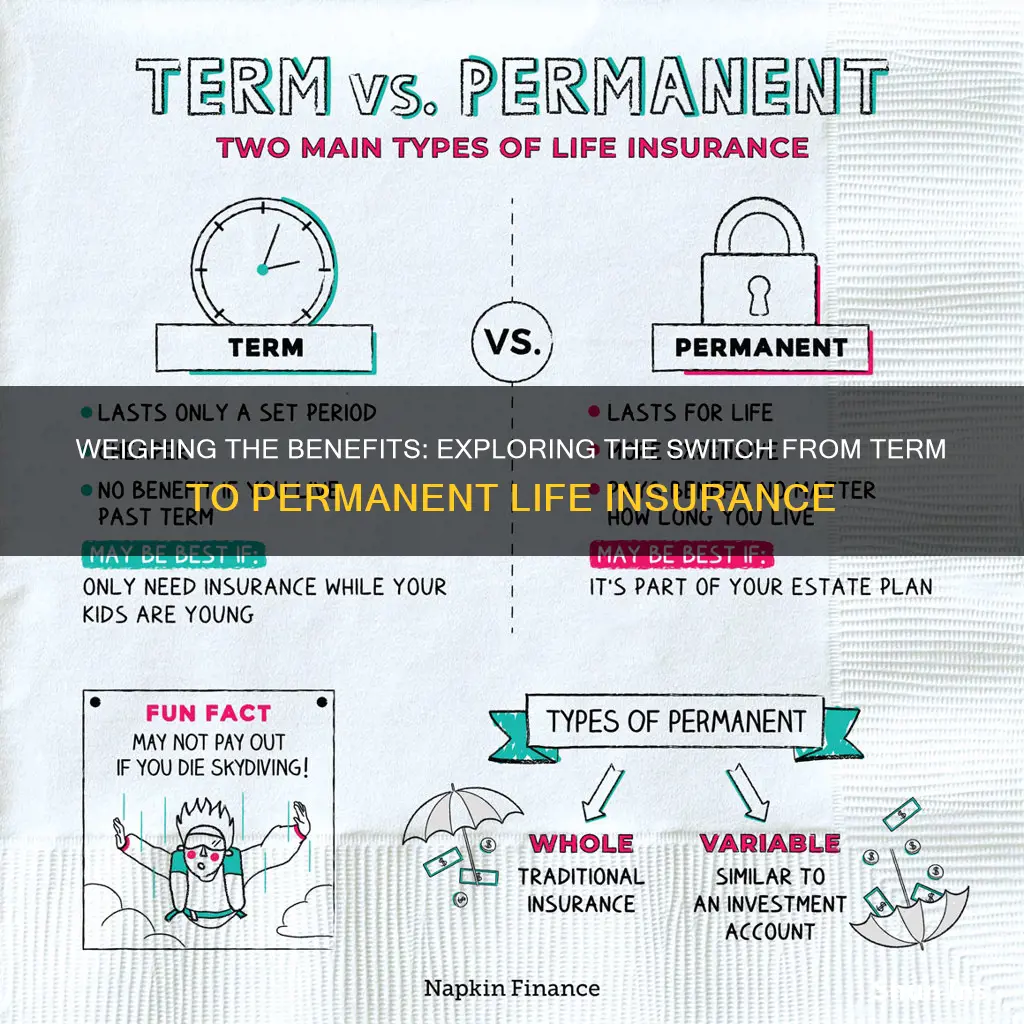

Term life insurance is a type of insurance that covers you for a specific period, usually between 10 and 30 years. On the other hand, permanent life insurance covers you until you die, regardless of how long that is. While term life insurance is more affordable, permanent life insurance offers lifelong coverage and the ability to build savings through cash value accumulation. Some term life insurance policies can be converted into permanent life insurance, allowing individuals to extend their coverage and enjoy the benefits of permanent policies. However, it is important to carefully consider the pros and cons of making such a switch, as it may come with higher premiums and limited policy options.

What You'll Learn

Converting term life insurance to permanent life insurance

Benefits of Converting to Permanent Life Insurance

- Permanent life insurance offers lifelong coverage, while term life insurance is limited to a specific period.

- Whole life policies include a savings component, where a part of your premium builds cash value over time.

- Premiums for whole life insurance are typically fixed and do not increase with age.

- Most insurers do not require a new health examination when converting from term to whole life.

Drawbacks of Converting to Permanent Life Insurance

- Whole life insurance premiums are significantly higher than term life premiums.

