Level term insurance is a type of life insurance policy that offers a fixed premium rate for a specified number of years, typically ranging from 10 to 30 years. During this period, the policyholder benefits from a consistent premium amount that does not fluctuate annually, as opposed to annual renewable term (ART) insurance, where premiums increase each year. Level term insurance provides long-term coverage and is more cost-effective in the long run compared to ART insurance, which is designed for short-term needs. While ART insurance offers the flexibility of yearly renewals without reapplication or medical exams, level term insurance guarantees a fixed rate for an extended duration, making it a more popular and financially prudent choice for most individuals seeking life insurance.

| Characteristics | Values |

|---|---|

| Type | Term life insurance |

| Premium Rate | Remains the same for a specified number of years |

| Premium Increase | No |

| Term | 10-30 years |

| Death Benefit | Does not rise in value |

| Calculation of Premium | Based on the risk that a person will die over a term of many years |

| Maximum Age | Varies by state, e.g. 80 in New York |

| Comparison to ART | Premium does not increase annually |

What You'll Learn

- Annual Renewable Term (ART) insurance is a form of short-term insurance

- ART insurance policies are renewed annually at an increasing rate

- Level term insurance is meant for the long term

- Level term insurance policies have level premiums that do not change

- Level term insurance policies are renewable but not mandatory until the end of the term

Annual Renewable Term (ART) insurance is a form of short-term insurance

ART insurance is designed to cover short-term insurance needs. The policy can be renewed annually without the need to reapply, but the premiums increase with each renewal as the insured person ages. The policy pays a death benefit that remains the same with each contract extension. ART policyholders designate at least one beneficiary, who will remain the same throughout the terms unless otherwise specified by the insured.

