Short-term health insurance is a temporary solution for those who are in between permanent insurance plans. It is not sold on the marketplace and differs from marketplace policies in several important ways. Short-term health insurance is often more affordable than major medical plans, but it does not cover pre-existing conditions and typically has high deductibles. It is also not considered adequate replacement for traditional major medical coverage.

| Characteristics | Values |

|---|---|

| Definition | Short-term health insurance is a type of major medical insurance that provides coverage for a limited term. |

| Availability | Short-term health insurance is available in around 38 states. |

| Coverage | Short-term health insurance covers emergency hospital visits, certain prescription medications, and some doctor's appointments not related to pre-existing conditions. |

| Exclusions | Short-term health insurance does not cover pre-existing conditions, maternity care, mental health, and preventive care. |

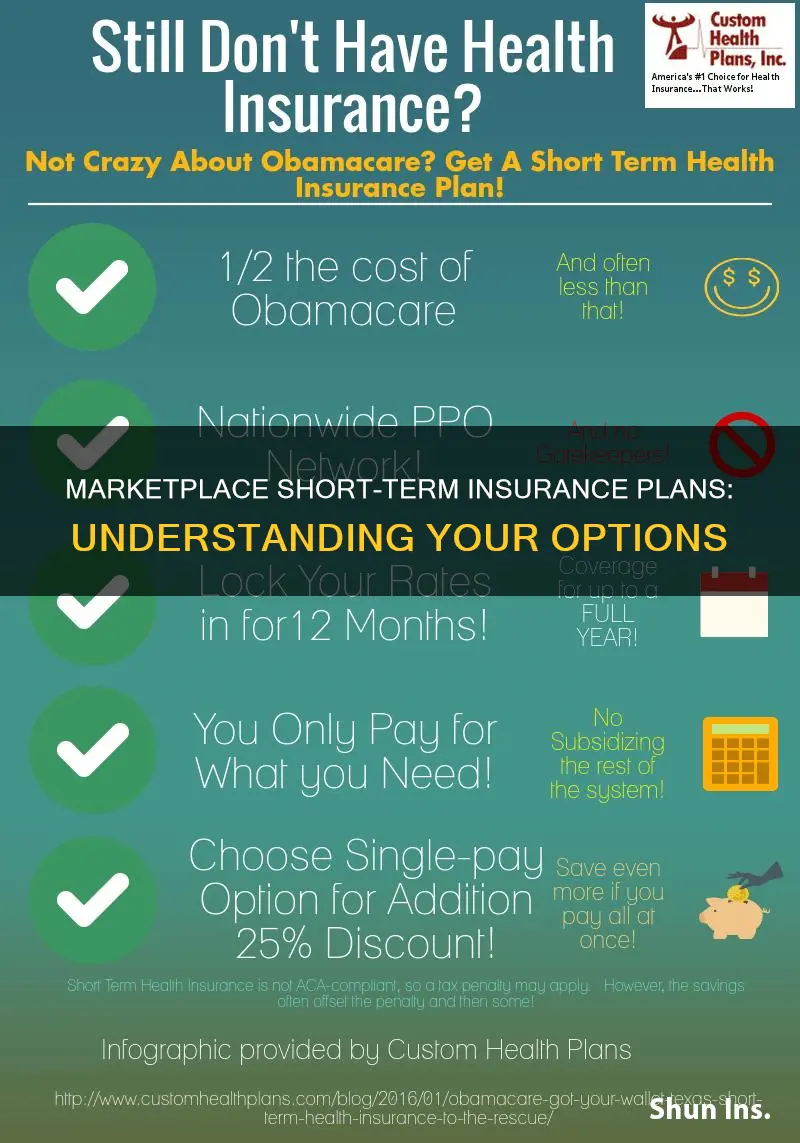

| Cost | Short-term health insurance is typically much more affordable than major medical plans, with plans available for as little as $55 per month. |

| Duration | Short-term health insurance policies offer coverage for less than one year, with some policies offering the option to extend or renew coverage. |

| Application Process | The application process for short-term health insurance typically involves filling out a health questionnaire and disclosing any pre-existing conditions. |

| Alternatives | Alternatives to short-term health insurance include marketplace plans, COBRA, and other types of private insurance. |

What You'll Learn

- Short-term health insurance is not sold on the marketplace

- Short-term health insurance is a temporary safety net for those who can't afford ACA-compliant plans

- Short-term health insurance is not a replacement for traditional major medical coverage

- Short-term health insurance is not regulated by the ACA

- Short-term health insurance is only available in some states

Short-term health insurance is not sold on the marketplace

Short-term health insurance is designed to fill temporary gaps in health insurance coverage. For example, it can be useful for people who cannot get group health insurance or COBRA, or who missed the open enrollment period for better coverage through an Affordable Care Act (ACA) plan. Short-term health insurance is also an option for those who cannot afford or access ACA major medical plans.

Short-term health insurance plans are not subject to the same regulations as ACA plans and are not required to cover pre-existing conditions. They also do not have to offer the same essential health benefits, such as prescription drugs, mental healthcare, and maternity care. As a result, short-term plans often come with high deductibles and extensive exclusions that can lead to high out-of-pocket costs and denials of coverage.

