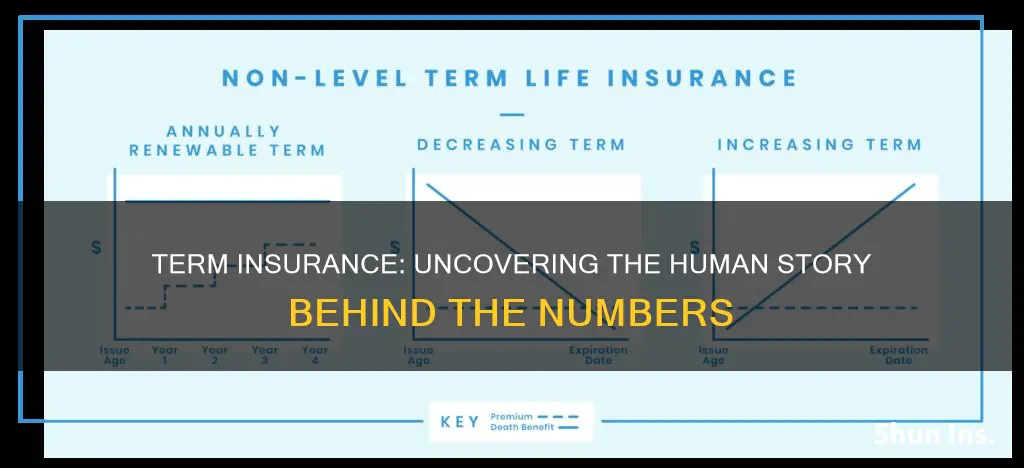

Term life insurance is a type of insurance policy that covers a person for a specific period, such as 10, 15, 20, or 30 years, or until they reach a certain age, such as 80. If the insured person dies during the policy term, their beneficiaries will receive a payout or death benefit from the insurance company. However, if the insured person does not die during the policy term, there will be no payout, and the policy will either end or be converted to permanent life insurance. Term life insurance is generally more affordable than permanent life insurance, but it does not have a cash value component, and the premiums increase with age.

What You'll Learn

- Term life insurance policies typically cover a set period, like 10, 20, or 30 years

- If the insured dies during the term, beneficiaries receive a death benefit payout

- After the term ends, the policy typically ends or can be converted to permanent insurance

- Term life insurance is temporary and does not accrue cash value like permanent insurance

- Premiums for term life insurance are based on age, health, and life expectancy

Term life insurance policies typically cover a set period, like 10, 20, or 30 years

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically 10, 20, or 30 years. It is a popular option for many people as it offers significant levels of coverage for relatively low premiums compared to permanent life insurance policies. Term life insurance guarantees a death benefit to the policyholder's beneficiaries if they die during the specified term. The policy has no cash value, and the premiums are usually based on the policyholder's age, health, and life expectancy.

Once the term life insurance policy expires, the policyholder can either renew it for another term, convert the policy to permanent coverage, or let the policy lapse. If the policy is renewed, the premiums will be recalculated based on the policyholder's age at the time of renewal, resulting in higher premiums.

Some term life insurance policies also offer the option to convert to a permanent life insurance policy, such as whole life or universal life insurance. This conversion option allows policyholders to extend their coverage and access additional benefits, such as a cash value component. However, the premium for the permanent policy will be higher than the original term policy.

Term life insurance is particularly attractive to young people with children as it provides substantial coverage at a low cost. It can also be suitable for those with growing families, ensuring coverage until their children become financially independent. Additionally, term life insurance may be a good option for those who cannot afford the higher premiums associated with whole life insurance.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

If the insured dies during the term, beneficiaries receive a death benefit payout

Term life insurance is a type of insurance policy that provides coverage for a specific period, such as 10, 15, 20, or 30 years. It is designed to offer financial protection to loved ones in the event of the policyholder's death during the specified term. Here is a detailed explanation of what happens if the insured dies during the term:

Death Benefit Payout

If the insured person passes away during the term of their policy, the insurance company will pay out a death benefit to the designated beneficiaries. This payout is typically a substantial sum of money intended to provide financial support to the beneficiaries. The death benefit can be used to cover various expenses, including funeral costs, outstanding debts, mortgage payments, and education fees. It is important to note that beneficiaries are not obligated to use the insurance money solely for settling the deceased's debts. The death benefit is usually tax-free, providing further financial relief to the beneficiaries.

Choosing Beneficiaries

The policyholder can choose one or more beneficiaries to receive the death benefit. These can be individuals, such as a spouse, children, or other family members, or organizations, such as charities. The policyholder can also specify the percentage of the death benefit that each beneficiary will receive. Additionally, contingent beneficiaries can be named, who will receive the benefit if the primary beneficiaries are no longer alive when the insured passes away.

Payout Options

There are several options for how the death benefit can be paid out to the beneficiaries. The most common method is a lump-sum payment, where the entire amount is paid at once. Alternatively, the beneficiaries can choose to receive the payout in installments over time, which may be beneficial for income-protection purposes. Another option is a retained asset account, where the insurance company holds the payout in an interest-bearing account, and the beneficiaries can access the funds via a checkbook.

Claims Process

To initiate the death benefit payout, the insurance company should be contacted as soon as possible after the death of the insured. The beneficiaries will need to submit a claim and provide a certified copy of the death certificate. The insurance company will then review the claim and, if approved, send the payout to the beneficiaries in their chosen form. Most insurance companies aim to complete this process within 30 to 60 days of receiving the claim.

