Short-term health insurance, also known as short-term medical insurance, temporary health insurance or term health insurance, is a type of health plan that provides temporary medical coverage. It is designed to fill gaps in coverage for individuals who are between health plans, outside enrollment periods, or need coverage in case of an emergency. Short-term health insurance is typically more affordable than major medical plans but offers limited benefits and shorter coverage periods, usually less than 365 days. These plans are not regulated by the Affordable Care Act (ACA) and do not cover pre-existing conditions. Short-term health insurance can be a good option for individuals who are healthy and do not require regular health services or prescription medications.

| Characteristics | Values |

|---|---|

| Purpose | Filling gaps in coverage when between health plans, outside enrollment periods, or in need of emergency coverage |

| Coverage Length | 1 month to 3 years |

| Coverage Type | Preventive care, doctor visits, urgent care, emergency care, prescriptions |

| Cost | Premium, deductible, coinsurance, copay, other out-of-pocket costs |

| Pros | Fills short-term gaps in coverage, can be cancelled anytime without penalties, multiple plan designs available |

| Cons | Significantly higher deductibles, no coverage for pre-existing conditions, limited coverage for most services, medical questionnaire required, no coverage for essential health benefits |

| Application | Requires answering a health questionnaire |

| Renewal | Not automatically renewed, can be renewed two times for a total of up to three years |

What You'll Learn

- Short-term health insurance is also known as short-term medical insurance, temporary health insurance, or term health insurance

- It is a more affordable solution for those who need limited health coverage during transitional periods

- Short-term health insurance is not regulated by the Affordable Care Act (ACA)

- It is not easy to renew short-term health insurance

- Short-term health insurance does not cover pre-existing conditions

Short-term health insurance is also known as short-term medical insurance, temporary health insurance, or term health insurance

Short-term health insurance, also known as short-term medical insurance, temporary health insurance, or term health insurance, is a type of health plan that provides temporary medical coverage for those who don't have a permanent health plan. These plans are designed to fill gaps in coverage for individuals who are between health plans, outside of enrollment periods, or need coverage in case of an emergency. Short-term health insurance is typically more affordable than major medical plans, with premiums starting as low as $55 per month. However, it's important to note that short-term health insurance is not regulated by the Affordable Care Act (ACA) and does not provide comprehensive coverage.

Short-term health insurance plans vary in terms of coverage and duration. Coverage options can include preventive care, doctor visits, urgent care, emergency care, and prescriptions. The duration of these plans can range from one month to nearly three years, depending on the state and the insurance company. It's important to carefully review the details of short-term health insurance plans, as they often have significant limitations and exclusions. For example, short-term plans typically do not cover pre-existing conditions, maternity care, mental health, substance use services, vision care, or dental care.

Short-term health insurance can be a good option for individuals who are healthy and do not require regular health services or prescription medications. It can provide temporary coverage during transitional periods, such as job loss, waiting for other coverage to begin, or turning 26 and transitioning off a parent's health plan. However, it's important to weigh the pros and cons of short-term coverage, as it may not be ideal for the long term. Short-term plans have higher deductibles, limited benefits, and may not cover all essential health services.