While short-term health insurance can provide quick and affordable coverage in certain situations, it is important to carefully review the limitations and exclusions of these plans. Short-term health insurance is not sold on the marketplace, and consumers eligible for marketplace subsidies cannot use them to purchase short-term policies.

Short-term health insurance is a temporary safety net for those who can't afford ACA-compliant plans

Short-term health insurance is designed to fill short-term gaps in coverage and can be cancelled at any time without penalties. It is important to note that short-term health insurance is not a good fit for everyone and does not provide comprehensive coverage. It is meant to be a temporary solution until an individual can enrol in a longer-term plan.

Short-term health insurance coverage varies depending on the plan and the insurance company. These types of plans are not required to comply with Affordable Care Act (ACA) guidelines and, therefore, do not provide certain levels of coverage. Short-term health insurance typically covers preventive care, doctor visits, urgent care, and emergency care. Some plans may also cover prescriptions and offer cost savings for seeing in-network providers. However, short-term health insurance usually does not cover pre-existing conditions, maternity care, mental health services, and prescription drugs.

It is important to carefully review the details of a short-term health insurance plan before purchasing, as the coverage may be limited and it may not meet an individual's specific needs. Short-term health insurance is not sold on HealthCare.gov or state marketplace websites, and consumers eligible for marketplace subsidies cannot use them to purchase short-term policies.

Navigating the Path of 'Do-It-Yourself' Term Insurance: A Guide to Going Solo

You may want to see also

Short-term health insurance is not a replacement for traditional major medical coverage

Firstly, short-term health insurance is not required to cover the same essential health benefits as ACA plans. This means that deductibles are often very high, and there are usually limits on how much the insurer will pay for certain services. For example, some short-term plans may only cover a certain number of doctor's visits, or only cover a portion of prescription drug costs.

Secondly, short-term health insurance does not cover pre-existing conditions. This is because short-term health insurance is medically underwritten, meaning that consumers will generally be turned down if they have pre-existing health conditions.

Thirdly, short-term health insurance is not available in all states. As of 2023, short-term health insurance was not available in 12 states and Washington D.C. due to state regulations banning or heavily restricting short-term policies.

Finally, short-term health insurance is not intended to be a long-term solution. Short-term plans are meant to bridge gaps in coverage and protect against high medical costs for a limited time. Most short-term plans have a maximum coverage period of 12 months, and it may be difficult to renew coverage if you become sick.

In summary, short-term health insurance can be a good option for those who are healthy and do not require comprehensive coverage. However, it is not a replacement for traditional major medical coverage, which offers more comprehensive and affordable protection for a wider range of healthcare needs.

Cigna's Individual Term Insurance Plans: Exploring Personalized Coverage Options

You may want to see also

Short-term health insurance is not regulated by the ACA

Short-term health insurance is not regulated by the Affordable Care Act (ACA). This means that short-term health insurance plans can deny policies to people based on pre-existing conditions and they don't have to cover the minimum "essential health benefits" mandated by the ACA.

Short-term health insurance plans are not required to cover the same essential health benefits as ACA plans. They often exclude maternity care, mental health care, preventive care, and prescription drugs. They also generally have caps on how much the insurer will pay for certain services or in total.

The lack of regulation by the ACA means that short-term health insurance plans can result in high out-of-pocket costs for consumers. This is because short-term plans often have high deductibles and extensive exclusions that can lead to denials of coverage. Up to 71% of plans do not cover outpatient prescription drugs, and no short-term health plans cover maternity care.

Short-term health insurance is intended to provide temporary coverage during transitions, such as when a person is between jobs or waiting for other insurance coverage to begin. These plans are typically much more affordable than major medical plans, with premiums as low as $55 per month compared to at least $225 per month for major medical coverage.

However, it is important to note that short-term health insurance is not a replacement for traditional major medical coverage. It is designed to fill a temporary gap in health insurance coverage and should not be relied upon as long-term protection.

Capitalization Conundrum: Navigating the World of Insurance Terminology

You may want to see also

Short-term health insurance is only available in some states

Short-term health insurance is not available in all states. As of 2023, short-term health insurance plans are not available in 14 states and Washington, D.C.

In some states, short-term health insurance is banned outright. In other states, insurers choose not to offer short-term plans because of strict state regulations.

The availability of short-term health insurance plans can also vary from year to year in a given state due to insurer business practices and evolving state regulations.

- California

- Colorado

- District of Columbia

- Hawaii

- Maine

- Massachusetts

- Minnesota

- New Hampshire

- New Mexico

- New York

- Rhode Island

- Vermont

- Washington

Insurance Contract Litigation: Exploring the Enforceability of 'Against Us' Clauses

You may want to see also

Frequently asked questions

Short-term health insurance is a type of major medical insurance that provides coverage for a limited term. It is meant to fill temporary gaps in health insurance coverage.

You can buy short-term health insurance from an agent or directly from an insurance company's website.

Short-term health insurance coverage varies based on the plan chosen. Most plans cover emergency hospital visits, certain prescription medications, and some doctor's appointments not related to pre-existing conditions.