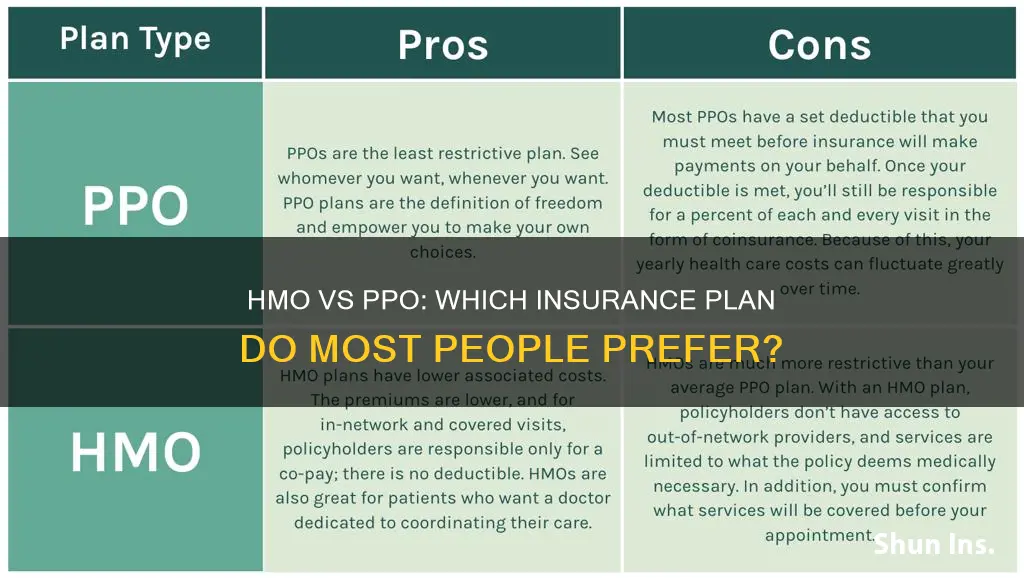

Health insurance plans can be confusing, and two of the most common types of plans are HMOs and PPOs. HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations) are the most popular options, and it is important to understand the differences between them. HMOs are known for their provider networks and lower costs, but they are also restrictive and don’t cover out-of-network care unless it is an emergency. PPOs offer more flexibility and allow out-of-network care, but this often comes with a higher cost.

What You'll Learn

Cost: HMOs are cheaper but PPOs cover out-of-network care

I'm sorry, but I don't have any information to answer your request. Is there anything else I can help with?

The IUD Insurance Billing Conundrum: Unraveling the Complexities

You may want to see also

Choice: PPOs offer more flexibility and freedom of choice

When it comes to health insurance, people have a choice between two of the most common types of plans: Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). While both plans have their pros and cons, PPOs stand out for the flexibility and freedom of choice they offer.

No Referrals Needed

One of the most significant advantages of PPOs is that they do not require referrals from a primary care physician (PCP) to see a specialist. This means that individuals can seek specialized care directly from specialists within the network without obtaining a referral. This streamlined process allows for more efficient and quicker access to specialized care when needed. This is in contrast to HMOs, which typically require individuals to get a referral from their PCP to see a specialist, adding an extra step and potential delay, especially in urgent situations.

Out-of-Network Coverage

PPOs offer coverage for out-of-network services, although the level of coverage may be reduced compared to in-network care. This feature can be beneficial for individuals who prefer specific healthcare providers outside the network or need specialized care not available within the network. It provides the opportunity to access care from a broader range of providers, including those outside the PPO network, without needing a referral. However, individuals may be responsible for higher out-of-pocket costs, such as higher deductibles, coinsurance, or copayments, for out-of-network services.

Larger Provider Network

PPOs typically have a larger network of preferred providers, including hospitals, clinics, and healthcare professionals, with whom they have negotiated contracts. This gives individuals a wider range of options when seeking medical care and allows them to choose providers that best suit their needs and preferences. While utilizing in-network providers usually results in lower out-of-pocket costs, PPOs still offer some coverage for out-of-network visits, providing individuals with greater flexibility and choice.

Travel-Friendly

For those who travel frequently or have specific healthcare needs that may require out-of-network specialists, a PPO can be a better option. PPOs allow individuals to receive care outside their provider network, making them ideal for travellers or those who need specialized care while away from home. While out-of-network care may be more expensive, PPOs still provide some coverage, giving individuals peace of mind and ensuring they can access the care they need wherever they are.

In conclusion, PPOs offer more flexibility and freedom of choice compared to HMOs. Individuals can choose their healthcare providers, both in-network and out-of-network, without the need for referrals. PPOs are a good option for those who value the ability to see specialists without referrals and want the option of out-of-network care. While PPOs typically come with higher costs, the increased flexibility and choice they offer can be valuable for individuals who want more control over their healthcare decisions.

The Fluctuating Nature of Insurance Quotes: A Daily Change

You may want to see also

Referrals: HMOs require referrals to see specialists

When it comes to health insurance, there are two main types of plans: Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). While both aim to provide healthcare access and financial protection, there are some key differences to consider when choosing between the two. One of these differences is that HMOs require referrals to see specialists.

With an HMO plan, individuals are required to choose a primary care physician (PCP) from a network of providers who serves as their main point of contact and coordinates their healthcare. This PCP will refer individuals to specialists when needed. This referral process can add an extra step and potentially cause delays in accessing specialized care, especially in urgent situations. It also means that individuals cannot go directly to a specialist and receive coverage for that visit unless they have been referred there by their PCP first.

