Florida is facing an insurance crisis, with residents paying triple the national average for insurance. The state has the sixth-highest number of uninsured drivers in the US, with an estimated 15.9% to 20.4% of Florida drivers lacking insurance on their vehicles. This is due to the high cost of insurance in Florida, with car insurance rates being among the most expensive in the country. Florida homeowners are also struggling with insurance costs, with some choosing to go without property insurance or self-insure. The state's insurance issues are compounded by frequent natural disasters, such as hurricanes and storms, and a legal landscape that allows for excessive litigation and claim costs.

| Characteristics | Values |

|---|---|

| Number of uninsured drivers in Florida | 15.9% of Florida drivers, according to the Insurance Information Institute (Triple-I). The Insurance Research Council (IRC) estimates a higher figure of 20.4%. |

| National ranking of uninsured drivers in Florida | 6th in the nation |

| Average monthly cost of car insurance in Florida | $115 for minimum-liability coverage and $270 for full coverage |

| Average annual cost of car insurance in Florida | $1,385 |

| National average annual cost of car insurance | $627 |

| Average annual cost of full coverage in the US | $2,008 |

| Average annual cost of full coverage in Florida | $3,244 |

| Percentage of Florida homeowners without property insurance | 13% |

| National average percentage of homeowners without property insurance | 7% |

What You'll Learn

Florida's insurance crisis

Florida is facing an insurance crisis, with residents struggling to afford coverage for their homes and vehicles. The state has some of the highest insurance premiums in the country, with residents paying triple the national average for insurance. This is causing some Floridians to give up their insurance altogether, despite the risks.

The Cost of Car Insurance in Florida

According to the Insurance Information Institute (Triple-I), around 15.9% of Florida drivers did not have insurance on their vehicles as of year-end 2022. This is higher than the national average of 14%. The Insurance Research Council (IRC) puts this figure even higher, at 20.4%. This is likely due to the high cost of car insurance in Florida, which is among the most expensive in the country. The average monthly cost of minimum-liability coverage in Florida is $115, compared to the national average of $52 per month. Full coverage in Florida costs an average of $270 per month, compared to the national average of $167.

The Cost of Home Insurance in Florida

Home insurance in Florida is also facing a crisis, with premiums skyrocketing and companies leaving the state or going out of business. Florida accounts for 9% of the country's home insurance claims but a staggering 78-79% of its home insurance lawsuits, many of which are fraudulent. This has resulted in insurance companies facing significant financial losses, with some going insolvent or choosing to leave the state. As a result, Florida homeowners are facing fewer options and increased premiums.

The Impact of the Insurance Crisis

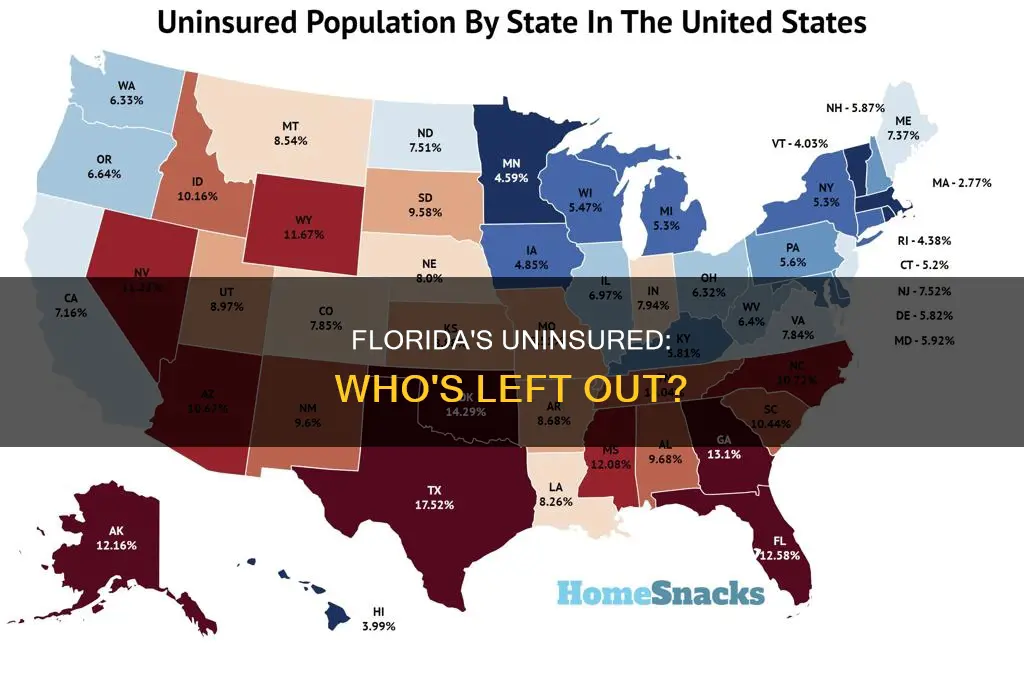

The high cost of insurance in Florida is having a significant impact on residents. Some are choosing to go without insurance altogether, despite the risks. According to the Miami Herald, an estimated 13% of Florida homeowners do not have property insurance, almost double the national average of 7%. For car insurance, this figure is even higher, with an estimated 20.4% of motorists without proper coverage.

