Purpose | To insure the risks of its owners, and its insureds benefit from the captive insurer's underwriting profits. |

| Formation | Captives are formed when insureds choose to put their own capital at risk by creating their own insurance company and working outside of the commercial insurance marketplace. |

| Risk | Insureds in a captive put their own capital at risk and participate in the risks and rewards. |

| Commercial Insurance | Captives work outside the traditionally regulated commercial insurance marketplace, allowing for more control and flexibility in risk management. |

| Benefits | Captives offer stability in pricing and availability, improved cash flow, and increased control over the insurance program. |

| Types | Pure Captives, Sponsored Captives, Group Captives, Rental Captives, Cell Captives, Micro Captives, etc. |

| Ownership | Captives are owned and controlled by their insureds, distinguishing them from commercial insurers. |

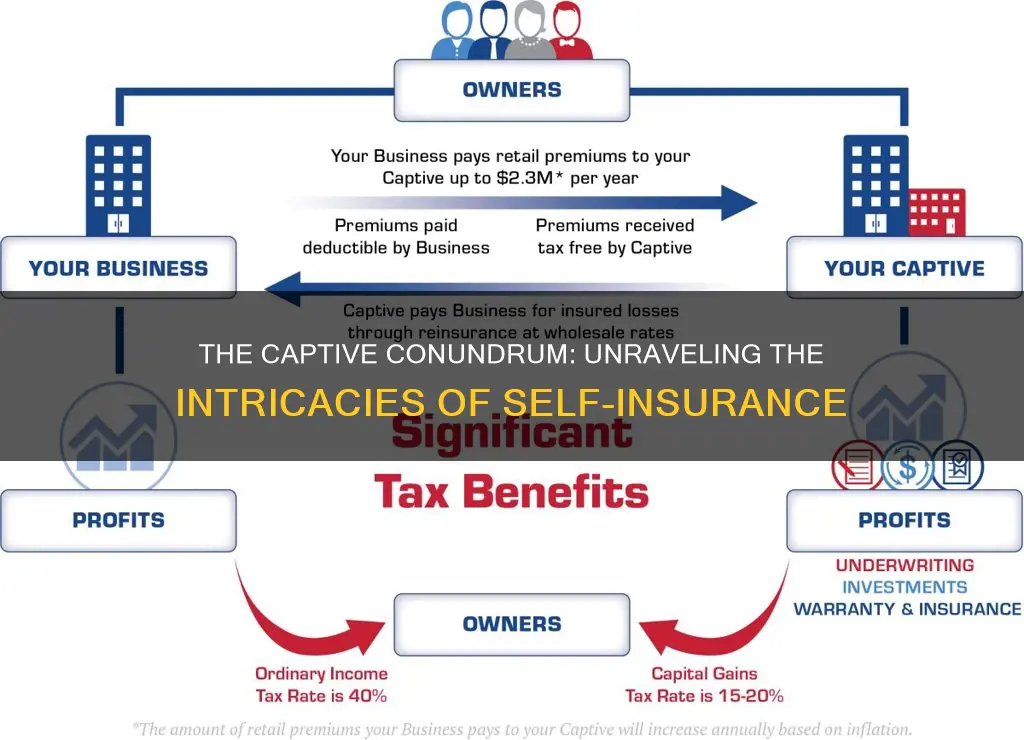

| Tax Implications | Captives can provide tax deductions and exemptions for parent companies, but they must comply with IRS regulations to avoid being penalized for tax evasion. |

| Industries | Captives are used across industries, including automotive, telecommunications, technology, healthcare, and energy. |

| Size | Captives can be used by large corporations, small businesses, and non-profit organizations. |

| Location | Captives may be domiciled in the US or offshore jurisdictions like Bermuda and the Cayman Islands for tax advantages. |

| Formation Assistance | Organizations like PwC offer services to assist companies in forming and maintaining captives. |

What You'll Learn

Captive insurance is a form of self-insurance

Captive insurance is a risk mitigation strategy. By creating its own insurance company, a business can protect itself against catastrophic losses, create coverage for unique risks that may be unavailable in a traditional insurance arrangement, and build a war chest of funds that will be available for future claims by taking advantage of pretax premium payments and underwriting investment.

Captive insurance companies are typically established to meet the unique risk-management needs of the owners or members. They are also formed to cover a wide range of risks; practically every risk underwritten by a commercial insurer can be provided by a captive.

Captive insurance companies have been in existence for over 100 years. The term "captive insurance" was coined by Frederic Reiss, a property-protection engineer in Youngstown, OH, in 1955. Reiss established the first captive insurance company in Bermuda in 1962. Over the past 30 years, there has been significant growth in the captive market. Today, there are over 7,000 captives globally.

Captive insurance is not a solution to all insurance problems. However, it can be a viable option for businesses that want more control over their financial losses. It is important to understand that a captive is a business separate and apart from your primary operating business, no matter what structure is ultimately selected. Close attention must be paid to the formation and operation of a captive, or the consequences will nullify the advantages.

Captives are owned by their insureds

Captive insurance companies are wholly owned by their insureds, who are also known as policyholders. This means that the insureds have ownership and control of the company and benefit from its profitability. Insureds who purchase captive insurance put their own capital at risk by creating their own insurance company and working outside the commercial insurance marketplace.

