To qualify for Employment Insurance (EI) regular benefits, you must have worked a minimum of 420 to 700 insurable hours, depending on the regional unemployment rate and where you live in Canada. The qualifying period is the shorter of the previous 52 weeks or the period since the start of your previous EI claim. The number of insurable hours is determined by the hours worked for which remuneration was received. In the case of hourly workers, this is straightforward, but for workers on a fixed salary, commission, or piecework basis, the number of insurable hours is determined by evidence such as timesheets or agreements between the employer and employee.

Hourly-paid workers

To qualify for Employment Insurance (EI) regular benefits, hourly-paid workers must meet the eligibility criteria. The general principle of the EI system is that each hour worked, for which remuneration is received, is insurable. The number of insurable hours is determined by the hours reported by the employer on a Record of Employment (ROE), which is required when there is an interruption of earnings.

For hourly-paid workers, the number of insurable employment hours is the number of hours actually worked and paid. This means that if a worker is paid an hourly rate, their insurable employment hours will be the hours they have worked and received remuneration for. It is important to note that unpaid overtime hours are not considered insurable.

In situations where an employer does not know the exact number of hours worked by an hourly-paid worker, an agreement can be reached between the employer and the worker regarding the number of hours that would typically be required to earn the remuneration paid. If the agreed-upon number of hours is unreasonable, the CRA will determine the number of insurable hours.

If it is impossible to establish or verify the actual number of hours worked, and there is no contract or agreement on the hours normally required to perform the job, or if the parties cannot reach an agreement on the number of hours, the insurable hours are calculated by dividing the insurable earnings by the current minimum wage in the province where the work was performed. However, the result of this calculation cannot exceed seven hours per day or 35 hours per week.

Additionally, for hourly-paid workers, it is important to note that vacation pay without actually taking any leave does not generate any insurable hours. This also applies to bonuses, gratuities, and in-lieu-of-notice payments.

To qualify for EI regular benefits, you must have worked a certain number of insurable hours during the qualifying period, which is typically the shorter of the 52-week period before the start date of your claim or the period since the start of your last EI claim. The number of hours required ranges from 420 to 700, depending on the unemployment rate in your region.

Rainwater: Surface Water Insurance Claims

You may want to see also

Non-hourly-paid workers

For workers who are not paid on an hourly basis, the number of insurable hours is determined by the following means:

- If an employer can provide evidence of the number of hours worked by a worker, those hours are considered insurable. Evidence can include timesheets, written contracts, and pay stubs.

- If an employer does not know the precise number of hours worked, they can reach an agreement with the worker regarding the number of hours that would normally have been required to earn the remuneration paid. If the agreed-upon number of hours is unreasonable, the CRA will determine the number of insurable hours.

- If it is impossible to establish or verify the number of hours worked, and there is no contract or agreement on the hours required to perform the work, or if the parties cannot reach an agreement, the insurable hours are determined by dividing the insurable earnings by the current minimum wage in the province where the work was performed. The result cannot exceed seven hours per day or 35 hours per week.

It is important to note that the employment must be insurable for the hours to be considered insurable. In cases where the employment is not insurable, there are no hours of insurable employment.

Additionally, certain types of employment require workers to be on standby, which means they are available for a specific period of time awaiting a request from their employer to work. Standby hours are considered insurable under the following conditions:

- They are paid at a rate equal to or above the rate that would have been paid if the hours were actually worked.

- The employee is present at the employer's premises, waiting for the employer to request their services as per the employment contract, and these hours are paid regardless of the rate.

Furthermore, all leaves paid for by an employer, such as vacation and sick leave, are included in the total hours worked by the worker. The number of insurable hours in this case is typically the number of hours the person would normally have worked and for which they would normally have been remunerated during that period.

Psoriasis: Autoimmune Disorder Insurance Coverage

You may want to see also

Standby time

Certain types of employment require workers to be available for a specific period of time, awaiting a request from their employer to work. In these situations, the worker is considered to be on standby. Standby hours are insurable in the following situations:

- They are paid at a rate equal to or above the rate that would have been paid if the hours were actually worked.

- When the employee is present (as required under a contract of employment) at the employer's premises waiting for the employer to request their services, these hours, if paid, regardless of the rate paid, are insurable. Please note that the expression "employer's premises" includes the location where the worker has to execute their work, for example, a forestry worker who is required to be at a cutting site.