Decorrelation's Impact: Unraveling the Intricacies of Insurance Risk Management

You may want to see also

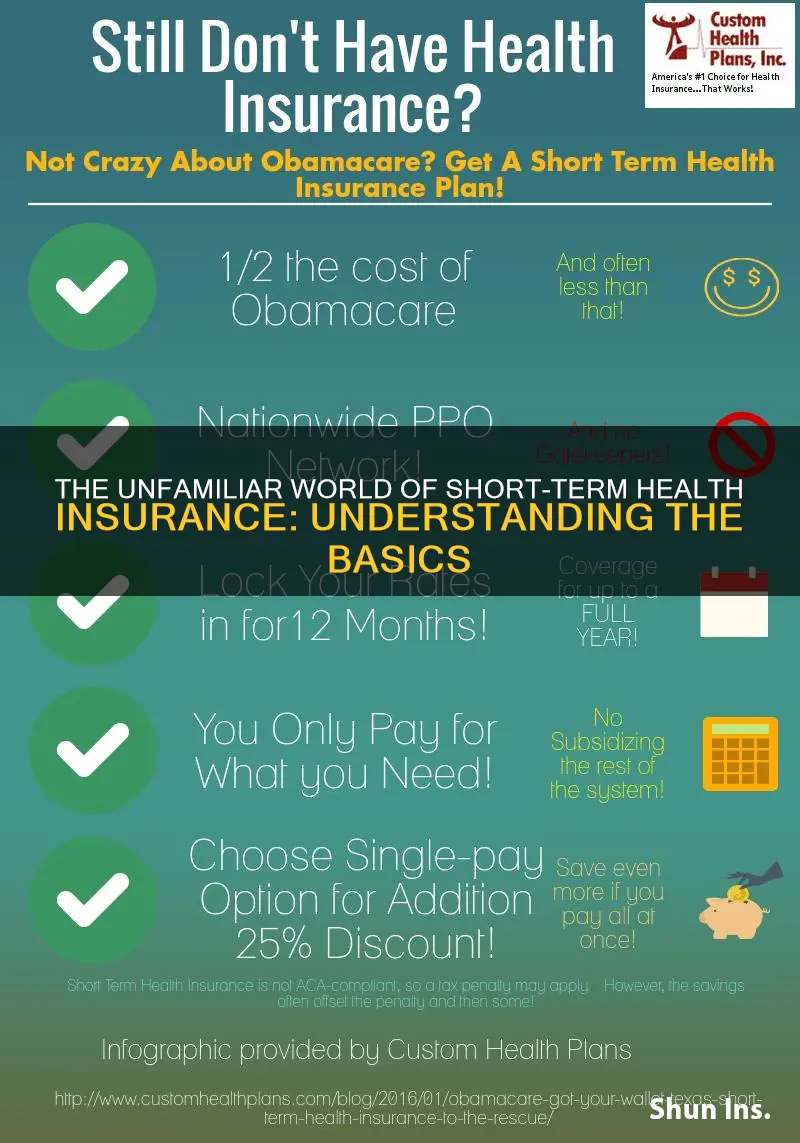

It is a more affordable solution for those who need limited health coverage during transitional periods

Short-term health insurance is a more affordable solution for those who need limited health coverage during transitional periods. These plans are designed for people who experience a temporary gap in health coverage. They are also a good option for those who are healthy and do not generally require health services or have regular prescription needs.

Short-term health insurance plans are typically much more affordable than major medical plans. They are available for as little as $55 per month, compared to at least $225 per month for major medical coverage.

Short-term health insurance plans can be purchased when an individual is:

- Waiting for other coverage to begin

- Waiting to be eligible for Medicare coverage

- Without health insurance, outside of open enrollment

- Facing a gap in coverage

Short-term health insurance plans are not a good fit for everyone. They do not cover pre-existing conditions and offer limited coverage for most services. They also have significantly higher deductibles than traditional health plans.

The Mystery of RFD Insurance: Unraveling the Acronym's Meaning and Its Role in Financial Protection

You may want to see also

Short-term health insurance is not regulated by the Affordable Care Act (ACA)

Short-term health insurance plans typically provide coverage for a period of up to 12 months and are designed to bridge temporary gaps in healthcare coverage. These plans are not subject to the regulations and standards set forth by the Affordable Care Act (ACA), which means they do not provide the same comprehensive benefits and consumer protections as ACA-compliant plans.

One of the key differences is that short-term health insurance plans are not required to cover pre-existing conditions, allowing insurers to deny coverage or charge higher premiums to individuals with pre-existing health issues. This is in contrast to the ACA, which prohibits insurers from discriminating based on medical history. Additionally, short-term plans often have limited benefits, excluding coverage for essential health benefits such as prescription drugs, maternity care, and mental health services, which are mandated by the ACA.