The insurance crisis is also causing Floridians to relocate, with a survey by Redfin finding that 11.9% of homeowners in the state planning to move in the next year due to climbing insurance costs. This is nearly double the national average of 6.2%.

Addressing the Insurance Crisis

Efforts are being made to address the insurance crisis in Florida. Governor Ron DeSantis has signed several insurance reform bills into law, aimed at stabilizing the market and reducing fraudulent lawsuits. These include the My Safe Florida Home Program, which provides grants to help homeowners strengthen their homes against storms and potentially lower their insurance premiums. However, it may take years to see the full impact of these changes and, in the meantime, Floridians continue to struggle with the high cost of insurance.

Understanding Orthodontic Insurance: Billing Brace Treatments

You may want to see also

The cost of car insurance in Florida

Florida is facing an insurance crisis, with residents paying triple the national average for insurance. This is reflected in the cost of car insurance in the state, which is among the most expensive in the country.

The average cost of car insurance in Florida is $3,467 for full coverage and $1,094 for minimum coverage, according to Bankrate's research. This is significantly higher than the national average. Full coverage in Florida costs 50% more than the national average, while minimum coverage is around 71% more.

The high cost of car insurance in Florida has led to an increase in the number of uninsured drivers. As of 2022, an estimated 15.9% of Florida drivers did not have insurance on their vehicles, higher than the national average of 14%. This number could be even higher, with the Insurance Research Council (IRC) estimating that 20.4% of Florida drivers are uninsured.

The consequences of being in a crash with an uninsured motorist can be significant, potentially limiting the compensation received and leading to legal action if the insured driver is at fault. As a result, understanding Florida's insurance laws and protecting oneself through adequate insurance coverage is essential.

Antitheft Devices: What Car Insurers Reward

You may want to see also

Florida's uninsured motorists

Florida has the highest rate of uninsured drivers in the US, with about 26.7% of all drivers lacking insurance coverage. This is significantly higher than the national average of 13%. The state's costly insurance rates are a key factor, with Florida's annual average cost of $3,244 for full coverage being much higher than the national average of $2,008. The high cost of insurance in Florida is due to various factors, including expensive repairs, rising medical costs, litigated claims, vehicle theft, and claim fraud schemes.

The issue of uninsured motorists in Florida has been further exacerbated by the recent insurance crisis, with premiums skyrocketing for those who can still afford coverage. As a result, an estimated 15.9% of Florida drivers did not have insurance on their vehicles as of year-end 2022, according to the Insurance Information Institute (Triple-I). The Insurance Research Council (IRC) puts this number even higher at 20.4%, which is more than one in five drivers.

The consequences of being an uninsured motorist in Florida can be severe, including legal fees, fines, suspension of driving privileges, and even jail time. Additionally, uninsured motorists increase the cost of insurance for those who are insured, as they are considered more reckless and make the roads less safe.

To address the issue of uninsured motorists, Florida offers "uninsured and underinsured motorist insurance" as additional coverage. This protects drivers and their families financially in the event of a collision with an uninsured driver, although it comes at an added cost.

The state's minimum auto insurance requirement of $10,000 in personal injury protection and property damage liability insurance also contributes to the high rate of uninsured motorists, as it does not include bodily injury liability coverage. As a result, victims of car accidents caused by uninsured drivers often have limited options for financial recourse.

Term Insurance for the Mature: Exploring Options for Peace of Mind at 57

You may want to see also

Florida's insurance laws

Car Insurance

Florida law requires all drivers to carry certain types of car insurance coverage. As a no-fault state, Florida's requirements differ from many other states. Florida mandates that drivers have personal injury protection (PIP) and property damage liability (PDL) automobile insurance. PIP covers 80% of necessary and reasonable medical expenses up to a minimum of $10,000, regardless of who caused the crash. PDL coverage pays for damage to another person's property, with a minimum requirement of $10,000. Taxis and other vehicles registered as such must carry bodily injury liability (BIL) coverage of $125,000 per person and $250,000 per occurrence, in addition to the PDL coverage.

