The No Surprises Act is a federal law that came into effect on January 1, 2022, and protects people from unexpected medical bills. It covers most types of health insurance and shields individuals from unexpected out-of-network medical bills for emergency room visits and non-emergency care related to visits to in-network hospitals, hospital outpatient departments, or ambulatory surgical centres. The law also applies to air ambulance services. In addition to the No Surprises Act, there are other bills aimed at providing universal access to quality healthcare, such as the National Health Insurance (NHI) Bill in South Africa. The NHI Bill seeks to provide all South Africans with access to quality healthcare, regardless of their socio-economic status, by creating a single public health fund.

What You'll Learn

Universal healthcare access

Universal health coverage (UHC) is a broad concept that has been implemented in several ways across the world. The common denominator for all such programs is some form of government action aimed at extending access to health care as widely as possible and setting minimum standards. Most countries implement universal health care through legislation, regulation, and taxation.

The goal of UHC is to ensure everyone receives the health services they need without facing financial hardship. It is about ensuring that everyone, especially the most vulnerable, has access to quality health care without suffering financial hardship. UHC allows countries to make the most of their strongest asset: human capital. Supporting health represents a foundational investment in human capital and in economic growth—with good health, children can attend school and eventually reach their full potential, while adults are able to lead productive healthy lives.

UHC is an important part of the Sustainable Development Goals (SDGs). SDG 3.8 aims to "achieve universal health coverage, including financial risk protection, access to quality essential health care services, and access to safe, effective, quality, and affordable essential medicines and vaccines for all."

UHC can be determined by three critical dimensions: who is covered, what services are covered, and how much of the cost is covered. It is described by the World Health Organization as a situation where citizens can access health services without incurring financial hardship.

There are several models of UHC:

- Single-payer model: This is a publicly financed and administered system, with the government collecting and providing the funding to pay for health care.

- Bismarck model: This is a form of statutory health insurance involving multiple nonprofit payers that are required to cover a government-defined benefits package and to cover all legal residents.

- Public option approach: This is a publicly administered plan that directly competes with private insurance plans and could be national or regional in scope.

- Medicare/Medicaid buy-in approach: This builds upon existing public programs by allowing individuals to purchase health care coverage through these programs.

There are several challenges to achieving UHC:

- Half of the world's population, or 4.5 billion people, is not covered by essential health services, and 2 billion people face severe financial hardship.

- Health service coverage has stagnated since 2015, and financial hardship due to out-of-pocket health spending has worsened, undermining efforts to eradicate poverty globally.

- Global commitments for women, children, and adolescents are falling behind. According to the latest estimates, 4.9 million children died before their fifth birthday in 2022.

- Demographics and disease profiles are changing, putting pressure on health systems. Globally, fertility has fallen significantly from an average of 5 births per woman in 1950 to 2.3 per woman in 2021.

- Populations are aging worldwide: people aged 65 and older now outnumber children under 5. By 2050, 1.5 billion people will be 65 and older.

- Non-communicable diseases (NCDs) are on the rise, accounting for 41 million deaths each year (74% of all deaths globally), with more than three-quarters of NCD deaths occurring in low and middle-income countries.

- Climate change is also a critical contributor to the burden of NCDs through factors such as air pollution, heat stress, and extreme weather events.

To overcome these challenges, the World Bank supports countries to:

- Strengthen service delivery and health financing, while mitigating the risks of climate and pandemics on health.

- Expand services in response to demographic and epidemiological changes, including essential services promoting maternal and child health, nutrition, prevention, gender equity, as well as non-communicable diseases, mental health, and long-term care associated with aging.

- Engage Ministries of Finance and Health and other sectors through knowledge and learning and strengthening data for decision-making to guide policy reform and achieve more efficient and effective spending for health.

Navigating Out-of-Network Insurance Billing: A Comprehensive Guide

You may want to see also

Healthcare funding

The cost of healthcare is a significant concern for many people, and understanding how it is funded can be complex. In the United States, the Affordable Care Act and Medicare aim to provide healthcare funding for citizens, but unexpected costs can still arise due to procedural codes, medical jargon, and insurance adjustments. To navigate this complex system, it is essential to understand the role of insurance companies and healthcare providers in determining costs and negotiating charges.