Additional Considerations

It is important to note that there may be circumstances where the insurance company denies or delays the death benefit payout. These situations include instances of fraud, such as lying on the policy application or omitting relevant health information. Additionally, if the insured engages in risky activities or occupations, or if the death is a result of suicide or homicide, the payout may be affected. Therefore, it is crucial to carefully review the terms and conditions of the policy to understand any exclusions or limitations.

Cigna's Individual Term Insurance Plans: Exploring Personalized Coverage Options

You may want to see also

After the term ends, the policy typically ends or can be converted to permanent insurance

When a term life insurance policy ends, the policyholder can either let the policy lapse or renew it annually. However, the latter option can be expensive as premiums are likely to increase each year based on the policyholder's current age.

Another option is to convert the term life insurance policy to permanent insurance. This option is available on many term life insurance policies and can be done without a new health screening. The new permanent insurance policy will continue for the rest of the policyholder's life or as long as they need it. While the premium for the new policy will be higher, the policyholder may have the option to convert to a policy with a smaller death benefit in exchange for a lower premium.

Some term life insurance policies also offer a return of premium (ROP) feature, which means that if the death benefit is not paid out by the end of the term, the policyholder will get back all or part of the premiums they paid.

Thrivent Term Insurance: Understanding the Offerings and Benefits

You may want to see also

Term life insurance is temporary and does not accrue cash value like permanent insurance

Term life insurance is a type of insurance that covers the insured for a specific period, such as 10, 15, 20, or 30 years. It is distinct from permanent insurance in that it does not accrue cash value over time. Instead, term life insurance offers fixed monthly premiums for a set period, along with predictable coverage in case of death. This simplicity and lack of investment or savings opportunities result in lower premiums compared to permanent insurance.

Term life insurance is a popular option due to its relatively low premiums and significant levels of coverage. However, it is important to note that term life insurance will not provide a payout if the insured outlives the policy term. On the other hand, permanent insurance, which includes whole, variable, and universal life insurance, accumulates cash value over time. This cash value can be accessed by the insured during their lifetime and can be used for various purposes, such as paying off debts or funding a trust for a dependent.

While term life insurance does not offer the same cash value benefits as permanent insurance, it is important to note that some term policies can be converted into permanent policies. This provides the insured with the flexibility to extend their coverage and access the additional benefits of permanent life insurance. Additionally, term life insurance is often sufficient for most individuals and families, especially those who are young and healthy, as it provides affordable coverage for a specific period.

In conclusion, term life insurance is a temporary form of insurance that does not accrue cash value. It offers fixed premiums and coverage for a set period, making it a cost-effective option for those seeking coverage for a defined duration. For those seeking lifelong coverage and the ability to build cash value, permanent insurance is a more suitable option.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

Premiums for term life insurance are based on age, health, and life expectancy

Term life insurance premiums are calculated based on a person's age, health, and life expectancy. These factors are used to determine the likelihood of the insurer having to pay out a claim during the policy term. Generally, the younger and healthier a person is, the lower their premiums will be.

Age

Age is a significant factor in determining life insurance premiums. As people age, their life expectancy decreases, and the likelihood of their insurer having to pay out a claim increases. Therefore, older individuals tend to pay higher premiums than younger ones.

Health

An individual's health is another critical factor in calculating life insurance premiums. Insurers will consider any pre-existing health conditions, as well as the person's overall health, including their blood pressure and cholesterol levels. People with chronic health issues or poor health habits, such as smoking, tend to pay higher premiums.

Life Expectancy

Life expectancy is influenced by factors such as age, gender, and family medical history. Women typically live longer than men and therefore often pay lower premiums. Additionally, insurers may inquire about risky hobbies or occupations that could impact life expectancy, potentially resulting in higher premiums.

Other Factors

Other factors that may influence term life insurance premiums include the policy's value, the company's business expenses, investment earnings, and mortality rates for each age group. The type of policy and its coverage amount also play a role, with higher coverage amounts leading to higher premiums.

Understanding the Role of Short-Term Insurance in Meeting FRS Requirements

You may want to see also

Frequently asked questions

If the insured person does not die during the term of their policy, the policy will simply end, and there will be no payout to the beneficiaries. The policyholder may have the option to renew the policy or convert it into permanent life insurance.

Term life insurance provides coverage for a specific period, such as 10, 15, 20, or 30 years, or until the insured reaches a certain age. Permanent life insurance, on the other hand, provides coverage for the insured's entire life as long as premiums are paid. Term life insurance is generally more affordable, while permanent life insurance offers the security of lifetime coverage.

Term life insurance premiums are based on several factors, including the policy's value, the insured person's age, gender, health, life expectancy, and driving record. The insurance company's business expenses and investment earnings also play a role in determining premiums.

If the insured person dies during the term of their policy, the insurance company will pay the policy's face value to the designated beneficiaries. This cash benefit can be used to settle healthcare and funeral costs, consumer debt, mortgage debt, and other expenses.

Yes, there are certain circumstances under which the insurance company may deny the death benefit. For example, if the insured person engages in risky activities or occupations, lies on their application, or fails to pay their premiums, the insurance company may withhold the benefit. Additionally, most policies have a ""suicide clause"" that excludes coverage if the insured person commits suicide within the first two years of the policy.