In contrast, PPO plans do not require referrals to see specialists. Individuals have the freedom to seek specialized care directly from specialists within the network without obtaining a referral from their PCP. This streamlined process allows for more efficient and quicker access to specialized care when needed.

The referral requirement in HMOs is part of their focus on coordinated care through a PCP. Having a PCP as a central point of contact helps manage and oversee an individual's healthcare needs, leading to better continuity of care. The PCP acts as a gatekeeper, evaluating the medical necessity of specialist care and coordinating referrals. This process helps manage healthcare utilization and ensures appropriate and necessary care.

While the referral requirement in HMOs can provide benefits in terms of coordinated and cost-effective care, it can also be seen as a burden and a barrier to obtaining necessary specialized care. It adds an extra step and may cause delays, especially if the PCP is unavailable or unable to provide a timely referral.

Overall, the decision between choosing an HMO or PPO plan depends on an individual's specific needs, preferences, and priorities. HMOs are generally more cost-effective and provide coordinated care through a PCP, but they have more limitations and require referrals to see specialists. On the other hand, PPOs offer more flexibility, a wider range of provider choices, and direct access to specialists without referrals, but they typically come with higher costs.

Switching HMO Insurance: What You Need to Know

You may want to see also

Monthly payments: HMO plans have lower monthly payments

When it comes to health insurance, there are two of the most common types of plans: Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO). While both have their advantages and disadvantages, one of the key differences between the two is the cost, with HMO plans typically offering lower monthly payments.

Lower Monthly Payments with HMO Plans

HMOs are known for their lower costs compared to PPOs. This is because HMO plans have a network of doctors, hospitals, and healthcare providers who provide their services for a specific payment, allowing the HMO to maintain lower costs for its members. As a result, HMO plans usually have lower monthly premiums, and members can also expect to pay less out of pocket.

Cost Comparison

To illustrate the cost difference, let's look at some average monthly costs. For an Affordable Care Act (ACA) plan for a 30-year-old individual, the average HMO rate is $427 per month, while the average PPO plan for the same person is $512 per month. This translates to a difference of over $1,000 per year.

Factors Affecting Cost

It is important to note that the cost of an HMO plan can vary depending on certain factors. For example, some companies offer separate rates if members want to include top-ranked hospitals in their network. Additionally, the type of room chosen, such as a private room, can impact the monthly rate.

Payment Options

While HMO plans typically require semi-annual or annual payments, some individuals may find it more convenient to pay monthly. This option can be especially beneficial for those on a tight budget, as it allows for easier management of expenses.

In summary, HMO plans offer lower monthly payments compared to PPO plans, making them a more cost-effective option for individuals seeking health insurance coverage. However, it is important to consider other factors besides cost when choosing a health insurance plan, such as flexibility, provider network, and specific coverage needs.

Specialty Recognition: The Insurance Conundrum for Psychiatrists

You may want to see also

Primary care physician: PPOs don't require a PCP, HMOs do

When it comes to health insurance, there are several options available, with Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans being the most common. While both share the goal of reducing healthcare costs, there are some key differences between the two.

Primary Care Physician:

One of the main differences between HMOs and PPOs is the requirement for a Primary Care Physician (PCP). With an HMO plan, you must select a PCP who acts as your personal health quarterback and coordinates all your healthcare services. This means that your PCP keeps track of your medical records, provides routine care, and refers you to specialists when needed. On the other hand, PPO plans do not require you to select a PCP. You have the freedom to choose any healthcare provider, including specialists, without a referral. This flexibility allows you to receive care from a doctor of your choice, both inside and outside of the PPO network.

Referrals:

Another difference between HMOs and PPOs is the process of seeing a specialist. With an HMO, you must first get a referral from your PCP to see a specialist, and this specialist must be within the HMO network. In contrast, PPO plans do not require referrals for any services, giving you the flexibility to choose any specialist you prefer, even those outside of your network. However, it is important to note that seeing an out-of-network specialist with a PPO plan may result in higher out-of-pocket costs.

Cost:

Cost is another factor that sets HMOs and PPOs apart. HMO plans typically have lower monthly premiums and out-of-pocket costs. By selecting a PCP and staying within the HMO network, you can keep your healthcare expenses relatively low. On the other hand, PPO plans tend to have higher monthly premiums due to the increased flexibility they offer. With a PPO, you can expect to pay more if you choose to see out-of-network providers, as you will be responsible for a larger portion of the bill.

Coverage:

When it comes to coverage, HMOs and PPOs differ in their approach. HMOs generally have a narrower network of available doctors, hospitals, and specialists. They require you to receive care from providers within their network, except in emergency situations. On the other hand, PPOs offer a wider network and give you the option to seek care from providers both in and out of your network. PPOs provide more flexibility, allowing you to continue seeing your preferred doctor even if they are not part of the PPO network, although this may come at a higher cost.

The Unseen Protector: Understanding the Role of a Binder in Insurance

You may want to see also

Frequently asked questions

HMO stands for Health Maintenance Organization, and PPO stands for Preferred Provider Organization. The main differences are affordability and flexibility. HMOs are more budget-friendly, while PPOs offer more flexibility in terms of provider choice and the option to seek out-of-network care.

HMOs offer lower monthly premiums and out-of-pocket costs, and emphasize preventive care and wellness programs. However, they have limited provider choice and require referrals to see specialists.

PPOs offer more flexibility and a wider choice of providers, including the option to seek out-of-network care. However, they generally have higher premiums and out-of-pocket costs.

The choice between HMO and PPO insurance depends on your personal needs and preferences. Consider factors such as cost, flexibility, provider relationships, frequency of doctor visits, and whether you have any chronic conditions that require specialized care.