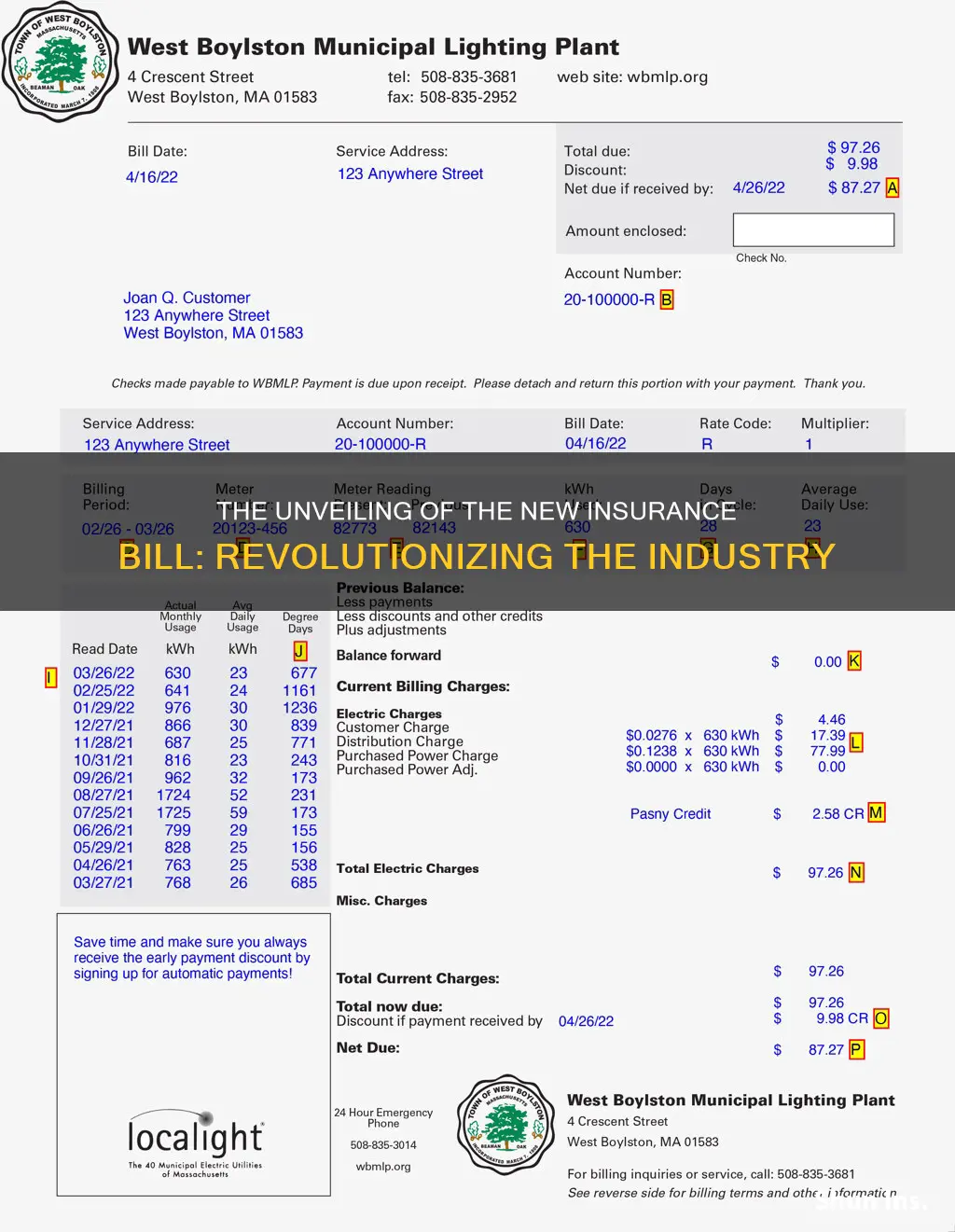

When seeking healthcare, individuals typically contact a healthcare provider and provide basic information, including insurance details. The healthcare provider then verifies this information with the insurance company and determines the patient's out-of-pocket expenses, known as co-pay. After receiving services, the patient receives a bill outlining the charges for the services provided. This bill consists of multiple components, including the service date, description of services, charges, adjustments, insurance payments, and the amount due.

