In 2022, nearly 304 million people in the United States had some form of health insurance, with private health insurance coverage being more prevalent than public coverage. This is a significant increase from 2010, when there were around 257 million insured people. The Affordable Care Act (ACA) has played a crucial role in reducing the number of uninsured people in the country, and by early 2022, over 35 million people had enrolled in coverage related to the ACA. As of 2022, about 8.4% of people in the US were uninsured, compared to 16% in 2010.

| Characteristics | Values |

|---|---|

| Year | 2022 |

| Total number of people insured | 304 million |

| Percentage of people insured | 92.1% |

| Number of people without insurance | 25.6 million |

| Percentage of people without insurance | 8.4% |

| Percentage of people with private insurance | 65.6% |

| Percentage of people with public insurance | 36.1% |

| Percentage of people with employment-based insurance | 54.5% |

| Percentage of people with Medicaid | 18.8% |

| Percentage of people with Medicare | 18.7% |

What You'll Learn

The Affordable Care Act (ACA) has expanded coverage to previously uninsured people

The ACA's coverage gains occurred across all income levels and among both children and adults, and disparities in coverage between races and ethnicities have narrowed. For example, the uninsured rate for nonelderly Hispanic people was 18% in 2022, more than 2.5 times the rate for White people (6.6%). However, this figure is still a significant improvement on pre-ACA levels.

The ACA's expansion of Medicaid has been a key driver of this increase in coverage. By 2014, two of the biggest coverage expansion provisions of the ACA had come into effect: the expansion of Medicaid and the launch of health insurance marketplaces for private coverage. Together, these programs now cover tens of millions of Americans. As of early 2022, more than 35 million people had enrolled in coverage related to the ACA, with 21 million of these people gaining coverage through Medicaid expansion.

Medicaid expansion has been particularly beneficial for lower-income individuals and their families. A large body of evidence shows that Medicaid expansion increases the utilisation of health services and the diagnosis and treatment of health ailments, including cancer, mental illness, and substance use disorder. It is also associated with improvements in health outcomes such as cardiac surgery outcomes and improved mortality rates for cardiovascular and end-stage renal disease. Beyond health outcomes, evidence points to improved financial well-being in Medicaid expansion states, including reductions in medical debt and improved satisfaction with one's financial situation.

The ACA has also improved access to prescription drugs by expanding Medicaid eligibility and broadening the Medicaid Drug Rebate Program, giving more low-income Americans access to brand-name and generic drugs and lowering costs for taxpayers.

Despite these successes, challenges remain. Undocumented immigrants, for example, are ineligible for federally-funded coverage and so remain uninsured. As of 2022, there were still over 25 million people in the United States without any kind of health insurance.

Driver Removal: Insurance Impact?

You may want to see also

In 2022, 92.1% of people in the US had health insurance

The US does not have universal health insurance, and healthcare costs are covered through a combination of private and public insurance programs. In 2021, almost 50% of the insured population of the US were insured through their employers, while 18.9% of people were insured through Medicaid, and 15.4% through Medicare.

The Affordable Care Act (ACA) has played a significant role in reducing the number of uninsured people in the US. The number of uninsured nonelderly individuals continued a downward trend in 2022, dropping by nearly 1.9 million from 2021. This decrease was driven by an increase in employer-sponsored, Medicaid, and non-group coverage among nonelderly adults.

Despite these gains, it is important to note that racial and ethnic disparities in coverage persist. In 2022, the uninsured rates for nonelderly Hispanic and American Indian and Alaska Native people were more than 2.5 times the uninsured rates for White people. Additionally, undocumented immigrants are ineligible for federally funded coverage, including Medicaid and Marketplace coverage, which can contribute to higher uninsured rates among certain populations.

The high cost of insurance is also a significant factor contributing to the number of uninsured individuals. In 2022, 64% of uninsured nonelderly adults cited the cost of coverage as the main reason for lacking insurance. This is particularly true for low-income families, who often cannot afford the high premiums associated with private insurance.

Overall, while the US has made progress in increasing the percentage of people with health insurance, there are still disparities and challenges that need to be addressed to ensure equitable access to healthcare for all.

