Insurance billing can be a complex process, but it's important to understand how it works to avoid unexpected costs. The billing process starts when a patient contacts a healthcare provider to schedule an appointment and provide basic information such as insurance details. The provider then verifies the patient's insurance coverage and determines the financial responsibility for the visit. During the visit, the patient may be required to complete registration paperwork, provide an insurance card, and make a co-payment. After the visit, the provider submits a claim to the patient's insurance company, detailing the services provided and associated costs. The insurance company then reviews the claim and decides on reimbursement. The patient will receive a bill for any remaining balance not covered by insurance. Throughout the process, it's important to keep track of billing statements and Explanation of Benefits (EOB) reports to identify and dispute any errors or unexpected charges.

| Characteristics | Values |

|---|---|

| Registration | Patient provides personal and insurance information to the provider |

| Establish financial responsibility | Biller determines which services are covered under the patient's insurance plan |

| Patient check-in and check-out | Patient completes forms, confirms information, and provides official identification and a valid insurance card |

| Check for coding and billing compliance | Biller ensures the claim meets the standards of compliance for coding and format |

| Prepare and transmit claims | Biller puts the superbill into a paper claim form or billing software |

| Monitor payer adjudication | Payer evaluates a medical claim and decides whether to accept, deny, or reject it |

| Generate patient statements or bills | Biller creates a statement or bill for the patient outlining the remaining amount to be paid |

| Assign patient payments and arrange collections | Biller mails out timely, accurate medical bills and follows up with patients whose bills are delinquent |

What You'll Learn

Understanding medical bills

Medical billing in the United States can be a complex process, with 72% of American consumers reporting confusion over their medical bills. This guide will help you navigate the process and understand your medical bills.

What Medical Bills Cover

Medical fees can seem arbitrary, but several factors influence how hospitals and physicians' offices calculate the cost of health services. These include facility capacity, supply and demand, hospital reputation, and the Charge Description Master (CDM) list, which is a master list of service costs and billing codes.

The Billing Cycle

The billing cycle begins when you contact a healthcare provider to schedule an appointment. At this stage, you should ask about the services and supplies you will receive and what your insurance will cover. You should then contact your insurance company to confirm coverage and get a cost estimate.

On the day of your appointment, you will complete registration paperwork and provide your insurance card, ID, policyholder name, and insurance group number. After your appointment, medical coders will identify all services, prescriptions, and supplies received and update your records with the corresponding codes.

The healthcare provider will then create an insurance claim and submit it to your insurance company. A claims processor will review the claim and decide whether to accept, deny, or reject it. If the claim is valid, the insurance company will reimburse your healthcare provider, and you will be billed for any remaining balance.

Reading Your Bill

When you receive a medical bill, it is important to understand the various components, including the statement date, account number, service date, description of services, charges, billed charges, adjustments, insurance payments, patient payments, and balance due.

Explanation of Benefits (EOB)

In addition to your medical bill, you may receive an Explanation of Benefits (EOB) from your insurance company. This is not a bill but a report that explains what treatments and services your insurance company agreed to pay for and what you are responsible for paying. The EOB will include information such as member information, patient account number, provider name, claim number, date of service, service codes, total amount, amount not covered, reason for denial, amount covered by the plan, deductibles, copayments, and total patient responsibility.

Dealing with Billing Errors

Billing errors can occur, so it is important to monitor your bills and EOBs closely. Common errors include incorrect quantities, duplicate charges, charges for treatments or procedures that were cancelled, inflated surgery and recovery times, and charges for basic supplies. If you spot an error, contact your healthcare provider's billing office or your insurance company to dispute the charge.

To avoid surprises, it is recommended to request an itemized bill and compare it to your final bill, create a list of charges, and check for common errors. You can also use online tools to compare charges in your area for specific procedures.

Weighing the Benefits: Exploring the Switch from Term to Permanent Life Insurance

You may want to see also

Establishing financial responsibility

Understanding Financial Responsibility

Financial responsibility in insurance billing refers to determining who is responsible for paying medical bills and how much they need to pay. This typically involves coordinating between the patient, their insurance provider, and, in some cases, government payers like Medicare and Medicaid. "Patient responsibility" specifically refers to the portion of the bill that the patient is required to pay out of pocket.

Determining Patient Responsibility

When a patient registers, it is essential to check their insurance details and ensure their information is up to date. If the patient has insurance, the provider will liaise with their insurance payer to understand their coverage and establish any prior authorization requirements. Based on this information, the provider can then estimate how much of the treatment cost will be reimbursed by the payer and how much will be the patient's responsibility.

Components of Patient Responsibility

Patient responsibility typically includes the following:

- Co-payment: A fixed fee that patients pay toward their medical care at the time of service.

- Deductible: The total amount patients must pay toward medical care annually before the payer contributes.