Another distinction lies in the eligibility for government subsidies. The ACA provides financial assistance through premium tax credits and cost-sharing reductions to individuals and families who purchase coverage through the Health Insurance Marketplace. However, these subsidies are not available for short-term health insurance plans, as they fall outside the scope of the ACA's regulations. As a result, individuals opting for short-term coverage may have to bear the full cost of the premiums without any financial assistance.

Furthermore, short-term health insurance plans do not guarantee renewability. Insurers can choose to non-renew or modify the terms of coverage at the end of the policy period, which may leave individuals without the option to renew their plan or facing changes in their benefits or premiums. In contrast, the ACA ensures that individuals with qualified health plans have the guaranteed renewability right to renew their coverage without the risk of being denied or having their benefits altered.

It is important for consumers to carefully review the terms and conditions of short-term health insurance plans before purchasing. While these plans may offer temporary coverage, they lack the comprehensive protections and benefits provided by ACA-compliant plans. Individuals should consider their own health needs, financial situation, and the potential risks, including limited benefits and non-guaranteed renewability, associated with short-term coverage before enrolling in a short-term health insurance plan.

Understanding Critical Illness Rider: Enhancing Term Insurance with Comprehensive Coverage

You may want to see also

It is not easy to renew short-term health insurance

Short-term health insurance is a temporary solution to fill gaps in coverage. It is not easy to renew short-term health insurance for several reasons. Firstly, short-term health insurance is not renewable in all states. In some states, short-term health insurance plans are not available for purchase at all. Secondly, even in states where short-term health insurance is available, there are limits on how many times a policy can be renewed. For example, in states that follow federal regulations, short-term health insurance can be renewed up to two times, providing coverage for up to three years. However, any medical conditions treated under a preceding plan will be considered pre-existing conditions, which may result in higher costs or a denial of coverage. Additionally, short-term health insurance premiums may increase at each renewal, especially if the insured individual has developed a new medical condition. Finally, short-term health insurance is not intended to be a long-term solution, as it does not cover pre-existing conditions and has limited benefits. Therefore, individuals seeking comprehensive and continuous coverage should consider traditional health insurance plans.

The Mystery of "COD" in Insurance Policies Unveiled

You may want to see also

Short-term health insurance does not cover pre-existing conditions

Short-term health insurance is a temporary solution for those who are between health plans, outside of enrollment periods, or need coverage in case of an emergency. These plans are not required to comply with Affordable Care Act (ACA) guidelines and, therefore, do not cover pre-existing conditions.

Short-term health insurance plans are not a good substitute for traditional, ACA-compliant health plans. They are designed to fill gaps in coverage and are useful when ACA plans are unaffordable or unavailable. They are also a good option for those who are healthy and do not require regular medical care or prescriptions.

Short-term health insurance plans are medically underwritten, meaning the insurance provider looks into your health history. If you have a pre-existing condition, you may be denied coverage, or you may have to pay more for your plan. Costs related to your pre-existing conditions may not be covered.

Short-term health insurance plans are not available in all states. Some states have banned them altogether, while others have set stricter limits on how long a person can be enrolled.

Understanding Franchising in the Insurance Industry: Exploring the Unique Dynamics

You may want to see also

Frequently asked questions

Short-term health insurance, also known as short-term medical insurance, temporary health insurance, or term health insurance, is a type of health plan that provides temporary medical coverage for those who are between health plans, outside of enrollment periods, or in need of emergency coverage.

Short-term health insurance coverage varies depending on the plan and the insurance company. These plans are not required to comply with Affordable Care Act (ACA) guidelines and typically provide coverage for preventive care, doctor visits, urgent care, emergency care, and prescriptions.

The cost of short-term health insurance depends on the level of coverage chosen, including the deductible and coinsurance, as well as the types of services covered. Typically, short-term plans have significantly higher deductibles than traditional health plans.