Term life insurance is a type of life insurance policy that provides financial protection for a set period of time, often ranging from 5 to 40 years. It guarantees a death benefit to the insured's beneficiaries if the insured person passes away during the specified term. This benefit is typically paid out as a lump-sum, tax-free payment and can be used by the beneficiaries for any purpose, such as settling healthcare and funeral costs, consumer debt, or mortgage debt. Term life insurance is usually more affordable than other types of life insurance, as it offers coverage for a restricted time and doesn't accumulate cash value. When the term expires, policyholders can choose to renew the policy, convert it to permanent coverage, or let it lapse.

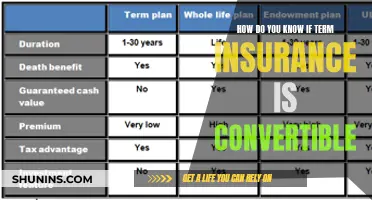

| Characteristics | Values |

|---|---|

| Length of protection | Temporary, for a set period of time (the term) |

| Protection period | 5 to 40 years |

| Payout | A lump-sum, tax-free payment (called the death benefit) |

| Premium | Locked in for the period of coverage selected |

| Premium cost factors | Age, gender, health, life expectancy, driving record, smoking status, occupation, hobbies, family history |

| Renewal | Possible, but premiums will increase |

| Conversion to permanent life insurance | Possible, but whole life insurance is more expensive |

| Riders | Accelerated benefit, accidental death benefit, guaranteed insurability |

| Return of premium (ROP) feature | If the death benefit isn't paid out by the end of the term, all or part of the premiums paid will be returned |

| Purchase options | Individual or group life insurance plan through an employer, civic, or religious organization |

| Age limit | Up to 80-90 years old |

What You'll Learn

- Term life insurance is a type of life insurance policy that has a specified end date

- The death benefit will only be paid out if the insured dies during the term

- Term life insurance is usually more affordable than other types of life insurance

- Term life insurance has no cash value

- Term life insurance can be bought individually or through a group life insurance plan

Term life insurance is a type of life insurance policy that has a specified end date

Term life insurance is a type of life insurance policy that provides financial protection for a set period of time, often referred to as the "term". This means that term life insurance has a specified end date, and the coverage only remains valid up until that date.

The duration of term life insurance policies can vary, typically ranging from 5 to 40 years. During this period, the policyholder pays a premium, which is a monthly or annual fee, to maintain their coverage. The premium remains the same throughout the length of the term. If the insured person passes away during the term, their beneficiaries will receive a lump-sum, tax-free payment known as the death benefit. This benefit can be used by the beneficiaries for any purpose, such as settling healthcare and funeral costs, consumer debt, or mortgage debt.

Once the term of the policy expires, the policyholder has a few options. They can choose to renew the policy for another term, possibly at a higher premium, or convert the policy to permanent coverage, which lasts for the lifetime of the policyholder. Alternatively, they may allow the term life insurance policy to lapse. It is important to note that if the insured person lives beyond the policy term, there is no payout to the beneficiaries.

Term life insurance is usually more affordable than other types of life insurance, such as whole life or universal life insurance. This is because it offers a death benefit for a restricted time and does not accumulate a cash value. Term life insurance is ideal for individuals who want substantial coverage at a lower cost. It is a good option for those who need short-term coverage or additional protection during specific periods.

Secure Future, Smart Move: Understanding the Benefits of 1 Crore Term Insurance

You may want to see also

The death benefit will only be paid out if the insured dies during the term

Term life insurance is a type of life insurance that provides coverage for a specified period, known as the "term". It is designed to offer financial protection to your loved ones in the event of your death during the term of the policy. This means that the death benefit, a lump-sum payment, will only be paid out to the beneficiaries if the insured person passes away within the term. This benefit can be used for various expenses, such as funeral costs, debts, or mortgage payments, but the beneficiaries are not obligated to use it for any specific purpose.

The key feature that distinguishes term life insurance from permanent life insurance is its temporary nature. Term life insurance policies have an end date, and the coverage only remains active during the chosen term, which can range from 5 to 40 years. If the insured person survives beyond the term, the policy expires, and there is no payout. However, some policies may offer the option to renew the coverage for another term or convert it to permanent life insurance, although this may result in increased premiums.

The death benefit provided by term life insurance remains the same throughout the term. It is important to note that term life insurance policies do not accumulate cash value, meaning they have no value other than the guaranteed death benefit. This sets them apart from permanent life insurance policies, which often include a savings component. As a result, term life insurance premiums are generally more affordable than those of permanent life insurance.

