HO-1733 is a type of insurance policy form. Policy forms are the different types of insurance policies available to homeowners. HO-1733 is a type of insurance policy that covers older homes with a replacement cost that exceeds the actual cash value of the home. This type of policy is often used to insure registered landmarks and architecturally significant structures.

What You'll Learn

HO-3 policies are the most common type of insurance form

HO-3 insurance is a package policy that covers dwelling, personal property, and liability. It is typically purchased for traditional, standalone homes rather than other types of homes like duplexes or condominiums.

HO-3 insurance policies cover your dwelling, belongings, and personal liability in the event of damage or injury. This includes damage to the home's structure and any attached structures, such as a deck or garage. It also covers standalone structures on your property, such as a barn or shed, and personal property such as furniture, kitchen appliances, and electronics.

In the event that your home becomes uninhabitable, HO-3 insurance will also cover temporary living expenses. It also includes liability coverage, which protects you if you are found at fault for damages to someone else's property or for their bodily injuries.

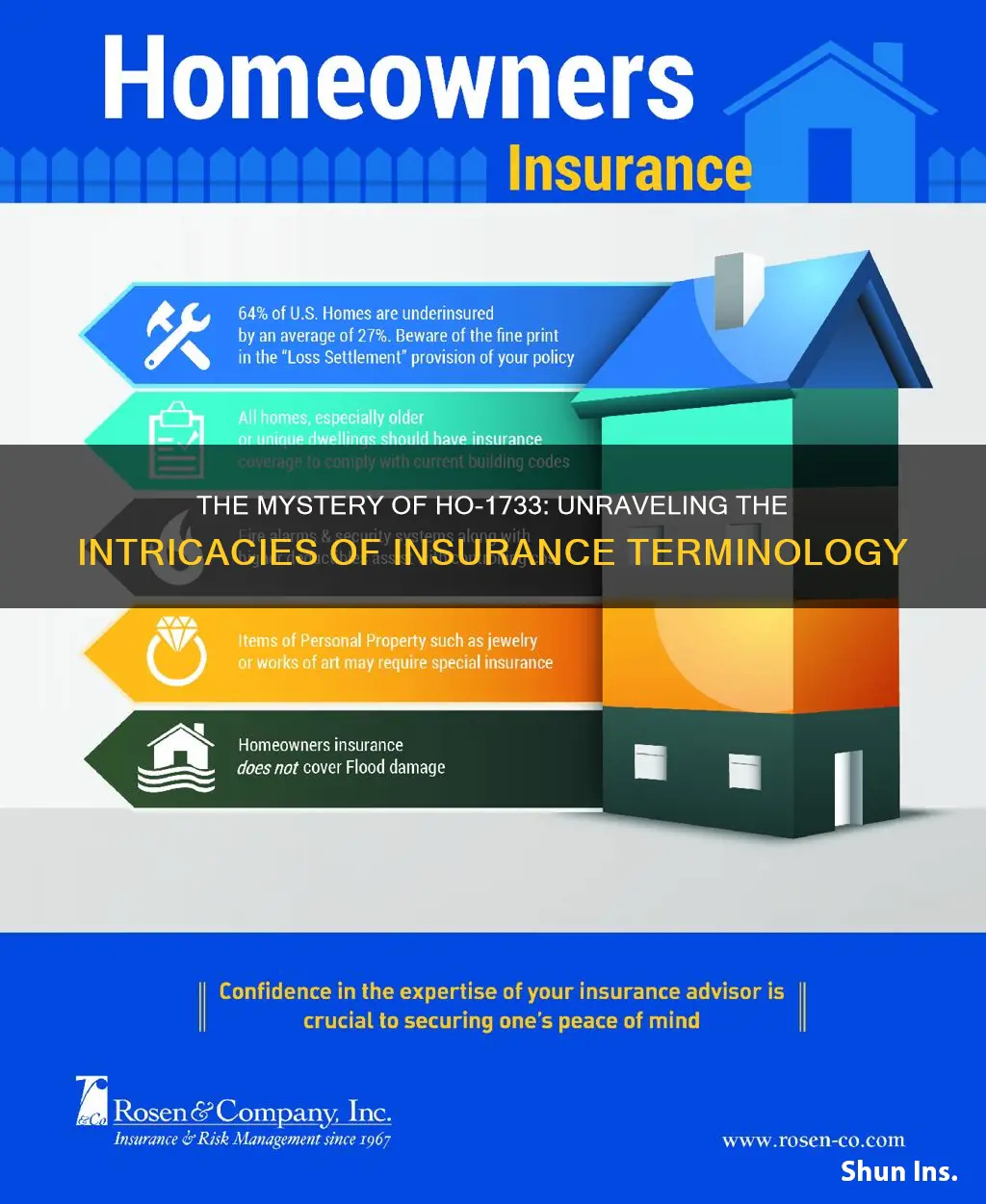

While HO-3 insurance covers a wide range of perils, there are some exclusions. These vary depending on the insurance provider but typically include power surges that originate off your property, floods, earthquakes, mudslides, sewer backups, ordinance updates, and government seizures.

It is important to carefully review the specifics of your HO-3 insurance policy, as the exact coverage can vary depending on your location and insurance provider.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

HO-3 policies cover a broad range of perils

HO-3 policies are the most common type of home insurance and are available through almost every private property insurance company. HO-3 policies cover a broad range of perils, including:

- Dwelling coverage: This covers repairs for your home's structure and any attached structures, like a porch or garage.