- Whole life policies can be more complex, with components like cash value and dividends that might be difficult to understand.

- For the same premium amount, the death benefit in a whole life policy may be lower compared to a term life policy.

- The growth of the cash value in a whole life policy depends on the policy's terms and market conditions, which can vary.

Factors to Consider when Converting to Permanent Life Insurance

- Assess your income, expenses, and financial obligations to determine if you can comfortably afford the higher premiums associated with whole life insurance.

- Consider your age and health condition. Converting at a younger age can result in lower premiums, and a potential change in health condition may impact your ability to qualify for a new policy in the future.

- Evaluate your long-term needs and goals. If you have dependents or expect people to rely on your income in the long term, permanent life insurance can provide coverage for your entire lifetime.

Process of Converting to Permanent Life Insurance

- Check your existing term life insurance policy to confirm if it is eligible for conversion to a permanent policy.

- Review the term conversion period specified in your policy. There is usually a window of time, such as the first 5 to 20 years of the term, during which you can convert your policy.

- Contact your insurance agent or company to discuss the conversion process and confirm the specific requirements and options available.

- Decide on the amount of coverage you need and determine if a partial conversion is feasible. Some insurers allow you to convert just a portion of your policy to permanent coverage.

- Complete the necessary conversion forms with your insurer. Typically, you will not need to undergo a new medical examination or fill out an additional application.

Understanding Convertible Term Insurance: Flexibility for Changing Needs

You may want to see also

Reasons to convert term life insurance to permanent life insurance

Term life insurance provides coverage for a specific period, usually 10 to 30 years, and is more affordable than permanent life insurance. However, permanent life insurance offers lifelong coverage and other benefits that may become necessary over time. Here are some reasons why converting term life insurance to permanent life insurance may be a good idea:

You want lifelong coverage:

Permanent life insurance provides coverage for your entire life, whereas term life insurance is only temporary. If you want to ensure that your loved ones are protected financially no matter when you pass away, permanent life insurance is the way to go.

You want to build cash value:

Permanent life insurance policies allow you to withdraw money while you're still alive, providing an emergency savings source. Additionally, part of your premium goes towards building cash value, which grows tax-deferred. This can be beneficial if you want to access cash during retirement or for other financial goals.

Your budget has changed:

You may have initially chosen term life insurance because it was more affordable. However, if your financial situation has improved and you can now afford higher premiums, converting to permanent life insurance can provide you with lifelong coverage and additional benefits.

Your health has changed:

Converting to permanent life insurance can be a good option if your health has declined since you first purchased term life insurance. You may not need to undergo a medical exam during the conversion process, and your current health will not affect the premium on the permanent policy.

You want to leave a legacy:

If you want to leave an inheritance for your children or grandchildren, permanent life insurance can help. It can provide peace of mind, knowing that you can spend more liberally during retirement while still leaving money for your loved ones.

You want to cover final expenses:

Even if you don't have dependents, converting your term policy to permanent life insurance can ensure that your final expenses, such as funeral costs, are covered. It can also help alleviate the financial burden on your family in the event of unexpected debts.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Pros and cons of converting term life insurance to permanent life insurance

Pros of converting term life insurance to permanent life insurance

- Permanent life insurance can help you build savings and plan your estate.

- It guarantees a death benefit to your beneficiaries as long as you maintain your policy.

- It can be used to pay for final expenses, provide financial security to a surviving spouse, or leave a financial legacy for children or grandchildren.

- It can help you achieve your retirement and other long-term accumulation goals.

- It can be a good option if your health has deteriorated, as you won't have to go through the underwriting process again.

- It can be useful if your income has increased and you can now afford the higher premiums.

- It can help you leave an inheritance for your heirs while still allowing you to spend on yourself during retirement.

- It can be beneficial if you are a high-net-worth individual and want to minimise the size of your taxable estate by transferring your life insurance policy to a trust.

- It can provide coverage for lifelong financial dependents, such as children with special needs.

- It can help with estate taxes, as the death benefit can be used by your heirs to pay these taxes.

Cons of converting term life insurance to permanent life insurance

- Permanent life insurance policies typically have much higher premiums than term life insurance.

- You may be limited in the types of policies you can convert to, and you may have more options if you purchase a new policy.

- The cash value of permanent life insurance policies may not be as easily accessible as your regular checking account, and there may be fees or taxes associated with withdrawing the money.

- Withdrawing money from the cash value of the policy will lower the value of your death benefit.

- The growth rate of the cash value may be lower than other investment strategies.