Captive insurance companies are formed to provide insurance to a non-insurance parent company and its affiliates or to an association. They are a form of self-insurance, where a company creates a subsidiary insurer to provide insurance coverage for itself.

Captive insurance companies are subject to state regulatory requirements, including financial reporting, capital and reserve requirements, and solvency levels. They can be domiciled and licensed in a wide number of jurisdictions, both in the US and offshore.

There are two main types of captive insurance companies: pure captives and group captives. Pure captives are owned and operated by the member companies and only insure the member companies that own the captive. Group captives are owned by a collection of companies and provide insurance coverage to member companies.

Long-Term Security: Exploring the Benefits of 20-Year Term Life Insurance Plans

You may want to see also

Captives offer greater control over coverage

Captive insurance companies are a form of corporate self-insurance. They are wholly owned subsidiaries created to provide insurance to their parent company or related entities. Captives are formed for a variety of reasons, including when the parent company cannot find suitable external insurance for specific business risks, when premiums paid create tax savings, and when the insurance provided is more affordable.

- Captives allow companies to tailor coverage for hard-to-insure or emerging risks. This is especially beneficial for companies with unique risk profiles that traditional insurers struggle to accommodate.

- Captives enable companies to apply alternative strategies to deal with insurance market cycles, providing financial incentives for loss control and offering flexibility in risk management.

- Captives give companies the freedom to customize insurance programs, including the terms and conditions of policies. This can improve loss control efficiency and promote greater awareness of factors that commonly cause losses.

- Captives allow companies to direct investment options, providing an opportunity to generate additional profits.

- Captives provide increased control over insurance-related services such as safety and loss control, and claims administration. This allows companies to establish their own claims handling policies and procedures, reducing the time taken to process and pay claims.

- Captives offer improved cash flow benefits by generating investment income from unearned premiums received. This is particularly advantageous when premiums are paid in advance and losses are paid out over an extended period.

- Captives provide greater control over premium fluctuations and changes in the market, allowing companies to choose between vendors and service providers.

Understanding the Criteria: Unlocking Short-Term Insurance Eligibility

You may want to see also

Captives are subject to state regulatory requirements

Captive insurance companies are subject to state regulatory requirements. This means that they must comply with the laws and regulations set forth by the state in which they are formed or domiciled. These requirements can vary from state to state, but generally include financial reporting, capital and reserve requirements, solvency levels, and rate reporting.

In the United States, captive insurance companies are also governed by provisions in the Internal Revenue Code (IRC). The IRC allows for tax deductions on premiums paid to captive insurance companies by their parent companies, provided that certain risk-shifting and risk-distribution rules are met. The IRC also requires that captives have enough money to pay claims and maintain a minimum surplus.

Captive insurance companies are regulated differently from traditional insurance companies. Traditional insurers provide risk transfer to the general public, while captives are a form of self-insurance where the insurer is owned wholly by the insured. As a result, the regulation of captives focuses more on the adequacy of finances and management competence rather than policy forms, rates, and claims personnel.

Captives are typically exempt from taxes and pool contributions that traditional insurers must pay into state-mandated funds. However, they are still required to comply with insurance regulations and meet solvency levels.

Overall, captives are subject to state regulatory requirements that may differ depending on the state in which they are formed. These requirements can include financial reporting, capital and reserve levels, solvency, and compliance with insurance regulations. Captives must also comply with the IRC, which offers tax deductions for premiums paid to captives by their parent companies.

Haven Insurance: Understanding the Fine Print

You may want to see also

Captives can be domiciled in the US or offshore

There are several factors to consider when choosing a domicile for a captive. One key consideration is the receptiveness of the regulatory environment, which should be acceptable to the parent company, insurers, and the government in the parent company's domicile. Those exploring captives should look for domiciles with a well-established regulatory authority focused on captives, stability in the political and economic regime, and regulatory compatibility with the business objectives of the captive.

Another important factor is the fiscal framework and tax planning. There are US tax effects and consequences to being onshore and offshore, and these should be carefully considered. Onshore jurisdictions typically assess a premium tax for direct or assumed premium written in the captive, while offshore jurisdictions tend to impose annual license renewal fees instead. Additionally, the domicile's tax authorities' view of each captive is important to consider, as achieving the most tax-efficient structure should be part of the captive strategy.

Other considerations include the availability of professional services, the quality of local infrastructure, the stability of the regulatory environment, and the flexibility of the investment portfolio. The length of time a jurisdiction has been a captive domicile, its level of experience, and its track record of efficient financial outcomes are also important factors to weigh.

Ultimately, the decision of whether to domicile a captive onshore or offshore depends on the specific needs and strategic plans of the company. Both options offer unique advantages and disadvantages, and it is crucial to carefully evaluate all aspects before making a choice.

Term Insurance: Understanding the Wait for Coverage

You may want to see also

Frequently asked questions

A captive is a licensed insurance company that is wholly owned and controlled by its insureds. It is a form of self-insurance where the insurer is owned by the insured.

Captives allow owners to take financial control of insurance allocations and manage risks. They can also provide financial incentives for loss control, offer flexibility in managing risk, and tailor coverage for hard-to-insure or emerging risks.

Captives are used by a diverse range of entities, including Fortune 500 companies, private companies, and non-profit organizations. They are also used across various market sectors, including automotive, telecommunications, technology, retail/consumer, manufacturing, healthcare, pharmaceutical, and energy.