Updating Dentrix Insurance Records: Address Change Procedure

You may want to see also

Private health insurance is more common than public coverage

While it is difficult to ascertain the exact number of people insured under federal programs, it is clear that private health insurance is more common than public coverage in the United States. As of 2022, nearly 304 million people in the US had some form of health insurance, a significant increase from around 257 million in 2010. However, there were still over 25 million uninsured people in the country.

The Affordable Care Act (ACA) has played a significant role in reducing the number of uninsured people. In early 2022, over 35 million people were enrolled in coverage related to the ACA, with more than 21 million gaining health care coverage due to the expansion of Medicaid. The ACA's expansion of Medicaid to low-income adults under 65 has been particularly impactful, with over two million people gaining coverage under the Biden-Harris Administration.

Despite these efforts, the repeal of the individual mandate has led to a rise in the number of uninsured. As of 2022, about 8.4% of people in the US were uninsured, compared to 16% in 2010. This increase highlights the ongoing debate around healthcare reform and the public's divided opinion on a Medicare-for-all plan.

Private health insurance is more prevalent than public coverage for several reasons. Firstly, private insurance is often provided by employers, who are mandated by the ACA to offer affordable health coverage to their employees. As a result, almost 50% of the insured population in 2021 were covered through their employers. Private insurance also offers comprehensive coverage, including extensive medical services, elective treatments, and specialized care. This is particularly advantageous for individuals with specific health conditions or those requiring personalized medical attention. Moreover, private insurance provides faster access to medical care, with reduced wait times, allowing individuals to receive prompt treatment.

However, private insurance tends to be more expensive, with higher prices compared to public options. This makes it less affordable for certain individuals, especially those with lower incomes. On the other hand, public health insurance, such as Medicare and Medicaid, aims to provide universal access to healthcare, regardless of financial circumstances. It is more affordable due to lower administrative costs and the absence of co-pays or deductibles.

In conclusion, while private health insurance is more common than public coverage in the US, both options have their advantages and limitations. Private insurance offers more comprehensive and faster access to medical care but comes with higher costs. Public insurance provides universal access and is more affordable, but may have limitations on choice and longer waiting times. Ultimately, the decision between private and public health insurance depends on an individual's specific healthcare needs and financial circumstances.

RTR Mustang Insurance: Ford Mustang Variant?

You may want to see also

Employment-based insurance is the most common type of health insurance

In the United States, health insurance is provided through a mix of private and public insurance programs. As of 2022, nearly 304 million people in the country had some form of health insurance, a notable increase from the approximately 257 million insured individuals in 2010. However, it is worth noting that there were still over 25 million uninsured people in the US as of 2022.

Among the insured population, employer-sponsored health insurance, also known as employment-based insurance, stands out as the most prevalent type. In 2021, nearly half of the insured individuals in the US, or about 153 million people, were covered by their employers. This trend underscores the significant role of employers in providing financial protection and access to healthcare services for their employees.

The popularity of employment-based insurance can be attributed to its advantages for both employers and employees. For employees, this type of insurance reduces the financial burden of medical expenses, offering peace of mind and ensuring they can seek necessary medical care without facing excessive costs. Employers, on the other hand, benefit from improved employee morale and productivity, enhanced ability to attract and retain top talent, and potential tax incentives.

The specific health insurance plans offered by employers vary, with Preferred Provider Organization (PPO) plans being the most common. In 2023, 47% of firms offered PPO plans, followed by High Deductible Health Plans with Savings Options (HDHP/SO) at 29%Health Maintenance Organization (HMO) plans at 13%

While employment-based insurance is the most common, it is worth noting that public insurance programs like Medicaid and Medicare also play a significant role in providing coverage for millions of Americans. As of 2021, 18.9% of people were insured through Medicaid, while 15.4% were covered by Medicare.

Navigating Florida's DMV Website: A Guide to Changing Your Car Insurance Details Online

You may want to see also

Medicare coverage is expanding

As of 2022, Medicare covered more than 64 million Americans aged 65 or older, as well as some younger people with disabilities. Over 9 million of those covered were under the age of 65. Medicare coverage has been expanding in several ways. Firstly, the number of people eligible for the program has increased. This is due to the aging US population and the fact that more people are qualifying for Social Security Disability Insurance (SSDI). As the US population ages, more people will become eligible for Medicare as they turn 65.