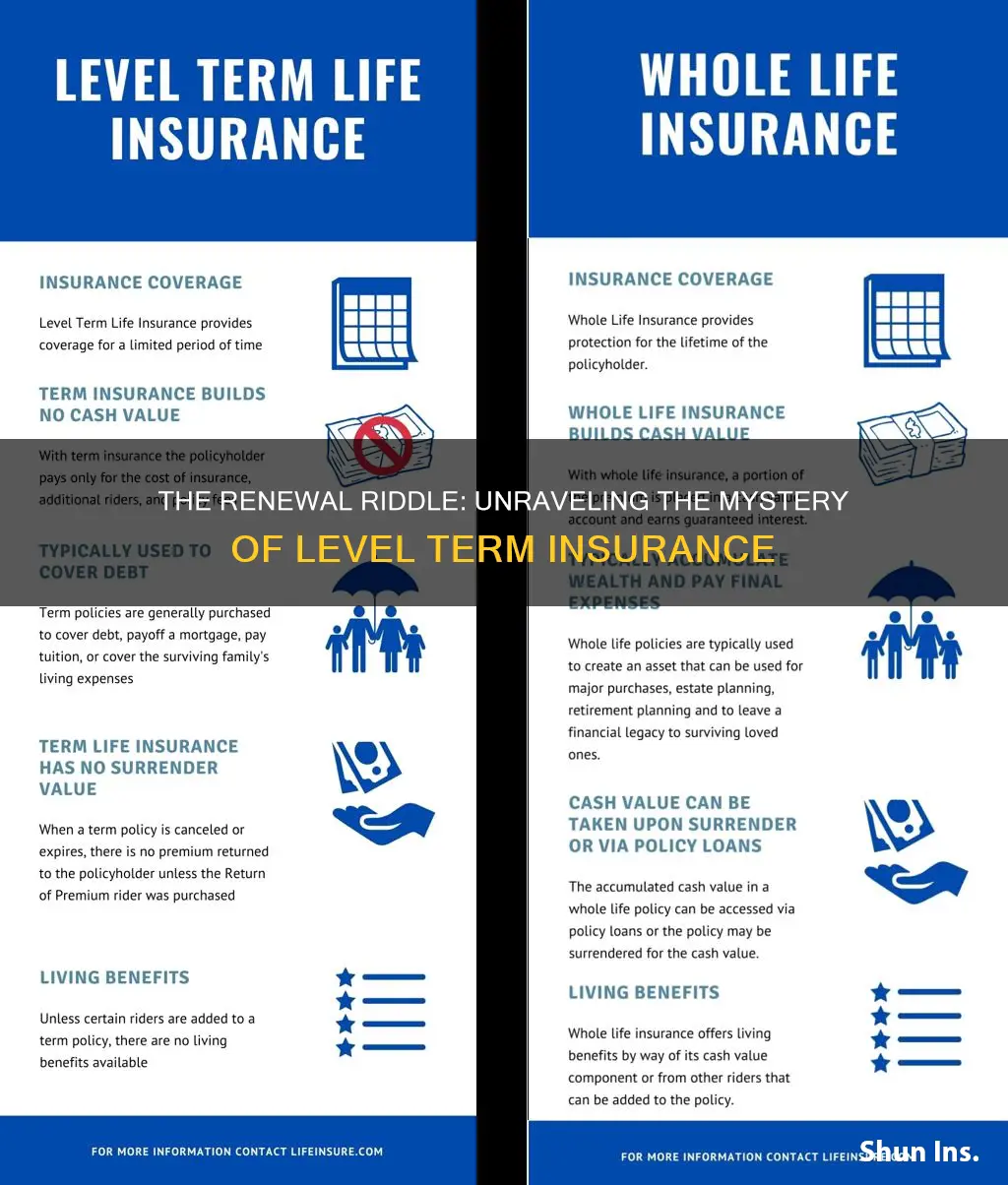

ART insurance is a less common type of term life insurance compared to level term insurance. Level term coverage has a premium rate that remains constant for a specified number of years, typically between 10 and 30 years. While both ART and level term insurance offer a death benefit that does not increase in value over time, the key difference lies in the calculation of premiums. ART premium payments increase annually, whereas level term premiums remain fixed. ART insurance premiums are calculated based on the risk of the insured person dying in the current year, a probability that increases with age and the duration of the policy. In contrast, level term insurance premiums are based on the risk of death over a longer term, resulting in stable premiums throughout the coverage period.

ART insurance may be suitable for individuals who need short-term coverage or are working towards qualifying for lower rates with a level term policy. However, for most people, level term insurance is a more cost-effective option over the long term.

Understanding Extended Term Nonforfeiture: An Important Decision for Policyholders

You may want to see also

ART insurance policies are renewed annually at an increasing rate

Annual Renewable Term (ART) insurance policies are a form of term life insurance that offers guaranteed future insurability for a set number of years, usually one. ART policies are designed to cover short-term insurance needs and are the least expensive form of life insurance to buy.

ART policies can be renewed annually without the need for the policyholder to reapply or take another medical exam. However, the premiums for ART policies increase on each renewal as the insured person ages, and the risk of death increases. This is in contrast to level term insurance policies, where the premium rate remains the same for a specified number of years, usually between 10 and 30 years.

While ART policies offer flexibility and are initially affordable, they may become increasingly expensive over time compared to level term policies. As such, ART policies are best suited for those with short-term coverage needs or those working to qualify for lower rates on a level term policy.

- ART policies are designed for short-term insurance needs and are less common than level term insurance.

- ART policies can be renewed annually without reapplication or a medical exam, but the premiums increase with each renewal.

- ART policies offer guaranteed future insurability for a set number of years, typically one.

- ART policies are the least expensive form of life insurance to purchase initially.

- The premiums for ART policies increase each year as the insured person ages, and the risk of death rises.

- ART policies are best suited for those with short-term coverage needs or those seeking lower rates on a level term policy.

- Over time, ART policies may become more expensive than level term policies, which have fixed premiums for a specified number of years.

Understanding Renewable Term Insurance: Unraveling the Benefits and Mechanics

You may want to see also

Level term insurance is meant for the long term

Level term insurance is designed for the long term. It provides a fixed payout to beneficiaries if the policyholder dies during the term, and the premium remains the same throughout. This makes it a good option for those seeking a stable and predictable monthly policy premium.