The general principle underlying the Employment Insurance (EI) system is that each hour worked, for which remuneration is received, is insurable. The determination of the number of insurable hours is required to establish entitlement to EI benefits. The hours are reported by the employer on a Record of Employment (ROE), which is required when there is an interruption of earnings.

The employment must be insurable in order for the hours to be insurable. When an employment is not insurable, there are no hours of insurable employment.

Misrepresentation: Understanding the Fine Line Between Inaccuracy and Fraud in Insurance

You may want to see also

Paid leave

To be considered for Employment Insurance (EI) benefits, you must have worked enough hours in insurable employment. This means that you have been paid for each hour worked. The number of insurable hours is determined by the employer and reported on a Record of Employment (ROE).

For workers paid on an hourly basis, the number of insurable employment hours is the number of hours actually worked and remunerated. For workers not paid on an hourly basis, the number of insurable hours is determined by the employer providing evidence of the number of hours worked, such as timesheets or pay stubs. If the employer does not know the exact number of hours worked, they can reach an agreement with the employee on the number of hours that would typically be required to earn the remuneration paid. If no agreement can be reached, the CRA will determine the number of insurable hours.

In the case of paid leave, such as vacation and sick leave, all hours paid for by the employer are included in the total hours worked by the employee. The number of insurable employment hours is typically the number of hours the employee would usually have worked and been remunerated for during that period. If the employee receives a lump sum payment for a period of leave, the number of insurable hours is either the number of hours they would normally have worked or the number of hours obtained by dividing the lump sum amount by their hourly rate of pay, whichever is less.

It is important to note that there are no insurable hours if payment is made and no leave is taken or if vacation pay is paid out upon termination of employment. Additionally, unpaid overtime hours are not considered insurable.

In terms of eligibility for EI benefits, you must meet specific criteria, including having worked the required number of insurable employment hours in the last 52 weeks or since your previous EI claim, whichever is shorter. The number of hours needed ranges from 420 to 700, depending on the unemployment rate in your region.

EI provides various types of paid leave, including:

- Sickness benefits: If you are unable to work due to medical reasons such as illness, injury, quarantine, or any other medical condition, you can receive up to 26 weeks of financial assistance, which is 55% of your earnings up to a maximum of $668 per week. You must provide a medical certificate indicating your inability to work.