- Flexible payment options may have limitations, and reducing premium payments can affect the future cash value and death benefit of the policy.

- Adding a large lump sum to your life insurance policy may result in the IRS reclassifying it as a modified endowment contract, which has different tax implications.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

Steps to convert term life insurance to permanent life insurance

Check if your term policy includes a conversion option:

First, determine whether your term life insurance policy includes the option to convert it to a permanent life insurance policy. This information should be available in your policy documents. If you are unsure, contact your insurance provider to review the disclosures regarding the conversion rider.

Understand the deadline for converting:

Term life insurance policies typically have a specified conversion period or deadline by which you must initiate the conversion. This period is usually defined in your policy documents and may vary depending on the insurer. Some policies allow conversion at any point during the term, while others may limit the conversion option to the first few years.

Explore available permanent life insurance options and costs:

Contact your insurance company to understand the types of permanent life insurance policies available for conversion and the associated costs. The conversion cost will depend on factors such as your age, the amount of coverage, and the type of permanent policy chosen.

Complete the conversion process:

Fill out a life insurance conversion application, choosing the desired coverage amount and billing preferences. Assign or update your beneficiaries as needed. Sign and submit the application to finalize the conversion process.

Weigh the pros and cons:

Consider the benefits and drawbacks of converting your term policy to permanent life insurance. Permanent life insurance offers lifelong coverage, builds cash value over time, and may provide peace of mind. However, it also comes with higher premiums, and you may have limited options for conversion depending on your insurer. Evaluate your financial situation, long-term goals, and affordability before making a decision.

The Intricacies of Insurance Twisting: Unraveling the Practice and Its Impact

You may want to see also

Permanent life insurance options

Permanent life insurance policies are active for your entire life as long as you pay your premiums. They are more expensive than term life insurance policies because they include a death benefit and a cash value account, which functions like a savings or investment vehicle.

There are several types of permanent life insurance policies, which are distinguishable by how they invest the cash value portion of the policy, whether you can adjust the premium amount, and if you can increase or decrease the death benefit. Here are some of the most common types:

Whole Life Insurance

This is the most basic type of permanent life policy. Whole life guarantees you a minimum rate of return on your cash value, and the death benefit remains fixed. In some cases, the policy might provide you with dividends that you could choose to use to pay your premiums.

Universal Life Insurance

This type of policy usually gives you more flexibility. Universal life typically allows you to adjust your death benefit or the cost of your premiums. However, the amount of interest that the cash value portion pays will rise and fall in tandem with general interest rates.

Variable Life Insurance

This type of policy typically allows you to modify the death benefit. With variable life, the cash value is generally invested in the stock market. While this may lead to bigger gains, it could lead to significant losses.

Variable Universal Life Insurance

Variable universal life insurance offers adjustable premiums and death benefits, and the cash value is typically invested in the stock market. The cash value gains or losses may or may not be capped, depending on your insurer.

Indexed Universal Life Insurance

The interest that an indexed universal life insurance policy earns is tied to the performance of an underlying financial benchmark, such as the S&P 500. However, this type of life insurance typically protects the policyholder against market drops.

Survivorship Life Insurance

Survivorship life insurance is sometimes called “joint life insurance” or “second-to-die” life insurance. It’s usually a whole life insurance policy. It differs from other permanent life insurance policies because the policy insures two people—usually a married couple. Once both spouses have passed away, the policy pays out the death benefit to the beneficiaries.

Burial Insurance

Burial insurance, also known as funeral insurance or final expense insurance, is a small whole life insurance policy with a death benefit that’s usually between $5,000 and $25,000. These policies are generally sold without a medical exam, and you can’t be turned down.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Frequently asked questions

Yes, some term life insurance policies can be converted to whole life insurance. Check your policy documents to confirm if this option is available to you.

A conversion clause is a section of a life insurance contract that allows policyholders to convert their term life insurance policy to a permanent form of life insurance without presenting new evidence of their insurability.

Converting to whole life insurance can give you the ability to obtain permanent coverage, often at a cheaper rate than if you purchased a new policy. Medical exams are usually not required when you convert, and you may be able to obtain permanent coverage if you have developed a new health issue. However, converting your policy may increase your premium, and you may be limited in the types of policies you can convert to.

There are several reasons why converting your term policy to whole life insurance could be beneficial. These include being able to afford the premiums, declining health, wanting to cover final expenses, building cash value, and having dependents who may need financial help after you die.

There is usually no direct cost to convert term life insurance to whole life insurance. However, you can expect to pay higher premiums for your new policy.