It is important to distinguish between the bill and the Explanation of Benefits (EOB). The EOB is sent by the insurance company and outlines the treatments and services covered by the patient's insurance plan and those for which the patient is responsible. It includes information such as member details, the provider's name, claim number, service code, and total amount. While the EOB may show a balance due, it is not a bill, and patients should not pay anything until they receive an actual bill from the healthcare provider.

In some cases, individuals may receive surprise medical bills, which are unexpected out-of-network medical bills. To protect against this, the No Surprises Act was implemented in 2022, safeguarding individuals from surprise bills when treated by an out-of-network provider within their health plan's network. This Act also applies to emergency room visits and related non-emergency care.

In South Africa, the National Health Insurance (NHI) Bill aims to provide universal access to quality healthcare for all citizens, regardless of their socio-economic status. The NHI fund will cover all South Africans, rich or poor, and legal long-term residents, narrowing the gap between the rich and poor in terms of healthcare standards. The fund will be supported by general taxes, contributions from individuals above a certain income threshold, and monthly employee contributions.

The Renewal Riddle: Unraveling the Mystery of Level Term Insurance

You may want to see also

Medical fees

Medical billing in the United States can be a confusing process, with a large percentage of consumers reporting that they are confused by their medical bills. The No Surprises Act, which came into effect on January 1, 2022, provides federal consumer protection against unexpected medical bills.

The No Surprises Act protects consumers from unexpected out-of-network medical bills for emergency room visits, non-emergency care related to a visit to an in-network hospital, and air ambulance services. It applies to most types of health insurance and requires providers to give consumers a good faith estimate of the expected charges for their health care.

In addition to the No Surprises Act, there are other ways to protect yourself from unexpected medical fees. It is important to understand the basic types of health insurance and know which one you have. The most common types of insurance plans include Exclusive Provider Organization (EPO), Health Maintenance Organization (HMO), Point of Service (POS), Preferred Provider Organization (PPO), and Medicare/Medicaid. Each plan has different requirements and stipulations on what is covered. For example, an EPO only covers services if you use doctors, specialists, or hospitals within the plan's network, except in an emergency.

It is also important to understand key aspects of your insurance plan, such as deductibles, co-insurance, and co-pays. A deductible is the amount of money that a patient must pay each calendar year before their insurance starts paying for their medical bills. A co-pay is a flat fee that is paid each time a patient receives a particular type of medical care, usually after the deductible has been met. Co-insurance is the percentage of charges that consumers must pay to their medical provider after meeting their deductible.

To avoid unexpected medical fees, it is recommended that consumers ask their doctor's billing folks to provide a complete list of the providers who could be part of their medical team and check with their insurer to see if these providers are covered by their specific plan.

Maximizing Telehealth Reimbursement: Navigating the Insurance Billing Landscape

You may want to see also

Insurance coverage

The new National Health Insurance (NHI) Bill seeks to provide universal access to quality healthcare for all South Africans, regardless of their socioeconomic status. The NHI fund will cover all South African residents, pooling healthcare funding for both private and public providers. The NHI fund will be financed through general taxes, contributions from individuals above a certain income threshold, and monthly contributions from employees.

Under the NHI, there will be no fees charged at healthcare facilities as the fund will cover the costs of medical care. The NHI will not replace medical aid schemes, and members will be free to continue with their existing schemes if they wish to. However, once the NHI is fully implemented, the role of medical schemes will change as they will provide cover for services not reimbursed by the NHI fund.

In other insurance news, the No Surprises Act, which came into effect on January 1, 2022, protects individuals in the US with health insurance from unexpected out-of-network medical bills for emergency room visits and certain other services. The Act also requires providers to give uninsured or self-pay patients a good faith estimate of expected charges when scheduling non-emergency services.

Health insurance policies typically cover all medical expenses outlined in the policy documents. However, any services provided before or after the effective date of the policy will not be covered. The effective date is when the coverage begins, and it is usually not immediate. To activate the coverage, individuals must complete an enrollment form and pay the first month's premium.

