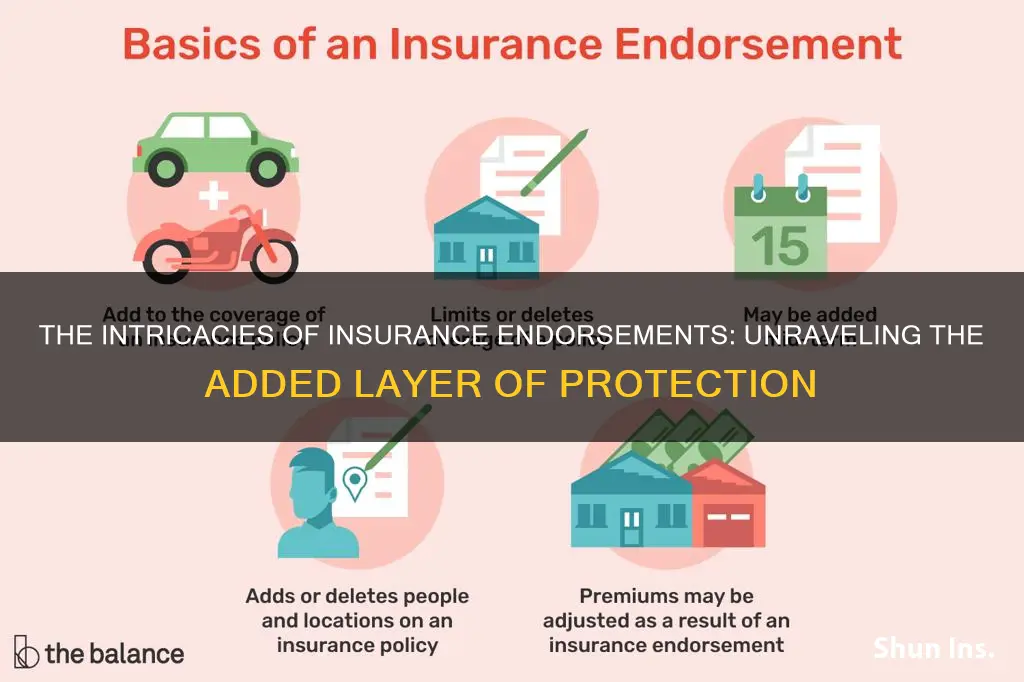

An insurance endorsement, also known as a rider, is a legally binding change to an insurance policy. It is a document added to your insurance policy that modifies it to better meet your needs. Endorsements are typically used to customise or enhance coverage to better suit a policyholder's specific needs. They can be used to increase or decrease coverage limits, change addresses or names, or otherwise alter your policy. When an endorsement reduces or increases coverage, your monthly premium can change as well – and so can your deductible.

| Characteristics | Values |

|---|---|

| Definition | An amendment to a contract of insurance that overrides the terms of the contract. |

| Other Names | Rider, Amendatory Endorsement, Policy Change |

| Types | Standard, Non-Standard, Mandatory, Voluntary |

| Usage | Adding/Removing Coverage, Limiting/Expanding Coverage, Adding/Removing People, Adding/Removing Locations, Changing Policy Details |

| Request Process | Contact Insurance Company, Provide Proof, Complete Paperwork |

| Cost | No Fee for Requesting Endorsement, Premium May Increase or Decrease Depending on Changes |

What You'll Learn

Endorsements are also known as riders or add-ons

Endorsements, also known as riders or add-ons, are changes made to an insurance contract. They are used to expand or restrict coverage for certain types of losses. For example, a sewer backup endorsement adds coverage for losses caused by sewer issues to a policy that otherwise wouldn't cover them.

Riders and endorsements are the same thing and these terms are often used interchangeably. Riders are used to add certain types of property to a policy. For instance, a jewellery rider adds coverage for individual pieces of jewellery that might not be covered under the standard policy. A watercraft floater is another example of a rider, which would add coverage for individual boats.

Endorsements are also referred to as add-ons. They are used to alter an existing insurance policy without the need for a new policy. For example, if you get engaged, you might amend your homeowners insurance policy to add personal property coverage for an engagement ring.

The Hidden Dangers of Physical Hazards: Uncovering the Insurance Perspective

You may want to see also

They allow you to add, remove or alter your coverage

An insurance endorsement is a change to your insurance policy that allows you to add, remove or alter your coverage. It is a legally binding amendment to your insurance contract that overrides the original terms of the policy. Endorsements can be used to increase or decrease coverage limits, change administrative details such as addresses or names, or add coverage for specific items.

For example, if you have recently purchased an expensive piece of jewellery, you may want to add an endorsement to your homeowners insurance policy to increase the coverage limit and ensure the item is protected. Alternatively, if your homeowners insurance policy includes flood coverage by default but you live in an area with a low risk of flooding, you may want to use an endorsement to remove this coverage and lower your premium.

