When a client has multiple insurance coverages, the first payer responsible for the remittance of the claim is known as the primary insurance, and the second payer is known as the secondary insurance. Primary insurance is responsible for their portion of the contracted rate as per the client's insurance plan, and the secondary insurance will often cover the client's copay or sometimes more. It is important to note that the client does not get to choose which insurance is their primary coverage, this is determined by the insurance payers. Typically, the insurance under which the client is the primary subscriber is the client's primary insurance. For example, if a client has insurance coverage from their employer but also has coverage through their spouse's employer, then their insurance coverage through their own employer would be primary and the coverage under their spouse's plan would be secondary. Once the primary payer has remitted the claim, it is then possible to submit the claim to the secondary payer.

| Characteristics | Values |

|---|---|

| When to bill secondary insurance | After the primary insurance has paid and there is a remaining balance |

| Who is the primary insurer? | The insurer under which the client is the primary subscriber |

| Who is the secondary insurer? | The insurer under which the client is the secondary subscriber |

| When to submit a claim to the secondary insurer | After the primary insurer has paid and there is an outstanding amount |

| What does the secondary insurer cover? | The secondary insurer will often cover the client's copay or a portion of the remaining balance |

What You'll Learn

Primary insurance must be billed before secondary insurance

When a patient has multiple insurance plans, it is essential to understand the difference between primary and secondary insurance to ensure that insurance claims are processed correctly and promptly.

Primary insurance is the policy that claims will be billed to first. It is typically the insurance plan under which the client is the primary subscriber. For example, if a client has insurance through their employer and their spouse, the insurance through their employer is usually the primary insurance. The client does not get to choose which insurance is their primary—this is determined by the insurance payers.

After the primary payer covers its portion of the claim, the claim is then sent to the secondary insurance company. The secondary insurance will pay a portion of the remaining balance, which often includes the client's copay. It is important to note that having two insurance plans does not mean the patient has zero payment responsibility. The secondary insurance won't cover the primary insurance's deductible, and the patient may still be responsible for copays or coinsurance.

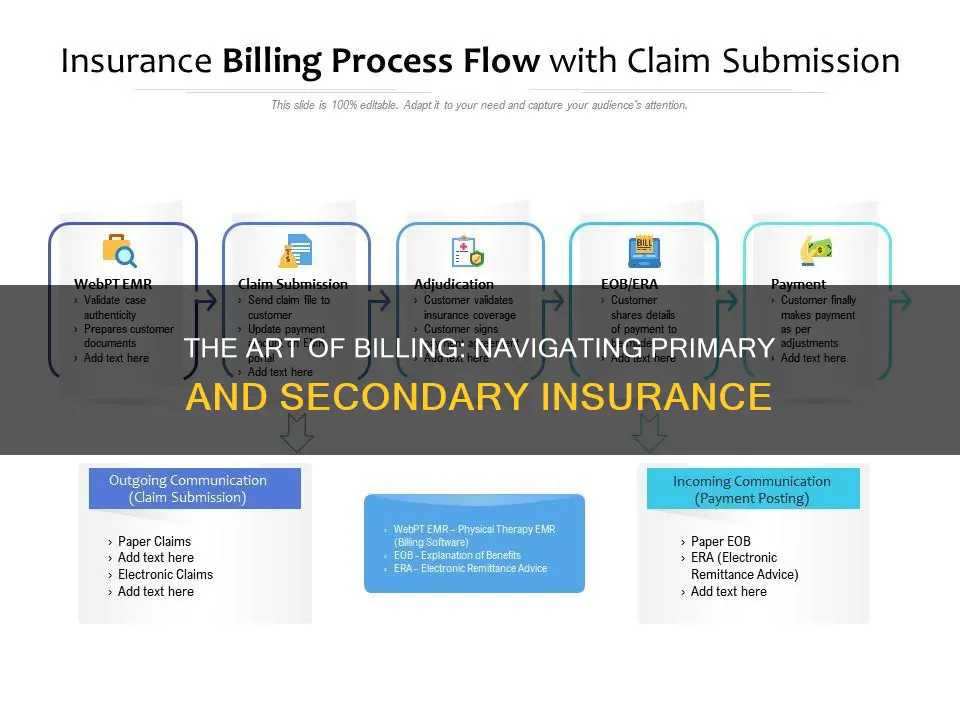

Before submitting a claim to secondary insurance, it is crucial to confirm which insurance is the patient's primary coverage. Healthcare practices cannot submit a claim to both insurance companies simultaneously. Therefore, the claim is first submitted to the primary insurance, and then, once the payment has been received, it is submitted to the secondary insurance.

When submitting a claim to secondary insurance, in addition to the regular billing details, the total initially billed amount, the amount paid by the primary insurer, and the reasons for any shortfalls in payment from the primary insurer should be included. It is also beneficial to include the full explanation of benefits from the primary insurer.

In summary, to ensure timely and accurate reimbursement, it is vital to understand the difference between primary and secondary insurance and to follow the correct billing procedures.