Insurance plans are cost-sharing agreements between the individual and the insurance company. Many insurance companies cover the costs for preventive care, such as check-ups and vaccinations. For other services, individuals may have to cover all costs until they reach a specified amount, known as a deductible, after which the insurance company starts paying for covered services.

The amount an individual pays for each procedure after reaching the deductible depends on their specific plan. The insurance company determines how much they will pay for each service, and the individual is responsible for the remaining amount. This is outlined in the Explanation of Benefits (EOB) provided by the insurance company.

Other key insurance terms include copay, deductible, coinsurance, and maximum out-of-pocket (MOOP) expense. A copay is a fixed dollar amount paid each time an individual receives medical care. A deductible is a fixed dollar amount that must be paid within a defined period before the insurer covers costs. Coinsurance refers to paying a percentage of the total costs rather than a fixed amount. The MOOP is the maximum amount an individual will have to pay for medical expenses within a given time period, usually a year.

It is important to understand the billing cycle and how to read medical bills and EOBs to ensure accurate and timely payments. Additionally, individuals should be aware of their rights and protections under relevant laws, such as the No Surprises Act, to avoid unexpected charges.

Unraveling the Insurance Billing Process: A Step-by-Step Guide

You may want to see also

Billing errors

- Know Your Health Plan: Understanding your health plan coverage is crucial. Read through your plan's summary of benefits, coverage details, and network of providers. Know your deductibles, copays, coinsurance, and out-of-pocket limits. This information is typically available on your insurer's or employer's benefits website.

- Estimate Costs in Advance: Whenever possible, try to estimate the costs of medical procedures or treatments before receiving care. Contact your doctor's office to inquire about the billing codes and expected charges. Then, reach out to your insurance company to confirm coverage and estimate your out-of-pocket expenses.

- Review Paperwork Carefully: After receiving medical care, you will typically get paperwork from both your healthcare provider and your insurer. This includes bills from the provider and an Explanation of Benefits (EOB) from your insurer. Review these documents carefully and compare them to the estimates you received beforehand. Look for discrepancies or unexpected charges.

- Act Quickly: If you identify a potential billing error, don't delay in addressing it. Contact your healthcare provider and/or insurer to inquire about the questionable charges. Discuss the issue with both parties if needed. It is important to act promptly, as you may have a limited time frame to resolve the issue before the bill goes to collections.

- Seek Help: If you are unable to resolve the issue on your own, consider reaching out for assistance. You can contact your employer's benefits department, work with a medical billing advocate, or even enlist legal counsel if necessary. Additionally, you can submit a complaint to the Centers for Medicare and Medicaid Services or utilize the No Surprises Help Desk for further guidance.

- Negotiate Your Bill: If you cannot dispute a charge, you may still have room to negotiate. Research typical prices for procedures in your area and compare them to your bill. If you find that you have been overcharged, reach out to your healthcare provider to request a reduction in fees. You can also inquire about payment plans or financial assistance programs offered by the provider.

- Preventative Measures: To avoid billing errors in the first place, stay proactive. Keep yourself informed about billing and coding trends, and always double-check your work when creating or reviewing a claim. Communicate regularly with the personnel in your provider's office to address any potential errors promptly.

The Dark Side of Short-Term Insurance: Uncovering the Hidden Pitfalls

You may want to see also

Frequently asked questions

The No Surprises Act is a federal law that came into effect on January 1, 2022, to protect people from unexpected medical bills. It applies to most types of health insurance and protects people from unexpected out-of-network medical bills from emergency room visits and non-emergency care related to a visit to an in-network hospital.

The NHI Bill is a piece of legislation in South Africa that aims to provide universal access to quality healthcare for all South Africans. The NHI fund will cover South Africans of all races and socioeconomic backgrounds, and legal long-term residents. There will be one pool of funding for both private and public healthcare providers, and the cost of the country's healthcare system will be reduced.

An EOB is a document sent by health insurance companies to their customers after a claim has been submitted by a healthcare provider. It explains what medical treatments and services the insurance company has agreed to pay for and what the customer may be responsible for paying. It is not the same as a medical bill, but it may show a balance due. When the EOB indicates that money is owed, the customer can expect a separate bill from the healthcare provider.