The length of the term can vary, with the most common terms being 10, 15, 20, and 30 years. Level term insurance is usually more affordable than other types of insurance in the long run, as the premium is locked in at the start of the policy based on the policyholder's age and health. This means that if you take out a policy when you are young and healthy, you can get affordable coverage for decades.

In contrast, annual renewable term (ART) insurance is a form of short-term insurance. While it is initially cheaper than level term insurance, the premium increases each year as the policyholder ages. This means that ART insurance can become more expensive than level term insurance over time.

Level term insurance is therefore a good option for those who want substantial coverage at a low cost over a long period.

Understanding Extended Term Insurance: Unlocking the Benefits of Long-Term Coverage

You may want to see also

Level term insurance policies have level premiums that do not change

Level term life insurance policies have level premiums that do not change over the life of the policy. This means that the policyholder will pay the same premium for the duration of the policy. The premium is usually based on the insured person's age and health at the start of the policy. While the premium remains the same, the death benefit may increase over time.

Level term life insurance is a popular choice for those seeking life insurance as it offers predictable and stable premiums. This allows individuals to budget effectively, knowing that their payments will not fluctuate. Additionally, level term life insurance is often more affordable than other types of life insurance, such as whole life or universal life insurance.

It is important to note that level term life insurance policies typically have a set term, usually between 10 and 30 years. At the end of the term, individuals may have the option to renew the policy, convert it to a permanent policy, or allow it to lapse. However, renewing a level term policy will result in higher premiums based on the individual's current age.

Overall, level term life insurance with level premiums provides individuals with stability and predictability in their insurance payments, making it a popular and cost-effective choice for life insurance coverage.

Marketplace Short-Term Insurance Plans: Understanding Your Options

You may want to see also

Level term insurance policies are renewable but not mandatory until the end of the term

The main difference between level term insurance and annual renewable term (ART) insurance lies in the duration of the policy and the calculation of premiums. Level term insurance offers long-term coverage, with premiums remaining the same for the entire length of the term, which is typically 10, 20, or 30 years. On the other hand, ART insurance is a form of short-term insurance that needs to be renewed annually, with premiums increasing each year.

The decision to renew a level term insurance policy depends on various factors. Policyholders who still require coverage at the end of their term may choose to renew, especially if their health has deteriorated, as this could impact their eligibility for a new policy. Additionally, those who want to maintain their existing coverage without undergoing another medical examination may find renewal convenient.

However, it is important to consider the potential increase in premiums associated with renewing a level term insurance policy. Premiums tend to rise annually after the initial term, and the cost can become significantly higher than that of a comparable level term policy. Therefore, level term insurance policies that offer guaranteed level premiums for an extended period may be more cost-effective in the long run.

In summary, while level term insurance policies are renewable, policyholders are not obligated to renew until the end of the term. The decision to renew involves weighing factors such as changing health conditions, convenience, and potential increases in premiums. Understanding the differences between level term insurance and ART insurance can help individuals make informed choices that align with their specific needs and financial goals.

Term Insurance: Uncovering the Human Story Behind the Numbers

You may want to see also

Frequently asked questions

Level term insurance is a type of insurance policy that has a level death benefit for the entire time the policy is in effect. This means that the beneficiaries will get paid the same amount regardless of whether the policyholder dies in the third year or last year of the policy.

Level term insurance policies pay the same benefit amount if death occurs at any point during the term. On the other hand, decreasing term insurance policies have a death benefit that declines over time, similar to how a repayment mortgage decreases over time.

Level term insurance offers predictability, as beneficiaries can make plans with a single dollar amount in mind. It also helps with budgeting, as the amount paid for coverage stays the same year-over-year. Additionally, it can be cheaper in the long run, as individuals can lock in a rate and coverage amount based on their current health.

The rates for level term insurance are locked in based on the policyholder's current health, which means that individuals who aim to improve their health over the years may end up paying a level but inflated price for the entire term.