- Other structures coverage: This covers detached structures, like detached garages, driveways, sheds and fences.

- Personal property coverage: This covers your personal items, like clothing and furniture, damaged from covered perils.

- Liability coverage: This provides financial protection if you or a household family member are found negligent for bodily injury or property damage caused to others.

- Medical payments coverage: This covers medical expenses for a guest injured at your home, regardless of fault.

- Additional living expenses: This covers expenses like hotel, food, laundry and parking if you have to relocate temporarily due to a covered peril.

HO-3 policies cover your home and other structures on an 'open perils' basis, meaning all types of damage or loss are covered except for the exclusions listed on the policy. However, personal property is covered on a 'named perils' basis, meaning only losses from a specific list of perils are covered.

Unraveling the Mystery of Calculating HLV for Term Insurance: A Comprehensive Guide

You may want to see also

HO-3 policies cover personal belongings against named perils

HO-3 policies are the most common type of home insurance and are offered by almost every home insurance provider. They cover damage to the structure of your home and your personal belongings, as well as liability, medical payments, and additional living expenses.

HO-3 insurance covers your home (dwelling) and standalone structures on your property (other structures) on an open-peril basis. This means that all types of damage or loss are covered unless they are specifically excluded in the policy.

However, HO-3 policies cover your personal belongings on a named-peril basis. This means that your personal items are only covered in the cases of specifically listed incidents (named perils). There are typically 16 named perils, including:

- Damage caused by aircraft

- Riots or civil disturbances

- Damage caused by vehicles

- Damage from the weight of snow, ice, or sleet

- Water damage from plumbing, heating, or air conditioning overflow

- Water heater cracking, tearing, and burning

- Damage from electrical current

It's important to note that HO-3 policies do not cover damage caused by flooding or earthquakes. If you live in an area prone to these natural disasters, you will need to purchase separate insurance policies for protection.

Overall, HO-3 insurance is a standard option for homeowners, but it has limitations when it comes to covering personal belongings. If you own a lot of high-value items, you may need additional coverage to ensure adequate protection.

Comprehensive Guide to Purchasing 1 Cr Term Insurance

You may want to see also

HO-1 policies are no longer available in most states

However, an HO-1 policy may still be a good fit in certain situations. For example, HO-1 insurance may be an option for an older structure that is considered high risk for an insurance loss. If you own a building that houses limited belongings and is not a primary residence, an HO-1 policy may be a relatively low-cost option for insuring the structure.

Understanding the Tax Implications of Term Insurance: A Comprehensive Guide

You may want to see also

HO-2 policies are also known as broad form

HO-2 policies, also known as broad form policies, are a type of homeowners insurance that provides coverage against 16 perils. This includes damage from fire and lightning, windstorms and hail, and theft. HO-2 policies are named-peril policies, meaning you're only protected against the perils listed on the policy.

HO-2 policies are less common than the traditional HO-3 policy, which is the most popular form of homeowners insurance. HO-3 policies are open-peril policies, meaning the structure of your home is protected against all perils except those specifically listed as exclusions.

HO-2 policies are typically less expensive than other types of homeowners insurance because they offer limited coverage and only cover specific incidents. According to the National Association of Insurance Commissioners, HO-2 policies cost $1,131 per year on average, compared to $1,754 per year for HO-3 policies.

In addition to covering your home and other detached structures, HO-2 policies also provide coverage for personal liability and additional living expenses if you are forced to vacate your home due to damage. They also cover medical expenses if a guest is injured on your property.

While HO-2 policies are more comprehensive than HO-1 policies, they offer less coverage than HO-3 and HO-5 policies. HO-2 policies are typically recommended for homeowners with older homes or properties that are difficult to insure. Most homeowners are better off with an HO-3 or HO-5 policy, which offer more comprehensive coverage.

Understanding the Islamic Perspective on Term Insurance: Halal or Haram?

You may want to see also

Frequently asked questions

The HO-3 insurance form, also known as the "special form", is the most common type of homeowners insurance policy. It offers open peril coverage for the structure of your home, meaning that it covers repairs if your home is damaged by any peril, unless it is specifically listed as an exclusion in your policy documents. It also offers named peril coverage for your personal property, meaning that it covers repairs or replacements for your belongings only if they are damaged by the perils specifically listed in your policy.

The HO-1 insurance form, also known as the "basic form", typically covers 10 perils, including fire and lightning, windstorms and hail, explosion, riots and civil commotion, aircraft, vehicles, smoke, vandalism and malicious mischief, theft, glass that is part of the home, and volcanic eruptions. HO-1 policies do not cover any unnamed perils and may not cover personal belongings in the home. HO-1 policies are no longer available in most states.

The HO-2 insurance form, also known as the "broad form", typically covers up to 10 perils, including the same perils covered by the HO-1 form, as well as damage from falling objects and water damage from accidental overflow of plumbing, heating, ventilation and air conditioning (HVAC), and household appliances. Like the HO-1 form, the HO-2 form covers personal property in the home and provides reimbursement for covered damage on an actual cash value basis, taking into account depreciation. This type of policy is often carried by historic homes and registered landmarks.