- Coinsurance: The patient's share of remaining medical costs after paying their deductible.

- Out-of-pocket maximum: Some health plans set an annual limit to how much a patient needs to pay, including co-payments, deductibles, and coinsurance.

Importance of Accurate Calculations

Accurate calculations of patient responsibility are crucial for the provider's revenue cycle. Incorrect charges, unexpected costs, and confusing payment processes can create poor financial experiences for patients and impact their satisfaction. Therefore, providers must be diligent in calculating patient responsibility to ensure clarity for all parties involved.

Utilizing Automation and Digital Tools

With frequent policy changes and complex insurance plans, manual processes for calculating patient responsibility are no longer feasible. Automation and digital tools, such as revenue cycle management (RCM) services, can help providers streamline the billing process. These tools enable providers to verify insurance eligibility, find missing or forgotten coverage, and automate prior authorization, making it easier to determine patient responsibility promptly and accurately.

Enhancing Payment Processes

To improve the likelihood of receiving payments, providers should make the payment process as convenient as possible for patients. This may include offering credit card processing, providing payment plans or charity assistance, and connecting patients with payment tools throughout their healthcare journey.

Outsourcing Difficult Collections

For challenging or time-consuming collections, providers can outsource to billing experts or RCM services vendors. These professionals can work empathetically with patients to address their financial concerns while freeing up staff time to focus on more critical tasks.

Managing Claims and Denials

Partnering with an RCM services vendor can also help providers effectively manage claims and denials, maximizing reimbursements from payers. Clean and accurate claims are essential to optimizing revenue and minimizing delays in the billing process.

By following these guidelines and utilizing the appropriate tools, providers can establish clear financial responsibility, improve the patient experience, and streamline their insurance billing processes.

Understanding Family Term Insurance: Protecting Your Loved Ones

You may want to see also

Patient check-in and check-out

Copayments are always collected at the point of service, and it is up to the provider to determine whether the patient pays the copay before or immediately after their visit. During check-in or check-out, the provider's office will also collect the patient's signature on the Advance Beneficiary Notice of Noncoverage (ABN), which states that the patient may be financially liable for costs if their insurance carrier denies the claim.

Once the patient has checked out, the medical report from their visit is sent to the medical coder, who translates the information into medical code. This report, which includes demographic information and the patient's medical history, is called the "superbill." The superbill is then transferred to the medical biller, who puts it into a paper claim form or billing software.

Understanding Reduced Paid-Up Term Insurance: A Guide to This Policy Option

You may want to see also

Claim adjustments

Understanding Claim Adjustments

Firstly, a claim adjustment refers to a change in the amount billed to a patient's insurance company. This can occur due to various reasons, such as errors, disputes, or changes in coverage. Adjustments can result in either an increase or decrease in the billed amount.

Common Reasons for Claim Adjustments

- Medical Necessity: Claims may be denied if a procedure is deemed medically unnecessary. In such cases, additional information or evidence may be required to prove that the service was medically necessary. For example, a surgery to remove excess skin after weight loss might be initially denied as cosmetic surgery. However, if the physician provides evidence that the procedure was necessary to treat chafing, irritation, or infection, it would be considered medically necessary.

- Service Not Covered: If a service, such as a weight loss plan, is not covered by the patient's insurance plan, the claim should not be adjusted. Instead, the patient who received the service should be billed directly. Adjusting the claim would essentially provide the service free of charge.

- Prior Authorization: Some insurance companies require prior authorization for certain treatments or services. Claims may be denied if prior authorization was not obtained. In such cases, it is important to check with the provider to confirm if authorization was received. If it was obtained, the relevant code can be added, and the claim can be resubmitted.

- Timely Filing: Timely filing denials are common when resubmitting a previously denied claim. To avoid this issue, ensure that the corrected claim includes the payer's previous claim number to establish that the original claim was filed within the required timeframe.

- Bilateral Procedures: When billing for bilateral procedures (procedures performed on both sides of the body), ensure that the claim clearly specifies this to avoid the payer incorrectly assuming it is a duplicate procedure.

- Bundling and Coding Errors: Incorrect bundling or coding of procedures can result in claim adjustments. For instance, using expired codes or failing to follow billing guidelines for specific procedures, such as cosmetic treatments, can lead to denials.

- Patient Responsibility: Insurance companies may not pay a claim or only partially pay if the patient has a cost-sharing responsibility, such as co-pays, deductibles, or co-insurance. In some cases, the patient may be designated to owe the full amount if the provider is out of network or the patient is not eligible for coverage on the service date.

Best Practices for Handling Claim Adjustments

- Appeal Denials: Many claim denials can be appealed, especially if there is additional information or evidence to support the medical necessity of the service provided.

- Verify Patient Coverage: Before performing any procedure, providers should verify the patient's insurance coverage and eligibility to avoid issues with reimbursement.