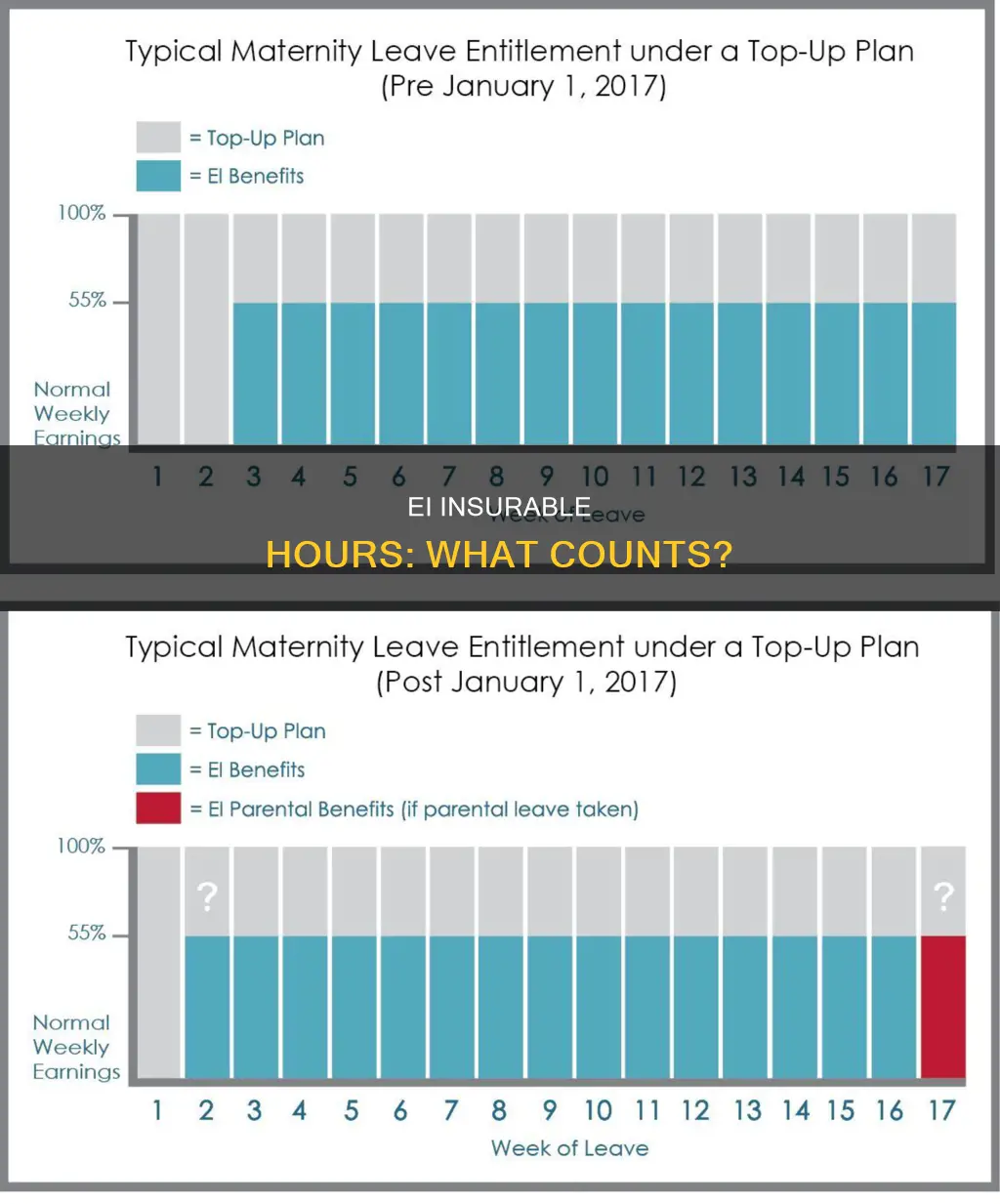

- Maternity and parental benefits: These benefits offer financial assistance to individuals who are away from work due to pregnancy, childbirth, or caring for a newborn or newly adopted child. You can receive up to 40 weeks of standard parental benefits or up to 69 weeks of extended parental benefits, with a maximum weekly amount of $668.

- COVID-19-related leave: During the COVID-19 pandemic, certain temporary measures were implemented for EI claims. For example, monies received by employees due to separation, such as severance pay and vacation pay, did not affect EI benefit payments. Additionally, the waiting period for EI claims related to COVID-19 was waived for a specific period.

Colonoscopy Conundrum: Unraveling the Insurance Billing Diagnostic Dilemma

You may want to see also

Statutory holidays

Statutory holiday pay is included in the total insurable hours. If an employee receives statutory holiday pay, the employer must include the statutory holiday hours in the total insurable hours. This depends on whether the employee's departure is final or not.

If the employee's departure is final, the employer does not need to include the hours for a paid statutory holiday that takes place after the employee's last day of work in the employee's total insurable hours. A final departure occurs when the employer-employee relationship is not expected to continue in the future. For example, if the employer dismisses an employee, or the business closes.

If the employee's departure is not final, the employer will include the hours in the total insurable hours if the employer has paid for a statutory holiday. This occurs when the employer-employee relationship is expected to continue in the future. For example, if the employee will be returning to work after a period of leave, or the employer intends to rehire the employee after a temporary layoff.

In the case of a statutory holiday that is paid in straight time and not worked, the insurable hours will be the hours that the employee would have normally worked. If the holiday is worked and no leave is given, the insurable hours will be the higher of either the number of hours worked or the regular hours of the statutory holiday as stated in the employment contract.

If the holiday is worked and paid at time and a half, and leave is given on another day, the holiday worked represents normal insurable hours for the time worked, plus the hours of leave when the leave is taken would also be insurable. If the holiday time is banked and paid on or after termination of employment, no insurable hours are given as the employee would have been credited with the hours actually worked on the holiday.

Understanding Betterment Clauses: Maximizing Insurance Claims and Minimizing Losses

You may want to see also

Frequently asked questions

Insurable hours are the hours worked for which remuneration is received.

The number of insurable hours is determined and reported by the employer on a Record of Employment (ROE). This is required when there is an interruption of earnings.

If it is impossible to verify the number of hours worked, the number of insurable hours is determined by dividing the insurable earnings by the current minimum wage in the province where the work was performed. This cannot exceed seven hours a day or 35 hours a week.

The minimum number of insurable hours required to qualify for EI benefits ranges from 420 to 700, depending on the regional unemployment rate and where you live in Canada.

Yes, you need 600 insurable hours for special benefits such as pregnancy, parental, sickness, or compassionate care leave.