Secondly, Medicare coverage has expanded in terms of the benefits offered. For example, in 2018, Medicare introduced a new benefit covering chronic kidney disease, including outpatient dialysis services for people with end-stage renal disease. Additionally, Medicare now covers some preventive services, such as an annual wellness visit, which includes a review of the patient's current health status and personalized health advice.

Thirdly, Medicare coverage has expanded geographically. As of January 2023, 38 states and Washington, D.C., have expanded their Medicaid programs to cover all adults with incomes below 138% of the federal poverty level. This expansion increases the number of people eligible for Medicare as it makes the program more affordable for a larger number of people.

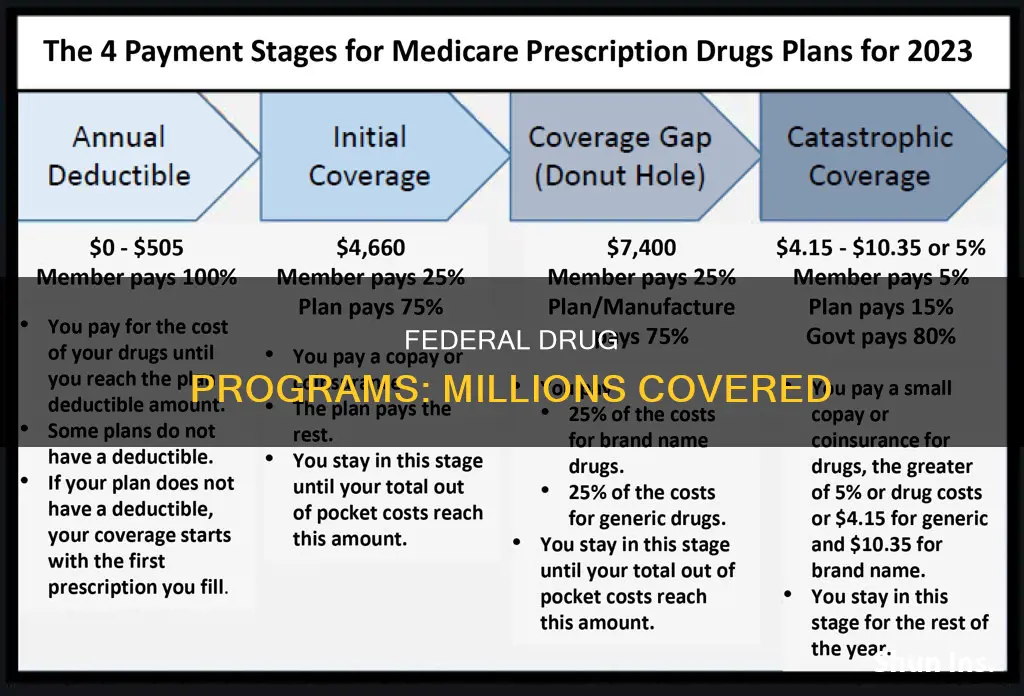

Finally, legislative action has expanded Medicare coverage. For instance, in 2022, Congress passed the Inflation Reduction Act, which included provisions to reduce the cost of prescription drugs for Medicare beneficiaries. This legislation makes Medicare more affordable and increases access to necessary medications for beneficiaries.

In conclusion, Medicare coverage is expanding in multiple ways. More people are becoming eligible, the benefits are increasing, the geographic reach is widening, and legislative action is enhancing the program's accessibility and affordability. These expansions ensure that Medicare can meet the evolving needs of its beneficiaries and provide them with improved access to healthcare services.

Retiree Guide: Navigating GIC Insurance Changes

You may want to see also

Frequently asked questions

As of 2022, nearly 304 million people in the United States had some form of health insurance, with almost 50% of those insured through their employer.

As of 2021, 18.9% of the insured population of the United States were insured through Medicare.

As of 2021, 18.9% of the insured population of the United States were insured through Medicaid.

As of early 2022, over 35 million people were enrolled in coverage related to the Affordable Care Act, with over 21 million of those enrolled in Medicaid Expansion Coverage.

The American Rescue Plan Act (ARPA) provides temporary incentives for states to implement Medicaid Expansion. As of 2024, 40 states and the District of Columbia have expanded Medicaid.