- Accurate Coding: Providers are responsible for ensuring accurate medical coding on claims. Using expired or incorrect codes can lead to claim denials or adjustments.

- Regular Review of Adjustments: Providers should regularly review adjustment reasons to evaluate the performance of payers or billing companies. This helps identify any consistent issues or errors that need to be addressed.

Unraveling the Insurance Billing Process Post-Practice Sale: A Comprehensive Guide

You may want to see also

Billing compliance

In the United States, the Health Insurance Portability and Accountability Act (HIPAA) sets the bar for compliance. Passed by Congress in 1996, it established the first national standard for the use and disclosure of health information and guarantees certain rights to individuals regarding their healthcare. Under HIPAA, patients must be allowed access to their medical records.

HIPAA outlines how certain entities (health plans, clearinghouses, or healthcare providers) can use or disclose personal health information (PHI). Since the enactment of HIPAA, all health entities covered by the Act have been required to submit their claims electronically, except in certain circumstances.

Billers must also follow guidelines set forth by the Office of the Inspector General (OIG). OIG compliance standards are relatively straightforward but lengthy.

In addition, billing compliance helps prevent fraud and abuse by healthcare providers. For example, billing for medically unnecessary services, billing for services not provided, or billing unreasonably high levels of care (upcoding) are all considered healthcare fraud.

To ensure billing compliance, healthcare providers should implement a comprehensive compliance program. This program should include written materials that demonstrate the provider's intention to comply with regulations. The Department of Health and Human Services (HHS) and the Office of Inspector General (OIG) expect every provider and clinic to incorporate and apply recommended compliance materials.

Furthermore, competent and trained staff are essential for billing compliance. Medical billing and coding are complex procedures that should be left to individuals with appropriate credentials.

Understanding Insurance Billing with Quest Diagnostics: A Guide to Navigating the Process

You may want to see also

Frequently asked questions

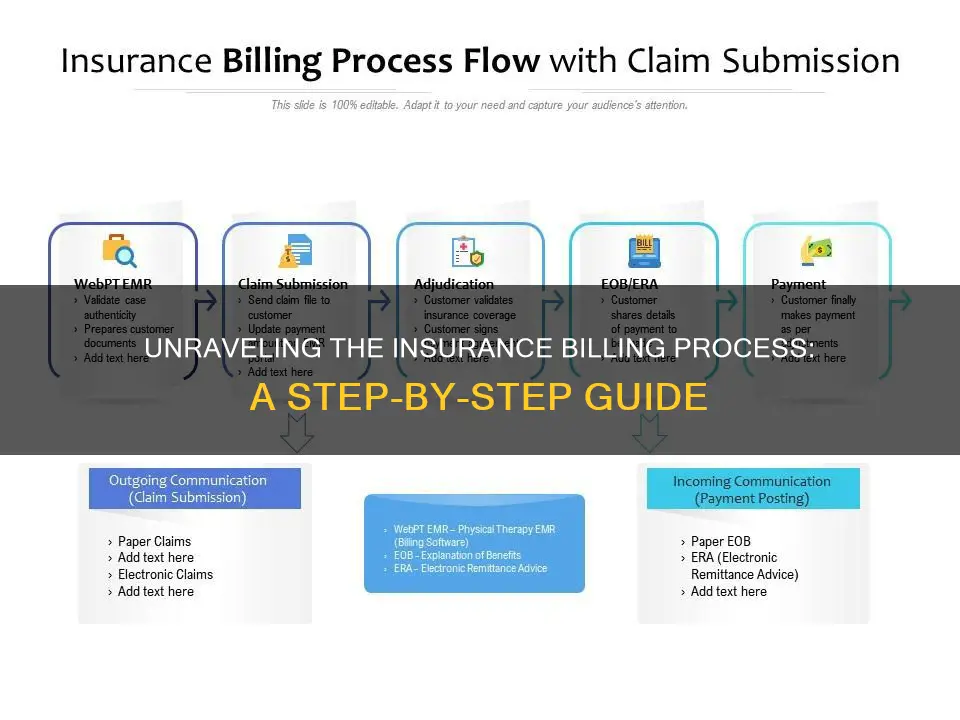

The process of insurance billing involves multiple parties and can be broken down into the following steps: registration, establishment of financial responsibility, patient check-in and check-out, checking for coding and billing compliance, preparing and transmitting claims, monitoring payer adjudication, generating patient statements or bills, and assigning patient payments and arranging collections.

Deductibles are provisions that require the member to accumulate a specific amount of medical bills before benefits are provided. For example, if a member has a policy with a $500 deductible, they must pay $500 out of pocket before the insurance carrier starts paying benefits.

An EOB is a statement sent by the insurance company after processing a claim received from the provider. It lists the total charges, allowed amount, non-covered charges, the amount paid to the provider, and any co-pay, co-insurance, and deductibles the patient pays.