Endorsements can be added at any time during the policy term, at the time of purchase, or when the policy is renewed. They can be requested by the policyholder or added by the insurance company, and they remain in force until the policy ends.

Term Insurance: Unraveling the Myth of Solely Death Benefits

You may want to see also

You can request an endorsement by contacting your insurance company

An insurance endorsement, also known as a rider, is a change to your insurance policy that adjusts your coverage. It is a document added to your insurance policy that modifies it to better meet your needs. Endorsements are necessary because insurance is not a one-size-fits-all service.

It's important to note that endorsements can be added at any time, such as when you buy or receive an expensive item, during an open enrollment period, or when your policy renews. They can also be requested during the enrollment process if you don't already have a policy. Remember that any changes to your policy may impact your monthly premium.

When requesting an endorsement, you can ask to add, remove, or alter your coverage, or make adjustments like changing your address or the names on the policy. For example, if you've recently purchased an expensive piece of jewellery, you can request an endorsement to increase your coverage limit and ensure it's protected.

Endorsements are a great way to customise your insurance policy to better suit your specific needs without having to get a completely new policy. By contacting your insurance company and providing the necessary information, you can easily request an endorsement and make the changes you need.

Juggling Multiple Policies: Navigating Short-Term Insurance Overlap with New Coverage

You may want to see also

Endorsements are legally binding changes to your insurance policy

An insurance endorsement, also known as a rider, is a legally binding change to an insurance policy. It is a document added to your insurance policy that modifies it to better meet your needs. Endorsements are necessary because insurance is not a one-size-fits-all service. They allow you to customise your coverage to meet your unique requirements.

Endorsements can be used to increase or decrease coverage limits, change addresses or names, or make other alterations to your policy. For example, if you get engaged, you might amend your homeowners insurance policy to add personal property coverage for an engagement ring. You can also use endorsements to add or remove people from a policy, which is useful if you've recently married or divorced.

Endorsements can be added at the time of purchase, during your contract term, or when you renew. They are typically requested by the insured, but sometimes the insurer will add endorsements of their own that are not optional. These types of endorsements are not common, however.

There are several types of endorsements:

- Standard endorsements are commonly requested and insurance companies have templates ready to be applied to policies.

- Non-standard endorsements are either specially drafted documents or changes to standard templates. These are used for unique situations, such as protecting a high-value asset.

- Mandatory endorsements are required by law.

- Voluntary endorsements are not required by law.

Endorsements are a way to alter your existing insurance policy without the hassle of getting a new policy. They are legally binding, meaning that they are enforceable by law.

Term Insurance: Navigating the Fine Print to Avoid Crashes

You may want to see also

They can increase or decrease your monthly premium

An endorsement, also known as a rider, is a legally binding change to an insurance policy. It is a document added to your insurance policy that modifies it to better meet your needs. Endorsements can increase or decrease your monthly premium depending on the changes made to the policy.

For example, if you increase your coverage limits for valuable items such as jewellery or artwork, your premium will likely increase as well. This is because you are expanding your insurance coverage, and the insurance company may charge a higher premium to compensate for the increased risk they are taking on.

On the other hand, if you decrease your coverage limits or remove certain types of coverage from your policy, your premium may decrease. This is because you are reducing the insurance company's potential liability, and they may pass some of those savings on to you in the form of lower premiums.

Additionally, endorsements can be used to make administrative changes to your policy, such as changing your address or name. These types of changes may not have a significant impact on your premium. However, it is important to note that any changes to your policy may affect your premium, so it is always a good idea to check with your insurance company before making any modifications.

Overall, endorsements provide a flexible way to customize your insurance policy to ensure it meets your specific needs. By adding, removing, or altering your coverage, you can ensure that you have the appropriate level of protection while also managing your insurance costs.

Weighing the Benefits: Exploring the Switch from Term to Permanent Life Insurance

You may want to see also

Frequently asked questions

An insurance endorsement, also known as a rider, is a legally binding change to an insurance policy. It is a document added to your insurance policy that modifies it to better meet your needs.

Endorsements can be standard, non-standard, mandatory, or voluntary. Standard endorsements are commonly requested and insurance companies have templates for them. Non-standard endorsements are either specially crafted or changes to standard templates. They are best for unique situations. Mandatory endorsements are required by law. Voluntary endorsements are not required by law and most endorsements fall under this category.

Insurance endorsements override the original policy and void outdated information. They can be used to add coverage, limit or exclude coverage, add or remove people, or add or remove locations.

To request an insurance endorsement, contact your insurance company or local agent. You will need to provide proof of the change you are requesting and complete some paperwork.