When purchasing term life insurance, the insurance company will consider factors such as the insured person's age, health, life expectancy, gender, and other risk factors to determine the premium amount. The premium remains fixed during the term, providing stability for the policyholder.

In summary, term life insurance offers a cost-effective way to ensure financial protection for your loved ones in the event of your untimely death during the specified term. It provides peace of mind and can help alleviate financial burdens for those left behind. However, it is important to carefully consider the duration of the term and the potential need for coverage beyond that period.

The Unfamiliar World of Short-Term Health Insurance: Understanding the Basics

You may want to see also

Term life insurance is usually more affordable than other types of life insurance

Term life insurance is a good option for people who want to make sure their loved ones are provided for if they die, but don't want to pay high premiums. It's also a good option for people who only need coverage for a specific period, such as while their children are still financially dependent on them, or while they're paying off their mortgage.

The cost of term life insurance depends on your age, gender, health, the length of coverage, and the amount of coverage. The younger and healthier you are, the cheaper it will be.

Term life insurance has no cash value

Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. The policyholder can choose how long they want their term policy to last – it can be anywhere between 5 to 40 years. If the insured person dies during the specified term, the insurer will pay the policy's face value to the beneficiaries. However, if the policy expires before the insured person's death or they outlive the policy term, there is no payout.

Term life insurance does not have a cash value component. This means that the policy has no value other than the guaranteed death benefit and does not accumulate cash value over time. In other words, it doesn't offer any cash benefits before the insured person dies. If the policyholder cancels or outlives the term policy, they do not receive a refund. In contrast, permanent life insurance policies, such as whole life and universal life insurance, can have a cash value component. This allows policyholders to accumulate value over time, which can be withdrawn or borrowed against while they are still alive.

The absence of a cash value component in term life insurance makes it more affordable than permanent life insurance. Term life insurance premiums are typically lower than those of permanent life insurance because they do not include a cash value element and have an expiration date. The reduced risk associated with term life insurance, as most policies expire without paying a death benefit, also contributes to the lower premiums.

While term life insurance does not offer a cash value component, it can still be a useful and cost-effective option for individuals seeking financial protection for their loved ones. It is important to consider one's needs, budget, and circumstances when deciding between term and permanent life insurance.

Term Insurance: Unraveling the Myth of Solely Death Benefits

You may want to see also

Term life insurance can be bought individually or through a group life insurance plan

Term life insurance is a type of life insurance that provides a lump sum, known as a "death benefit", to a beneficiary if the insured person dies within a set period of time. This type of insurance is typically offered for periods of 10, 15, 20, or 30 years, and can be purchased either individually or through a group life insurance plan.

Buying Term Life Insurance Individually

There are several ways to buy term life insurance as an individual. You can purchase it directly from an insurance company, either through their website, over the phone, or in person. You can also buy it through an agent or broker, who can help you find the right policy for your needs. Some insurers and agencies even allow you to shop for and buy term life policies online or through an app.

Buying Term Life Insurance Through a Group

Term life insurance can also be purchased through a group life insurance plan, which is offered by an employer, civic, or religious organization. This type of insurance is typically less expensive than individual policies since the cost is based on factors such as the age, health, and risk factors of the group as a whole, rather than the individual. Group life insurance is a good option for those who want the peace of mind of having life insurance but may not be able to afford an individual policy.

Factors to Consider When Buying Term Life Insurance

When deciding where and how to buy term life insurance, there are several factors to consider. One important factor is the financial strength rating of the insurance company, which indicates their ability to pay out claims in the future. You can also look at the company's complaint history to see if they have a record of issues with paying claims. Additionally, you may want to consider the length of coverage you need, the cost of the policy, and any additional features or benefits you may want to add on.

Nature's Fury: Understanding Tornadoes and Their Impact on Home Insurance Policies

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. The death benefit will only be paid out to beneficiaries if the insured dies during this time period.

When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value (the payout amount) and factors such as your age, gender, and health. If you die during the policy term, the insurer will pay the policy's face value to your beneficiaries. This cash benefit can be used to settle healthcare and funeral costs, consumer debt, mortgage debt, and other expenses.

Term life insurance provides temporary protection for a set period of time, whereas permanent life insurance is designed to provide long-term or lifelong coverage. Term life insurance is generally more affordable, but permanent life insurance offers the security of lifelong protection and the opportunity to build cash value.

Term life insurance is an affordable option for those seeking short-term coverage or additional protection during specific times. It offers flexibility, particularly for those with growing families, and can provide substantial coverage for a low cost.