Drivers in Florida are not required to have bodily injury liability coverage, unlike in most other states. However, Florida's low minimum coverage limits are considered inadequate, leaving drivers at risk of having to pay out of pocket for any additional expenses. Therefore, it is recommended that drivers obtain coverage above the state-mandated limits.

Home Insurance

Florida does not mandate that homeowners carry insurance for fire, flood, theft, or storms. However, if a homeowner has a mortgage, their lender will likely require insurance to secure the loan. If a home is paid off, homeowners can legally choose to go without insurance or self-insure. Self-insuring means that homeowners would need to pay for any repairs, damage, or replacement out of pocket, which can be a significant financial burden, especially after a natural disaster.

Insurance Requirements for Vehicle Registration

In Florida, before registering a vehicle with at least four wheels, proof of PIP and PDL insurance is required. The insurance must be issued by a company licensed in Florida or through a self-insurance certificate issued by the FLHSMV. Continuous coverage is mandatory, even if the vehicle is not being driven or is inoperable. If insurance is cancelled, the license plate must be surrendered to avoid suspension and reinstatement fees. Failure to maintain the required insurance coverage can result in the suspension of driving privileges and a reinstatement fee of up to $500.

Penalties for Driving Without Insurance

Florida imposes steep penalties on drivers who operate a motor vehicle without the proper insurance coverage. These penalties include the suspension of the driver's license and vehicle registration for up to three years. If an uninsured driver causes an accident, they may be required to pay significant amounts in addition to these penalties.

Optional Car Insurance Coverage

While Florida law sets minimum insurance requirements, there are several optional coverages that drivers can add to their policies for more comprehensive protection. These include bodily injury liability, collision coverage, comprehensive insurance, medical payments coverage, roadside assistance, and uninsured/underinsured motorist coverage.

Insurance Crisis in Florida

Florida is facing an insurance crisis, with the state's insurance rates being among the most expensive in the country. This has led to a rise in the number of uninsured drivers, with an estimated 15.9% of Florida drivers not having insurance on their vehicles as of year-end 2022. The high cost of insurance in Florida is attributed to various factors, including expensive repairs, rising medical costs, a high volume of litigated claims, vehicle theft, and claim fraud schemes.

The insurance crisis in Florida has resulted in a cycle where the high number of uninsured motorists contributes to increasing insurance rates for those who are insured. This, in turn, leads to more drivers forgoing coverage, further impacting insurance rates.

Renter's Insurance: Who's Covered?

You may want to see also

Florida's insurance requirements

Florida has some of the most expensive car insurance rates in the country, which has led to a high number of uninsured drivers. According to the Insurance Research Council, 20.4% of drivers in Florida do not have insurance, though other sources place the figure at 15.9% or 13%. This is higher than the national average of 14% and is among the highest in the country.

Florida is a no-fault state, meaning that each driver's insurance covers injuries or medical expenses for them and their passengers, regardless of who caused the incident. Florida's insurance requirements are as follows:

- Personal Injury Protection (PIP): minimum of $10,000 per accident. This covers 80% of all necessary and reasonable medical expenses resulting from a covered injury, regardless of who caused the crash.

- Property Damage Liability (PDL): minimum of $10,000 per accident. This covers damage to another person's property caused by the policyholder or someone else driving their insured vehicle.

- Bodily Injury Liability (BIL): not required in Florida, but pays for injury or death to others.

Any vehicle with a current Florida registration must be insured with PIP and PDL insurance at the time of registration and maintain continuous coverage even if the vehicle is not being used or is inoperable. The policy must be purchased from a carrier licensed to do business in Florida and continuous coverage must be maintained throughout the registration period. Failure to do so may result in the suspension of the driver's license and registration, as well as a reinstatement fee of up to $500.

Florida also has some requirements for homeowners' insurance. While home insurance is not mandated by the state, mortgage lenders typically require homeowners to carry insurance for fire, flood, theft, or storms to secure their loan. Policyholders will also pay a 1% assessment starting in October 2024 to go towards the state nonprofit agency that pays claims from insolvent insurers.

Driver's Ed: Insurance Training?

You may want to see also

Frequently asked questions

According to the Insurance Research Council (IRC), 20.4% of Florida drivers do not have insurance on their vehicles, though other estimates place the figure at 15.9%.

Florida is one of the top ten states for the highest number of uninsured drivers, with only Mississippi, Michigan, Tennessee, New Mexico, and Washington having higher percentages of uninsured drivers.

The cost of car insurance in Florida is among the most expensive in the country, with an average annual cost of $3,244 for full coverage, compared to the national average of $2,008.

Driving without insurance in Florida is a violation of state law and can result in a suspension of your driver's license and registration, as well as a reinstatement fee of up to $500. Uninsured drivers also contribute to higher insurance rates for those who are insured.