The Unveiling of the New Insurance Bill: Revolutionizing the Industry

You may want to see also

Secondary insurance covers the client's copay

When a client has multiple insurance coverages, the first payer is called the primary insurance, and the second payer is called the secondary insurance. The client does not get to choose which insurance is primary and which is secondary; this is determined by the insurance payers. The primary insurance will be the insurance plan under which the client is the primary subscriber. For example, if a client has insurance through their employer and their spouse's employer, the insurance coverage through their employer will likely be primary, and the coverage through their spouse's employer will be secondary.

When billing for primary and secondary claims, the primary claim is sent before the secondary claim. Once the primary payer has paid, you can send the claim to the secondary payer. The secondary insurance will then pay some or all of the remaining costs.

It is important to note that having two health insurance plans does not mean that you will receive double the benefits. The total amount received from both insurance plans cannot exceed 100% of the total medical costs. Additionally, having two insurance plans means you may have to pay two premiums and deductibles, which can increase costs.

The Insurance Conundrum: Unraveling the Safety Net of Treasury Bills

You may want to see also

The client doesn't choose which insurance is primary

When a client has multiple insurance coverages, the first payer is known as the primary insurance, and the second payer is known as the secondary insurance. The client does not get to choose which insurance is primary and which is secondary—this is determined by their insurance payers. Typically, the primary insurance will be the insurance plan under which the client is the primary subscriber.

For example, if a client has insurance coverage from their employer but also has coverage through their spouse's employer, the insurance coverage provided by their own employer would be primary, and the coverage under their spouse's plan would be secondary. In this case, the client's own insurer is always the primary payer for their medical bills.

When a client has more than one form of insurance coverage, and one of those plans is TriCare or Medicaid, it is likely that the TriCare or Medicaid coverage is secondary. Medicare plans can be either primary or secondary coverage, depending on the client's situation.

If a client has two forms of insurance coverage and one of those plans is through their employer, it is generally considered the primary insurance. However, if the client is a minor or young adult covered under their parent's insurance plans, the birthday rule applies. In this case, whichever parent's birthday falls first in the year is considered the primary insurance, regardless of age. If the parents share a birthday, the primary plan would be the one that has been effective longer.

Understanding Betterment Clauses: Maximizing Insurance Claims and Minimizing Losses

You may want to see also

Secondary insurance may not pay if primary insurance denies coverage

When a client has multiple insurance coverages, the first payer responsible for settling the claim is known as the primary insurance, and the second payer is known as the secondary insurance. The secondary insurance only comes into play if the primary insurance is unable to cover the entire claim. In such cases, the secondary insurance may cover some or all of the remaining costs. However, it is not guaranteed that the secondary insurance will pay the remaining costs.

If your primary insurance denies coverage, the secondary insurance may or may not pay some part of the cost, depending on the insurance. In the absence of primary insurance, the secondary insurance may make little or no payment for your healthcare costs. Therefore, it is essential to understand how your insurance plans work together to get the most coverage.

When billing for primary and secondary claims, the primary claim is sent before the secondary claim. Once the primary payer has remitted the primary claim, you can send the claim to the secondary payer. It is a common mistake to think that primary and secondary insurance claims are billed simultaneously.

To determine which insurance is primary and which is secondary, the client's insurance payers make that decision. Typically, the insurance plan under which the client is the primary subscriber is considered the primary insurance. For example, if a client has insurance coverage from their employer and their spouse's employer, the insurance coverage through their employer is likely the primary insurance, and the coverage under their spouse's plan is secondary.

The IUD Insurance Billing Conundrum: Unraveling the Complexities

You may want to see also

Secondary insurance may cover deductibles, copayments, and coinsurances

When a client has multiple insurance coverages, the first payer is known as the primary insurance, and the second payer is known as the secondary insurance. The secondary insurance will often cover the client's copay or a portion of the remaining balance, which may include deductibles, copayments, and coinsurances.

A deductible is the amount you pay each year for eligible medical services or medications before your health plan begins to share in the cost of covered services. For example, if you have a $2,000 yearly deductible, you need to pay the first $2,000 of your total eligible medical costs before your plan starts contributing.

A copayment, or copay, is a flat fee that you pay each time you go to the doctor or fill a prescription. For instance, if you go to the doctor due to back pain or need a refill of your child's asthma medicine, the amount you pay for that visit or medicine is your copay. Copayments are usually printed on your health plan ID card.

Coinsurance is a portion of the medical cost you pay after your deductible has been met. It is the percentage of a medical charge you pay, with the rest paid by your health insurance plan. For example, if you have 20% coinsurance, you pay 20% of each medical bill, and your health insurance will cover the remaining 80%.

Frequently asked questions

Secondary insurance is the second payer when a client has multiple insurance coverages. The first payer is known as the primary insurance.

Primary insurance pays first for your medical bills. Then, the secondary insurance pays some or all of the remaining costs, such as deductibles, copayments, and coinsurances.

You first submit the claim to the primary payer. Only after the primary payer has paid or denied the claim do you submit it to the secondary payer.

Typically, the insurance plan under which the client is the primary subscriber is the primary insurance. The client does not get to choose which insurance is their primary—it is determined by the insurance payers.

If your primary insurance denies coverage, the secondary insurance may or may not pay some part of the cost, depending on the insurance.